Deferred Revenue Definition

Over time, when the product or service is delivered, the deferred revenue account is debited and the money credited to revenue. In other words, the revenue or sale is finally recognized and, therefore, the money earned is no longer a liability. Each contract can stipulate different terms, whereby it’s possible that no revenue can be recorded until all of the services or products have been delivered. In other words, the payments collected from the customer would remain in deferred revenue until the customer has received what was due according to the contract.

As a result, the company adds $40,000 to the cash total on the assets side of its balance sheet. Then, in recognition of the fact that the company still has an outstanding obligation to earn that money, it adds an offsetting $40,000 under “deferred revenue” on the liabilities side of the balance sheet. Nothing goes on the company’s income statement, because the company hasn’t actually made any money yet.

Deferred income (also known as deferred revenue, unearned revenue, or unearned income) is, in accrual accounting, money earned for goods or services which have not yet been delivered. According to the revenue recognition principle, it is recorded as a liability until delivery is made, at which time it is converted into revenue.

How Does Deferred Revenue Work?

What is deferred revenue journal entry?

Deferred revenue is money received by a company in advance of having earned it. In other words, deferred revenues are not yet revenues and therefore cannot yet be reported on the income statement. As a result, the unearned amount must be deferred to the company’s balance sheet where it will be reported as a liability.

Deferred revenue is classified as either a current liability or a long-term liability. This classification depends on how long it will take the company to earn the revenue. If services will be performed, or goods shipped, within one year, the deferred revenue is a current liability. If services will be performed, or goods shipped, over a period of more than one year, the deferred revenue is a long-term liability. Under the revenue recognition principles of accrual accounting, revenue can only be recorded as earned in a period when all goods and services have been performed or delivered.

Deferred revenue is the accounting strategy used in accrual accounting when you do not recognize revenue immediately upon receipt, but instead recognize that revenue over time. For example, SaaS businesses that are selling pre-paid subscriptions with services rendered over time will defer revenue over the life of the contract and use accrual accounting to demonstrate how the company is doing over the longer term. The exchange of goods or services for money isn’t always simultaneous in the business world. When a service is provided without immediate compensation or money is received before goods are shipped, the revenue is either accrued or deferred. Accrued and deferred revenue both relate to the timing of transactions, which are recognized when they occur, not when money changes hands.

The accounting concept known as revenue recognition states that revenue is recognized when earned. In the landscaper example, when the $200 payment was received, no landscaping services had been performed.

Deferred revenue, also known asunearned revenue, refers to advance payments a company receives for products or services that are to be delivered or performed in the future. The company that receives the prepayment records the amount as deferred revenue, a liability, on itsbalance sheet. The firm’s accountants record each payment as a liability in the balance sheet until the company delivers the software to the customer. Once the customer receives the download link and gets the software, the order is completed and accountants move the payment from the deferral account to the revenues account.

How is deferred revenue recorded in the balance sheet?

Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company’s balance sheet as a liability and not as an asset.

In the case of a prepayment, a company’s goods or services will be delivered or performed in a future period. The prepayment is recognized as a liability on the balance sheet in the form of deferred revenue. When the good or service is delivered or performed, the deferred revenue becomes earned revenue and moves from the balance sheet to the income statement. According to GAAP, deferred revenue is a liability related to a revenue-producing activity for which revenue has not yet been recognized. Since you have already received upfront payments for future services, you will have future cash outflow to service the contract.

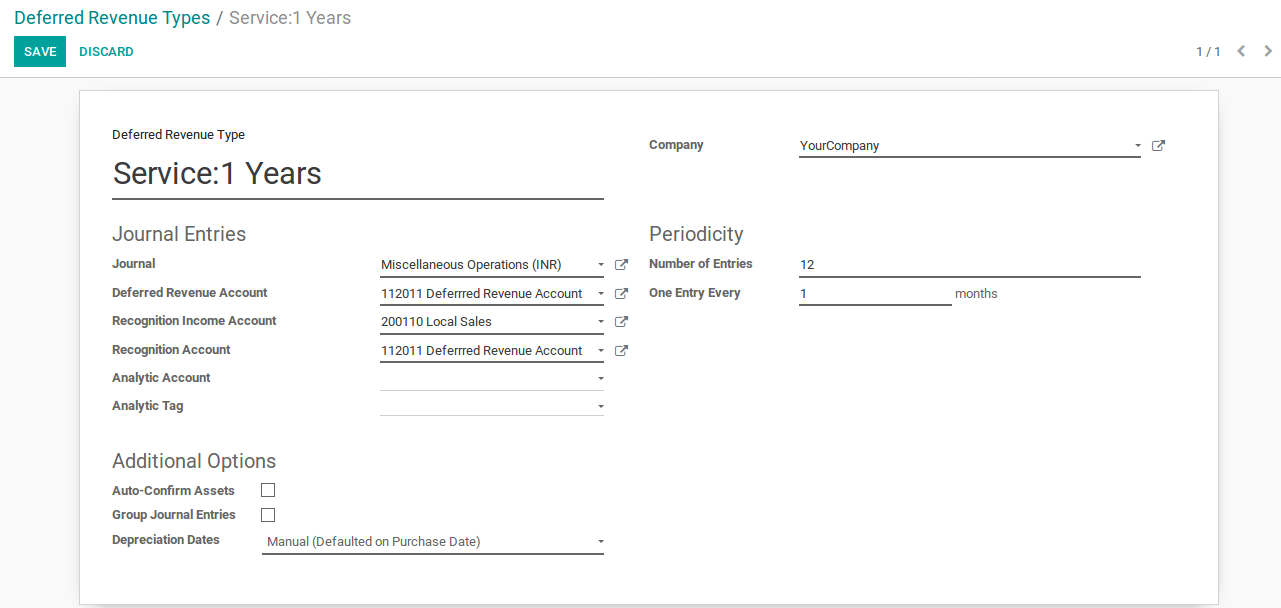

Deferred Revenue Journal Entry Bookkeeping Explained

The rules of corporate financial accounting generally prevent a company from claiming advance cash payments as revenue. But such payments, known as deferred revenue, still have to appear somewhere in the company’s financial statements. Deferred revenue appears on the balance sheet, and the cash flow statement.

