How Do Accounts Payable Show on the Balance Sheet?

This allows them to continue to build their business, so in some sense, the loan could be considered an investment in a business’ own ability to grow. The drawback is that a debt is considered a business liability, and non-payment may result in further penalties and potentially even legal action.

What are examples of current liabilities?

A liability is something a person or company owes, usually a sum of money. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. Even marriages can change your liability.

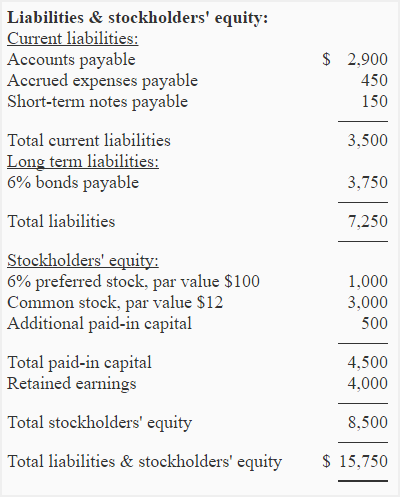

Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet. Current liabilities are short-term liabilities of a company, typically less than 90 days. In order to assess the financial health of a company we need to look at its component parts. Liabilities are simply something of value a business owes to another person or organization.

In this lesson, we’ll be looking specifically at non-current liabilities, which are the long-term financial obligations of a business that do not come due for payment for a year or more. A financial obligation can be a payment of money, goods or services. If the money owed is for repayment of a loan, such as a mortgage or an equipment lease, then the liability is a debt.

Current vs. Long-term Liabilities

The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. Non-current liabilities are long-term liabilities, which are financial obligations of a company that will come due in a year or longer.

An accrued liability is an expense that a business has incurred but has not yet paid. A company can accrue liabilities for any number of obligations, and the accruals can be recorded as either short-term or long-term liabilities on a company’s balance sheet. Payroll taxes, including Social Security, Medicare, and federal unemployment taxes are liabilities that can be accrued periodically in preparation for payment before the taxes are due.

What are liabilities?

Noncurrent liabilities are those obligations not due for settlement within one year. These liabilities are separately classified in an entity’s balance sheet, away from current liabilities. Examples of noncurrent liabilities are: Long-term portion of debt payable.

Other Definitions of Liability

Non-current liabilities are reported on a company’s balance sheet along with current liabilities, assets, and equity. Examples of non-current liabilities include credit lines, notes payable, bonds and capital leases. Accounts payableis the amount of short-term debt or money owed to suppliers and creditors by a company.

The cluster of liabilities comprising current liabilities is closely watched, for a business must have sufficient liquidity to ensure that they can be paid off when due. All other liabilities are reported as long-term liabilities, which are presented in a grouping lower down in the balance sheet, below current liabilities.

The benefit for the creditor is that to be able to make a loan is the sign of a healthy and thriving business. There is also profit to be made in the form of interest paid on every loan repayment – so the ultimate amount paid back will be more than what was borrowed. The drawback is there is potential for non-payment, forcing the creditor to pursue potentially expensive legal proceedings to get what they’re owed. Current liabilities on balance sheet impose restrictions on the cash flow of a company and have to be managed prudently to ensure that the company has enough current assets to maintain short-term liquidity.

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

In most cases, companies are required to maintain liabilities for recording payments which are not yet due. Again, companies may want to have liabilities because it lowers their long-term interest obligation. Liabilities are also known as current or non-current depending on the context.

Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. They can also be thought of as a claim against a company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000. The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000.

As a result, accounts receivable are assets since eventually, they will be converted to cash when the customer pays the company in exchange for the goods or services provided. Accounts payable are the opposite of accounts receivable, which are current assets that include money owed to the company. Debtors are shown as assets in the balance sheet under the current assets section while creditors are shown as liabilities in the balance sheet under the current liabilities section.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses. In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions.

Classifications Of Liabilities On The Balance Sheet

For example, the terms could stipulate that payment is due to the supplier in 30 days or 90 days. The payable is in default if the company does not pay the payable within the terms outlined by the supplier or creditor. Products and services may often be prohibitively expensive to pay for up front, or in one lump sum. Financing allows an individual or business to have use of the asset while paying for it in more manageable instalments – often weekly, monthly, or sometimes quarterly. The benefit for the debtor is that they get access to funds or equipment that would otherwise be beyond them.

They can include a future service owed to others; short- or long-term borrowing from banks, individuals, or other entities; or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest likeaccounts payableand bonds payable.

Liability Definition

In the context of personal finance and small business accounting, bills payable are liabilities such as utility bills. They are recorded as accounts payable and listed as current liabilities on a balance sheet. In financial accounting, an asset is any resource owned by the business.

Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized. The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion. Accounts payable are not to be confused with accounts receivable. Accounts receivablesare money owed to the company from its customers.

Anything tangible or intangible that can be owned or controlled to produce value and that is held by a company to produce positive economic value is an asset. Simply stated, assets represent value of ownership that can be converted into cash (although cash itself is also considered an asset). The balance sheet of a firm records the monetary value of the assets owned by that firm. It covers money and other valuables belonging to an individual or to a business.

Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations. Current liabilities may also be settled through their replacement with other liabilities, such as with short-term debt. A current liability is an obligation that is payable within one year.

Accounts payable are short-term credit obligations purchased by a company for products and services from their supplier. Accounts receivable are similar to accounts payable in that they both offer terms which might be 30, 60, or 90 days. However, with receivables, the company will be paid by their customers, whereas accounts payables represent money owed by the company to its creditors or suppliers. Current Liabilities on the balance sheet refer to the debts or obligations that a company owes and is required to settle within one fiscal year or its normal operating cycle, whichever is longer. These liabilities are recorded on the Balance Sheet in the order of the shortest term to the longest term.

The definition does not include amounts that are yet to be incurred as per the accrual basis of accounting. For example, the salary to be paid to employees for services in the next fiscal year is not yet due since the services have not yet been incurred.