How to Calculate Cost of Inventory

While this is typically synonymous with operating expenses, many times companies list SG&A as a separate line item on the income statement below cost of goods sold, under expenses. This is typically a debit to the purchases account and a credit to the accounts payable account.

SG&A includes nearly everything that isn’t included incost of goods sold(COGS). Interest expense is one of the notable expenses not in SG&A and is listed as a separate line item on the income statement. Also, research and development costs are not included in SG&A. Cost of sales measures the cost of goods produced or services provided in a period by an entity. It includes the cost of the direct materials used in producing the goods, direct labor costs used to produce the good, along with any other direct costs associated with the production of goods.

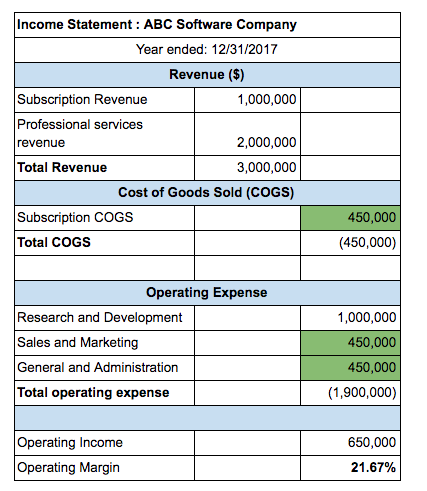

Cost of goods sold is listed on the income statement beneath sales revenue and before gross profit. The basic template of an income statement is revenues less expenses equals net income.

The decision to list SG&A and operating expenses separately on the income statement is up to the company’s management. Some companies may prefer more discretion when reporting employee salaries, pensions, insurance, and marketing costs. As a result, an aggregate total of all non-production expenses is compiled and reported as a single line item titled SG&A. SG&A expenses are typically the costs associated with a company’s overall overhead since they can not be directly traced to the production of a product or service.

In case of services cost of sales includes the labor cost or salaries of the employees and other directly attributable costs. Direct materials are a part of your company’s inventory along with your direct labor costs and any manufacturing overhead costs associated with making your products. Calculating direct materials cost requires knowing how much your company has actually spent on the materials used during production over the period.

OPEX are not included incost of goods sold(COGS) but consist of the direct costs involved in the production of a company’s goods and services. COGS includes direct labor, direct materials or raw materials, and overhead costs for the production facility. Cost of goods sold is typically listed as a separate line item on the income statement. The cost of sales is the accumulated total of all costs used to create a product or service, which has been sold.

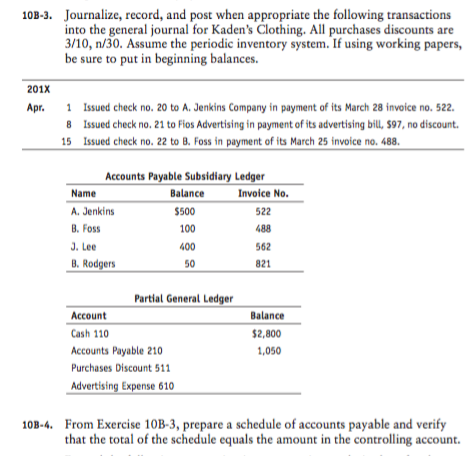

At the end of the reporting period, the balance in the purchases account is shifted over to the inventory account with a debit to the inventory account and a credit to the purchases account. Finally, the resulting book balance in the inventory account is compared to the actual ending inventory amount. The difference is written off to the cost of goods sold with a debit to the cost of goods sold account and a credit to the inventory account.

How do you find the cost of merchandise purchased?

Calculate the cost of inventory with the formula: The Cost of Inventory = Beginning Inventory + Inventory Purchases – Ending Inventory. The calculation is: $30,000 + $10,000 – $5,000 = $35,000.

To calculate direct materials, add beginning direct materials to direct materials purchases and subtract ending direct materials. For example, say that a company had $3,000 worth of flour stock at the beginning of the year, bought $10,000 worth of flour during the year, and has $2,000 worth of flour remaining at year end. Direct materials for the period is $3,000 plus $10,000 less $2,000, or $11,000. Cost of goods sold represents what it cost for a company to make or purchase the products it sells to customers. To calculate cost of goods sold, a company must understand inventory levels at different stages of the accounting period.

Cost of goods sold can be determined after sales revenue and before gross profit on a multiple-step income statement. The cost of goods sold balance is an estimation of how much money the company spent on the goods and services it sold during an accounting period. The company’s costing system and its inventory valuation method can affect the cost of goods sold calculation. Selling, general, and administrative expenses also consist of a company’s operating expenses that are not included in the direct costs of production or cost of goods sold.

The cost of sales is a key part of the performance metrics of a company, since it measures the ability of an entity to design, source, and manufacture goods at a reasonable cost. A manufacturer is more likely to use the term cost of goods sold.

