Days in inventory

The other two stages aredays sales outstanding(DSO) anddays payable outstanding(DPO). While the DSO ratio measures how long it takes a company to receive payment on accounts receivable, the DPO value measures how long it takes a company to pay off its accounts payable. Since DSI indicates the duration of time a company’s cash is tied up in its inventory, a smaller value of DSI is preferred. On the other hand, a large DSI value indicates that the company may be struggling with obsolete, high-volume inventory and may have invested too much into the same.

This total is subtracted from the total sales to get a gross, rather than a net, profit. To get the average number of days it takes to sell an item, divide the total number of days in a year by the average inventory turnover ratio. In our example, the average turnover ratio for Company A is 1.47, so we divide that by 365 to determine the average age of an inventory item. This number includes all labor and materials that were used to make the products you sell.

Days’ sales in inventory (DSI) indicates the average time required for a company to convert its inventory into sales. However, a large number may also mean that management has decided to maintain high inventory levels in order to achieve high order fulfillment rates. DSI is the first part of the three-part cash conversion cycle (CCC), which represents the overall process of turning raw materials into realizable cash from sales.

Managing inventory levels is vital for most businesses, and it is especially important for retail companies or those selling physical goods. Days’ sales of inventory is one of the formulas managers use for proper inventory management.

Finally, this quantity is multiplied by Weighted Average Cost per Unit to give an estimate of ending inventory cost. The cost of goods sold valuation is the amount of goods sold times the Weighted Average Cost per Unit. The sum of these two amounts (less a rounding error) equals the total actual cost of all purchases and beginning inventory. Businesses must efficiently manage inventory turnover in order to optimize cash flow, meet customers’ needs, and maximize profits.

A pharmacy needs to know how long certain medicines sit on the shelf before they are sold. It is important for every business to be able to analyze the average amount of time necessary to sell its inventory. Some goods expire and are unable to be used after a certain amount of time. Managers use the days’ sales in inventory (DSI) ratio to assess the average amount of time for the company to sell its inventory.

What are the Indications of Low and High DSI?

When done effectively, businesses reduce the costs of carrying excess inventory while maximizing sales. Good inventory management can help you track your inventory in real time to streamline this process. Thankfully, it’s pretty simple to avoid an inventory turnover ratio that’s too high. Your business either needs to order more inventory to meet demand or make fewer sales! A good rule of thumb is to buy more inventory of a popular product so that you have backstock ready to go.

To know the amount of time needed to convert money used to purchase inventory into sales, divide your current inventory balance by average daily cost of goods sold. Marketing is very useful for increasing the demand for inventory, as long as it’s well-designed and cost-appropriate. When you spread the good word about your company and it’s products, you’ll be able to move more product while increasing sales. Your return on investment for such a well-organized marketing campaign will be revealed when compared with the higher inventory turnover ratio. Inventory management is the part of supply chain management that aims to always have the right products in the right quantity for sale, at the right time.

The days’ sales in inventory figure is intended for the use of an outside financial analyst who is using ratio analysis to estimate the performance of a company. The metric is less commonly used within a business, since employees can access detailed reports that reveal exactly which inventory items are selling better or worse than average. DSI is a measure of the effectiveness of inventory management by a company. Inventory forms a significant chunk of the operational capital requirements for a business.

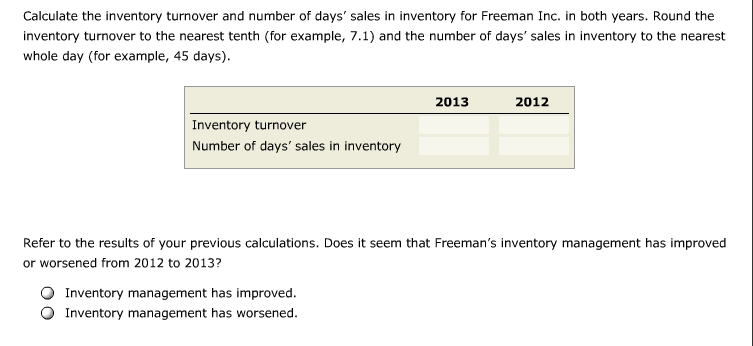

Inventory turnover, or the inventory turnover ratio, is the number of times a business sells and replaces its stock of goods during a given period. It considers the cost of goods sold, relative to its average inventory for a year or in any a set period of time. To calculate age in inventory, you need to first determine the inventory turnover ratio.

They also want to decrease the chances of inventory getting too old to use or sell, which cost the company money. Managers also must know when purchasing new inventory items is necessary to keep the business operating smoothly. Now, you can calculate the inventory turnover ratio by dividing the cost of goods sold by average inventory.

