Fixed asset accounting

It is often deemed the most illiquid of all current assets – thus, it is excluded from the numerator in the quick ratio calculation. Fixed asset write offs should be recorded as soon after the disposal of an asset as possible. Otherwise, the balance sheet will be overburdened with assets and accumulated depreciation that are no longer relevant. Also, if an asset is not written off, it is possible that depreciation will continue to be recognized, even though there is no asset remaining. To ensure a timely write off, include this step in the monthly closing procedure.

If the fully depreciated asset is disposed of, the asset’s value and accumulated depreciated will be written off from the balance sheet. In such a scenario, the effect on the income statement will be the same as if no depreciation expense happened. The accounting treatment for the disposal of a completely depreciated asset is a debit to the account for the accumulated depreciation and a credit for the asset account. Inventory is a current asset account found on the balance sheet, consisting of all raw materials, work-in-progress, and finished goods that a company has accumulated.

How do you record the sale of asset journal entries?

Debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset. Gain on sale. Debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account.

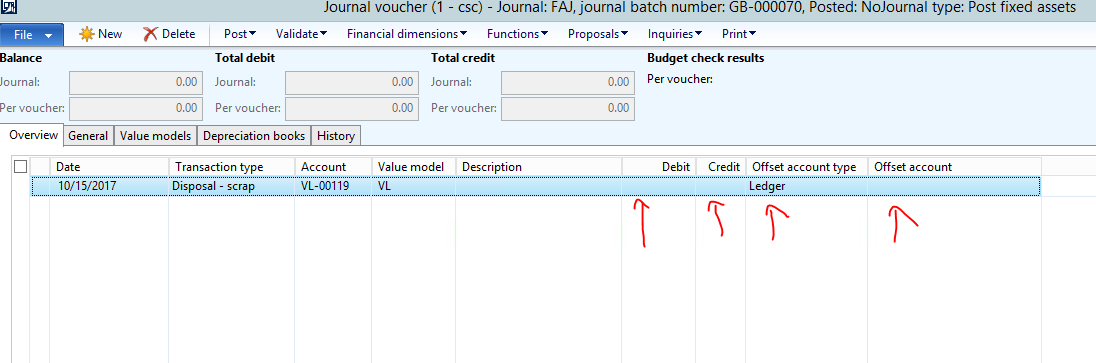

The disposal of assets involves eliminating assets from the accounting records. This is needed to completely remove all traces of an asset from the balance sheet (known as derecognition). An asset disposal may require the recording of a gain or loss on the transaction in the reporting period when the disposal occurs. Journal Entries are the building blocks of accounting, from reporting to auditing journal entries (which consist of Debits and Credits). Without proper journal entries, companies’ financial statements would be inaccurate and a complete mess.

Over time the productive assets in use by a company may no longer be needed and a decision is made to dispose of those assets. In any case, it is necessary to update depreciation calculations through the date of disposal.

The balance in the accumulated depreciation account is paired with the amount in the fixed asset account, resulting in a reduced asset balance. Depreciation and a number of other accounting tasks make it inefficient for the accounting department to properly track and account for fixed assets. They reduce this labor by using a capitalization limit to restrict the number of expenditures that are classified as fixed assets. Any expenditure for which the cost is equal to or more than the capitalization limit, and which has a useful life spanning more than one accounting period (usually at least a year) is classified as a fixed asset, and is then depreciated.

How do you account for sale of fixed assets?

When a fixed asset is purchased, it is recognized as an asset on balance sheet by debiting the asset account and crediting cash or accounts payable or notes payable depending on whether it is a cash purchase, credit purchase or deferred payment.

For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company. In the scenario of a company in a high-risk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk. Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset. At that time, stop recording any depreciation expense, since the cost of the asset has now been reduced to zero.

Fixed asset accounting

If the asset is still used in the company’s operations, the asset’s account and accumulated depreciation will still be reported on the company’s balance sheet. The reported asset’s value and accumulated depreciation will be equal, but no entry will be required until the asset is disposed of.

On the income statement, the operating profit is likely to increase because the depreciation expense will no longer be recorded on the income statement. If assets are classified based on their convertibility into cash, assets are classified as either current assets or fixed assets. An alternative expression of this concept is short-term vs. long-term assets. At the end of a fixed asset’s useful life, it is sold off or scrapped.

- In the scenario of a company in a high-risk industry, understanding which assets are tangible and intangible helps to assess its solvency and risk.

- Over time, the accumulated depreciation balance will continue to increase as more depreciation is added to it, until such time as it equals the original cost of the asset.

- For example, understanding which assets are current assets and which are fixed assets is important in understanding the net working capital of a company.

The entry is to debit the accumulated depreciation account for the amount of all depreciation charges to date and credit the fixed asset account to flush out the balance associated with that asset. If the asset was sold, then also debit the cash account for the amount of cash received. Any residual amount needed to balance this entry is then recorded as a gain or loss on sale of asset. A proper fixed asset disposal is of some importance from the perspective of maintaining a clean balance sheet, so that the recorded balances of fixed assets and accumulated depreciation properly reflect the assets actually owned by a business.

A fixed asset is written off when it is determined that there is no further use for the asset, or if the asset is sold off or otherwise disposed of. A write off involves removing all traces of the fixed asset from the balance sheet, so that the related fixed asset account and accumulated depreciation account are reduced.

If assets are classified based on their usage or purpose, assets are classified as either operating assets or non-operating assets. Debit cash for the amount received, debit all accumulated depreciation, credit the fixed asset, and credit the gain on sale of asset account. Debit cash for the amount received, debit all accumulated depreciation, debit the loss on sale of asset account, and credit the fixed asset. Moreover, the proper accounting of the disposal of an asset is critical to maintaining updated and clean accounting records.

The most common types of depreciation methods include straight-line, double declining balance, units of production, and sum of years digits. There are various formulas for calculating depreciation of an asset.

Classification of Assets: Physical Existence

Depreciation expense is used in accounting to allocate the cost of a tangible asset over its useful life. The overall concept for the accounting for asset disposals is to reverse both the recorded cost of the fixed asset and the corresponding amount of accumulated depreciation. Any remaining difference between the two is recognized as either a gain or a loss. The gain or loss is calculated as the net disposal proceeds, minus the asset’s carrying value.

The following journal entry shows a typical transaction where a fixed asset is being eliminated. The asset has an original cost of $10,000 and accumulated depreciation of $8,000. We want to completely eliminate it from the accounting records, so we credit the asset account for $10,000, debit the accumulated depreciation account for $8,000, and debit the disposal account for $2,000 (which is a loss). Depreciation is the gradual charging to expense of an asset’s cost over its expected useful life. The reason for using depreciation to gradually reduce the recorded cost of a fixed asset is to recognize a portion of the asset’s expense at the same time that the company records the revenue that was generated by the fixed asset.

The journal entry for depreciation can be a simple entry designed to accommodate all types of fixed assets, or it may be subdivided into separate entries for each type of fixed asset. This guide will teach you to perform financial statement analysis of the income statement, balance sheet, and cash flow statement including margins, ratios, growth, liquiditiy, leverage, rates of return and profitability.

Properties of an Asset

However, this is a lengthier approach that is not appreciably more transparent and somewhat less efficient than treating the disposal account as a gain or loss account itself, and so is not recommended. The accounting for depreciation requires an ongoing series of entries to charge a fixed asset to expense, and eventually to derecognize it.

These entries are designed to reflect the ongoing usage of fixed assets over time. The amount of this asset is gradually reduced over time with ongoing depreciation entries. This yields a monthly depreciation charge, for which the entry is a debit to depreciation expense and a credit to accumulated depreciation.