This is a simple accounting system for the cost of sales that works well in smaller organizations. Inventory change is the difference between the inventory totals for the last reporting period and the current reporting period. The concept is used in calculating the cost of goods sold, and in the materials management department as the starting point for reviewing how well inventory is being managed. It is also used in budgeting to estimate future cash requirements.

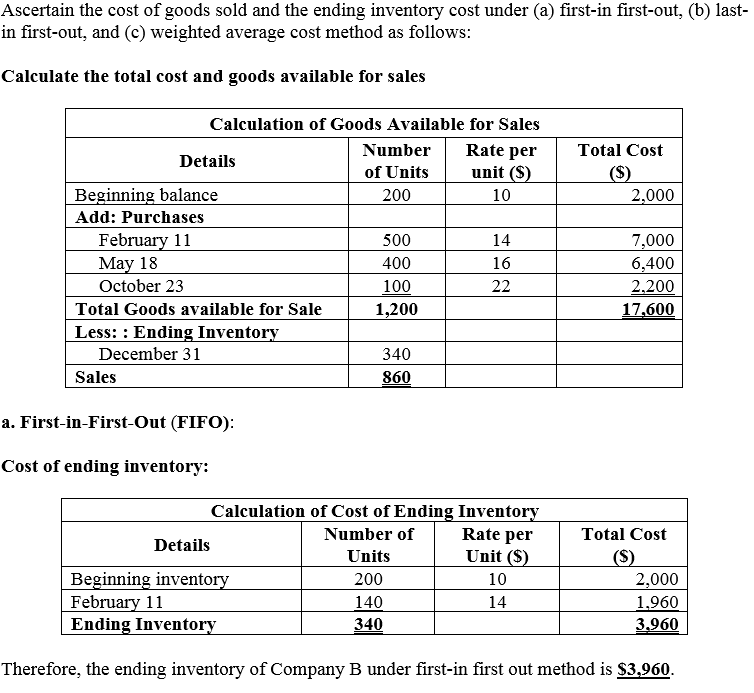

An Example of the Cost of Goods Sold Calculation

- Cost of goods sold can be determined after sales revenue and before gross profit on a multiple-step income statement.

- The cost of goods sold balance is an estimation of how much money the company spent on the goods and services it sold during an accounting period.

How do you find the total cost of merchandise purchased for the year?

Thus, the steps needed to derive the amount of inventory purchases are: Obtain the total valuation of beginning inventory, ending inventory, and the cost of goods sold. Subtract beginning inventory from ending inventory. Add the cost of goods sold to the difference between the ending and beginning inventories.

However, exactly what’s included in cost of goods sold depends on the costing system the company employs. The two main types of costing systems used by companies with inventory are absorption costing and variable costing.

If a business only issues financial statements on an annual basis, then the calculation of the inventory change will span a one-year time period. More commonly, the inventory change is calculated over only one month or a quarter, which is indicative of the more normal frequency with which financial statements are issued.

Absorption costing adds fixed manufacturing overhead, such as rent or property tax, to the cost of goods sold. Under variable costing, cost of goods sold includes variable labor, materials and overhead costs.

To find cost of goods sold, the accountant starts with the beginning inventory balance, adds any inventory purchases during the period and subtracts the ending inventory balance. Cost of goods sold is pretty explanatory, it’s how much you spend to either purchase or produce the products you sell. It factors in the direct costs such as materials and labor to help determine how much it costs to make the things you sell. If you don’t manufacture the products you sell, it uses the price you paid to purchase the inventory to calculate cost of goods sold.

AccountingTools

Having this information allows you to analyze your inventory costs and determine your work-in-progress inventory, which is inventory that is not completely finished at the time you do your analysis. As a rule of thumb, cost of goods sold includes the labor, materials and overhead costs associated with bringing a product to market.

The cost of sales line item appears near the top of the income statement, as a subtraction from net sales. The result of this calculation is the gross margin earned by the reporting entity. The cost of goods sold (COGS), also referred to as the cost of sales or cost of services, is how much it costs to produce your products or services.

Information for the COGS Calculation

However, companies with inventory and cost of goods sold use a multiple-step income statement, so named because there are multiple subtractions to compute net income. In a multiple-step income statement, the accountant subtracts cost of goods sold from sales to determine gross profit. After calculating gross profit, the accountant subtracts all other expenses to arrive at net income. Direct materials cost is the sum of all direct materials costs incurred during the accounting period. For purposes of inventory calculation, the direct materials account includes the cost of materials used rather than materials purchased.

COGS include direct material and direct labor expenses that go into the production of each good or service that is sold. Typically, the operating expenses and SG&A of a company represent the same costs – those independent of and not included in cost of goods sold. But sometimes, SG&A is listed as a subcategory of operating expenses on the income statement.