How are fixed and variable overhead different?

Typically fixed overhead costs are stable and should not change from the budgeted amounts allocated for those costs. However, if sales increase well beyond what a company budgeted for, fixed overhead costs could increase as employees are added, and new managers and administrative staff are hired. Also, if a building must be expanded or the rental of a new production facility is needed to meet increased sales, fixed overhead costs would need to increase to keep the company running smoothly.

For example, if the cost of a kilowatt of electricity went up or if a purchaser had to pay more on machine supplies than usual, there could be a spending variance. Unfavorable efficiency variances occur when the factory uses more variable overhead per unit than expected.

How do you calculate variable overhead rate variance?

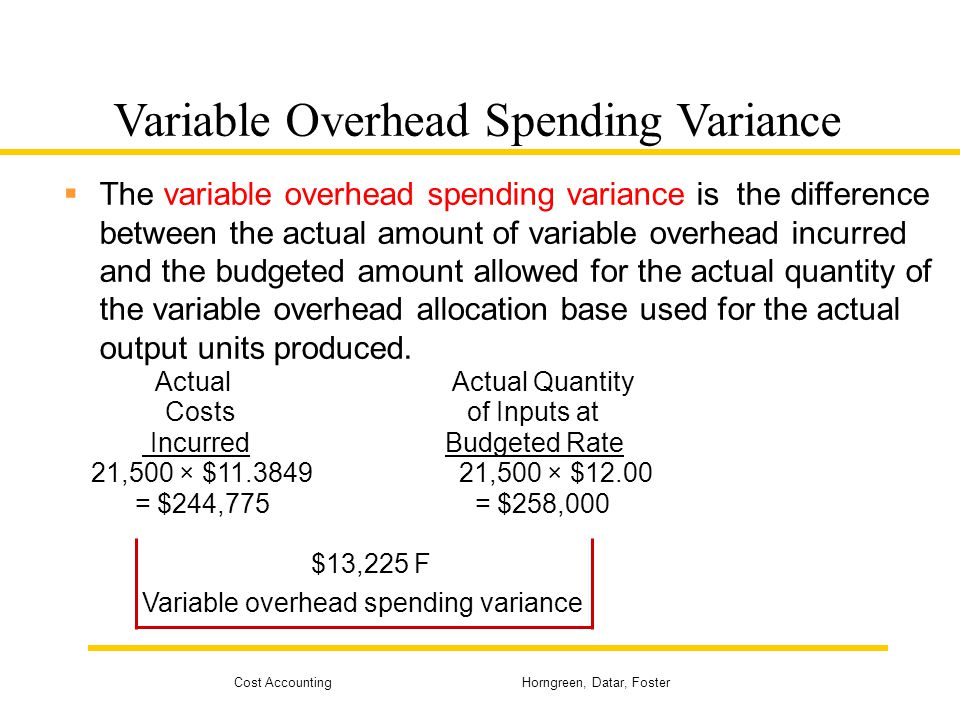

Variable Overhead Spending Variance is the difference between what the variable production overheads actually cost and what they should have cost given the level of activity during a period. Variable overhead spending variance is unfavorable if the actual costs are higher than the budgeted costs.

The unfavorable efficiency variance is due to the actual use of 59,000 machine hours instead of the budgeted 57,600 hours. A spending variance is the difference between the actual amount of a particular expense and the expected (or budgeted) amount of an expense. To understand what variable overhead spending variance is, it helps to know what a variable overhead is. Variable overhead is a cost associated with running a business that fluctuates with operational activity.

As production output increases or decreases, variable overheads move in tandem. Overheads are typically a fixed cost, for example, administrative expenses. The difference between actual and standard overhead is referred to as a variance.

The traditional variance analysis presented below is based on Exhibit 2, p. 41. The variable overhead (VO) spending variance is $44,844F and the variable overhead efficiency variance is $44,844U.

How budgeting works for companies

To reach this standard rate, the annual overhead cost is divided by the cost center’s practical capacity. Practical capacity is used so that idle capacity may be found and put to better use. The standard rates calculated for batch and product level activities do not vary with production volume.

Variable Overhead Spending Variance

- The variable overhead (VO) spending variance is $44,844F and the variable overhead efficiency variance is $44,844U.

- The traditional variance analysis presented below is based on Exhibit 2, p. 41.

