Fraud

First, management(what if some in the management are the perpetrators of fraud- JUDGE -MIDLANDS STATE UNIVERSITY) must ensure that all control processes are performed as designed and approved. Control compliance analysis to verify correct performance of procedures could reveal a control that has been inappropriately modified or one that is not performed as approved; this control weakness could present the opportunity for fraud. Proactively identifying these weaknesses and correcting the weakness is this is the fraud deterrence aspect of the monitoring process” (Cendrowski, Martin, Petro, The Handbook of Fraud Deterrence).

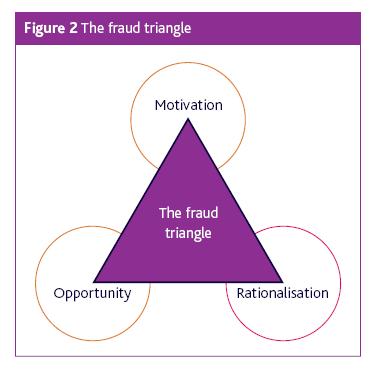

What are the three main components of the fraud triangle?

(TCO 5) The three main components of the fraud triangle are (Points : 3) rationalization, opportunity, and greed. opportunity, motive, and lack of ethics. motive, opportunity, and rationalization.

The ACFE, for example, recommends that a fraud examination engagement letter state, “We cannot provide assurances that fraud, if it exists, will be uncovered as a result of our examination” (2017 Fraud Examiners Manual). The “fraud audit” is not a defined term or defined professional service; what is likely meant by this term is a fraud investigation or examination. The Association of Certified Fraud Examiners (ACFE) explains that the term “fraud examination” “refers to a process of resolving allegations of fraud from inception to disposition, and it is the primary function of the anti-fraud professional” (2017 Fraud Examiners Manual). Earlier (pre-2014) editions of the manual contained an oft-cited chart comparing an audit of financial statements to a fraud examination.

Fraud Triangle

There is even greater significance for the integrity of the audit process; if the audit team’s view is that detecting fraud is not really an auditor’s job, then compliance with the requirements of auditing standards on fraud detection may become a rote exercise and not a focus of the audit. The purpose of this article is to clarify the true differences between an audit of financial statements and a fraud audit, and to dispel some of the myths that surround comparisons of them. This article is not an attempt to fully explain or even summarize all aspects of fraud examinations and audits; rather, the focus is to explain how the responsibility to detect fraud differs between the two services. Internal audits evaluate a company’s internal controls, including its corporate governance and accounting processes.

The distinction between an audit and a fraud examination is sometimes presented in engagement letters in a misleading manner. Audit engagement letters typically state that there is some risk that an audit in accordance with auditing standards may not detect a material misstatement caused by error or fraud.

What is the fraud triangle in auditing?

The fraud triangle is a framework commonly used in auditing to explain the motivation behind an individual’s decision to commit fraud. The fraud triangle outlines three components that contribute to increasing the risk of fraud: (1) opportunity, (2) incentive, and (3) rationalization.

Most importantly, external auditors, though engaged and paid by the company being audited, should be regarded as independent. Regarding fraud risk factors relating to attitude/rationalization, you cannot possibly know with certainty a person’s ethical standards and beliefs. However, during the course of your engagement, you may become aware of circumstances that indicate the possible presence of an attitude or ability to rationalize that you consider to be a fraud risk.

The Fraud Triangle

In addition, in areas of the financial statements that are judged to be less susceptible to material misstatement due to fraud, an auditor is more likely to select a representative sample to reach audit conclusions. The basic goal for most fraud examinations is to determine whether fraud occurred, and if so, who perpetrated it. A particular engagement may, however, have additional goals, such as to establish and secure evidence to be used in a criminal or other disciplinary action or to provide proof to recover losses from an insurer (2017 Fraud Examiners Manual). Implicit in this difference are several other naturally resulting differences related to scope, methodology and professional standards, and the relationship to stakeholders. “Monitoring activities deal with ongoing or periodic assessment of the quality of internal control performance by management to determine that controls are operating as intended and that they are modified as appropriate for changes in conditions” (Arens, Elder, Beasley, Auditing and Assurance Services).

They ensure compliance with laws and regulations and accurate and timely financial reporting and data collection, as well as helping to maintain operational efficiency by identifying problems and correcting lapses before they are discovered in an external audit. Internal audits play a critical role in a company’s operations and corporate governance, now that the Sarbanes-Oxley Act of 2002 has made managers legally responsible for the accuracy of its financial statements. This result is somewhat inconsistent with the results from Statements 13 and 14; nevertheless, moving from the current report’s implicit obligation for material fraud to a report with an explicit obligation could have implications for liability. Since the auditing standard on fraud is not changing, it is difficult to ascertain the implications for audit liability.

As part of an audit, external auditors will test a company’s accounting processes and internal controls and provide an opinion as to their effectiveness. These results suggest that lenders believe that the explicit clarification of an auditors’ responsibility for fraud in the audit report helps users to have a better understanding of that responsibility. Specifically, the explicit fraud clarification indicates that auditors have a responsibility to detect material financial statement fraud and that auditors must devote effort and time to risk assessment of material misstatements, including those associated with fraud.

