Depreciation Methods: Check Formula, Factors & Types

For our calculations, we assume that the sample client is in the 30% tax bracket. This template is designed to help accountants and other financial professionals calculate tax depreciation for assets that fall under modified accelerated cost recovery system (MACRS) rules. The template calculates both 5-year depreciation and 7-year depreciation.

Essentially, a MACRS depreciation schedule will begin with a declining balance method, then switch to a straight line schedule to finish the schedule. The MACRS method was introduced in 1986, and generally property placed into service after that date will be depreciated according to the MACRS method. It is a modification of the Accelerated Cost Recovery System, or ACRS, which was in use from 1981 to 1986.

More specifically, MACRS enables you to calculate the depreciation expense—the percentage of assets your business can write off—throughout its useful life. Assets are classed into different categories based on their useful life.

MACRS depreciation

MACRS is used to recover the basis of most business and investment property placed in service after 1986. MACRS consists of two depreciation systems, the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). Generally, these systems provide different methods and recovery periods to use in figuring depreciation deductions.For more information on MACRS, what can and cannot be depreciated under MACRS and how to figure the deduction, see IRS Publication Figuring Depreciation under MACRS. The IRS introduced the Modified Accelerated Cost Recovery System (MACRS), a depreciation method used for accounting purposes, in 1986.

The U.S. tax code allows for a tax deduction for the recovery of the cost of tangible property over the useful life of the property. The Modified Accelerated Cost Recovery System (MACRS) is the current depreciation method for most property. The market certainty provided by MACRS allows businesses in a variety of economic sectors to continue making long-term investments and has been found to be a significant driver of private investment for the solar industry and other energy industries. The modified accelerated cost recovery system (MACRS) is the proper depreciation method for most assets. MACRS allows for greater accelerated depreciation over longer time periods.

Asset costs and accumulated depreciation were tracked by “vintage accounts” consisting of all assets within a class acquired in a particular tax year. All vintage accounts for the same year were assumed placed in service in the middle of the year; however, a taxpayer could elect the modified half year convention with potentially favorable results. Brookshire Brothers Holding Inc. operated grocery stores in Texas.

Likewise, certain intangible assets, such as patents and copyrights, are depreciable. Under MACRS a taxpayer must compute tax deductions for depreciation of tangible property using specified lives and methods. Assets are divided into classes by type of asset or by business in which the asset is used. (See tables of classes below.) Where a general class based on the nature of the asset applies (00.xx classes below), that class takes precedence over the use class.

What is Macrs depreciation?

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation.

This is beneficial since faster acceleration allows individuals and businesses to deduct greater amounts during the first few years of an asset’s life, and relatively less later. Depreciation using MACRS can be applied to assets such as computer equipment, office furniture, automobiles, fences, farm buildings, racehorses, and so on. MACRS is the current tax depreciation system in the United States.

Alternative depreciation system

This property, which is subject to the 27.5-year recovery period, is defined as a rental building or structure for which 80% or more of the gross rental income for the tax year is rental income from dwelling units. If you occupy any part of the building, the gross rental income includes the fair rental value of the part you occupy. This property does NOT include a unit in a hotel, motel, inn, or other establishment where more than one-half of the units are used on a transient basis.Nonresidential real property31.5 yearsNonresidential real property placed in service after December 31, 1986, but before May 13, 1993. Must use straight-line depreciation, mid-month conventionNonresidential real property39 YearsNonresidential real property placed in service after May 12, 1993. Only the declining balance method and straight line method of computing depreciation are allowed under MACRS.

The MACRS system puts fixed assets into classes that have set depreciation periods. The modified accelerated cost recovery system (MACRS) method of depreciation assigns specific types of assets to categories with distinct accelerated depreciation schedules. Furthermore, MACRS is required by the IRS for tax reporting but is not approved by GAAP for external reporting. As defined by the Internal Revenue Service (IRS), depreciation is an income tax deduction that allows a business to recover the cost basis of certain property. It is an annual allowance for the wear and tear, deterioration, or obsolescence of the property.

Taxpayers using the declining balance change to the straight line method at the point at which depreciation deductions are optimized. All tangible personal property acquired during the year is considered placed in service in the middle of the tax year (“half-year convention”). Real property is considered placed in service in the middle of the month in which acquired (“mid-month convention”). Special rules apply for pro rating deductions for short tax years and for the first year of business, or where more than 40% of tangible personal property additions are in the final quarter of the year.

A specific recovery period (the number of years you can claim a deduction) is defined for each class of property. Use the MACRS Depreciation Methods Table (in IRS Pub 946 or Section below) to figure out the class of your asset. The standard method of depreciation for federal income tax purposes is called the Modified Accelerated Cost Recovery System, or MACRS.

- The Modified Accelerated Cost Recovery System (MACRS), established in 1986, is a method of depreciation in which a business’ investments in certain tangible property are recovered, for tax purposes, over a specified time period through annual deductions.

- Class depreciation timeframes vary between three and 50 years, depending on the certain type of property.

The Modified Accelerated Cost Recovery System (MACRS), established in 1986, is a method of depreciation in which a business’ investments in certain tangible property are recovered, for tax purposes, over a specified time period through annual deductions. MACRS is the method of depreciation used for most property, though assets vary by class, which determines the depreciable life, or cost recovery period, of the property. Class depreciation timeframes vary between three and 50 years, depending on the certain type of property. Some examples of classes include television and radio broadcasting equipment, which qualify for a cost recovery period of five years and office furniture and equipment, which qualify for a cost recovery period of seven years.