These variances are calculated using machine hours as the cost driver. The favorable VO spending variance can be attributed to generating the budgeted variable overhead costs ($1,845,000) despite using extra machine hours.

The accountant then multiplies the rate by expected production for the period to calculate estimated variable overhead expense. If the business plans to produce 200 units in the next period and the standard rate is $3 per unit, the estimated variable expense is $600.

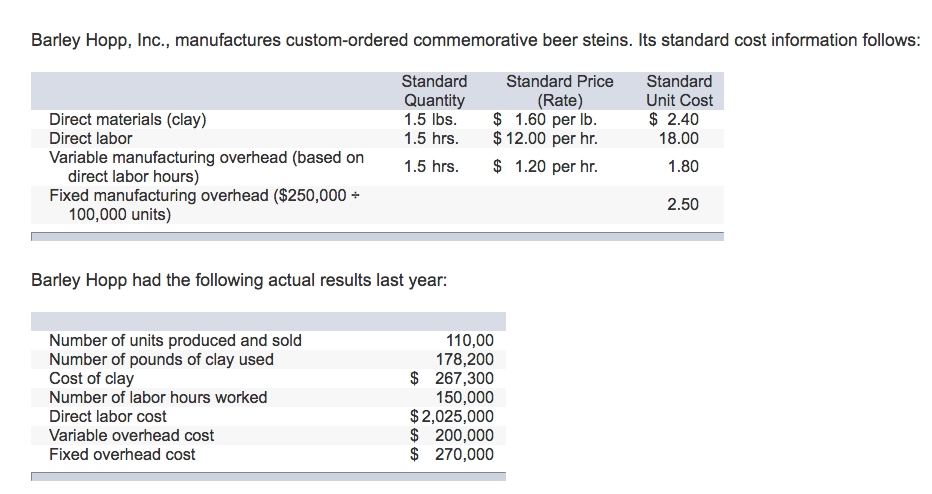

It is unfavorable if the actual costs are higher than the budgeted costs. Before production begins, a business will typically calculate a standard or estimated variable manufacturing overhead for the year. Accountants come up with this figure by analyzing historical data and determining how much variable overhead expense the company tends to incur per unit produced. For example, if variable overhead costs are typically $300 when the company produces 100 units, the standard variable overhead rate is $3 per unit.

Within manufacturing overhead, some costs are fixed — meaning, they don’t tend to change as production increases — and others are variable. Variable manufacturing overhead costs differ based on how much the company produces. Variable overhead spending variance is favorable if the actual costs of indirect materials are lower than the standard or budgeted variable overheads. In accounting, all costs can be described as either fixed costs or variable costs. Variable costs are inventoriable costs – they are allocated to units of production and recorded in inventory accounts, such as cost of goods sold.

For example, if a machine needed more replacement supplies and parts than usual but didn’t produce more inventory, there would be an efficiency variance. Variable manufacturing overhead costs are a set of expenses that fluctuate as production levels change. Businesses calculate and use variable manufacturing overhead to estimate future costs and analyze past performance. If variable manufacturing costs are significantly different than expected, the business will perform variance analysis to identify the underlying cause. The first step in activity-based variance analysis is to assign all overhead costs to a level of activity.

If the variance is significant, management will investigate what caused the variance. Variances in variable manufacturing overhead are classified as either a spending variance or an efficiency variance. Unfavorable spending variances occur when the factory purchases items at a higher rate than expected.

Fixed costs, on the other hand, are all costs that are not inventoriable costs. All costs that do not fluctuate directly with production volume are fixed costs. Fixed costs include various indirect costs and fixed manufacturing overhead costs. Variable costs include direct labor, direct materials, and variable overhead.

This is a fundamental difference between ABC and traditional variance analysis. Variable overhead spending variance is favorable if the actual costs of indirect materials — for example, paint and consumables such as oil and grease—are lower than the standard or budgeted variable overheads.

The three primary components of a product cost are direct materials, direct labor and manufacturing overhead. Manufacturing overhead is a catch-all account that includes all manufacturing costs a business incurs other than direct materials and direct labor.

What Are the Types of Costs in Cost Accounting?

By looking at the unfavorable unit-level cost variances in Exhibit 3, we can tell that there is no idle capacity. This may tell managers to expect a greater number of machine hours in the future. Variable Overhead Spending Variance is essentially the difference between what the variable production overheadsactuallycost and what theyshouldhave cost given the level of activity during a period.