How to Calculate Ending Inventory Using Absorption Costing

More commonly, the inventory change is calculated over only one month or a quarter, which is indicative of the more normal frequency with which financial statements are issued. To calculate the ending inventory, the new purchases are added to the ending inventory, minus the cost of goods sold.

Calculating Ending Inventory – A Business Case:

The faster your inventory sells, the quicker you recoup your purchase costs and earn a profit. The inventory turnover ratio and the average of inventory tell you how fast your inventory sells and the average amount of inventory you keep on hand. An unusual fluctuation in the inventory turnover ratio or the average of inventory may signal problems with your purchasing policy or with your sales volume.

This work in process formula yields an estimate, rather than an exact figure. It does not take into account added costs that may be incurred as work is completed, such as the cost of scrap, spoilage or the need to rework some items. However, this is very time-intensive, and generally, it is not done. Often, this is the case when the manufacturing operation is short enough to allow all work in process to be completed when the period ends and current accounts are closed. For most manufacturing operations, the costs that are included in an ending work in process inventory are raw materials or parts used, direct labor and manufacturing overhead.

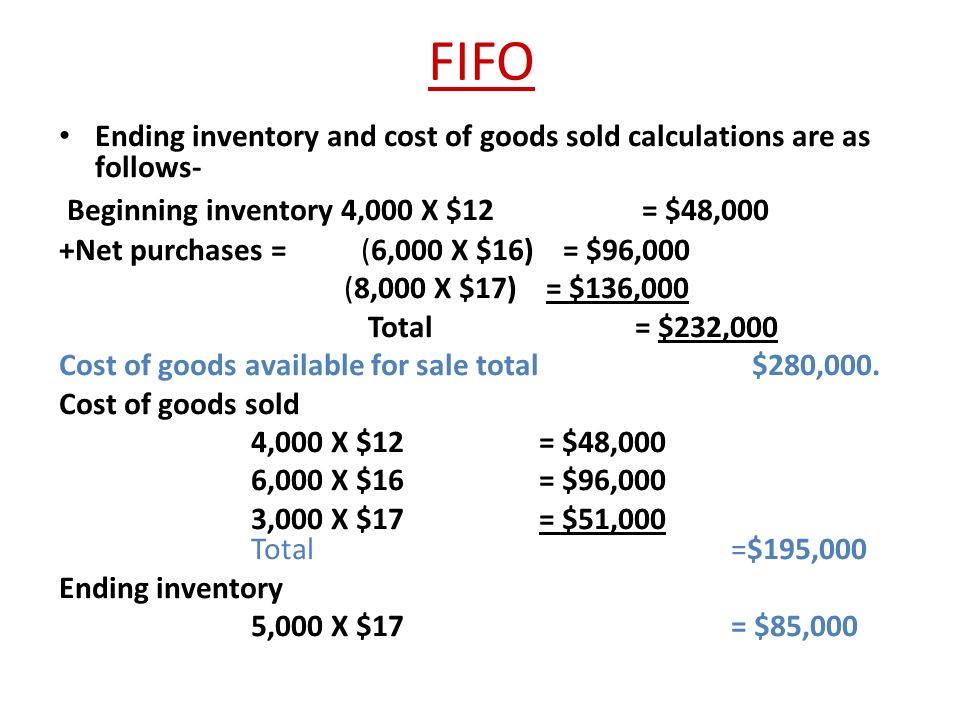

Calculate Ending Inventory Using the FIFO Method

It provides a different view of the balance sheet than other accounting methods such as first-in-first-out (FIFO). In an inflationary environment, it can more closely track the dollar value effect of cost of goods sold (COGS) and the resulting effect on net income than counting the inventory items in terms of units. If inflation and other economic factors (such as supply and demand) were not an issue, dollar-value and non-dollar-value accounting methods would have the same results.

This tells you how many times you purchased and sold your inventory for one calendar or fiscal year. Another version of this formula measures how many days of inventory you have on hand. You calculate the on-hand inventory by dividing the inventory turnover ratio amount by 365 days.

Calculate Ending Inventory: Formula & Explanation

In this case, you have 122 days’ worth of inventory stock on hand on any given day. Determine the cost of goods sold (COGS) using your previous accounting period’s records.

Work in process inventory is an asset The ending work in process inventory is simply the cost of partially completed work as of the end of the accounting period. Ending WIP is listed on the company’s balance sheet along with amounts for raw materials and finished goods.

The inventory turnover ratio is an effective measure of how well a company is turning its inventory into sales. The ratio also shows how well management is managing the costs associated with inventory and whether they’re buying too much inventory or too little. Cost of goods sold (COGS) is a measurement of the production costs of goods and services for a company.

Since the specific identification method, identifies exactly which cost the purchase comes from it does not change under perpetual or periodic. Under the perpetual method, cost of goods sold is calculated and recorded with every sale. Under the periodic inventory method, cost of goods sold is calculated at the end of the period only and recorded in one entry. The bad news is the periodic method does do things just a little differently.