As the landscaper performs weekly maintenance services, $50 will move from the balance sheet as deferred revenue to the income statement as earned revenue. The transition occurs because a portion of the contracted services has now been performed.

Allocating revenues to the proper period is a cornerstone of the accrual method of accounting. They represent the amount of money that is owed to another person or company. Deferred revenue is included as a liability because goods have not been received by the customer or the company has not performed the contracted service even though money has been collected.

- Over time, when the product or service is delivered, the deferred revenue account is debited and the money credited to revenue.

- When a company accrues deferred revenue, it is because a buyer or customer paid in advance for a good or service that is to be delivered at some future date.

- When a company uses the accrual accounting method, revenue is only recognized as earned when money is received from a buyer, and the goods or services are delivered to the buyer.

Therefore, the buyer had become directly obligated to incur a cost to the subscribers without any additional cash payment from them. If the buyer was unable to perform, it would likely have to refund the balance to the subscriber. This obligation for the buyer was a reserve for a future expense and different from the unearned revenue balance that was used to track the seller’s unrecognized income. In fact, for tax purposes, the seller recognized income for the entire unearned revenue balance, and this was never in dispute. An accrued expense is a liability that represents an expense that has been recognized but not yet paid.

By the end of the fiscal year, the deferred revenue balance will be zero and all of the payments will become revenue on the income statement. Deferred revenue refers to payments received in advance for services which have not yet been performed or goods which have not yet been delivered. These revenues are classified on the company’s balance sheet as a liability and not as an asset.

Therefore, a company should record deferred revenue as a liability in the balance sheet when it receives payments from clients for products or services that have not yet been delivered or rendered. Deferred revenueis when a company receives payment from a customer before the product or service has been delivered; however, the payment is not yet counted as revenue. Deferred revenue, which is also referred to as unearned revenue, is listed as a liability on the balance sheet because, under accrual accounting, the revenue recognition process has not been completed.

Free Financial Statements Cheat Sheet

When a company uses the accrual accounting method, revenue is only recognized as earned when money is received from a buyer, and the goods or services are delivered to the buyer. When a company accrues deferred revenue, it is because a buyer or customer paid in advance for a good or service that is to be delivered at some future date.

In either case, the company would need to repay the customer, unless other payment terms were explicitly stated in a signed contract. Under the expense recognition principles of accrual accounting, expenses are recorded in the period in which they were incurred and not paid.

For example, let’s say a software company signs a three-year maintenance contract with a customer for $48,000 per year. The company gets paid $48,000 upfront on January 1st for the maintenance service for the entire year. On January 1st, when the company receives cash payments from the customer, the company will debit cash for $48,000 and credit (increase) the deferred revenue account for $48,000. , the IRS held that the deemed payment made by a seller to a buyer for assuming the unearned revenue account is treated as gross income to the buyer for tax purposes. Presumably, the buyer can defer the income recognition if it uses the accrual method.

Unearned or not, cash received in advance is still cash in the company’s hands, and the company needs to account for it. Assume, for example, a company gets a $40,000 cash payment in advance for products to be delivered later.

Deferred revenue is also reported when a company receives payment before shipping goods that have been ordered. For example, if you use the shipment of goods as the triggering event for all other sales, this would be the normal accounting practice. Deferred revenue is recognized as a liability on the balance sheet of a company that receives an advance payment. This is because it has an obligation to the customer in the form of the products or services owed. The payment is considered a liability to the company because there is still the possibility that the good or service may not be delivered, or the buyer might cancel the order.

To put this more clearly, deferred income – the money that a company receives in advance – indicates the goods and services the company owes to its customers, while accrued expense indicates the money a company owes to others. For example, a company receives an annual software license fee paid out by a customer upfront on January 1. So, the company using accrual accounting adds only five months’ worth (5/12) of the fee to its revenues in profit and loss for the fiscal year the fee was received. The rest is added to deferred income (liability) on the balance sheet for that year.

At first glance, the deferred revenue account would seem to be a revenue, or income, account that would be included on a company’s income statement. However, deferred revenue is actually reported on a company’s balance sheet as a liability. Deferred revenue is commonly reported on the balance sheets of service companies when clients pay for services before the service is rendered. Some examples of service companies include landscapers, lawyers and contractors.

What is deferred revenue?

If a company incurs an expense in one period but will not pay the expense until the following period, the expense is recorded as a liability on the company’s balance sheet in the form of an accrued expense. When the expense is paid, it reduces the accrued expense account on the balance sheet and also reduces the cash account on the balance sheet by the same amount.

The expense is already reflected in the income statement in the period in which it was incurred. Deferred and unearned revenue are accounting terms that both refer to revenue received by a company for goods or services that haven’t been provided yet.