How Do Net Income and Operating Cash Flow Differ?

The cash flow statement can be prepared using either the direct or indirect method. The cash flow from financing and investing activities’ sections will be identical under both the indirect and direct method. Under the direct method, the cash flow from operating activities is presented as actual cash inflows and outflows on a cash basis, without starting from net income on an accrued basis.

Prepare the Statement of Cash Flows Using the Indirect Method

What is difference between direct and indirect method of cash flow statement?

The direct method of cash flow in operating activities includes the cash being received from the customers and the cash paid to the suppliers, employees, and others. Indirect cash flow method, on the other hand, the calculation starts from the net income and then we go along adjusting the rest.

The indirect method presents the statement of cash flows beginning with net income or loss, with subsequent additions to or deductions from that amount for non-cash revenue and expense items, resulting in cash flow from operating activities. In the case of a trading portfolio or an investment company, receipts from the sale of loans, debt, or equity instruments are also included. When preparing a cash flow statement under theindirect method, depreciation, amortization, deferred tax, gains or losses associated with a noncurrent asset, and dividends or revenue received from certain investing activities are also included.

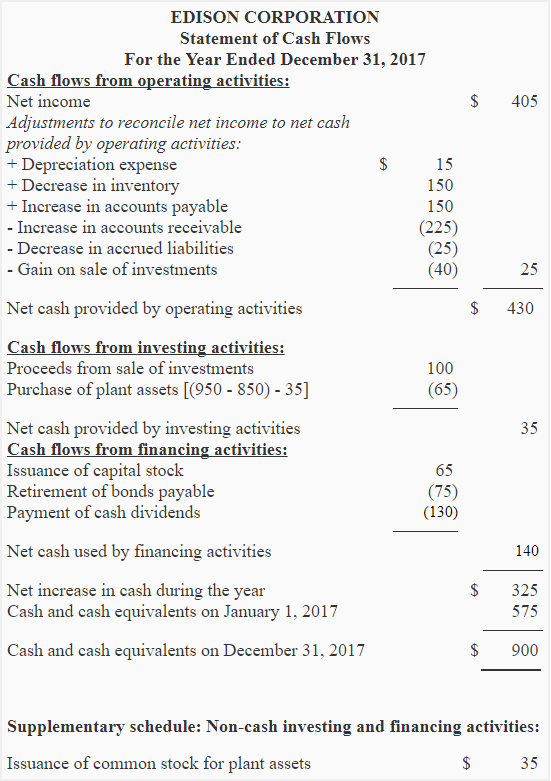

A gain is subtracted from net income and a loss is added to net income to reconcile to cash from operating activities. Propensity’s income statement for the year 2018 includes a gain on sale of land, in the amount of $4,800, so a reversal is accomplished by subtracting the gain from net income. On Propensity’s statement of cash flows, this amount is shown in the Cash Flows from Operating Activities section as Gain on Sale of Plant Assets.

The following sections discuss specifics regarding preparation of these two nonoperating sections, as well as notations about disclosure of long-term noncash investing and/or financing activities. Changes in the various long-term assets, long-term liabilities, and equity can be determined from analysis of the company’s comparative balance sheet, which lists the current period and previous period balances for all assets and liabilities.

Secondarily, decreases in accrued revenue accounts indicates that cash was collected in the current period but was recorded as revenue on a previous period’s income statement. In both scenarios, the net income reported on the income statement was lower than the actual net cash effect of the transactions.

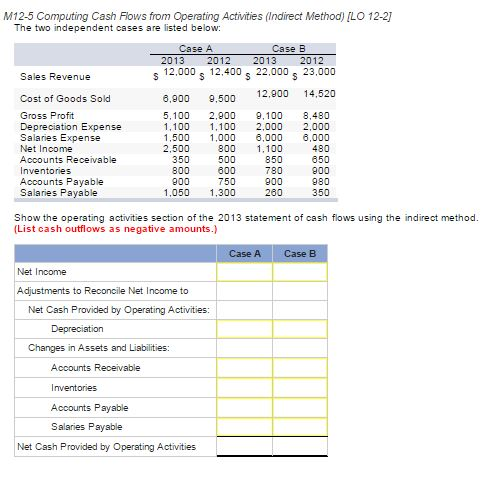

The second category, timing differences, involves changes in assets and liabilities on the balance sheet. These adjusting entries compensate for the way companies recognize revenue and expenses under accrual accounting rules. The third category covers non-operating gains or losses, which means income or losses generated by activities other than the core functions of the company. Companies that use accrual basis accounting can assemble their statement of cash flows in one of two ways, using either the direct method or the indirect method. The more commonly used indirect method shows the company’s net income, and adjusts it with reconciling entries, to arrive at the company’s operating cash flow.

