Fair Value vs Market Value

In the futures market, fair value is the equilibrium price for a futures contract. This is equal to the spot price after taking into account compounded interest (and dividends lost because the investor owns the futures contract rather than the physical stocks) over a certain period of time. On the other side of the balance sheet the fair value of a liability is the amount at which that liability could be incurred or settled in a current transaction.

Market Capitalization Versus Market Value: What’s the Difference?

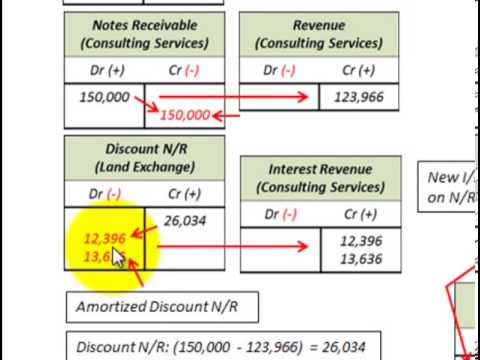

Also known as mark-to-market, fair value accounting is one of the most widely recognized valuation standards that becomes increasingly important when the company is sold, or assets are acquired. Under US GAAP (FAS 157), fair value is the amount at which the asset could be bought or sold in a current transaction between willing parties or transferred to an equivalent party other than in a liquidation sale. The carrying value, or book value, is an asset value based on the company’s balance sheet, which takes the cost of the asset and subtracts its depreciation over time.

Fair value is also used in a consolidation when a subsidiary company’s financial statements are combined or consolidated with those of a parent company. The parent company buys an interest in a subsidiary, and the subsidiary’s assets and liabilities are presented at fair market value for each account. The fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1), and the lowest priority to unobservable inputs (Level 3). Second, prior studies highlight the importance of disclosure for level 3 fair value estimates.

For example, in estimating level 2 fair values, companies can use market inputs such as yield curve or empirical correlation, but the fair value still depends on which model the firm selects. In support of this point, Song, Thomas, and Yi, as well as Riedl and Serafeim, found evidence that level 2 assets contribute less to value than level 1 assets.

The fair value of all a company’s assets and liabilities must be listed on the books in a mark-to-market valuation. An analysis of the existing research leads to three primary conclusions relevant for investors, auditors, and regulators. First, level 3 assets, whose fair values are subjectively determined by management, hurt companies’ market values in the form of larger share price discounts. These discounts seem to be driven by investors’ skepticism about the reliability of management’s estimates. Radian Group Inc. reported a net profit of $195 million in the first quarter of 2008, primarily driven by gains from level 3 liabilities.

Before FASB issued Statement of Financial Accounting Standards (SFAS) 157, Fair Value Measurements, in September 2006, the amount of fair-valued assets measured by management was not available to financial statement users. Under SFAS 157, exchange-listed entities are required to classify their fair-valued assets into three categories (level 1, level 2, and level 3) on the basis of their liquidity or input reliability. If an asset has a liquid market with a readily available price, it is classified as level 1. If an asset does not have a liquid market, but a similar type of asset has a relevant market, it is classified as level 2. If an asset does not have any relevant market base for valuation, its fair value is measured by applying a valuation model, and it is classified as level 3.

They found that the stock price discount resulting from holding level 3 assets is mitigated for companies with higher audit committee effectiveness and auditor engagement effort. Fair value accounting is a way of measuring the assets and liabilities that are listed on the company’s financial statements. The valuation principle was implemented by the Financial Accounting Standards Board (FASB) to standardize the calculation of financial instruments by looking at their historical cost. The best way to determine the fair value of an asset is by listing the security on the exchange.

Fair Value and Financial Statements

Furthermore, greater disclosure about the level 2 fair value estimation process will make financial statements even more informative. Companies possess considerable amounts of level 2 assets, and despite the relatively less subjective estimation process, the measurement of level 2 fair values still relies on managerial discretion.

- If an asset has a liquid market with a readily available price, it is classified as level 1.

