Days Sales Of Inventory – DSI Definition

This means your inventory has been sold, or turned over, three times during the year. To find out how many days’ worth of inventory you keep on hand, divide three into 365 days. In this case, you have 122 days’ worth of inventory stock on hand on any given day. The inventory turnover ratio measures how much time elapses from when you first purchase the inventory until it is sold.

Alternatively, you can divide the average inventory by the cost of goods sold, and multiply by the number of days in the accounting period. Inventory turnover, or the inventory turnover ratio, is the number of times a business sells and replaces its stock of goods during a given period. It considers the cost of goods sold, relative to its average inventory for a year or in any a set period of time.

Since sales and inventory levels usually fluctuate during a year, the 40 days is an average from a previous time. According to your annual financial statements and accounting records, your cost of goods sold is $60,000 and the ending inventory is $20,000. After dividing $20,000 into $60,000, your inventory turnover ratio is three.

You calculate the on-hand inventory by dividing the inventory turnover ratio amount by 365 days. Moving inventory out of your warehouse and into your customers’ hands is a major objective of running a profitable business. The faster your inventory sells, the quicker you recoup your purchase costs and earn a profit. The inventory turnover ratio and the average of inventory tell you how fast your inventory sells and the average amount of inventory you keep on hand. An unusual fluctuation in the inventory turnover ratio or the average of inventory may signal problems with your purchasing policy or with your sales volume.

Inventory turnover measures a company’s efficiency in managing its stock of goods. The ratio divides the cost of goods sold by the average inventory. Now, you can calculate the inventory turnover ratio by dividing the cost of goods sold by average inventory. The formula to calculate days in inventory is the number of days in the period divided by the inventory turnover ratio.

Moving Average, Weighted Moving Average, and Exponential Moving Average

Therefore, it makes sense to calculate the average inventory when comparing inventory to total sales or cost of goods sold. This calculation eliminates confusion from spikes in the inventory level. To calculate your inventory turnover ratio, you need to know your cost of goods sold (COGS), and your average inventory (AI). To illustrate the days’ sales in inventory, let’s assume that in the previous year a company had an inventory turnover ratio of 9. Using 360 as the number of days in the year, the company’s days’ sales in inventory was 40 days (360 days divided by 9).

Then, you’ll need to divide the number of days in the period by this inventory turnover ratio to determine days in inventory. If you have not calculated the inventory turnover ratio, you could simply use the cost of goods sold and the average inventory figures. Then you would multiply that number by the number of days in the accounting period. To calculate days in inventory, find the inventory turnover rate by dividing the cost of goods sold by the average inventory. Then, use the inventory rate to calculate the the days in inventory by dividing the number of days in the period by the previously calculated turnover rate.

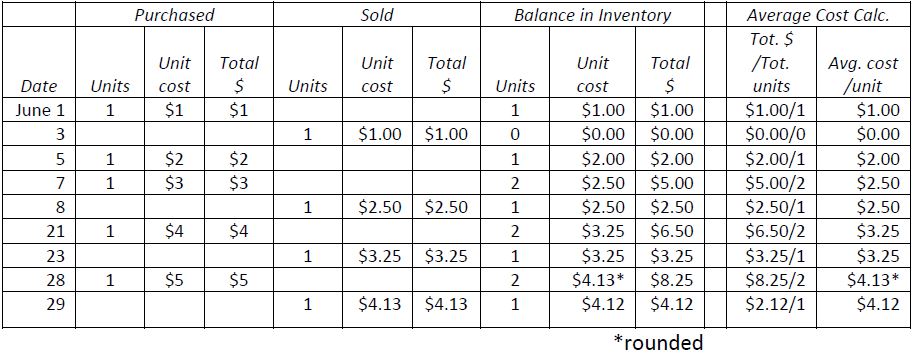

Moving Average Inventory

How do you calculate average inventory?

Average inventory is a calculation that estimates the value or number of a particular good or set of goods during two or more specified time periods. Average inventory is the mean value of an inventory within a certain time period, which may vary from the median value of the same data set.

To calculate the annual inventory turnover rate, divide the total ending inventory into the annual cost of goods sold. This tells you how many times you purchased and sold your inventory for one calendar or fiscal year. Another version of this formula measures how many days of inventory you have on hand.

Like a typical turnover ratio, inventory turnover details how much inventory is sold over a period. To calculate the inventory turnover ratio, cost of goods sold is divided by the average inventory for the same period. Once you know the inventory turnover ratio, you can use it to calculate the days in inventory. Days in inventory is the total number of days a company takes to sell its average inventory. It also determines the number of days for which the current average inventory will be sufficient.

- With this information, you can compare your business’s inventory days with that of your competitors.

- Managing inventory is very important in a company that sells products to make a profit.

Inventory Valuation — LIFO vs. FIFO

Managing inventory is very important in a company that sells products to make a profit. Calculating inventory days is an indicator of how well the business is doing in terms of inventory. With this information, you can compare your business’s inventory days with that of your competitors.

The inventory turnover ratio is calculated by dividing the cost of goods sold for a period by the average inventory for that period. The inventory turnover ratio is an efficiency ratio that shows how effectively inventory is managed by comparing cost of goods sold with average inventory for a period. This measures how many times average inventory is “turned” or sold during a period. In other words, it measures how many times a company sold its total average inventory dollar amount during the year. A company with $1,000 of average inventory and sales of $10,000 effectively sold its 10 times over.

This formula is used to determine how quickly a company is converting their inventory into sales. A slower turnaround on sales may be a warning sign that there are problems internally, such as brand image or the product, or externally, such as an industry downturn or the overall economy.

DSI is a measure of the effectiveness of inventory management by a company. Inventory forms a significant chunk of the operational capital requirements for a business. The value of inventory may change significantly within an accounting period.

Companies use this metric to evaluate their efficiency in using their inventory. The formula for inventory turnover ratio is the cost of goods sold divided by the average inventory for the same period.

What Is Average Inventory?

To calculate days in inventory, you need the cost of goods sold and the average inventory, not the sales amount. Once you know the COGS and the average inventory, you can calculate the inventory turnover ratio. Using the information from the above examples, in this 12 month period, the company had a COGS of $26,000 and an average inventory of $6,000. To calculate the inventory turnover ratio, you would divide the COGS by the average inventory.

To manufacture a salable product, a company needs raw material and other resources which form the inventory and come at a cost. Additionally, there is a cost linked to the manufacturing of the salable product using the inventory. DSI is calculated based on the average value of the inventory and cost of goods sold during a given period or as of a particular date. Mathematically, the number of days in the corresponding period is calculated using 365 for a year and 90 for a quarter.

A lower inventory days measurement means that you are achieving higher inventory turnover and a better return on assets. Calculating inventory days involves determining the cost of goods sold and average inventory in a given period. To calculate the days in inventory, you first must calculate the inventory turnover ratio, which comprises the cost of goods sold and the average inventory.