Four Steps to Calculating Process Costs

You can now calculate a fixed overhead flexible-budget variance (sometimes referred to as a spending variance). A flexible budget changes as activity levels (sales, production) change.

Indirect expenses, or overhead costs, are expenses that apply to more than one business activity. You cannot apply an indirect cost directly to the production of a specific good or service.

Instead of efficiency variance, fixed overhead variance uses something called a production-volume variance. Because fixed costs are fixed, the production volume variance measures how much output you got for the fixed costs you put in. The focus is on the output, not the amount of costs you put in (the input).

Selling, general, and administrative expenses are all classified as non-manufacturing. For instance, if your client owns Bubbles Bubblegum Company, the cost of ingredients, labour to make the gum, and the machinery that makes the gum are manufacturing overhead costs. Fixed costs are expenses you must pay every month regardless of the productivity and profitability of your business.

Overheads are the expenditure which cannot be conveniently traced to or identified with any particular cost unit, unlike operating expenses such as raw material and labor. Therefore, overheads cannot be immediately associated with the products or services being offered, thus do not directly generate profits. However, overheads are still vital to business operations as they provide critical support for the business to carry out profit making activities.

For example, building rent remains the same until a scheduled rent increase alters it. Alternatively, the recognized impairment of a fixed asset may reduce the amount of depreciation expense associated with that asset.

Cost Allocation Mechanism

The resulting allocation can be quite inaccurate, but is easy to derive. U.S. GAAP requires that all manufacturing costs—direct materials, direct labor, and overhead—be assigned to products for inventory costing purposes. These can include rent or mortgage payments, depreciation of assets, salaries and payroll, membership and subscription dues, legal fees and accounting costs. Fixed expense amounts stay the same regardless if a business earns more — or loses more — in revenue that month.

Cost Allocation

What do you mean by cost allocation?

Cost allocation is the process of identifying, aggregating, and assigning costs to cost objects. Examples of cost objects are a product, a research project, a customer, a sales region, and a department. Cost allocation is used for financial reporting purposes, to spread costs among departments or inventory items.

Variable costs grow when you make increased efforts in sales or production. You must know the difference so you can plan sales and production efforts.

Cost allocation methods

Fixed overhead costs can change if the activity level varies substantially outside of its normal range. Thus, fixed overhead costs do not vary within a company’s normal operating range, but can change outside of that range. Apply the overhead in the cost pool to products at the standard allocation rate. Non-manufacturing overhead costs are expenses that your client’s company must pay but aren’t directly related to making the product.

Because fixed costs do not change within a relevant range, there is no adjustment of budgeted fixed costs from a static to a flexible budget. This holds true as long as actual costs are within the relevant range. Unlike indirect costs, you do not divide direct costs among different departments or projects. You must know your business’s direct and indirect costs when pricing products and updating your accounting books so your records are accurate.

Fixed overhead is a set of costs that do not vary as a result of changes in activity. Overhead costs are indirect costs that are not part of manufacturing costs. They are not related to the labor or material costs that are incurred in the production of goods or services. They support the production or selling processes of the goods or services. Overhead costs are charged to the expense account, and they must be continually paid regardless of whether the company is selling any good or not.