- Before FASB issued Statement of Financial Accounting Standards (SFAS) 157, Fair Value Measurements, in September 2006, the amount of fair-valued assets measured by management was not available to financial statement users.

Fair Value vs Market Value

The study first examined why some companies provided reliability disclosure, finding that those with a large amount of level 3 assets are more likely to provide such disclosure. Given prior studies’ findings regarding the heavy stock market discounts for companies with a large proportion of level 3 assets, this suggests an attempt to acknowledge and alleviate investors’ concerns. Second, the study investigated how the provision of reliability disclosure affects stock prices and found that the price discount for holding level 3 assets diminishes in entities that make a reliability disclosure.

This suggests that management’s assurance about the integrity of the process and controls in place for making level 3 fair value estimates is effective in mitigating investors’ concerns about the reliability of those estimates. Fair Market Value (FMV) is an important concept in the valuation and exchange of real property and other property. The Internal Revenue Service uses it to determine the dollar value of charitable donations, assets converted to business use, and in various other tax-related matters. At December 31, 2011 and 2010, the fair value measurement amounts for the Company’s short-term and long-term investments consisted of marketable securities which are classified as available-for-sale.

Fair Value

The fair value of an asset is usually determined by the market and agreed upon by a willing buyer and seller, and it can fluctuate often. In other words, the carrying value generally reflects equity, while the fair value reflects the current market price.

Because level 3 inputs are unobservable, the issue of the trustworthiness of level three asset values has been quite controversial. The adoption of SFAS 157 provided an opportunity to study how stock market participants perceive and value these opaque assets.

Businesses could easily overstate their level 3 assets and recognize the gains from fair value changes in those assets whenever necessary to paint up decent earnings numbers. Under US GAAP (FAS 157), fair value is the amount at which the asset could be bought or sold in a current transaction between willing parties, or transferred to an equivalent party, other than in a liquidation sale. This is used for assets whose carrying value is based on mark-to-market valuations; for assets carried at historical cost, the fair value of the asset is not used. In accounting, fair value is used as a certainty of the market value of an asset (or liability) for which a market price cannot be determined (usually because there is no established market for the asset). Under US GAAP (FAS 157), fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.

Without the fair value gains, Radian would have reported a loss of about $215 million. Both the findings of recent accounting research and the example of Radian suggest that a more conservative valuation approach is warranted for level 3 estimates to protect investors and financial analysts from the consequences of errors. Using the financial statements of 431 banks from 2008, they examined how stock market participants priced level 1, 2, and 3 assets. Their analysis presents evidence that the stock market values each dollar of level 1, 2, and 3 assets at $0.98, $0.97, and $0.68, respectively. The drop in valuation of level 3 assets indicates that investors are concerned about the reliability of management’s estimates of their fair values.

What is the fair value of an asset?

Fair value is a broad measure of an asset’s worth and is not the same as market value, which refers to the price of an asset in the marketplace. In accounting, fair value is a reference to the estimated worth of a company’s assets and liabilities that are listed on a company’s financial statement.

Disclosures on assumptions and models adopted during estimation, which are currently unavailable, could help mitigate reliability concern for level 2 estimates and reduce the associated stock market discount. Song, Thomas, and Yi further evaluated the effect of corporate governance on the pricing of level 3 fair value assets. Song, Thomas, and Yi constructed a measure of firms’ corporate governance systems using 1) audit committee financial expertise, 2) the frequency of audit committee meetings, and 3) the size of the audit engagement office.

Fair value accounting is a financial reporting approach, also known as the “mark-to-market” accounting practice, under generally accepted accounting principles (GAAP). Using fair value accounting, companies measure and report the value of certain assets and liabilities on the basis of their actual or estimated fair market prices.

The Company’s cash and cash equivalents include cash on hand, deposits in banks, certificates of deposit and money market funds. Due to their short-term nature, the carrying amounts reported in the consolidated balance sheets approximate the fair value of cash and cash equivalents.