FIFO or LIFO Inventory Methods

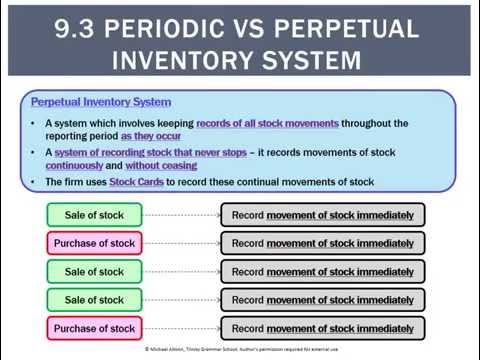

In a perpetual inventory system, a business updates these accounts every time it buys and sells inventory, which makes their balances readily available without an inventory count. Perpetual inventory is a method of accounting for inventory that records the sale or purchase of inventory immediately through the use of computerized point-of-sale systems and enterprise asset management software.

Because the average cost is being re-calculated and is different for each transaction, this method is often referred to as a moving average. With a real-time system updating constantly, there are many advantages to the business owner. It is a proactive way to prevent stock from running out as when stock is low it can be instantly identified and stock can be reordered. It also gives business owners a better understanding of customer buying patterns and their purchasing behavior.

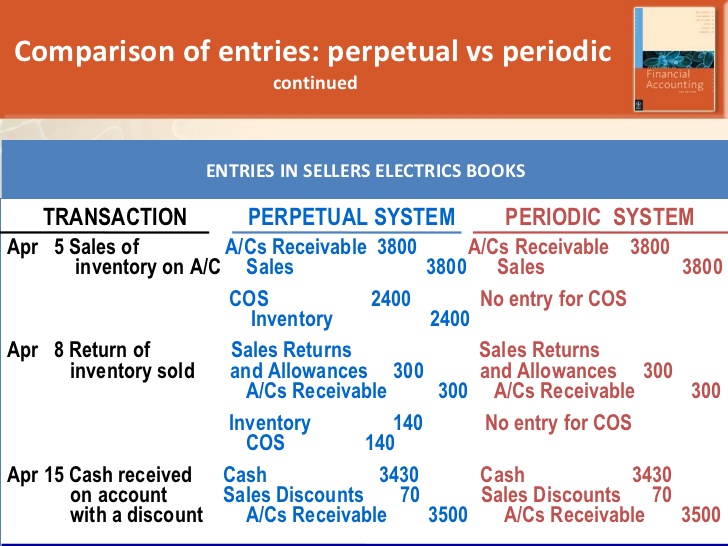

When goods are sold under the periodic inventory system there is no entry to credit the Inventory account or to debit the account Cost of Goods Sold. Hence, the Inventory account contains only the ending balance from the previous year.

Why is perpetual better than periodic?

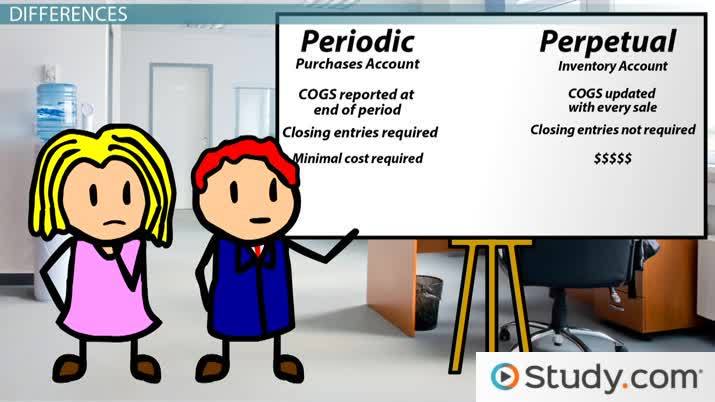

The difference between the periodic and perpetual inventory systems. The periodic system relies upon an occasional physical count of the inventory to determine the ending inventory balance and the cost of goods sold, while the perpetual system keeps continual track of inventory balances.

Perpetual inventory provides a highly detailed view of changes in inventory with immediate reporting of the amount of inventory in stock, and accurately reflects the level of goods on hand. Within this system, a company makes no effort at keeping detailed inventory records of products on hand; rather, purchases of goods are recorded as a debit to the inventory database. Effectively, the cost of goods sold includes such elements as direct labor and materials costs and direct factory overhead costs. Companies that use a perpetual inventory system update the inventory account whenever inventory is purchased or sold. If inventory is sold again later in that same period, the company must calculate another average cost that will be used to calculate the Cost of Goods Sold to be recognized on that transaction.

