Here’s How Capital Gains Taxes on Investment Properties Work

Treasury requires them to pass through most of their income to their shareholders. These dividends are not “qualified” for capital gains tax treatment. If you don’t want to pay 15% or 20% in capital gains taxes, give the appreciated assets to someone who doesn’t have to pay as high a rate. The IRS allows taxpayers to gift up to $14,000 per person (a couple filing jointly can gift up to $28,000), per year without incurring any gift tax.

How Dividends Affect Stock Prices

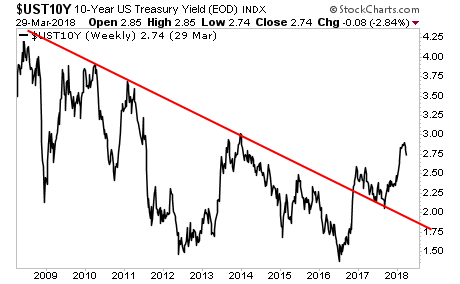

Setting the bond yield equal to its coupon rate is the simplest definition. More complex calculations of a bond’s yield will account for the time value of money and compounding interest payments. These calculations include yield to maturity (YTM), bond equivalent yield (BEY) and effective annual yield (EAY). (Discover the difference between Bond Yield Rate vs. Coupon Rate).

Yes, besides sales tax, excise tax, property tax, income tax, and payroll taxes, individuals who buy and sell personal and investment assets must also contend with the capital gains tax system. If you sell assets like vehicles, stocks, bonds, collectibles, jewelry, precious metals, or real estate at a gain, you’ll likely pay a capital gains tax on some of the proceeds.

Let’s consider the example of an investor who realized a gain of $5,000 from the sale of some securities, while also incurring a loss of $20,000 from selling others. The capital loss can be used to cancel out tax liability for the $5,000 gain.

If they’ve owned the stock for a year or less, then they’ll pay short-term capital gains tax at their ordinary income tax rate on the profit. If they’ve held the stock for longer than a year, then the lower long-term capital gains tax rates will apply. If you have short-term losses, your marginal tax rate determines the rate you’ll pay on capital gains. So, selling capital gain assets in “lean” years may lower your capital gains rate and save you money. Capital gains are reported on your annual tax return, along with income from other sources.

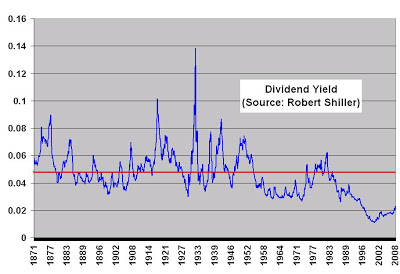

If dividends are paid before the sale of shares, the investment income generated is $2 x 100, or $200. While high dividend yields are attractive, they may come at the cost of growth potential.

The remaining capital loss of $15,000 can then be used to offset income, and thus the tax on those earnings. If the investor’s annual income is $50,000, they can, in the first year, report $50,000 minus a maximum annual claim of $3,000. The investor still has $12,000 of capital losses and so could deduct the $3,000 maximum from their taxable income for the next four years.

The current yield of a bond is calculated by dividing the annual coupon payment by the bond’s current market value. Because this formula is based on the purchase price rather than the par value of a bond, it more accurately reflects the profitability of a bond, relative to other bonds on the market. The current yield calculation helps investors drill down on bonds that generate the greatest returns on investment each year. After that, you must close on the new property within 180 days of selling your investment property, or before your tax return is due for the year you sold the property — whichever comes first.

Capital gains transactions are reported on Schedule D. Sales of securities are reported on Form 8949. Total capital gains or losses (limited to $3,000) are reported on Form 1040, line 6. If you use tax preparation software like H&R Block, you’ll be able to easily enter your capital gain numbers for calculation in your tax liability.

Cost Basis 101: How to Correctly Understand It

The requirement of capital yield formula used when there is a change in the buying price of a stock and with the selling price of the particular stock within a one-year time frame. When a stock price appreciates and the holder of the stock sales at a premium price and the difference of the amount is entitled to a short-term capital gains tax.

- Yes, besides sales tax, excise tax, property tax, income tax, and payroll taxes, individuals who buy and sell personal and investment assets must also contend with the capital gains tax system.

Capital Gains Yield

Is capital gains yield the same as growth rate?