Very simply, the MACRS allows for a larger tax deduction in the early years of an asset’s useful life and less as time goes by. This is in contrast to straight-line depreciation, where you claim the same deduction year after year. he Modified Accelerated Cost Recovery System (MACRS) is a federal income tax convention. It benefits your company in that it helps you plan for the depreciation of your assets over a set period.

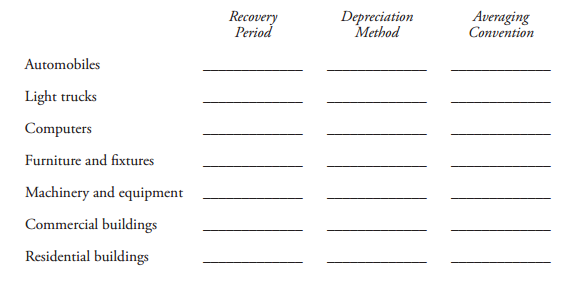

MACRS GDS property classes table

Qualifying solar photovoltaic systems are eligible for a cost recovery period of five years. For systems in which an Investment Tax Credit (ITC) is taken, the owner must reduce the project’s appreciable basis by one-half the value of the 30% ITC.

The Modified Accelerated Cost Recovery System (MACRS) is the current tax depreciation system in the United States. Under this system, the capitalized cost (basis) of tangible property is recovered over a specified life by annual deductions for depreciation. The Internal Revenue Service (IRS) publishes detailed tables of lives by classes of assets. The deduction for depreciation is computed under one of two methods (declining balance switching to straight line or straight line) at the election of the taxpayer, with limitations.

AccountingTools

In 1981, Congress again changed the depreciation system, providing generally for shorter lives for recovery of costs. Under the Accelerated Cost Recovery System (ACRS), broad groups of assets were assigned based on the old ADR lives (which the IRS has updated since). Taxpayers were permitted to calculate depreciation only under the declining balance method switching to straight line or the straight line method. In response to the economic downturn of 2008, Congress took action to further incentivize capital investment by accelerating the depreciation schedule economy-wide.

TheTax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010allowed companies to claim a 100% depreciation bonus on qualifying capital equipment purchased and placed in service by December 31, 2011. Congress included an extension of 50% bonus depreciation in early 2013 in the so-called “fiscal cliff” deal, which was scheduled to expire at the end of 2013. Under 50% bonus depreciation, in the first year of service, companies could elect to depreciate 50% of the basis while the remaining 50% is depreciated under the normal MACRS recovery period. MACRS depreciation is an important tool for businesses to recover certain capital costs over the property’s lifetime.

MACRS

Allowing businesses to deduct the depreciable basis over five years reduces tax liability and accelerates the rate of return on a solar investment. This has been a significant driver for the solar industry and other energy industries. Residential rental property27.5 YearsResidential rental property placed in service after December 31, 1986.

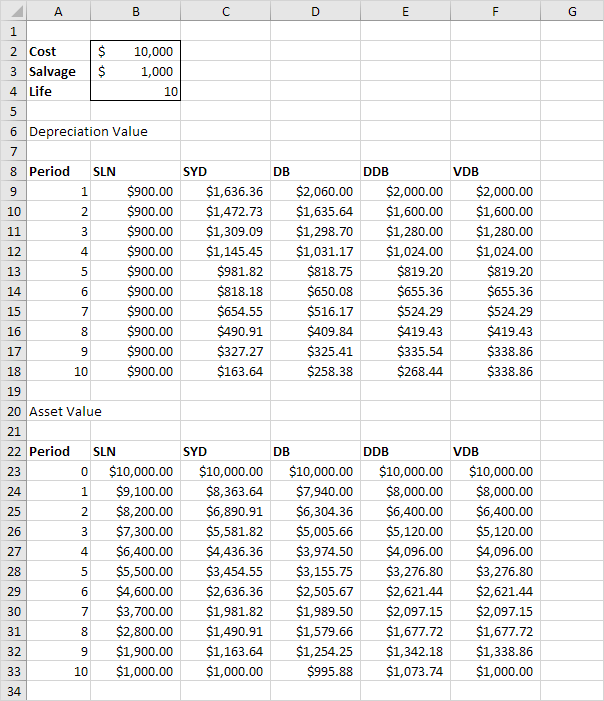

Tax deductions for depreciation have been allowed in the U.S. since the inception of the income tax. Prior to 1971, these deductions could be computed in a variety of manners over a wide range of lives, under old Bulletin F. In 1971, Congress introduced the Class Life Asset Depreciation Range (ADR) system in an attempt to simplify calculations and provide some uniformity. Under ADR, the IRS prescribed lives for classes of assets based on the nature or use of the asset. Such classes included general classes (such as office equipment) and industry classes (such as assets used in the manufacture of rubber goods). Taxpayers could use their choice of several methods of depreciating assets, including straight line, declining balance, and sum of years digits.

We shall look at the underlying principles of this approach first, then deal with its actual use. The modified accelerated cost recovery system (MACRS) is a depreciation system used for tax purposes in the U.S. MACRS depreciation allows the capitalized cost of an asset to be recovered over a specified period via annual deductions.

The holding company and its subsidiaries filed a consolidated tax return. Brookshire used the modified accelerated cost recovery system (MACRS) for purposes of recovering the cost of the tangible assets used in its businesses. In 1991 Brookshire began constructing gas stations at its grocery store locations. It identified the stations as nonresidential real property, reporting depreciation on a straight-line basis over 311/2 years and then 39 years after the recovery period changed.

“Depreciation” is the loss of value that occurs over time when the object purchased is used for a specific use. As a business owner, you are eligible to deduct this “loss in value” from your taxable income when used for your business. If you are running a profitable business, and you canshow that the solar power you are generating is for business use (as opposed to personal use), then itmayhave a strong impact on reducing your bottom line.