Cost Per Unit Definition & Example

Where do marginal and average costs meet?

Total fixed costs are the sum of all consistent, non-variable expenses a company must pay. For example, suppose a company leases office space for $10,000 per month, it rents machinery for $5,000 per month and has a $1,000 monthly utility bill. In this case, the company’s total fixed costs would, therefore, be $16,000. Total cost in economics, unlike in cost accounting, includes the total opportunity cost (implicit cost) of each factor of production as part of its fixed or variable costs. In table 3, when output is zero, variable costs are also zero.

You may also want to assess fixed costs and the total variable manufacturing cost to make informed decisions regarding your product lines when production expenses climb. For example, further examination of higher direct material costs at your jewelry company may attribute increased expenses to higher gold prices – a variable cost.

In this sense, compute it as cost of goods available for sale divided by the number of units available for sale. This will give you the average per-unit value of the inventory of goods available for sale.

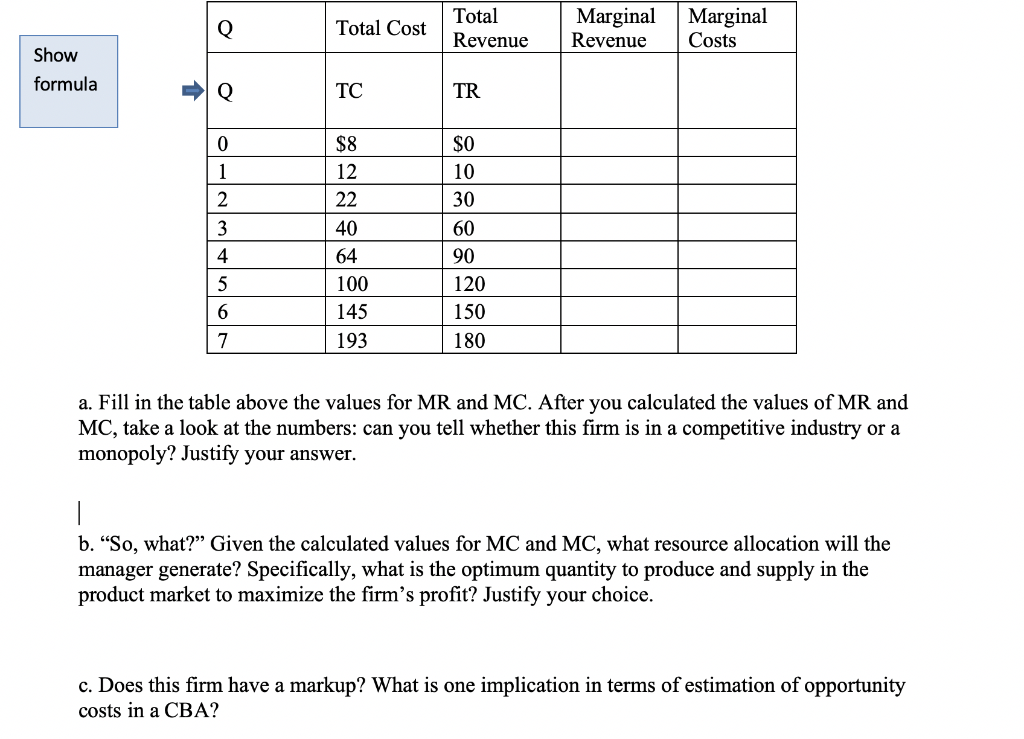

Marginal cost (MC) is calculated by taking the change in total cost between two levels of output and dividing by the change in output. The breakdown of total costs into fixed and variable costs can provide a basis for other insights as well. The first five columns of Table 1 should look familiar—they come from the Clip Joint example we saw earlier—but there are also three new columns showing average total costs, average variable costs, and marginal costs. These new measures analyze costs on a per-unit (rather than a total) basis. In accounting, to find the average cost, divide the sum of variable costs and fixed costsby the quantity of units produced.

To calculate total cost for a personal budget, start by tracking your spending for 1 month to determine your average monthly expenses. Next, add up your variable costs for 1 month, such as nights out, clothing, and vacations.