CGY can be positive, negative or a capital loss. However, an investment that has a negative CGY may generate profits for an investor. The higher the share price at a specific period, the greater the capital gains indicating higher stock performance.

Capital gains tax is a levy assessed on the positive difference between the sale price of the asset and its original purchase price. Long-term capital gains tax is a levy on the profits from the sale of assets held for more than a year. Short-term capital gains tax applies to assets held for a year or less, and is taxed as ordinary income.

Can capital gains yield be negative?

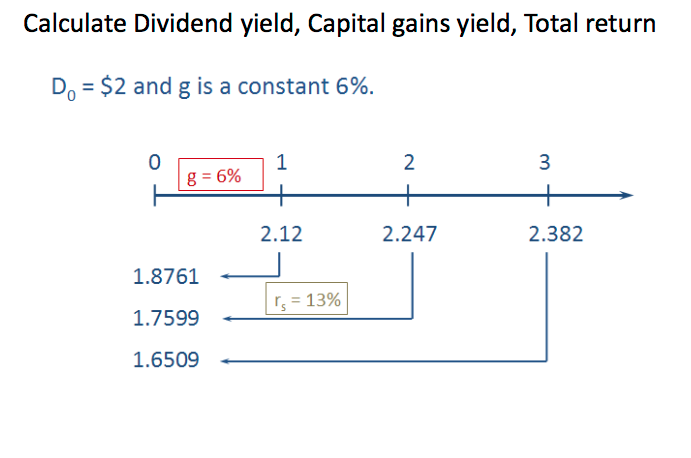

Capital gains yield is the percentage price appreciation on an investment. It is calculated as the increase in the price of an investment, divided by its original acquisition cost. For example, if a security is purchased for $100 and later sold for $125, the capital gains yield is 25%.

If you don’t meet these deadlines, the transaction won’t count as a 1031 exchange and any capital gains taxes will become due. Short-term capital gains happen when you sell an investment property you held for one year or less. That means you pay the same tax rate on short-term gains as you would on wages from your job. For 2019, there are seven tax brackets that range from 10% to 37%. Investment income is income coming from interest payments, dividends, capital gains collected upon the sale of a security or other assets.

Instead, you calculate the capital gain (or loss) by subtracting the “cost basis” of the property from the “net proceeds” you make from the sale. This means your profit — and tax burden — might be smaller than it seems at first glance. The tax is calculated only on the net capital gains for that tax year. Net capital gains are determined by subtracting capital losses—income lost on an investment that was sold at less than what it was purchased for—from capital gains for the year. Most investors will pay a capital gains tax rate of less than 15%.

Every dollar a company is paying in dividends to its shareholders is a dollar that the company is not reinvesting to grow and generate capital gains. Shareholders can earn high returns if the value of their stock increases while they hold it. Along with REITs, master limited partnerships (MLPs) and business development companies (BDCs) also have very high dividend yields.

A capital gain, therefore, is the profit realized when an investment is sold for a higher price than the original purchase price. Unlike capital gains, the amount of return for these investments is not reliant on the initial capital expenditure. In the capital gains example, assume company ABC pays a dividend of $2 per share for each of the 100 shares that the investor purchased.

That means you could gift appreciated stock or other investments to a family member in a lower income tax bracket. If the family member chooses to sell the asset, it will be taxed at their rate, not yours. When you sell an investment property, any profits are subject to capital gains taxes. But it’s not as simple as subtracting what you paid for the property from what you sold it for.

Formula Calculation

This concept does not include any dividends received; it is only based on changes in the price of an investment. To calculate the total return on a share, an investor must combine the capital gains yield and the dividend yield. Dividend yield and Capital gains yields are required in case of appreciation of a stock price. A growing business in most of the cases gives a scope of capital appreciation for the shareholders. In most of the cases, a yield is computed on yearly basis and in extreme cases yields are calculated on a half-yearly and quarterly basis.

The rate of change can be found by subtracting the end amount from the buying price and then divided it by the original amount. For your taxable account, though, your best defense against capital gains taxes is to be a long-term investor.

Capital games yield denotes the absolute return of a stock based on the appreciation of that particular stock after purchasing. The formula of capital gains yields is calculated by excluding the dividend paid by the stock. Combining capital gains yields and dividend yield we get the total return from this particular stock. Capital gains it is primarily used to calculate the rate of change of the stock price only.