The concept is used in calculating the cost of goods sold, and in the materials management department as the starting point for reviewing how well inventory is being managed. It is also used in budgeting to estimate future cash requirements. If a business only issues financial statements on an annual basis, then the calculation of the inventory change will span a one-year time period.

- The LIFO reserve is an accounting term that measures the difference between the first in, first out(FIFO) and last in, first out(LIFO) cost of inventory for bookkeeping purposes.

- In periods of rising prices, constant increases in costs can create a credit balance in the LIFO reserve, which results in reduced inventory costs when reported on the balance sheet.

How do you calculate ending inventory units?

Multiply (1 – expected gross profit %) by sales during the period to arrive at the estimated cost of goods sold. Subtract the estimated cost of goods sold (step #2) from the cost of goods available for sale (step #1) to arrive at the ending inventory.

However, since costs do change over time, the dollar-value LIFO presents the data in a manner that shows an increased cost of goods sold (COGS) when prices are rising, and a resulting lower net income. When prices are decreasing, dollar-value LIFO will show a decreased COGS and a higher net income. Dollar value LIFO can help reduce a company’s taxes (assuming prices are rising), but can also show a lower net income on shareholder reports. The LIFO reserve comes about because most businesses use the FIFO, or standard cost method, for internal use and the LIFO method for external reporting, as is the case with tax preparation. This is advantageous in periods of rising prices because it reduces a company’s tax burden when it reports using the LIFO method.

At any given time, a portion of the inventory in a manufacturing operation is in the process of being transformed from raw materials or components into finished goods. Refereed to as a work in progress, a work in process or a WIP, this part of the overall inventory is an asset.

This provides the final value of the inventory at the end of the accounting period. According to your annual financial statements and accounting records, your cost of goods sold is $60,000 and the ending inventory is $20,000. After dividing $20,000 into $60,000, your inventory turnover ratio is three. This means your inventory has been sold, or turned over, three times during the year. To find out how many days’ worth of inventory you keep on hand, divide three into 365 days.

For construction or other lengthy projects, the components of a WIP are often listed as materials, wages and benefit costs for labor, subcontractor costs and expenses. Either way, determining the value of work in progress can be time consuming, so companies try to minimize the WIP directly before the end of the accounting period. Ending inventory is the value of goods available for sale at the end of an accounting period. It is the beginning inventory plus net purchases minus cost of goods sold.

Net purchases refer to inventory purchases after returns or discounts have been taken out. Again, inventory is a current asset that is reported on the balance sheet.

The ratio divides the cost of goods sold by the average inventory. Like a typical turnover ratio, inventory turnover details how much inventory is sold over a period. To calculate the inventory turnover ratio, cost of goods sold is divided by the average inventory for the same period. Work in process is the term for a product that is being manufactured, but which is not yet completed. That is, WIP doesn’t include raw materials that have not been used yet or completed goods.

The LIFO reserve is an accounting term that measures the difference between the first in, first out(FIFO) and last in, first out(LIFO) cost of inventory for bookkeeping purposes. In periods of rising prices, constant increases in costs can create a credit balance in the LIFO reserve, which results in reduced inventory costs when reported on the balance sheet. Then, for internal purposes – such as in the case of investor reporting – the same company can use the FIFO method of inventory accounting, which reports lower costs and higher margins. Dollar-value LIFO is an accounting method used for inventory that follows the last-in-first-out model. Dollar-value LIFO uses this approach with all figures in dollar amounts, rather than in inventory units.

The change in inventory is used to adjust the amount of purchases in order to report the cost of the goods that were actually sold. If some of the purchases were added to inventory, they are not part of the cost of goods sold. Moving inventory out of your warehouse and into your customers’ hands is a major objective of running a profitable business.

How do you find the ending inventory?

Ending inventory, the value of goods available for sale at the end of the accounting period, plays an important role in reporting the financial status of a company and can best be figured out using the equation, Beginning Inventory + Net Purchases – Cost of Goods Sold (or COGS) = Ending Inventory.

The formula for inventory turnover ratio is the cost of goods sold divided by the average inventory for the same period. Companies usually calculate total work in process at the end of a month, year or other accounting period. The work in process formula is the beginning work in process amount, plus manufacturing costs minus the cost of manufactured goods. Inventory change is the difference between the inventory totals for the last reporting period and the current reporting period.

Under the LIFO Method, cost of goods sold is calculated using the most recent inventory first and then working our way backwards until the sales order has been filled. Inventory turnover measures a company’s efficiency in managing its stock of goods.

In order to properly account for partially completed work, a business needs to determine the ending work in process inventory at the end of each accounting period. Work in process is also a useful measure for management, because it provides a tool for tracking production flow and costs. If a company had net sales of $4,000,000 during the previous year and the cost of goods sold during that year was $2,600,000, then gross profit was $1,400,000 and the gross profit margin was 35%. The inventory turnover ratio measures how much time elapses from when you first purchase the inventory until it is sold. To calculate the annual inventory turnover rate, divide the total ending inventory into the annual cost of goods sold.