Free cash flow

It’s the amount of money available for equity shareholders after paying all expenses, debts, reinvestment. Also, consider free cash flow to equity as an adjustment for debt cash flow. Free cash flow (FCF) is the amount of cash a company has generated after spending on everything required to maintain and grow the business.

Companies that experience surging FCF—due to revenue growth, efficiency improvements, cost reductions, share buybacks, dividend distributions, or debt elimination—can reward investors tomorrow. That is why many in the investment community cherish FCF as a measure of value.

Free cash flow is also called free cash flow to firms, abbreviated as FCFF. This number is helpful to shareholders interested in the amount of cash that can be withdrawn from an organization without disturbing operations.

FCF is also helpful as the starting place for potential shareholders or lenders to evaluate how likely the company will be able to pay their expected dividends or interest. If the company’s debt payments are deducted from FCF (Free Cash Flow to the Firm), a lender would have a better idea of the quality of cash flows available for additional borrowings.

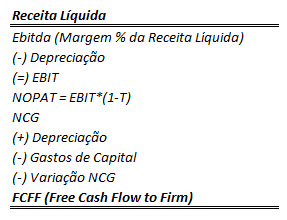

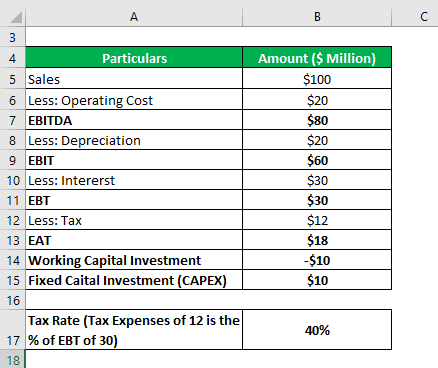

Earnings before interest and taxes, EBIT, is, as it suggests, the earnings from a company’s operations before adjusting for interest expense and taxes. EBIT can be found on the company’s income statement or calculated from the cash flow statement. The free cash flow to firm formula does adjust for taxes by multiplying EBIT by one minus the tax rate. Analysts need to compute these quantities from available financial information, which requires a clear understanding of free cash flows and the ability to interpret and use the information correctly. Forecasting future free cash flows is also a rich and demanding exercise.

The analyst’s understanding of a company’s financial statements, its operations, its financing, and its industry can pay real “dividends” as he or she addresses that task. Many analysts consider free cash flow models to be more useful than DDMs in practice. Free cash flow (FCF) is the cash flow available for the company to repay creditors or pay dividends and interest to investors. Some investors prefer FCF or FCF per share over earnings or earnings per share as a measure of profitability because it removes non-cash items from the income statement. However, because FCF accounts for investments in property, plant, and equipment, it can be lumpy and uneven over time.

You calculate it by subtracting capital expenditures from operating cash flow. Conversely, negative free cash flow might simply mean that the business is investing heavily in new equipment and other capital assets causing the excess cash to disappear. Like with all financial ratios, FCF is a peak into how a company is operated and the strategies that management is taking.

Discounted cash flow (DCF) valuation views the intrinsic value of a security as the present value of its expected future cash flows. When applied to dividends, the DCF model is the discounted dividend approach or dividend discount model (DDM).

You have to measure and analyze the numbers to understand why the ratios are the way they are and whether or not a business is healthy. Free cash flow to firm differs from free cash flow to equity in that it calculates the amount available to both debt and equity holders, as opposed to simply equity holders. One part of how this difference is shown in the free cash flow to firm formula is by instead of using net income, EBIT adjusted for taxes is used. This allows interest expenses to be included as they are paid to debt holders.

Analysts usually value operating assets and nonoperating assets separately and then combine them to find the total value of the firm, an approach described in Section 5. FCF can provide a useful Discounted Cash Flow Analysis technique that can derive the value of a free cash flow firm or the value of the firm’s common equity.

Free cash flow is an indicator of overall business health

A positive or negative cash flow gives investors an understanding of how a company is performing financially. FCF is only the amount of cash left after cash spent to support daily operations and capital assets like land, property and machinery. Examples of financial obligations covered by levered cash flow are operating expenses and interest payments.

The free cash flow calculation is one of the most important results from cash flow analysis that you, as a small business owner, can take away from the analysis of your company’s Statement of Cash Flows. Simply put, free cash flow is the cash that a company has left after it pays for any capital expenditures it makes, like new plant or equipment. Some describe free cash flow as the money the company has left to pay investors after it meets all its financial obligations, but it is more complicated than that.

In other words, this is the excess money a business produces after it pays all of its operating expenses and CAPEX. This is an important concept because it shows how efficient the business is at generating cash and if it can pay its investors a return after it funds its operations and expansions. Free cash flow to the firm (FCFF) and free cash flow to equity (FCFE) are the cash flows available to, respectively, all of the investors in the company and to common stockholders. Section 2 defines the concepts of free cash flow to the firm and free cash flow to equity and then presents the two valuation models based on discounting of FCFF and FCFE. We also explore the constant-growth models for valuing FCFF and FCFE, which are special cases of the general models, in this section.

