Difference Between Gross Margin and Gross Profit

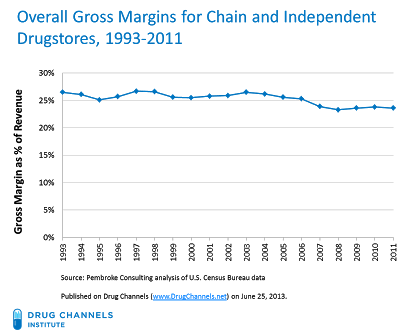

The direct labor and direct material costs used in production are called cost of goods sold. Full-service restaurants have gross profit margins in the range of 35 to 40 percent.

On the other hand, a company may opt to boost prices for its goods and service in an effort to bolster its financial numbers. Gross profit margin shows the percentage of revenue that exceeds a company’s costs of goods sold. It illustrates how well a company is generating revenue from the costs involved in producing their products and services. The higher the margin, the more effective the company’s management is in generating revenue for each dollar of cost. This guide will cover formulas and examples, and even provide an Excel template you can use to calculate the numbers on your own.

Gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue. Gross Margin is often used interchangeably with Gross Profit, but the terms are different. When speaking about a monetary amount, it is technically correct to use the term Gross Profit; when referring to a percentage or ratio, it is correct to use Gross Margin. In other words, Gross Margin is a percentage value, while Gross Profit is a monetary value. Gross profit margin is a ratio that indicates the performance of a company’s sales and production.

As a result, direct costs are factored into gross profit through COGS. In this article, we explore the relationship between gross profit, cost of goods sold, overhead, and labor costs. The gross profit margin ratioanalysis is an indicator of a company’s financial health.

How Do You Calculate Gross Margin in Dollars?

Each of these profit margins weigh the cost of doing business with or without certain costs factors. For a detailed explanation of each profit margin, and how to calculate them, check out “How Do You Calculate Profit Margin for Your Startup”.

It is much more rare to see amortization included as a direct cost of production, although some businesses such as rental operations may include it. Otherwise, amortized expenses are typically not captured in gross profit. Accounting treatment on income statements varies somewhat for each business and by industry. Both depreciation and amortization are accounting methods designed to help companies recognize expenses over several years.

For example, if a company’s gross margin is falling, it may strive to slash labor costs or source cheaper suppliers of materials. Alternatively, it may decide to increase prices, as a revenue increasing measure.

The Difference Between Revenue and Cost in Gross Margin

Average net profit margins for medical practices come in around 11.5 percent, demonstrating strong potential for interested entrepreneurs. Insurance reimbursements can be tens of thousands of dollars for simple procedures, offering significant income in exchange for in-demand services. While not a perfect indicator of profitability, these industries offer great potential for those seeking a stable, secure sector in which to launch a fledgling enterprise.

The term “gross margin” describes the profit achieved on sales, expressed as a percentage of the total revenue generated by the sales. Gross margin omits incidental costs, such as operating expenses, and focuses on the product wholesale prices and the amount of sales. Gross margin may be calculated for an entire company by totaling all sales, or it may be calculated for individual items to describe its individual profit margin. Companies use gross margin to measure how their production costs relate to their revenues.

How to Calculate Gross Margin

- Gross margin is the difference between revenue and cost of goods sold (COGS) divided by revenue.

While gross margin focuses solely on the relationship between revenue and COGS, the net profit margin takes all of a business’s expenses into account. When calculating net profit margins, businesses subtract their COGS, as well as ancillary expenses such as product distribution, sales rep wages, miscellaneous operating expenses, and taxes. Cost of goods sold (COGS) represents the costs directly related to the production of a company’s goods. Direct labor costs are part of cost of goods sold as long as the labor is directly tied to production.

As a rule of thumb, food costs are about one-third of sales, and payroll takes another third. A well-managed restaurant might net closer to 10 percent, but that’s rare. A gross profit margin that is sufficient for one industry may be woefully poor in another.

It tells investors how much gross profit every dollar of revenue a company is earning. Compared with industry average, a lower margin could indicate a company is under-pricing.

The expense reduces the amount of profit, allowing a company to have a lower taxable income. Since depreciation and amortization are not typically part of cost of goods sold—meaning they’re not tied directly to production—they’re not included in gross profit. Gross profitis the revenue earned by a company after deducting the direct costs of producing its products.

Small business owners use the gross profit margin to measure the profitability of a single product. If you sell a product for $50 and it costs you $35 to make, your gross profit margin is 30% ($15 divided by $50). Gross profit margin is a good figure to know, but probably one to ignore when evaluating your business as a whole. The gross profit margin is a metric used to assess a firm’s financial health and is equal to revenue less cost of goods sold as a percent of total revenue.

How do gross profit margin and operating profit margin differ?

Keep reading to find out how to find your profit margin and what is the gross margin formula. Basically, businesses use gross margin to benchmark their production costs against their sales revenues. If gross margin is down, a business may elect to curb expenses in key areas like staffing, research or manufacturing, in an effort to improve the financial bottom line.

Gross profit margins can also be used to measure company efficiency or to compare two companies of different market capitalizations. Gross profit margin is the percentage of revenue you retain after accounting for costs of goods sold. The figure is common and much needed as a basic means of measuring your business profit. The ways you can analyze and use the gross profit figures are endless. In the big picture view, gross profit simply shows how much money you make against the cost of the product so you can project and interpret profit potential.

How do you calculate gross margin?

Gross margin is a company’s net sales revenue minus its cost of goods sold (COGS). In other words, it is the sales revenue a company retains after incurring the direct costs associated with producing the goods it sells, and the services it provides.

Gross profit and gross profit margin both provide good indications of a company’s profitability based on their sales and costs of goods sold. However, the ratios are not a thorough measure of profitability since they don’t include operating expenses, interest, and taxes. We can see that Apple recorded a total gross profit, after subtracting revenue from COGS of $88 billion for 2017 as listed on their income statement labeled as gross margin. Gross profit and gross margin show the profitability of a company when comparing revenue to the costs involved in production. Both metrics are derived from a company’s income statementand share similarities but show profitability in a different way.

This ratio is made by accounting for the cost of goods sold—which include all costs generated to produce or provide your product or service—and your total revenue. If your business has a gross profit margin of 24%, it means that 24% of your total revenue became profit.

What Is Gross Margin?

The gross profit margin ratio, also known as gross margin, is the ratio of gross margin expressed as a percentage of sales. Gross margin, alone, indicates how much profit a company makes after paying off its Cost of Goods Sold. It is a measure of the efficiency of a company using its raw materials and labor during the production process. The income statement line for gross profit margin will help you determine and set the specific profit margins for your products and categories of products. If, during a month, you sell $25,000 worth of products and your wholesale cost for those products was $15,000, your gross profit margin was $10,000 or 40 percent.

A higher gross profit margin indicates that a company can make a reasonable profit on sales, as long as it keeps overhead costs in control. In accounting, the gross margin refers to sales minus cost of goods sold. It is not necessarily profit as other expenses such as sales, administrative, and financial costs must be deducted.

This margin calculator will be your best friend if you want to find out an item’s revenue, assuming you know its cost and your desired profit margin percentage. In general, your profit margin determines how healthy your company is – with low margins you’re dancing on thin ice and any change for the worse may result in big trouble. High profit margins mean there’s a lot of room for errors and bad luck.