GL Codes – Dash

Sample Chart of Accounts For a Large Corporation

This is a partial listing of another sample chart of accounts. Note that each account is assigned a three-digit number followed by the account name. The first digit of the number signifies if it is an asset, liability, etc.

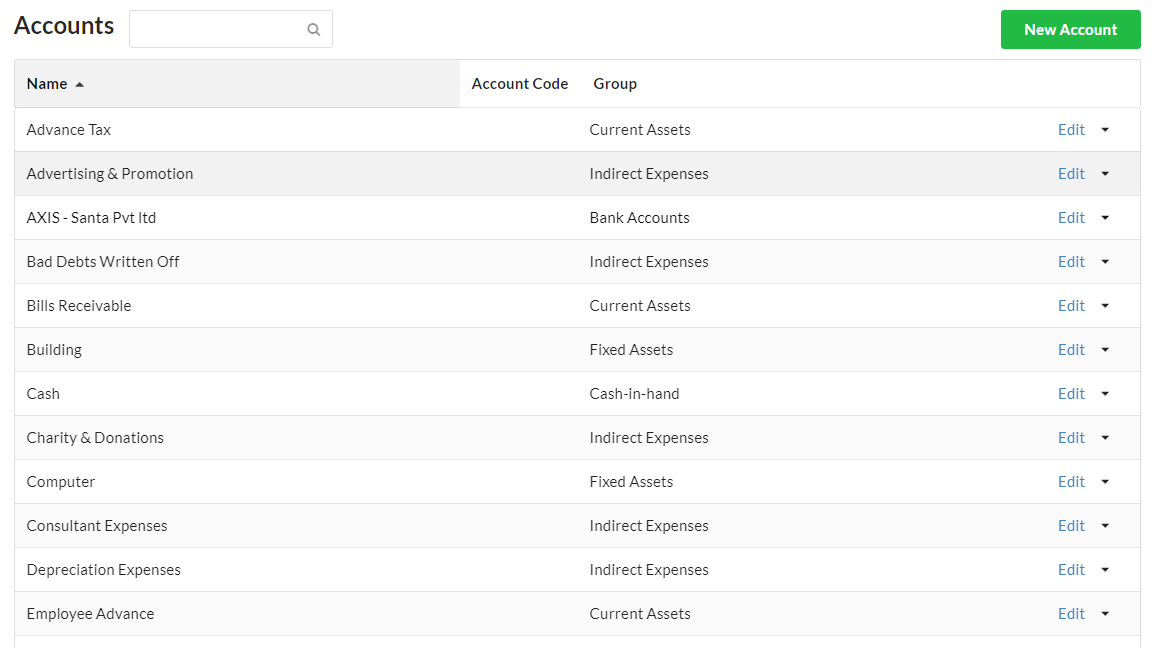

The chart of accounts is a list of every account in the general ledger of an accounting system. Unlike a trial balance that only lists accounts that are active or have balances at the end of the period, the chart lists all of the accounts in the system.

A chart of accounts (COA) is an index of all the financial accounts in thegeneral ledgerof a company. In short, it is an organizational tool that provides a digestible breakdown of all the financial transactions that a company conducted during a specific accounting period, broken down into subcategories.

A chart of accounts is a list of all your company’s “accounts,” together in one place. It provides you with a birds eye view of every area of your business that spends or makes money.

A general ledger account is an account or record used to sort, store and summarize a company’s transactions. These accounts are arranged in the general ledger (and in the chart of accounts) with the balance sheet accounts appearing first followed by the income statement accounts. A chart of accounts (COA) is a financial organizational tool that provides a complete listing of every account in the general ledger of a company, broken down into subcategories. Companies use a chart of accounts (COA) to organize their finances and give interested parties, such as investors and shareholders, a clearer insight into their financial health. Separating expenditures, revenue, assets, and liabilities help to achieve this and ensure that financial statements are in compliance with reporting standards.

INTERCOMPANY PAYABLES

The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. Accounts are usually listed in order of their appearance in the financial statements, starting with the balance sheet and continuing with the income statement. Thus, the chart of accounts begins with cash, proceeds through liabilities and shareholders’ equity, and then continues with accounts for revenues and then expenses. The exact configuration of the chart of accounts will be based on the needs of the individual business. The list of each account a company owns is typically shown in the order the accounts appear in its financial statements.

That means that balance sheetaccounts, assets, liabilities and shareholders’ equity, are listed first, followed by accounts in theincome statement— revenues and expenses. An important purpose of a COA is to segregate expenditures, revenue, assets and liabilities so that viewers can quickly get a sense of a company’s financial health.

What are the 5 types of accounts?

There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories.

Chart of Accounts Outline

- A chart of accounts is a list of all your company’s “accounts,” together in one place.

- It provides you with a birds eye view of every area of your business that spends or makes money.

Think of a chart of accounts as a piece of paper with a list of account names and numbers. It is kept separately from the ledgers as a reference document since it applies to more than one year and possibly even to more than one company. Assets are also grouped according to either their life span or liquidity – the speed at which they can be converted into cash.

For example, if the first digit is a “1” it is an asset, if the first digit is a “3” it is a revenue account, etc. The company decided to include a column to indicate whether a debit or credit will increase the amount in the account. This sample chart of accounts also includes a column containing a description of each account in order to assist in the selection of the most appropriate account. Typically, a COA contains the accounts’ names, brief descriptions and identification codes.

A chart of accounts (COA) is a financial organizational tool that provides a complete listing of every account in an accounting system. An account is a unique record for each type of asset, liability, equity, revenue and expense.

Current assets are items that are completely consumed, sold, or converted into cash in 12 months or less. Examples of current assets include accounts receivable and prepaid expenses. Sub Type 1 for Revenue and Expense GL Accounts are completely customizable with your own values.

It doesn’t include any other information about each account like balances, debits, and credits like atrial balancedoes. Designing a good chart of accounts is very much an art and not a science.

PREPAID EXPENSES & OTHER CURRENT ASSETS

A chart of accounts in most traditional accounting systems refers to a single data tag used to classify an asset, liability, equity, revenue or expense that the company incurs. There may be some limited ability to group the data tags in one or two levels. A company’s organization chart can serve as the outline for its accounting chart of accounts. Each department will have its own phone expense account, its own salaries expense, etc.

Within the categories of operating revenues and operating expenses, for instance, accounts might be further organized by business function and/or by company divisions. There are five main types of accounts in accounting, namely assets, liabilities, equity, revenue and expenses. Their role is to define how your company’s money is spent or received. Each category can be further broken down into several categories.

What is the standard chart of accounts?

In accounting, a standard chart of accounts is a numbered list of the accounts that comprise a company’s general ledger. Furthermore, the company chart of accounts is basically a filing system for categorizing all of a company’s accounts as well as classifying all transactions according to the accounts they affect.

A well-designed COA not only meets the information needs of management, it also helps a business to comply with financial reporting standards. A company has the flexibility to tailor its chart of accounts to best suit its needs.