A more accurate understanding of customer preferences can guide which items a business stocks and when they place them on the sales floor. If a company has several locations, a perpetual inventory system centralizes this management. It amalgamates all information and places it in one consolidated and accessible place. Overall, this automated system is more accurate and accurate information can be very valuable to a business owner. It can assess if customers were responsive to discounts, their purchasing habits, and if they returned any items.

A perpetual inventory system is superior to the older periodic inventory system because it allows for immediate tracking of sales and inventory levels for individual items, which helps to prevent stockouts. A perpetual inventory does not need to be adjusted manually by the company’s accountants, except to the extent it disagrees with the physical inventory count due to loss, breakage or theft. Under the perpetual system, there are continual updates to either the general ledger or inventory ledger as inventory-related transactions occur. Conversely, under a periodic inventory system, there is no cost of goods sold account entry at all in an accounting period until such time as there is a physical count, which is then used to derive the cost of goods sold.

Often times, use both methods where the perpetual keeps a running account of the inventory value. By combining the two inventory methods, it means that the financial statements will be most accurate per the periodic method. The periodic inventory system does not update the general ledger account Inventory when a company purchases goods to be resold.

The inventory counts are performed frequently to prevent theft of assets, not to maintain inventory levels in the accounting system. Perpetual inventory systems provide the business owner with a record of detailed sale transactions by item, including where, when, and at what price items were sold. As a result, businesses can have inventory spread over more than one physical location while maintaining a centralized inventory management system. A periodic inventory system differs from the perpetual inventory method because there is no continuous record taken to determine the inventory value.

Perpetual vs Periodic Inventory Management

Barcodes, radiofrequency identification scanners (known as RFID), and point of sale systems (also known as POS) provided support for this system by quickly inputting inventory information as customers purchase items. When a retailer purchases merchandise, the retailer debits its Inventory account for the cost of the merchandise. When the retailer sells the merchandise to its customers, the retailer credits its Inventory account for the cost of the goods that were sold and debits its Cost of Goods Sold account for their cost.

Rather than staying dormant as it does with the periodic method, the Inventory account balance is continuously updated. A point-of-sale system drives changes in inventory levels when inventory is decreased, and cost of sales, an expense account, is increased whenever a sale is made. Inventory reports are accessed online at any time, which makes it easier to manage inventory levels and the cash needed to purchase additional inventory. A periodic system requires management to stop doing business and physically count the inventory before posting any accounting entries. Businesses that sell large dollar items, such as car dealerships and jewelry stores, must frequently count inventory, but these firms also maintain a point-of-sale system.

The difference between the periodic and perpetual inventory systems

LIFO means last-in, first-out, and refers to the value that businesses assign to stock when the last items they put into inventory are the first ones sold. The products in the ending inventory are either leftover from the beginning inventory or those the company purchased earlier in the period. LIFO in periodic systems starts its calculations with a physical inventory. In this example, we also say that the physical inventory counted 590 units of their product at the end of the period, or Jan. 31. We use the same table (inventory card) for this example as in the periodic FIFO example.

Unlike periodic inventory systems, the perpetual module reduces the need for frequent, physical inventory counts. The periodic inventory system is a method of inventory valuation for financial reporting purposes in which a physical count of the inventory is performed at specific intervals. This accounting method takes inventory at the beginning of a period, adds new inventory purchases during the period and deducts ending inventory to derive the cost of goods sold (COGS).

- In a periodic inventory system, a business updates its inventory and cost of goods sold accounts in its records only at the end of an accounting period.

- At this time, a business physically counts its inventory and uses the information to calculate its cost of goods sold.

The company uses a periodic inventory system to account for sales and purchases of stock. It helps the cost of goods sold calculation without taking periodic inventory count. Perpetual inventory system gives continuing information needed to keep maximum and minimum inventory levels by analyzing the appropriate timing of purchase. This ability of modern cloud-based inventory management softwares to get integrated with all the systems makes perpetual inventory system more practical.