Four statements in the survey assessed lenders’ perceptions in terms of responsibility. Eighty percent of respondents agreed with Statement 9, “The clarification of the auditor’s responsibility for fraud implies that auditors have a greater responsibility to detect financial statement fraud.” Approximately 6% disagreed with the statement, and 14% neither agreed nor disagreed. One of the reasons auditors fail to detect material misstatements caused by fraud is that they tend to look at current numbers in isolation from the past or other relevant information. For that reason, SAS no. 99 says the auditor should consider the results of analytical procedures in identifying the risks of material misstatement caused by fraud, and the standard provides a list of procedures auditors can employ that may indicate the presence of such risks.

- External auditor/ Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company’s financial statements are free of material misstatements, whether due to fraud or error.

- External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements.

For example, a recurring attempt by management to justify marginal, inappropriate accounting on the basis of materiality and a strained relationship between management and the current or predecessor auditor are fraud risks relating to fraudulent financial reporting. In the authors’ opinion, the results of this survey suggest that commercial lenders support the new, explicit audit report clarification regarding fraud. Most participants believe that the clarification would result in auditors devoting more effort and time in performing the audit to assess the risks of material misstatements of the financial statements due to fraud. While lenders believe audit fees will increase as a result, a substantial majority believes the resulting report will be more relevant and more useful for making loan decisions. Those who have studied fraudulent financial reporting have noted that risk of management override is unpredictable, and, therefore, it is difficult for auditors to design procedures to identify and assess it.

That chart compared auditing versus fraud examination on the basis of timing, scope, objective, relationship, methodology, and presumption. This comparison’s primary shortcoming was its failure to probe how the two services differ with respect to responsibility for fraud detection or acknowledge the auditor’s own detection responsibilities. Because both services involve some level of responsibility for fraud detection, a meaningful comparison must differentiate the services within that area of overlap. The auditing standards describe reasonable assurance as a “high level of assurance” that is obtained when the auditor has obtained sufficient appropriate evidence to reduce the risk that financial statements are materially misstated to an “appropriately low level” (AS 1015.10 and 1101.2). In other words, there should be an appropriately low level of risk that a fraud which materially mis-states the financial statements will not be detected.

Fraud deterrence has gained public recognition and spotlight since the 2002 inception of the Sarbanes-Oxley Act. Of the many reforms enacted through Sarbanes-Oxley, one major goal was to regain public confidence in the reliability of financial markets in the wake of corporate scandals such as Enron, WorldCom and Waste Management. Section 404 of Sarbanes Oxley mandated that public companies have an independent Audit of internal controls over financial reporting. Congress in passing the Sarbanes Oxley Act was attempting to proactively deter financial misrepresentation (Fraud) in order to ensure more accurate financial reporting to increase investor confidence. Internal controls have become a key business function for every U.S. company since the accounting scandals in the early 2000s.

Random Audits

External auditor/ Statutory auditor is an independent firm engaged by the client subject to the audit, to express an opinion on whether the company’s financial statements are free of material misstatements, whether due to fraud or error. For publicly traded companies, external auditors may also be required to express an opinion over the effectiveness of internal controls over financial reporting. External auditors may also be engaged to perform other agreed-upon procedures, related or unrelated to financial statements.

Auditing Standard (AS) 1001,Responsibilities and Functions of the Independent Auditor,clearly states that “the auditor has a responsibility to plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement, whether caused by error or fraud. The auditor’s opinion that accompanies financial statements is based on an audit of the procedures and records used to produce them.

For that reason, management override always should be addressed in the design of audit procedures. It is indisputable that an auditor of financial statements has a fraud detection responsibility.

This is accurate because, as alluded to earlier, an auditor does not obtain absolute assurance. Sometimes, however, this statement is followed by a statement that if the client wants assurance of fraud detection, additional fraud services can be provided. This second statement is misleading because it implies an audit does not provideanyassurance of detection of material misstatements caused by fraud. It is also misleading concerning the nature of a fraud examination engagement, because it incorrectly implies that a fraud examination is an all-purpose search for any and all fraudulent activity. Furthermore, a fraud examination is not a guaranty that provides assurance that fraud will be detected.

Importance Of Fraud Triangle In Effectively Preventing Business Fraud

Department of the Treasury’s Advisory Committee on the Auditing Profession (ACAP) urged the PCAOB to explicitly clarify in the auditor’s report the auditor’s role in detecting fraud under current auditing standards. ACAP believed that explicitly clarifying the auditor’s role would enhance auditors’ fraud prevention and detection skills, improve financial reporting and audit quality, and enhance investor confidence in financial reporting and the auditing function. SAS no. 99 provides comprehensive examples of conditions you may identify during fieldwork that might indicate fraud. SAS no. 99 reminds auditors that analytical procedures conducted as substantive procedures or as part of the overall review stage of the audit also may uncover previously unrecognized risks of material misstatement due to fraud.

Free Accounting Courses

The standard provides several examples of unusual or unexpected analytical relationships that may indicate a risk of material misstatement due to fraud. The boundaries or extent of a fraud examiner’s investigation may be limited to a specific subject matter, department, or geographic area at issue (2017 Fraud Examiners Manual). An auditor’s selection of significant accounts to examine is based on the assessment of the risks of material misstatement caused by either fraudulent activity or unintentional misstatement. Accordingly, an auditor’s work is significantly affected by the concept of materiality, but a fraud examiner’s scope is not so constrained.