How Are Retained Earnings Recorded?

While Retained Earnings is expressed as a dollar amount, it is not held in a cash account. Instead, this figure represents the amount of assets that a company has purchased or operating costs it has paid out of its profits, rather than out of its earnings from selling its own stock. Retained Earnings is a critical measure of a company’s value and stability, since it tells an investor both how much a company is likely to pay in dividends, and how profitable it has been over time.

These funds are retained and reinvested into the company, allowing it to grow, change directions or meet emergency costs. If these profits are spent wisely the shareholders benefit because the company — and in turn its stock — becomes more valuable. But if the retained earnings category is disproportionately large, and especially if it is held in cash, the shareholders may ask for a dividend to be paid.

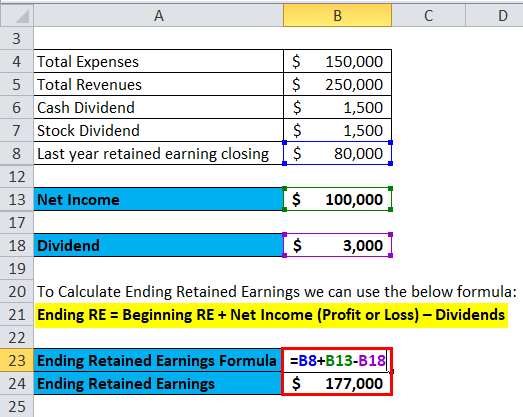

Retained Earnings are listed on a balance sheet under the shareholder’s equity section at the end of each accounting period. To calculate Retained Earnings, the beginning Retained Earnings balance is added to the net income or loss and then dividend payouts are subtracted. In an accounting cycle, the second financial statement that should be prepared is the Statement of Retained Earnings.

In short, retained earnings is the cumulative total of earnings that have yet to be paid to shareholders. These funds are also held in reserve to reinvest back into the company through purchases of fixed assets or to pay down debt. The retained earnings account and the paid-in capital account are recorded in the stockholders’ equity section on the balance sheet. The balance for the retained earnings account is taken from the income statement. The net income or net loss disclosed on the income statement for each accounting period is added to the existing retained earnings balance.

This is the amount of income left in the company after dividends are paid and are often reinvested into the company or paid out to stockholders. Cash payment of dividend leads to cash outflow and is recorded in the books and accounts as net reductions. As the company loses ownership of its liquid assets in the form of cash dividends, it reduces the company’s asset value in the balance sheet thereby impacting RE.

Positive earnings are more commonly referred to as profits, while negative earnings are more commonly referred to as losses. The retained earnings normal balance is the money a company has after calculating its net income and dispersing dividends. By definition, retained earnings are the cumulative net earnings or profits of a company after accounting for dividend payments. It is also called earnings surplus and represents the reserve money, which is available to the company management for reinvesting back into the business.

Shareholder equity represents the amount left over for shareholders if a company paid off all of its liabilities. To see how retained earnings impact a shareholders’ equity, let’s look at an example.

This balance is carried from year to year and thus will grow as a company ages. A company’s shareholder equityis calculated by subtractingtotal liabilitiesfrom itstotal assets.

When expressed as a percentage of total earnings, it is also calledretention ratio and is equal to (1 – dividend payout ratio). The retained earnings statement summarizes changes in retained earnings for a fiscal period, and total retained earnings appear in the shareholders’ equity portion of the balance sheet.

Your retained earnings balance is the cumulative total of your net income and losses. Retained earnings represent the accumulated net income your business keeps after paying all costs, expenses and taxes. The retained earnings balance changes if you pay your stockholders a dividend. If you are the sole owner, you may choose to forego dividend payments in favor of using the funds for your business. However, if you sold stock shares to raise capital, your stockholders may expect an occasional dividend.

Retained earnings are also known as retained capital or accumulated earnings. A very young company that has not yet produced revenue will have Retained Earnings of zero, because it is funding its activities purely through debts and capital contributions from stockholders. In later years once the company has paid any amount of dividends, the remainder is recorded as an increase in Retained Earnings.

This account is the only available source for dividend payments, but a company is under no legal obligations to pay these earnings to shareholders as dividends. Stockholders’ equity, also referred to as shareholders’ equity, is the remaining amount of assets available to shareholders after all liabilities have been paid. It is calculated either as a firm’s total assets less its total liabilities or alternatively as the sum of share capital and retained earnings less treasury shares.

Dividends and Retained Earnings

- The most basic financial equation in a company is Assets less Liabilities equals Stockholders’ Equity.

- Stockholders’ Equity is then further broken down into Capital Stock and Retained Earnings.

