Expensing vs Capitalizing in Finance

Under Generally Accepted Accounting Principles, you report startup costs as expenses incurred at the time you spend the money. Some of your initial expenses, such as buying equipment, are not classified as startup costs under GAAP and have to be capitalized, not expensed. An ongoing question for the accounting of any company is whether certain costs incurred should be capitalized or expensed. Costs which are expensed in a particular month simply appear on the financial statement as a cost incurred that month.

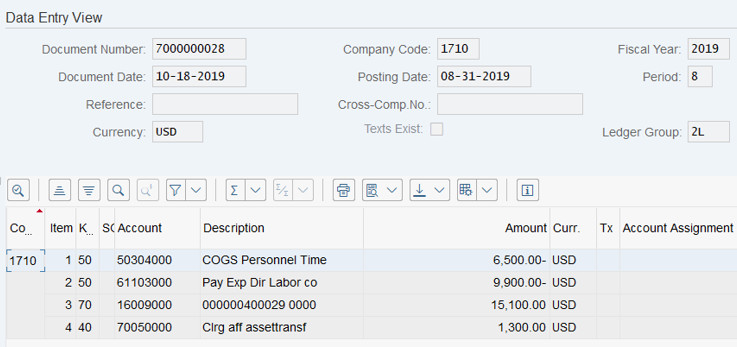

These items are fixed assets, such as computers, cars, and office buildings. The cost of these items are recorded on the general ledger as the historical cost of the asset. Therefore, these costs are said to be capitalized, not expensed. A capitalized cost is an expense that is added to the cost basis of a fixed asset on a company’s balance sheet.

What are the advantages and disadvantages of capitalizing interest for tax purposes?

A company can make a large purchase but expense it over many years, depending on the type of property, plant, or equipment involved. As the assets are used up over time to generate revenue for the company, a portion of the cost is allocated to each accounting period. For example, expenses incurred during construction of a warehouse are not expensed immediately.

A capital expenditure is a purchase that a company records as an asset, such as property, plant or equipment. Instead of recognizing the expense for an asset all at once, companies can spread the expense recognition over the life of the asset. Assets generally look better on a financial statement compared to expenses, so many companies try to capitalize as many related expenses as they can.

Organizations can possibly capitalize the interest given that they are building the asset themselves; they can’t capitalize interest on an advance to buy the asset or pay another person to develop it. Organizations can just perceive interest cost as they acquire costs to develop the asset. The roasting facility’s packaging machine, roaster, and floor scales would be considered capitalized costs on the company’s books. The monetary value isn’t leaving the company with the purchase of these items.

The costs associated with building the warehouse, including labor costs and financing costs, can be added to the carrying value of the fixed asset on the balance sheet. These capitalized costs will be expensed through depreciation in future periods, when revenues generated from the factory output are also recognized.

A cost is an outlay of money to pay for a specific asset, whereas an expense is money used to pay for something regularly. The difference allows for capitalized costs to be spread out over a longer period, such as the construction of a fixed asset, and the impact on profits is for a longer time frame.

Capitalized costs are incurred when building or purchasing fixed assets. Capitalized costs are not expensed in the period they were incurred but recognized over a period of time via depreciation or amortization. Capitalized assets are not expensed in full against earnings in the current accounting period.

In accounting, the cost of an item is allocated to the cost of an asset, as opposed to being an expense, if the company expects to consume that item over a long period of time. Rather than being expensed, the cost of the item or fixed asset is capitalized and amortized or depreciated over its useful life. The total cost of the capitalized asset is shown in the asset section of a corporation’s balance sheet, but the depreciation charges related to the assets are shown on the income statement.

Generally Accepted Accounting Principles, or GAAP, provide companies guidance on how to record the initial purchase and subsequent asset expenses. There is not an objective distinction between expensed costs and capitalized costs; each company determines for itself which costs should be capitalized vs. expensed (within GAAP guidelines).

Costs that are capitalized, however, are amortized or depreciated over multiple years. Most ordinary business costs are either expensable or capitalizable, but some costs could be treated either way, according to the preference of the company. Capitalized interest if applicable is also spread out over the life of the asset. Sometimes an organization needs to apply for a line of credit to build another asset, it can capitalize the related interest cost. Accounting Rules spreads out a couple of stipulations for capitalizing interest cost.

