How to account for cash dividends

How Do Dividends Affect the Balance Sheet?

Cash dividends offer a typical way for companies to return capital to their shareholders. The cash dividend affects the cash and shareholders’ equity accounts primarily. There is no separate balance sheet account for dividends after they are paid.

Paid on a per share basis, only the shareholders on record by a certain date are entitled to receive the cash payout. Dividends are often paid quarterly, but may also be paid annually or semi-annually. Retained earnings, an equity account found on the company’s balance sheet, is reduced at the time the dividends are declared, and not at the time the dividends are paid.

Companies distribute stock dividends to their shareholders in a certain proportion to its common shares outstanding. Stock dividends reallocate part of a company’s retained earnings to its common stock and additional paid-in capital accounts. Therefore, they do not affect the overall size of a company’s balance sheet. While cash dividends reduce the overall shareholders’ equity balance, stock dividends represent a reallocation of part of a company’s retained earnings to the common stock and additional paid-in capital accounts. For example, on March 1, the board of directors of ABC International declares a $1 dividend to the holders of the company’s 150,000 outstanding shares of common stock, to be paid on July 31.

How to Calculate a Payment Dividend on Balance Sheets

Retained earnings is located on the balance sheet in the shareholders’ equity section. The cash within retained earnings can be used for investing in the company, repurchase shares of stock, or pay dividends. A dividend is allocated as a fixed amount per share with shareholders receiving a dividend in proportion to their shareholding. For the joint-stock company, paying dividends is not an expense; rather, it is the division of after-tax profits among shareholders. Retained earnings (profits that have not been distributed as dividends) are shown in the shareholders’ equity section on the company’s balance sheet – the same as its issued share capital.

However, after the dividend declaration and before the actual payment, the company records a liability to its shareholders in the dividend payable account. Cash dividends are the most common form of payment and are paid out in currency, usually via electronic funds transfer or a printed paper check. Such dividends are a form of investment income of the shareholder, usually treated as earned in the year they are paid (and not necessarily in the year a dividend was declared). Thus, if a person owns 100 shares and the cash dividend is 50 cents per share, the holder of the stock will be paid $50.

These shareholders own stock that stipulates that missed dividend payments must be paid out to them first before shareholders of other classes of stock can receive their dividend payments. This results in accumulated dividends, which are unpaid dividends on shares of cumulative preferred stock.

Public companies usually pay dividends on a fixed schedule, but may declare a dividend at any time, sometimes called a special dividend to distinguish it from the fixed schedule dividends. Cooperatives, on the other hand, allocate dividends according to members’ activity, so their dividends are often considered to be a pre-tax expense. Cash dividends are the payments a corporation makes to its shareholders as a return of the company’s profits.

Dividends paid are not classified as an expense, but rather a deduction of retained earnings. Dividends paid does not appear on an income statement, but does appear on the balance sheet. If a company pays stock dividends, the dividends reduce the company’s retained earnings and increase the common stock account. Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account.

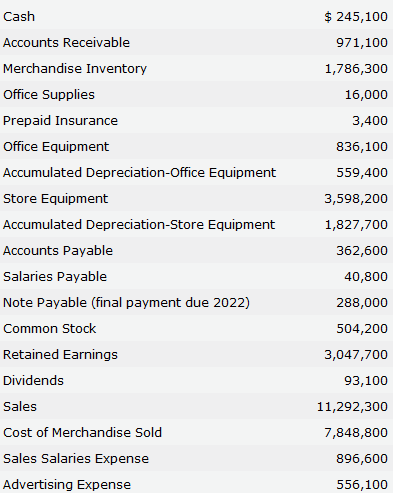

Financial Statements of a Corporation

- Therefore, they do not affect the overall size of a company’s balance sheet.

- Companies distribute stock dividends to their shareholders in a certain proportion to its common shares outstanding.

When a company issues a stock dividend, it distributes additional quantities of stock to existing shareholders according to the number of shares they already own. Dividends impact the shareholders’ equity section of the corporate balance sheet—the retained earnings, in particular. Companies usually distribute dividends to their shareholders in cash, but they sometimes give them stock instead. Dividends of any kind, cash or stock, represent a return of profits to the company owners, so they reduce the retained earnings account in the stockholders’ equity section of the balance sheet. You can’t completely rely on reported net income as it appears at this point, though.

Therefore, preferred stock dividends in arrears are legal obligations to be paid to preferred shareholders before any common stock shareholder receives any dividend. All previously omitted dividends must be paid before any current year dividends may be paid. Preferred dividends accumulate and must be reported in a company’s financial statement.

After the dividends are paid, the dividend payable is reversed and is no longer present on the liability side of the balance sheet. When the dividends are paid, the effect on the balance sheet is a decrease in the company’s retained earningsand its cash balance. Retained earnings are listed in the shareholders’ equity section of the balance sheet. Because preferred stockholders have priority over common stockholders in regards to dividends, these forgone dividends accumulate and must eventually be paid to preferred shareholders.

Where are dividends on the balance sheet?

There is no separate balance sheet account for dividends after they are paid. However, after the dividend declaration and before the actual payment, the company records a liability to its shareholders in the dividend payable account. Retained earnings are listed in the shareholders’ equity section of the balance sheet.

Instead, dividends impact the shareholders’ equity section of the balance sheet. Dividends, whether cash or stock, represent a reward to investors for their investment in the company.

This is due to the nature of preferred stock and preferred stock dividends. Regular cash dividends paid on ordinary common stock arenotdeducted from the income statement.

Where do dividends appear on the financial statements?

The two types of dividends affect a company’sbalance sheet in different ways. Cash or stock dividends distributed to shareholders are not recorded as an expense on a company’s income statement.

Noncumulative preferred stock does not have this feature, and all preferred dividends in arrears may be disregarded. When a dividend is later paid to shareholders, debit the Dividends Payable account and credit the Cash account, thereby reducing both cash and the offsetting liability. However, the situation is different for shareholders of cumulative preferred stock.

While cash dividends have a straightforward effect on the balance sheet, the issuance of stock dividends is slightly more complicated. Stock dividends are sometimes referred to as bonus shares or a bonus issue. Adividendis a method of redistributing a company’s profits to shareholders as a reward for their investment. Companies are not required to issue dividends on common sharesof stock, though many pride themselves on paying consistent or constantly increasing dividends each year. When a company issues a dividend to its shareholders, the dividend can be paid either in cash or by issuing additional shares of stock.

Do Dividends Go On The Balance Sheet?

Upon payment, the company debits the dividends payable account and credits the cash account, thereby eliminating the liability by drawing down cash. A cash dividend is a sum of money paid by a company to a shareholder out of its profits or reserves called retained earnings. Each quarter, companies retain or accumulate their profits in retained earnings, which is essentially a savings account.