Efficiency variance

About Labor Variances

The labor efficiency variance focuses on the quantity of labor hours used in production. It is defined as the difference between the actual number of direct labor hours worked and budgeted direct labor hours that should have been worked based on the standards. This information gives the management a way to monitor and control production costs. Next, we calculate and analyze variable manufacturing overhead cost variances. These include all the expenses you pay outside of labor costs — things like building costs, property taxes, and utilities — and they can be calculated either monthly or annually, depending on the needs of your business.

The units produced are the equivalent units of production for the labor cost being analyzed. Labor efficiency variance is also known as labor time variance and labor usage variance. Labor price variance equals the standard hourly rate you pay direct labor employees minus the actual hourly rate you pay them, times the actual hours they work during a certain period. For example, assume your small business budgets a standard labor rate of $20 per hour and pays your employees an actual rate of $18 per hour.

It also includes other benefits such as worker’s compensation and unemployment insurance, health insurance and contributions to pension or retirement plans. The efficiency variance is the difference between the actual unit usage of something and the expected amount of it. The expected amount is usually the standard quantity of direct materials, direct labor, machine usage time, and so forth that is assigned to a product. For example, an efficiency variance can be calculated for the number of hours required to complete an audit versus the budgeted amount. Labor efficiency variance is calculated by comparing the actual hours worked with standard hours allowed, both at the standard labor rate.

Comparison of Labor Price Variance vs. Labor Efficiency Variance

This is in addition to other employee-related expenses, including state payroll taxes, Social Security and Medicaid taxes, and the cost of benefits (insurance,paid time off, and meals or equipment or supplies). The direct labor hourly rate, also known as the labor rate standard, includes the hourly pay rate, fringe benefits costs and your portion of employee payroll taxes.

Each cost is added together and then divided by the employee’s hours worked per year. An obvious way to reduce your costs is to analyze the prices you pay for materials. Say you operate a bicycle factory, and you use aluminum to manufacture bike frames. During planning, you come up with a standard or budgeted price of $5 per pound for aluminum. When you review your actual costs, you find that the real price paid was $5.75 per pound.

Owners, directors, managers and supervisors are the common types of fixed labor in small business. These individuals usually earn a fixed salary regardless of the hours worked in the business. Business owners used fixed salaries to avoid paying managers and supervisors overtime during business operations. Managers and supervisors usually work more hours than regular employees and provide more benefits to small businesses. Fixed labor costs can be difficult to lower without compromising the effectiveness or efficiency of business operations.

How do you calculate labor efficiency variance?

The labor efficiency variance measures the ability to utilize labor in accordance with expectations. This variance is calculated as the difference between the actual labor hours used to produce an item and the standard amount that should have been used, multiplied by the standard labor rate.

Calculate the hourly value of fringe benefits and employee taxes by dividing that amount by the number of hours worked in the pay period. Some of the workers in a factory perform tasks that are directly linked to the manufacturing process.

Accounting for Managers

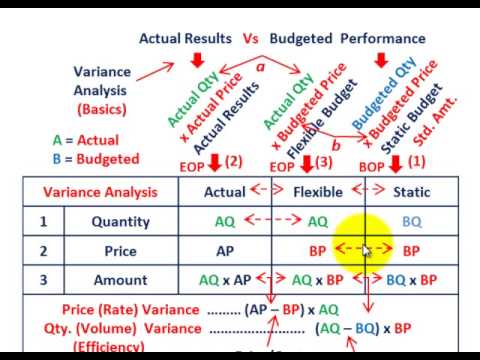

- Labor price variance, or rate variance, measures the difference between the budgeted hourly rate and the actual rate you pay direct labor workers who directly manufacture your products.