Periodic Inventory System

Cost flow assumptions are inventory costing methods in a periodic system that businesses use to calculate COGS and ending inventory. Beginning inventory and purchases are the input that accountants use to calculate the cost of goods available for sale. They then apply this figure to whichever cost flow assumption the business chooses to use, whether FIFO, LIFO or the weighted average. Most accounting software use a perpetual inventory system to track and update inventory purchases, sales and the cost of goods in real time.

What does perpetual inventory mean?

Perpetual inventory systems keep a running account of the company’s inventory that updates after every item sale or return. Perpetual inventory systems involve more record-keeping than periodic inventory systems, which takes place using specialized, automated software. Every inventory item is kept on a separate ledger.

As you can see, a lot of different factors can affect the cost of goods sold definition and how it’s calculated. Management looking to improve reported company performance could incorrectly count inventory, change billing and material information, allocate overhead inappropriately and a number of other things. Net inventory purchases equals the total amount purchased minus any refunds or discounts you receive from suppliers.

Hence, the ledger tally accounts for purchases, and transactions are not kept running. FIFO means first-in, first-out and refers to the value that businesses assign to stock when the first items they put into inventory are the first ones sold. Products in the ending inventory are the ones the company purchased most recently and at the most recent price. In a periodic FIFO inventory system, companies apply FIFO by starting with a physical inventory. In this example, let’s say the physical inventory counted 590 units of their product at the end of the period, or Jan. 31.

In a periodic inventory system, a business updates its inventory and cost of goods sold accounts in its records only at the end of an accounting period. At this time, a business physically counts its inventory and uses the information to calculate its cost of goods sold. The periodic system is generally used by small businesses with limited inventory.

This way business owners are able to keep track of accurate COGS figures and adjust for obsolete inventory or scrap losses. Under the perpetual system the Inventory account is constantly (or perpetually) changing. Rather than staying dormant as it does with the periodic method, the Inventory account balance under the perpetual average is changing whenever a purchase or sale occurs. Under the perpetual system, there are continual updates to the cost of goods sold account as each sale is made. In the latter case, this means it can be difficult to obtain a precise cost of goods sold figure prior to the end of the accounting period.

A perpetual inventory system, or continuous inventory system, is an inventory control system that allows businesses to keep a real-time account of inventory on hand. The widespread use of computers after the 1970s increased this systems popularity because businesses were able to more easily keep track of inventory as it sold.

Under a periodic review inventory system, the accounting practices are different than with a perpetual review system. To calculate the amount at the end of the year for periodic inventory, the company performs a physical count of stock. Organizations use estimates for mid-year markers, such as monthly and quarterly reports. Accountants do not update the general ledger account inventory when their company purchases goods to be resold. The accountant removes the balance to another account at the end of the year.

Gross profit is the money a business earns from sales after paying for the cost to make or buy its inventory, or products, but before paying operating expenses. The gross profit formula — net sales minus cost of goods sold — is the same regardless of which inventory system a company uses. However, the calculation of cost of goods sold in the periodic inventory system differs from that of other systems. Businesses use one of two ways to manage inventory – periodic and perpetual.

Periodic inventory management is tracked manually, counting at the end of an accounting period. Perpetual inventory is for larger businesses using point-of-sale technology. According to a physical count, 1,300 units were found in inventory on December 31, 2016.

Companies may use either the perpetual system or the periodic system to account for inventory. Under the periodic system, merchandise purchases are recorded in the purchases account, and the inventory account balance is updated only at the end of each accounting period. The periodic inventory system is ideal for smaller businesses that maintain minimum amounts of inventory. The physical inventory count is easy to complete, small businesses can estimate the cost of goods sold figures for temporary periods. The company makes a physical count at the end of each accounting period to find the number of units in ending inventory.

The company then applies a first-in, first-out (FIFO) method to compute the cost of ending inventory. First in First out (FIFO), this cost flow assumption method believes in calculating the value of your ending inventory by presuming the fact that the products purchased first are sold first. In periodic FIFO inventory, the businesses begin by physically counting the inventory. Cost flow assumptions in periodic inventory system are somewhat similar to perpetual inventory methods as far as formulas are concerned. However, the way calculations are carried out is different because, in periodic inventory, there is no continuous record of sales.

Rather than debiting Inventory, the company debits the temporary account Purchases. Any adjustments related to these purchases of goods will be credited to a general ledger contra account such as Purchases Discounts or Purchases Returns and Allowances. When the balances of these three purchases accounts are combined, the resulting amount is known as net purchases.