Current Ratio Definition

Related Terms

It measures the ability to use its quick assets (cash and cash equivalents, marketable securities and accounts receivable) to pay its current liabilities. The cash asset ratio (or cash ratio) is also similar to the current ratio, but it compares only a company’s marketable securities and cash to its current liabilities. The quick ratiob measure of a company’s ability to meet its short-term obligations using its most liquid assets (near cash or quick assets). Quick assets include those current assets that presumably can be quickly converted to cash at close to their book values.

A high current ratio can be a sign of problems in managing working capital (what is leftover of current assets after deducting current liabilities). While a low current ratio may indicate a problem in meeting current obligations, it is not indicative of a serious problem.

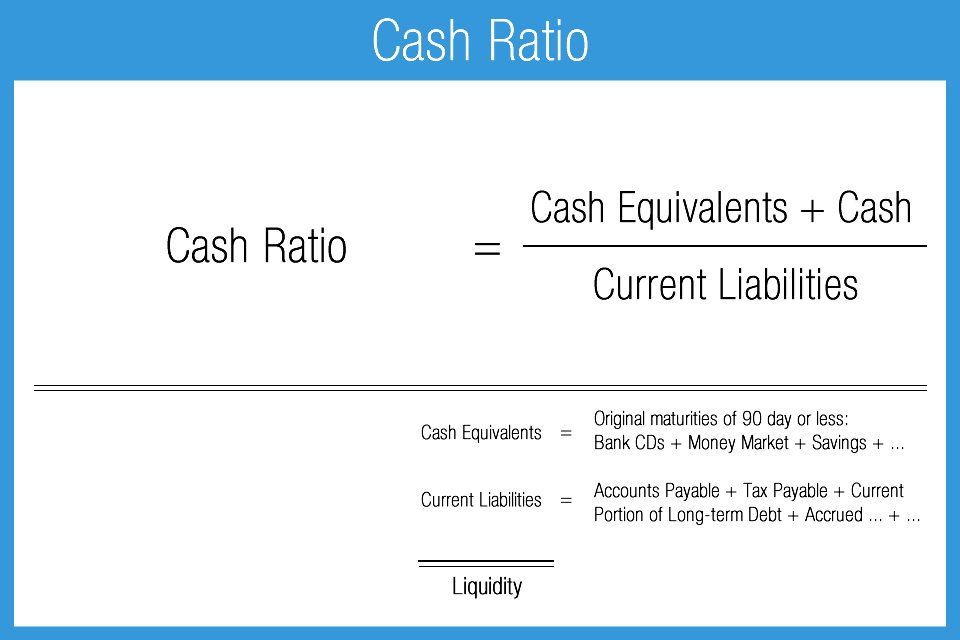

Cash ratio is the most stringent and conservative of the three liquidity ratios (current, quick and cash ratio). It only looks at the company’s most liquid short-term assets – cash and cash equivalents – which can be most easily used to pay off current obligations. To calculate the ratio, analysts compare a company’s current assets to its current liabilities. Current assets listed on a company’s balance sheet include cash, accounts receivable, inventory and other assets that are expected to be liquidated or turned into cash in less than one year. Current liabilities include accounts payable, wages, taxes payable, and the current portion of long-term debt.

Quick ratio is viewed as a sign of a company’s financial strength or weakness; it gives information about a company’s short term liquidity. The ratio tells creditors how much of the company’s short term debt can be met by selling all the company’s liquid assets at very short notice.

An acid test is a quick test designed to produce instant results—hence, the name. The current ratio is an indication of a firm’s market liquidity and ability to meet creditor’s demands. Acceptable current ratios vary from industry to industry and are generally between 1.5 and 3 for healthy businesses. If a company’s current ratio is in this range, then it generally indicates good short-term financial strength. If current liabilities exceed current assets (the current ratio is below 1), then the company may have problems meeting its short-term obligations.

What is the cash ratio formula?

The cash ratio is a measurement of a company’s liquidity, specifically the ratio of a company’s total cash and cash equivalents to its current liabilities. The metric calculates a company’s ability to repay its short-term debt with cash or near-cash resources, such as easily marketable securities.