- When applied to dividends, the DCF model is the discounted dividend approach or dividend discount model (DDM).

- Discounted cash flow (DCF) valuation views the intrinsic value of a security as the present value of its expected future cash flows.

- This reading extends DCF analysis to value a company and its equity securities by valuing free cash flow to the firm (FCFF) and free cash flow to equity (FCFE).

How to Calculate FCFE from EBITDA?

As stated in the prior section, the free cash flow to firm formula is used to determine how much debt and equity holders have available. Apart from this general use of the free cash flow to firm, it may also used in valuation models for a company’s stock using the FCFF approach to discounting future cash flows.

This reading extends DCF analysis to value a company and its equity securities by valuing free cash flow to the firm (FCFF) and free cash flow to equity (FCFE). Whereas dividends are the cash flows actually paid to stockholders, free cash flows are the cash flows available for distribution to shareholders.

Enterprise and Equity Values

Analysts use variations of the FCF equation to calculate free cash flow to the firm or equity. In corporate finance, free cash flow (FCF) or free cash flow to firm (FCFF) is a way of looking at a business’s cash flow to see what is available for distribution among all the securities holders of a corporate entity. Growing free cash flows are frequently a prelude to increased earnings.

The business is like a human body, the body needs blood, the business needs cash. Investor look at Free Cash Flow to make their decision for investment. The Free Cash Flow definition is cash generated by the company after deducting capital expenditures from its operating cash flow the amount of. Free cash flow is the amount of cash an organization generates after operational expenses and funds used to manage assets are dispersed.

Similarly, shareholders can use FCF minus interest payments to think about the expected stability of future dividend payments. FCFF measures the enterprise value, referred to as “unlevered” cash flow. Free cash flow to firm shows available cash to all investor – both debt and equity. In an Unlevered Discounted Cash Flow analysis, you would use WACC (Weighted Average Cost of Capital).

A company can expand, develop new products, pay dividends, reduce its debts or seek any possible business opportunities for the time being necessary for the expansion of the company, only if it comprises with adequate FCF. So, it is often desirable for the businesses to hold more FCF to boost the growth of the company. However, the reverse of that is not always necessarily true, a company with low FCF might have made huge investments in its current capital expenditures and that will benefit the company to grow in long run. Free cash flow (FCF) represents the cash a company generates after accounting for cash outflows to support operations and maintain its capital assets.

When a firm’s share price is low and free cash flow is on the rise, the odds are good that earnings and share value will soon be heading up. Free cash flowis an important measurement since it shows how efficient a company is at generating cash. Investors use free cash flow to measure whether a company might have enough cash, after funding operations and capital expenditures, to pay investors through dividends and share buybacks.

Free cash flow = Sales revenues – Operating costs and taxes – Required investments in operating capital

Free cash flow is commonly confused with cash flow which appears on the cash flow statement. The key difference between the two is that cash flow is the net of amount of cash or cash equivalents cycling in and out of the company.

Many people use FCF as a substitution for earnings when valuing businesses that are mature in nature. Like price-to-earnings ratios, price-to-free-cash-flow ratios can be useful in valuing a business. To calculate a price-to-free-cash-flow ratio, you can simply divide the price of a share by the free-cash-flow per share, or the market cap of a company divided by its total free cash flow. Thus, its business’s ability to generate cash that really matters to stakeholders, especially those who are more wary about the liquidity of the company than its profitability like suppliers of the business. A company with sound working capital management provides strong and sustainable liquidly signals and FCF is on top of that.

After reviewing the FCFF and FCFE valuation process in Section 2, we turn in Section 3 to the vital task of calculating and forecasting FCFF and FCFE. Section 4 explains multistage free cash flow valuation models and presents some of the issues associated with their application.

Free cash flow is the net change in cash generated by the operations of a business during a reporting period, minus cash outlays for working capital, capital expenditures, and dividends during the same period. This is a strong indicator of the ability of an entity to remain in business, since these cash flows are needed to support operations and pay for ongoing capital expenditures. Free cash flow as a part of cash flow analysis became important a few years ago when instances of company fraud started to pop up, such as the Enron scandal. The reason investors started looking toward the concept of free cash flow is that it was not as easy to manipulate as earnings per share or net income.

Free cash flow is the cash a company produces through its operations, less the cost of expenditures on assets. In other words, free cash flow (FCF) is the cash left over after a company pays for its operating expenses and capital expenditures, also known as CAPEX. An analyst who calculates the free cash flows to equity in a financial model must be able to quickly navigate through the financial statements. The primary reason is that all the inputs required for the calculation of the metric are taken from the financial statements. The guidance below will help you to quickly and correctly incorporate the FCFE from EBITDA calculation into a financial model.