Deferred Tax Asset Definition

Just as you can have Accounts receivable net of an allowance for bad debts (for customers unlikely to pay up), you can have deferred tax assets net of the valuation allowance. Perceptron has the item “Long-Term Deferred Income Tax Asset” grouped with other non-current assets. Also on the balance sheet is “Short-Term Deferred Income Tax Asset”, under “Current assets”, and it isn’t net of any part of the valuation allowance.

These tax assets are typically used to reduce the total amount of taxable income for a company. This link from macabacus.com about Net Operating Losses (NOL) is probably only suitable for accountants, but it confirms that the benefit from NOLs occurs when they are created rather than when they were used. The piece has nothing about the valuation allowance, and as explained here, Net income benefits when the valuation allowance is reduced (relative to the Deferred tax assets). For example, a company that gives its customers a warranty will set up a reserve to cover the expected cost of customers using them. The cost of replacement or repair lies in the future, and when it occurs, the expense will be tax deductable.

A company’s deferred tax assets are assets the company can use to offset earnings in the future. It adjusts the value of the tax asset according to how much of the asset the company believes it will actually take advantage of. Valuation allowances should be disclosed on the balance sheet as an offset of the deferred tax asset. This video discusses the Deferred Tax Asset Valuation Allowance in Financial Accounting. Deferred Tax Assets provide future tax savings by reducing income tax payable in the future.

Often created due to the taxes that have been paid or are carried forward, deferred tax assets are not until then recognised in the income statement. Deferred tax assets reduce taxes paid in future periods (they represent future tax savings).

However, the company would only be able to report this deferred tax asset of $100,000 if the chance of it making more than $100,000 in income in the next quarter was greater than 50%. Deductible temporary differences reduce taxable income in future periods and create deferred tax assets. Deferred tax assets and liabilities are often overlooked in a company’s financial reporting. In this issue of the Tax Insight, we look at ASC 740 requirements for accounting for income taxes and deferred taxes, and factors to consider when determining whether a valuation allowance should be established. There is a benefit to the operating cash flow, because the reduction of Deferred Tax Assets is added back in the reconciliation.

A firm cannot realize these tax savings, however, if the firm does not generate taxable income in the future. If at some point in the future the firm does generate taxable income, it can reduce the valuation allowance. Management has considerable discretion in making decisions regarding the likelihood that the benefits from a deferred tax asset will be realized.

I know that looks like saying one equals minus one, but I’ve mixed two conventions. In the cash flow statement, an adjustment or change is positive if it increases cash flow.

Businesses can carry losses foward to offset against taxable income in future years. Those losses are “Net Operating Losses” or “NOLs”, and they are defined by tax rules, not by GAAP (the principles financial reports are based on).

Equity research with a difference.

Because inventories are consumed or converted into cash within a year or one operating cycle, whichever is longer, inventories usually follow cash and receivables on the balance sheet. Imagine a company had an NOL of $5 million one year and had taxable income of $6 million the next.

allowance to reduce inventory to net realizable value definition

A merchandising company can prepare an accurate income statement, statements of retained earnings, and balance sheets only if its inventory is correctly valued. On the income statement, a company using periodic inventory procedure takes a physical inventory to determine the cost of goods sold. Since the cost of goods sold figure affects the company’s net income, it also affects the balance of retained earnings on the statement of retained earnings. On the balance sheet, incorrect inventory amounts affect both the reported ending inventory and retained earnings. Inventories appear on the balance sheet under the heading ” Current Assets,” which reports current assets in a descending order of liquidity.

- A company’s deferred tax assets are assets the company can use to offset earnings in the future.

- Valuation allowances should be disclosed on the balance sheet as an offset of the deferred tax asset.

Deferred Tax Asset Definition

The full loss from the first year can be carried forward on thebalance sheetto the second year as a deferred tax asset. The loss, limited to 80% of income in the second year, can then be used in the second year as an expense on theincome statement. It lowers net income, and therefore the taxable income, for the second year to $1.2 million ($6 million – $4.8 million). A $200,000 deferred tax asset will remain on the balance sheet to be carried into the third year.

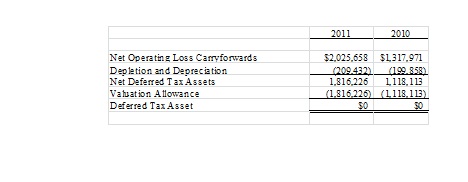

If inventories go up, the change in inventories in the cash flow statement is negative. Perceptron’s “Net deferred taxes” is tax assets (net of the valuation allowance) minus tax liabilities, so it has the same sign an asset, and the negative change in it means the adjustment in the cash flow statement is positive. That’s how the non-cash tax expense is reversed in the reconciliation from Net income to the operating cash flow. Income Taxes” they report a Deferred tax asset of $20,484, and the long term portion of it is exactly offset by the Valuation allowance of ($19,453) (in thousands).