Financial Modeling Certification

It is also possible that the company may be retaining high inventory levels in order to achieve high order fulfillment rates, such as in anticipation of bumper sales during an upcoming holiday season. Inventory turnover is a ratio that expresses how often you must replace inventory during a month or other period. The higher the inventory turnover, the less capital must be tied up in stock for a given sales volume.

DSI is calculated based on the average value of the inventory and cost of goods sold during a given period or as of a particular date. Mathematically, the number of days in the corresponding period is calculated using 365 for a year and 90 for a quarter. The manager of a supermarket needs to know how long perishable items in the produce section remain in the store before they are sold.

- To calculate age in inventory, you need to first determine the inventory turnover ratio.

- Inventory turnover, or the inventory turnover ratio, is the number of times a business sells and replaces its stock of goods during a given period.

To calculate the cost of goods sold, you take the beginning inventory, add purchases, and deduct ending inventory for the period. Most accounting software lets you run a profit and loss report that includes your cost of goods sold for the period. The formula to calculate days in inventory is the number of days in the period divided by the inventory turnover ratio. This formula is used to determine how quickly a company is converting their inventory into sales. A slower turnaround on sales may be a warning sign that there are problems internally, such as brand image or the product, or externally, such as an industry downturn or the overall economy.

How do you calculate days sales in inventory?

The days sales in inventory value is calculated by dividing the inventory balance (including work-in-progress) by the amount of cost of goods sold. The DSI figure represents the average number of days that a company’s inventory assets are realized into sales within the year.

You want to have sufficient stock on hand to meet customer demand. For some businesses, a month is an appropriate time between inventories. If you find another time interval serves you better, you can use the method described here simply by adjusting the time interval.

Analyzing sales during specific periods will help you readily identify these ebbs and flows. Once identified, calculate the inventory turnover ratios for various timeframes. During slower periods, find ways to move the stock faster and during busier times, make sure you always have enough on hand. It’s important to note that calculating the costs of goods sold will be different for different businesses. For retailers who simply buy products from a wholesaler that are ready to be sold, the costs will simply be the price of the items.

Inventory turnover measures the number of times inventory is sold and replaced within a time period. Improving this measurement can lead to better sales strategies, which benefits every aspect of your business.

Generally, a small average of days sales, or low days sales in inventory, indicates that a business is efficient, both in terms of sales performance and inventory management. Hence, it is more favorable than having a high days sales in inventory. A low days sales in inventory reflects fast sales of inventory stocks and thus would minimize handling costs, as well as increase cash flow. It takes Cost of Goods Available for Sale and divides it by the number of units available for sale (number of goods from Beginning Inventory + Purchases/production). A physical count is then performed on the ending inventory to determine the number of goods left.

Which Industries Have the Highest Inventory Turnover?

But for those businesses that use labor to create or finish a product, the labor, and any additional materials must also be added to the costs. Rent, sales costs, marketing, equipment, and others should not be added to this number. Costs of goods take the beginning inventory of the determined reference time frame and add all production costs and new purchases made by the company are added to this number. Whatever additional inventory that is left at the end of the year is subtracted and the result is the final costs of goods sold.

To calculate your inventory turnover ratio, you need to know your cost of goods sold (COGS), and your average inventory (AI). – Many retail businesses have ups and downs in sales throughout the year.

To calculate days’ sales of inventory, divide the ending inventory number by the cost of goods sold for the period. Then multiply this number by 365, or by the number of days in the period in question. This formula gives management insight on when to order new merchandise, when to run specials and promotions, or when to get rid of obsolete inventory. Days’ sales of inventory is an important part of proper inventory management. Managers want inventory to move fast so they can use the cash from sales on other business expenses.

Inventory turnover ratio is calculated by dividing the cost of goods sold by average inventory for the period. Divide the number of days in a year 365 by your inventory turnover ratio to get the average age of inventory. To manufacture a salable product, a company needs raw material and other resources which form the inventory and come at a cost. Additionally, there is a cost linked to the manufacturing of the salable product using the inventory.

By calculating the number of days that a company holds onto the inventory before it is able to sell it, this efficiency ratio measures the average length of time that a company’s cash is locked up in the inventory. The days sales of inventory (DSI) is a financial ratio that indicates the average time in days that a company takes to turn its inventory, including goods that are a work in progress, into sales.

What is Days Sales in Inventory (DSI)?

Inventory turnover measures a company’s efficiency in managing its stock of goods. The ratio divides the cost of goods sold by the average inventory.