For example, in accrual accounting, a company records a sale even if the customer has yet to pay his invoice. Under the indirect method, the company starts with net income as reported on the income statement and adjusts net income on an accrual basis rather than cash basis. For instance, since depreciation is a noncash expense, the indirect method adds the amount to net income. An increase in accounts receivable is a use of cash because, essentially, the company is providing a good to a client on credit. Decreases in current assets indicate lower net income compared to cash flows from prepaid assets and accrued revenues.

The reconciliation report is used to check the accuracy of the operating activities, and it is similar to the indirect report. The reconciliation report begins by listing the net income and adjusting it for non-cash transactions and changes in the balance sheet accounts.

What is the indirect method of statement of cash flows?

The indirect method presents the statement of cash flows beginning with net income or loss, with subsequent additions to or deductions from that amount for non-cash revenue and expense items, resulting in cash flow from operating activities.

With theindirect method, cash flow from operating activities is calculated by first taking the net income off of a company’s income statement. Because a company’s income statement is prepared on anaccrual basis, revenue is only recognized when it is earned and not when it is received. The indirect method also makes adjustments to add back non-operating activities that do not affect a company’s operating cash flow. In contrast, under the indirect method, cash flow from operating activities is calculated by first taking the net income from a company’s income statement. Because a company’s income statement is prepared on an accrual basis, revenue is only recognized when it is earned and not when it is received.

- Under the direct method, the only section of the statement of cash flows that will differ in the presentation is the cash flow from the operations section.

The direct method starts with sales and follows cash as it flows through the income statement, while the indirect method starts with income after taxes and adjusts backwards for noncash and other items. The direct and indirect method calculates the financing and investing cash flows the same way, and both methods will result in the same cash flow figure. To reconcile net income to cash flow from operating activities, these noncash items must be added back, because no cash was expended relating to that expense. The sole noncash expense on Propensity Company’s income statement, which must be added back, is the depreciation expense of $14,400. On Propensity’s statement of cash flows, this amount is shown in the Cash Flows from Operating Activities section as an adjustment to reconcile net income to net cash flow from operating activities.

What Is the Indirect Method?

Under the direct method, the only section of the statement of cash flows that will differ in the presentation is the cash flow from the operations section. The direct method lists the cash receipts and cash payments made during the accounting period. The indirect method for the preparation of the statement of cash flows involves the adjustment of net income with changes in balance sheet accounts to arrive at the amount of cash generated by operating activities. The statement of cash flows is one of the components of a company’s set of financial statements, and is used to reveal the sources and uses of cash by a business. It presents information about cash generated from operations and the effects of various changes in the balance sheet on a company’s cash position.

However, purchases or sales oflong-term assetsare not included in operating activities. It essentially presents a reconciliation of accrual accounting net income to cash from operating activities. Accrual accounting records revenues and expenses when they occur regardless of when cash changes hands.

What Factors Decrease Cash Flow From Operating Activities?

The investing and financing sections of the statement of cash flows are prepared in the same way for both the indirect and direct methods. Gains and/or losses on the disposal of long-term assets are included in the calculation of net income, but cash obtained from disposing of long-term assets is a cash flow from an investing activity. Because the disposition gain or loss is not related to normal operations, the adjustment needed to arrive at cash flow from operating activities is a reversal of any gains or losses that are included in the net income total.

To reconcile net income to cash flow from operating activities, add decreases in current assets. You’ll need to make three types of adjustments to reach operating cash flow. The first, noncash items, includes items that don’t reduce cash, but they still get recorded as an income statement expense that reduces net income.

For decreases in prepaid assets, using up these assets shifts these costs that were recorded as assets over to current period expenses that then reduce net income for the period. Thus, cash from operating activities must be increased to reflect the fact that these expenses reduced net income on the income statement, but cash was not paid this period.

Corporate Cash Flow: Understanding the Essentials

The exact formula used to calculate the inflows and outflows of the various accounts differs based on the type of account. In the most commonly used formulas, accounts receivable are used only for credit sales and all sales are done on credit. If cash sales have also occurred, receipts from cash sales must also be included to develop an accurate figure of cash flow from operating activities. Since the direct method does not include net income, it must also provide a reconciliation of net income to the net cash provided by operations. The main difference between the direct and indirect methods of calculating cash flows is the way that cash flow from operations is calculated.

The three main financial statements are the balance sheet, income statement, and cash flow statement. The cash flow statement is divided into three categories—cash flow from operating, cash flow from financing, and cash flow from investing activities.