If a company pays 34% tax, they have a “Deferred tax asset” equal to 34% of the NOLs. It isn’t that simple, because there are different tax rates in different countries. If management think they probably won’t make enough taxable income to use all the NOLs before they expire, they have to set up a “valuation allowance”, which offsets the tax assets. Indefinite-lived intangible assets such as goodwill, trademarks, and perpetual franchises are not amortized for financial statement purposes, but they are instead evaluated for their value being impaired each year. When preparing the income statement, it is easy to get in the habit of netting deferred tax assets and deferred tax liabilities and calling it a day.

That future tax benefit is recognized by creating a deferred tax asset at the same time as setting up the warranty reserve. The timing difference is between sales with the warranty attached, which make a future tax deductable expense likely, and the period when the actual tax deductable expense is deducted to reduce taxable income. For NOLs, the timing difference is between the period when a tax operating loss arises and the period when the loss is offset against taxable income. Deferred tax assets originate when the amount of tax has either been paid or has been carried forward but it has still not been acknowledged in the statement of income.

The benefit of creating a tax asset or reducing the valuation allowance is recognized in the income statement, and the benefit is not recognized twice, so there’s no benefit in the income statement just from using tax assets. “Deferred income taxes” is the tax assets net of the valuation allowance and net of tax liabilities. For many companies, that would be a liability representing income taxes payable in the future, but for Perceptron it represented a substantial net tax asset in 2015, and a small net liability in 2016. At $12,521 thousand, the adjustment for Deferred income taxes (in the red border, above) is close to the -$12,537 thousand I calculated for the change in “Net deferred taxes”.

Deferred tax assets result from temporary differences between book and tax income. This video provides an example to illustrate how a deferred tax asset could arise and the journal entries that would be necessary to record the deferred tax asset.

The “Total deferred tax assets” of 1,031 in the image below equals the “Short-term deferred income tax asset” in the image above. That equality is consistent with the balance sheet item “Long-term deferred income tax asset” being zero (though it’s reported as a hyphen). An asset which is available on the company’s balance sheet and is used to decrease the taxable income, is called a deferred tax asset.

AccountingTools

What is a valuation allowance account?

A valuation allowance is a reserve that is used to offset the amount of a deferred tax asset. The amount of the allowance is based on that portion of the tax asset for which it is more likely than not that a tax benefit will not be realized by the reporting entity. Related Courses.

However, if there are deferred tax liabilities related to indefinite-lived intangibles together with a valuation allowance position, practitioners should take a second look. A valuation allowance occurs when a company lets various carryforwards expire unused or has excess losses. With deferred tax assets, the firm will have either paid taxes early, or have paid too much tax, and is therefore entitled to some money back from the tax authorities. Deferred tax assets can be used when the company carries over a net loss, but only when there is a greater than 50% chance that the company’s accounting income will be positive in the next reporting period. For example, if a company carries forward a deferred tax asset of $100,000 and in the next reporting period has a taxable income of $500,000, it can use this deferred tax asset and reduce the taxable income to only $400,000.

Section 382 generally requires a corporation to limit the amount of its income in future years that can be offset by historic losses, i.e. NOLs and certain built-in losses, after a corporation has undergone an ownership change. The Section 382 base limitation is calculated by multiplying the fair market value of the loss corporation by the federal long-term tax exempt rate. Careful consideration must be given to analyzing NOLs given the potential impact future NOL utilization can have on future cash flows of a company and ultimately the value of the company.

In some cases, management may exploit the deferred tax asset valuation allowance for purposes of earnings management. If the government drops the tax rate, that’s great for future Net income and cash flows, but it would reduce the value of tax assets. For companies with a relatively big number for net tax assets (net of the valuation allowance and deferred tax liabilities), it could have a big effect on the balance sheet, and presumably in some cases would wipe out shareholders equity. According to “What a Corporate Tax Cut Might Mean” by Mark E. Haskins and Paul J. Simko, November 2011 (cfo.com), CFOs could overlook the necessary adjustment, though I think word would get round.

A net operating loss (NOL) may be carried forward to offset taxable income in future years in order to reduce a company’s futuretax liability. The purpose behind this tax provision is to allow some form of tax relief when a company loses money in a tax period. The IRS recognizes that some companies’ business profits are cyclical in nature and not in line with a standard tax year. Deferred tax assets, such as net operating loss (NOL) carryforwards, can be used to offset future taxable income thereby reducing a company’s tax burden and increasing its cash flow in a given year. However, NOLs can be subject to certain limitations, such as IRC Section 382.