At some point, accumulated retained earnings may exceed the amount of contributed equity capital and can eventually grow to be the main source of stockholders’ equity. Retained earnings refer to the amount of net income that a business has after it has paid out dividends to its shareholders.

The retained earnings balance recorded on the balance sheet is reduced by $10. You can use an accounting formula to update the retained earnings account balance. To calculate the new amount, find the current retained earnings account on the balance sheet.

Retained earnings are corporate income or profit that is not paid out as dividends. Another factor that affects owner’s equity is invested capital for companies with multiple stockholders or an owner’s contributions for sole proprietorships and other small businesses. Suppose a sole proprietor contributes cash to the business for operating costs. Similarly, in a public company, paid-in capital, the money investors spend to purchase shares of stock, is listed as invested capital.

Retained Earnings

The basic accounting equation for a business is assets equal liabilities plus the owner’s equity; simply turned around, this means the owner’s equity equals assets minus liabilities. Shown on a balance sheet, the terms used to indicate owner’s equity may be listed as one or more accounts. Regardless of the account names, equity is the portion of the business the owner actually owns, including retained earnings. Corporations must publish a quarterly income statement that details their costs and revenue, including taxes and interest, for that period. The balance shown on the statement is the corporation’s net income for the quarter and is considered accumulated returned earnings.

Those closing entries can be debited from their respective accounts and credited to Retained Earnings. You can find your business’s previous retained earnings on your business balance sheet or statement of retained earnings. Your company’s net income can be found on your income statement or profit and loss statement. If you have shareholders, dividends paid is the amount that you pay them. Retained earnings are the portion of a company’s net income that management retains for internal operations instead of paying it to shareholders in the form of dividends.

Using Retained Earnings

Retained earnings are the profits or net income that a company chooses to keep rather than distribute it to the shareholders. Retained earnings are business profits that can be used for investing or paying down business debts. They are cumulative earnings that represent what is leftover after you have paid expenses and dividends to your business’s shareholders or owners.

Add the current net income or net loss reported on the income statement to the beginning retained earnings balance. Next, subtract the amount of dividends paid to get your retained earnings ending balance. For example, suppose the beginning retained earnings balance is $5,000. After subtracting $100 of paid dividends, the ending retained earnings balance is recorded on the balance sheet as $6,900. The statement of retained earnings is afinancial statement that is prepared to reconcile the beginning and ending retained earnings balances.

The most basic financial equation in a company is Assets less Liabilities equals Stockholders’ Equity. Stockholders’ Equity is then further broken down into Capital Stock and Retained Earnings. The Retained Earnings account is built from the closing entries from the Balance Sheet, Income Statement, Statement of Cash Flows and Statement of Retained Earnings.

If shareholders do not need immediate cash, they may vote to retain corporate earnings to avoid income tax. As retained earnings increase, the stock value of the company also increases. This allows shareholders to later sell the company at a higher price or they can simply withdraw dividends in the future. Retained earnings are a company’s net income from operations and other business activities retained by the company as additional equity capital. They represent returns on total stockholders’ equity reinvested back into the company.

How do you calculate retained earnings on a balance sheet?

The retained earnings are calculated by adding net income to (or subtracting net losses from) the previous term’s retained earnings and then subtracting any net dividend(s) paid to the shareholders. The figure is calculated at the end of each accounting period (quarterly/annually.)

The dividend payment is reported on the balance sheet and reduces the amount in your retained earnings account. Retained earnings are all the profits a company has earned but not paid out to shareholders in the form of dividends.

Stockholders’ equity might include common stock, paid-in capital, retained earnings and treasury stock. Retained earnings are a company’s cumulative earnings since it began the business, minus any shareholder dividends that were issued. This figure represents stockholder equity that can be used for development, marketing or further distribution of profits. “Beginning retained earnings” refers to the previous year’s retained earnings and is used to calculate the current year’s retained earnings. It is typically not listed on a current balance sheet but is instead the retained earnings from the previous year.

Instead, the corporation likely used the cash to acquire additional assets in order to generate additional earnings for its stockholders. In some cases, the corporation will use the cash from the retained earnings to reduce its liabilities. As a result, it is difficult to identify exactly where the retained earnings are presently.

This means that every dollar of retained earnings means another dollar of shareholders’ equity or net worth. A cash dividend payment is not the only transaction that affects the retained earnings account. You calculate the value of the stock dividend by multiplying the number of stock shares issued and outstanding by the stock dividend percentage. For example, suppose you have 1,000 shares issued and outstanding and declare a 1 percent stock dividend.