- In accounting, the matching principle requires companies to record expenses in the same accounting period in which the related revenue is incurred.

- For example, office supplies are generally expensed in the period when they are incurred since they are expected to be consumed within a short period of time.

In accounting, the matching principle requires companies to record expenses in the same accounting period in which the related revenue is incurred. For example, office supplies are generally expensed in the period when they are incurred since they are expected to be consumed within a short period of time. However, some larger office equipment may provide a benefit to the business over more than one accounting period.

When the roasting company spends $40,000 on a coffee roaster, the value is retained in the equipment as a company asset. The price of shipping and installing equipment is included as a capitalized cost on the company’s books. The costs of a shipping container, transportation from the farm to the warehouse, and taxes could also be considered part of the capitalized cost. These expenses were necessary to get the building set up for its intended use.

In other words, the goal is to match the cost of an asset to the periods in which it is used, and is therefore generating revenue, as opposed to when the initial expense was incurred. Long-term assets will be generating revenue over the course of their useful life. Therefore, their costs may be depreciated or amortized over a long period of time. Capitalizing a fixed asset refers to the accounting treatment reserved for the purchase of items to be used in the operation of the business.

For example, the $40,000 coffee roaster from above may have a useful life of 7 years and a $5,000 salvage value at the end of that period. Depreciation expense related to the coffee roaster each year would be $5,000 (($40,000 historical cost – $5,000 salvage value) / 7 years). When capitalizing costs, a company is following the matching principle of accounting. The matching principle seeks to record expenses in the same period as the related revenues.

How is capitalized cost calculated?

A capitalized cost is an expense that is added to the cost basis of a fixed asset on a company’s balance sheet. Capitalized costs are not expensed in the period they were incurred but recognized over a period of time via depreciation or amortization.

Advantages and Disadvantages of Capitalized Costs

Most companies follow a rule that any purchase over a certain dollar amount counts as a capital expenditure, while anything less is an operating expense. When high dollar value items are capitalized, expenses are effectively smoothed out over multiple periods. This allows a company to not present large jumps in expense in any one period from an expensive purchase of property, plant, or equipment. The company will initially show higher profits than it would have if the cost was expensed in full.

Most accounting organizations set minimum purchase thresholds for an item to be considered a fixed asset. The purpose of the capitalization threshold is to prevent the business from placing immaterial expenses on the balance sheet instead of recognizing them as an expense in the period incurred.

However, this also means that it will have to pay more in taxes initially. Cost and expense are two terms that are used interchangeably in everyday language.

What Is a Capitalized Cost?

There is no set value for a capitalization threshold, but the Internal Revenue Service indicates that most items with a useful life of more than one year should be capitalized. Businesses usually prefer to take tax deductions for purchases of business assets currently rather than spread them out over time. But the IRS has strict rules on what costs can be immediately expensed. As noted above, the IRS usually wants the costs of buying capital assets to be capitalized and spread out. Expenses associated with intangible assets can also be capitalized; these include trademarks, filing and defending of patents, and software development.

Because capitalized costs are depreciated or amortized over a certain number of years, their effect on the company’s income statement is not immediate and, instead, is spread out throughout the asset’s useful life. Usually, the cash effect from incurring capitalized costs is immediate with all subsequent amortization or depreciation expenses being non-cash charges. These include loan-origination costs, customer acquisition costs, R&D, taxes and purchasing capital assets. Capitalized costs are originally recorded on the balance sheet as an asset at their historical cost. These capitalized costs move from the balance sheet to the income statement as they are expensed through either depreciation or amortization.

If a company borrows funds to construct an asset, such as real estate, and incurs interest expense, the financing cost is allowed to be capitalized. Also, the company can capitalize on other costs, such as labor, sales taxes, transportation, testing, and materials used in the construction of the capital asset. However, after the fixed asset is installed for use, any subsequent maintenance costs must be expensed as incurred.

Financial statements can be manipulated when a cost is wrongly capitalized or expensed. If a cost is incorrectly expensed, net income in the current period will be lower than it otherwise should be. If a cost is incorrectly capitalized, net income in the current period will be higher than it otherwise should be.