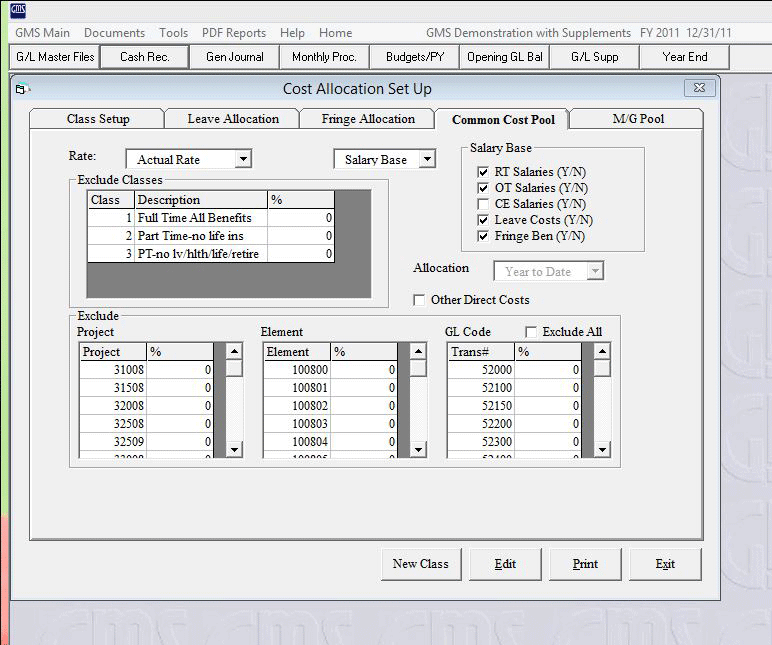

- When cost accounting, the more accurately you allocate fixed overhead costs, the more accurately your product’s total costs are reflected.

- To more accurately allocate fixed overhead you use cost pools and cost allocations to compute a cost allocation rate.

This variance reveals how efficient you were at producing goods using a fixed level of budgeted costs. You incur the same amount of fixed costs regardless of how efficiently you produce your goods. If your actual production is higher or lower than planned, it doesn’t change your flexible budget total for fixed overhead variance.

Instead, they are costs that go into running your business as a whole. If you want to determine the portion of your indirect costs that go towards producing certain items, you must distribute the costs.

When cost accounting, the more accurately you allocate fixed overhead costs, the more accurately your product’s total costs are reflected. If total cost is accurate, you can add a profit and calculate an accurate sale price. To more accurately allocate fixed overhead you use cost pools and cost allocations to compute a cost allocation rate. In business, overhead or overhead expense refers to an ongoing expense of operating a business.

Despite these costs occurring periodically and sometimes without prior preparation, they are usually one-off payments and are expected to be within the company’s budget for travel and entertainment. Overhead expenses are all costs on the income statement except for direct labor, direct materials, and direct expenses. Overhead expenses include accounting fees, advertising, insurance, interest, legal fees, labor burden, rent, repairs, supplies, taxes, telephone bills, travel expenditures, and utilities. You can allocate indirect costs by taking your total indirect expenses and dividing them by some sort of allocation measure, like direct labor expenses, direct machine costs, or direct material costs.

Associated payroll costs, including outsourcing payroll services, are included in the fixed expense category. Labor costs, such as employee time, that are not chargeable to a direct manufacturing or production activity also fall under fixed expenses. Balance sheet is a financial statement which outlines a company’s financial assets, liabilities, and shareholder’s equity at a specific time. Both assets and liabilities are separated into two categories depending on their time frame; current and long-term. Business overheads in particular fall under current liabilities as they are costs for which the company must pay on a relatively short-term/immediate basis.

Free Accounting Courses

Although there are cases when the two physical buildings may overlap, it is the usage of the overheads that separates them. This will include company-paid business travels and arrangements. As well as refreshments, meals, and entertainment fees during company gatherings.

Since fixed overhead costs do not change substantially, they are easy to predict, and so should rarely vary from the budgeted amount. These costs also rarely vary from period to period, unless a change is caused by a contractual modification that alters the cost.

For example, overhead costs such as the rent for a factory allows workers to manufacture products which can then be sold for a profit. Overheads are also very important cost element along with direct materials and direct labor. Factory overhead costs are routinely allocated to products based on the number of direct labor hours used in the production of the products.

Fixed costs show your current break-even point, and variable costs tell you how much you need to increase spending to improve your income. A business’s overhead refers to all non-labor related expenses, which excludes costs associated with manufacture or delivery. Payroll costs — including salary, liability and employee insurance — fall into this category. Overhead expenses are categorized into fixed and variable, according to Entrepreneur.

It is important for a small business owner to know how to calculate and separate his overhead costs — especially if he’s looking for financing or creating a bid for partnership. Manufacturing overheads are all costs endured by a business that is within the physical platform in which the product or service is created. Difference between manufacturing overheads and administrative overheads is that manufacturing overheads are categorized within a factory or office in which the sale takes place. Whilst administrative overheads is typically categorized within some sort of back-office or supporting office.