FIFO

Which Method Is Better FIFO or LIFO?

So for example, if a business produced spent $10 to produce 10 units, $15 to produce 20, and $20 to produce 10, every asset sold would decrease inventory by $15. The LIFO method is used in the COGS (Cost of Goods Sold) calculation when the costs of producing a product or acquiring inventory has been increasing. Under FIFO, the oldest inventory cost is used to calculate cost of goods sold. Most companies try to sell their oldest inventory first to reduce the risk of obsolescence and spoilage, so costs are generally more accurate. This can help the business with planning and forecasting.

The costs paid for those recent products are the ones used in the calculation. Under LIFO, a business records its newest products and inventory as the first items sold. The opposite method is FIFO, where the oldest inventory is recorded as the first sold.

Or maybe it should use the latest inventory for its calculations. This decision is critical and will affect a company’s gross margin, net income, and taxes, as well as future inventory valuations.

Apple Store managers also handle the inventory management of their respective stores. Imagine a firm replenishing its inventory stock with new items that cost more than the old inventory. When it comes time to calculate cost of goods sold, should the company average its costs across all inventory? Should it count the ones it bought earlier and for cheaper?

While the business may not be literally selling the newest or oldest inventory, it uses this assumption for cost accounting purposes. If the cost of buying inventory were the same every year, it would make no difference whether a business used the LIFO or the FIFO methods. But costs do change because, for many products, the price rises every year. In this decision area of operations management, Apple Inc. uses different methods of inventory management, such as the serialized method for effective tracking and control of products. The company also uses the first in, first out (FIFO) method, which ensures that most old-model units are sold before new Apple product models are released to the market.

The LIFO (“Last-In, First-Out”) method assumes that the most recent products in a company’s inventory have been sold first and uses those costs instead. Advantages and disadvantages of LIFO The advantages of the LIFO method are based on the fact that prices have risen almost constantly for decades.

So technically a business can sell older products but use the recent prices of acquiring or manufacturing them in the COGS (Cost Of Goods Sold) equation. This means the COGS number that is generated is not accurate. Businesses are required to choose one method and use it consistently over time. U.S. accounting standards do not require that the method mirrors how a business sells it goods.

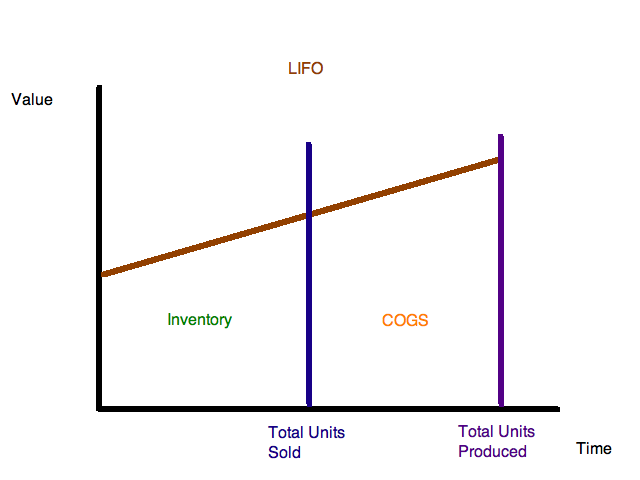

It is a method used for cost flow assumption purposes in the cost of goods sold calculation. The LIFO method assumes that the most recent products added to a company’s inventory have been sold first.

Is LIFO better than FIFO?

FIFO (“First-In, First-Out”) assumes that the oldest products in a company’s inventory have been sold first and goes by those production costs. The LIFO (“Last-In, First-Out”) method assumes that the most recent products in a company’s inventory have been sold first and uses those costs instead.

- The reason why companies use LIFO is the assumption that the cost of inventory increases over time, which is a reasonable assumption in times of inflating prices.

FIFO and LIFO are methods used in the cost of goods sold calculation. FIFO (“First-In, First-Out”) assumes that the oldest products in a company’s inventory have been sold first and goes by those production costs.

If a business sells its earliest produced goods first, it can still choose LIFO. The LIFO does have some tax benefits, as later produced goods are generally more expensive, which increases the business’ cost of goods sold, which decreases taxable revenue. The comparative quality of financial information from using either LIFO or FIFO is unclear, and so is the effect of those choices on stock price.

FIFO method

During times of inflation, FIFO has the effect of increasing the value of remaining inventory and increasing net income. Showing large assets and income can help a company that’s trying to lure in potential investors and lenders. LIFO isn’t a terribly realistic inventory system and can be difficult to maintain. LIFO also isn’t a great idea if the business plans to expand internationally; many international accounting standards don’t allow LIFO valuation.

Why is LIFO banned?

If the opposite its true, and your inventory costs are going down, FIFO costing might be better. Since prices usually increase, most businesses prefer to use LIFO costing. If you want a more accurate cost, FIFO is better, because it assumes that older less-costly items are most usually sold first.

The three most common methods are First-In-First-Out, or FIFO, Last-In-First-Out,or LIFO, and Weighted Average. FIFO method involves matching the oldest produced goods with revenues. So the first asset produced is identified as the first object sold with the cost of manufacture for that good matched with the revenue from the first sale. LIFO is the opposite; the last object produced and its cost of manufacture is matched with the first product sold. The weighted average involves averaging the cost of all products’ manufacture and using that amount as the constant expense.

FIFO is the most used method by major U.S. methods, but LIFO is a close second. The LIFO method goes on the assumption that the most recent products in a company’s inventory have been sold first, and uses those costs in the COGS (Cost of Goods Sold) calculation.

The reason why companies use LIFO is the assumption that the cost of inventory increases over time, which is a reasonable assumption in times of inflating prices. By shifting high-cost inventory into the cost of goods sold, a company can reduce its reported level of profitability, and thereby defer its recognition of income taxes.

Inventory Valuation Methods Described

LIFO supporters claim this upward trend in prices leads to inventory, or paper, profits if the FIFO method is used. During periods of inflation, LIFO shows the largest cost of goods sold of any of the costing methods because the newest costs charged to cost of goods sold are also the highest costs. The larger the cost of goods sold, the smaller the net income. Inventory methods relate to measuring the value of goods that are sold from inventory, which then effects how the inventory is valued.

LIFO method

As well, the LIFO method may not actually represent the true cost a company paid for its product. This is because the LIFO method is not actually linked to the tracking of physical inventory, just inventory totals.