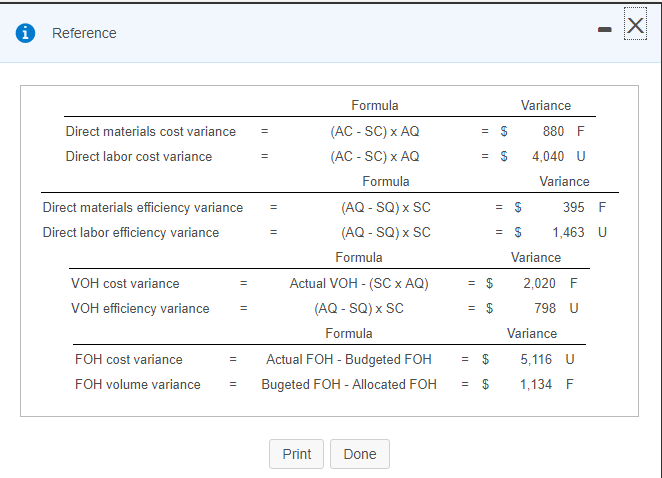

Figure 10.6 “Direct Labor Variance Analysis for Jerry’s Ice Cream” shows how to calculate the labor rate and efficiency variances given the actual results and standards information. Review this figure carefully before moving on to the next section where these calculations are explained in detail. After an accounting period is closed, managers evaluate operational results and compare them to budgeted projections. Companies that create products typically analyze the actual price they paid for raw materials compared to what they expected to pay. An employee’s total salary and wages account for 68.3 percent of their total cost.

Labor price variance, or rate variance, measures the difference between the budgeted hourly rate and the actual rate you pay direct labor workers who directly manufacture your products. Labor efficiency variance measures the difference between the number of direct labor hours you budgeted and the actual hours your employees work. Compare these two variances to determine how well your small business managed its direct labor costs during a period.

Payroll taxes are first calculated according to your state, as it’s your state that determines the rate at which you’re taxed. Payroll taxes also include labor cost taxes, Social Security taxes, Medicare taxes, and state and federal unemployment taxes. Use the calculator above to determine the cost of payroll taxes in your state, per employee. The labor cost formula takes into account an employee’s hourly wages, the hours they work in a week, and the weeks they work in a year. An employer’s overhead cost per employee is also considered, in addition to the employer’s annual taxes.

Suppose XYZ Widgets employs a direct labor workforce of 10 people, who work 40 hours per week, and they earn an average of $18 per hour. Total wages are equal to 40 hours multiplied by $18 and then multiplied by 10. Additional payroll taxes and benefits total $1,800, which gives a total direct labor weekly payroll expenditure of $9,000. Ten workers normally work 400 hours in a week, so the standard or average cost of one hour of direct labor equals $9,000 divided by 400, or $22.50. Recall from Figure 10.1 “Standard Costs at Jerry’s Ice Cream” that the standard rate for Jerry’s is $13 per direct labor hour and the standard direct labor hours is 0.10 per unit.

Companies typically try to lock in a standard price per unit for raw materials, but sometimes suppliers raise prices due to inflation, a shortage or increasing business costs. If there wasn’t enough supply available of the necessary raw materials, the company purchasing agent may have been forced to buy a more expensive alternative.

To figure it out, just divide your total annual overhead costs by the number of employees at your business. The cost of labor is the sum of each employee’s gross wages, in addition to all other expenses paid per employee. Other expenses include payroll taxes, benefits, insurance, paid time off, meals, and equipment or supplies.

If the company bought a smaller quantity of raw materials, they may not have qualified for favorable bulk pricing rates. To calculate the labor burden, add each employee’s wages, payroll taxes, and benefits to an employer’s annual overhead costs (building costs, property taxes, utilities, equipment, insurance, and benefits). Standard costs are used to establish the flexible budget for direct labor. The flexible budget is compared to actual costs, and the difference is shown in the form of two variances. The labor rate variance focuses on the wages paid for labor and is defined as the difference between actual costs for direct labor and budgeted costs based on the standards.

Other factory floor employees are considered indirect labor because their jobs are not immediately tied to making the product. Equipment maintenance technicians and security guards fall into this category. The difference is crucial because only direct labor is counted as part of the cost of manufacturing a good. Direct labor includes wages plus employer-paid payroll taxes like Social Security and Medicare tax.

Direct Labor Efficiency Variance Calculation

Your labor price variance would be $20 minus $18, times 400, which equals a favorable $800. Fixed labor cost remains the same regardless of the company’s production output.

The standard hours allowed figure is determined by multiplying direct labor hours established or predetermined to produce a single unit by the number of units produced. For example, if standard time to produce one unit of a product is 2 hours and 10 units of product have been manufactured during the period than the standard time allows would be 20 hours (2 × 10).

This will help determine how much an employee costs their employer per hour. It is important to have a consistent employee timesheetsoftware or app for long term labor cost success. Once the total overhead is added together, divide it by the number of employees, and add that figure to the employee’s annual labor cost. The material price variance calculation tells managers how much money was spent or saved, but it doesn’t tell them why the variance happened. One common reason for unfavorable price variances is a price change from the vendor.