Cash ratio (also called cash asset ratio) is the ratio of a company’s cash and cash equivalent assets to its total liabilities. Cash ratio is a refinement of quick ratio and indicates the extent to which readily available funds can pay off current liabilities. Potential creditors use this ratio as a measure of a company’s liquidity and how easily it can service debt and cover short-term liabilities.

What is a good cash ratio?

Cash ratio = (Cash + Marketable Securities)/Current Liabilities. Quick ratio = (Cash + Marketable Securities + Receivables)/Current liabilities. Current ratio = (Cash + Marketable Securities + Receivables + Inventory)/Current Liabilities.

- It is the most conservative of all the liquidity measurements, since it excludes inventory (which is included in the current ratio) and accounts receivable (which is included in the quick ratio).

- The ratio is used to determine whether a business can meet its short-term obligations – in effect, whether it has sufficient liquidity to stay in business.

- The cash ratio compares a company’s most liquid assets to its current liabilities.

How Is the Acid-Test Ratio Calculated?

If the current ratio is too high, then the company may not be efficiently using its current assets or its short-term financing facilities. In such a situation, firms should consider investing excess capital into middle and long term objectives. The cash ratio is a measurement of a company’s liquidity, specifically the ratio of a company’s total cash and cash equivalents to its current liabilities. The metric calculates a company’s ability to repay its short-term debt with cash or near-cash resources, such as easily marketable securities. This information is useful to creditors when they decide how much money, if any, they would be willing to loan a company.

The current ratio, on the other hand, considers inventory and prepaid expense assets. In most companies, inventory takes time to liquidate, although a few rare companies can turn their inventory fast enough to consider it a quick asset. Prepaid expenses, though an asset, cannot be used to pay for current liabilities, so they’re omitted from the quick ratio. If the value of a current ratio is considered high, then the company may not be efficiently using its current assets, specifically cash, or its short-term financing options.

The cash ratio compares a company’s most liquid assets to its current liabilities. The ratio is used to determine whether a business can meet its short-term obligations – in effect, whether it has sufficient liquidity to stay in business. It is the most conservative of all the liquidity measurements, since it excludes inventory (which is included in the current ratio) and accounts receivable (which is included in the quick ratio). This ratio may be too conservative, especially if receivables are readily convertible into cash within a short period of time. The cash ratio or cash coverage ratio is a liquidity ratio that measures a firm’s ability to pay off its current liabilities with only cash and cash equivalents.

If an organization has good long-term revenue streams, it may be able to borrow against those prospects to meet current obligations. Some types of businesses usually operate with a current ratio of less than one. For example, when inventory turns over more rapidly than accounts payable becomes due, the current ratio will be less than one.

The sale will therefore generate substantially more cash than the value of inventory on the balance sheet. Low current ratios can also be justified for businesses that can collect cash from customers long before they need to pay their suppliers. As with other liquidity measurements, such as the current ratio and the quick ratio, the formula for the cash ratio uses current liabilities for the denominator. Current liabilities include any obligation due in one year or less, such as short-term debt, accrued liabilities, and accounts payable.

What is the Cash Ratio?

Some types of businesses can operate with a current ratio of less than one, however. If inventory turns into cash much more rapidly than the accounts payable become due, then the firm’s current ratio can comfortably remain less than one. Inventory is valued at the cost of acquiring it and the firm intends to sell the inventory for more than this cost.

The cash ratio is much more restrictive than thecurrent ratio orquick ratiobecause no other current assets can be used to pay off current debt–only cash. If current liabilities exceed current assets the current ratio will be less than 1. A current ratio of less than 1 indicates that the company may have problems meeting its short-term obligations.

The quick ratio is an indicator of a company’s short-term liquidity position and measures a company’s ability to meet its short-term obligations with its most liquid assets. Since it indicates the company’s ability to instantly use its near-cash assets (assets that can be converted quickly to cash) to pay down its current liabilities, it is also called the acid test ratio.

The quick ratio is more conservative than the current ratio because it excludes inventory and other current assets, which are generally more difficult to turn into cash. The quick ratio considers only assets that can be converted to cash very quickly.