For example, widget company ZYX may have to spend $10 to manufacture one unit of product. Therefore, if the company receives and inordinately large purchase order during a given month, its monthly expenditures rise accordingly. Most businesses’ fixed and variable costs can be found on their financial documents. Specifically, the income statement should contain all of the variable costs tied to the production of the business’s goods and services in addition to crucial fixed costs like rent, utilities, and so on.

As the output increases to 8 units, total costs go up to 86. It means as the output increases fixed costs remain the same, but variable costs increase at a diminishing rate then at constant rate and ultimately at an increasing rate.

Variable costs are the sum of all labor and materials required to produce a unit of your product. Your total variable cost is equal to the variable cost per unit, multiplied by the number of units produced.

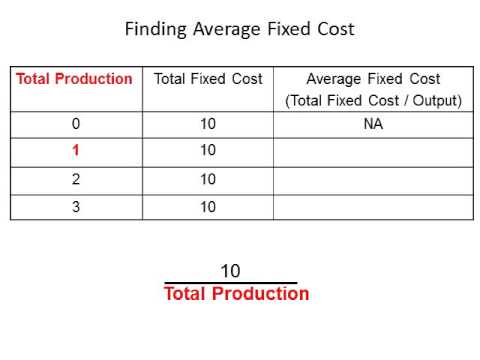

Your average variable cost is equal to your total variable cost, divided by the number of units produced. The information on total costs, fixed cost, and variable cost can also be presented on a per-unit basis. Average total cost (ATC) is calculated by dividing total cost by the total quantity produced. Average variable cost (AVC) is calculated by dividing variable cost by the quantity produced. The average variable cost curve lies below the average total cost curve and is typically U-shaped or upward-sloping.

If the price per unit on your major products can be reduced, your profits go up. When your profits increase, you may need to discontinue certain product lines or reduce production, until your costs stabilize. Learning how to calculate the cost-per-unit will guide you through many key business decisions and, hopefully, help you grow revenue.

Total Cost in Economics: Definition & Formula

Finally, add your fixed costs to your variable costs to get your total costs. Total cost, fixed cost, and variable cost each reflect different aspects of the cost of production over the entire quantity of output being produced. In contrast, marginal cost, average cost, and average variable cost are costs per unit. In the previous example, they are measured as cost per haircut. Thus, it would not make sense to put all of these numbers on the same graph, since they are measured in different units ($ versus $ per unit of output).

The concept of marginal cost of production is recently developed by Austrian School of Economics. Marginal cost is an addition to the total cost caused by producing one more unit of output. For instance, the total cost for the production of 100 units is Rs. 5000.

- To calculate total cost for a personal budget, start by tracking your spending for 1 month to determine your average monthly expenses.

- The implications of fixed costs will become clearer when you’ve learned about overhead costs, variable costs and the total cost formula.

The output at which marginal cost is equal to marginal revenue keeps losses minimum. The producer may not cover the total costs, if the price of the product is less than the short-run average cost. Then the distinction between fixed cost and variable costs must be kept in mind.

You can calculate it with the formula below (for reference, the equation to the top left of the box is your total variable cost). Variable costs vary because they can increase and decrease as you make more or less of your product. The more units you sell, the more money you’ll make, but some of this money will need to pay for the production of more units. So, you’ll need to produce more units to actually turn a profit.

How do you calculate total cost and quantity?

The formula to calculate total cost is the following: TC (total cost) = TFC (total fixed cost) + TVC (total variable cost).

In the world of finance, when someone refers to “total cost,” she can be talking about several things. It can be daunting to calculate expenses that change as your company evolves. Sometimes, you just want to know exactly what you’re paying to run your business. Using the formulas above, however, you’ll be able to easily track your variable costs no matter what stage of life your business might be in. Your average variable cost uses your total variable cost to determine how much, on average, it costs to produce one unit of your product.

Variable Cost Formula

All business costs can be classified as either variable costs or fixed costs. Fixed costs are those costs that do not change based on production levels, while variable costs increase or decrease based on production. Fixed costs, total fixed costs, and variable costs all sound similar, but there are important differences between the three. Fixed costs do not account for the number of goods or services a company produces, while variable costs and total fixed costs depend largely on that number.

The implications of fixed costs will become clearer when you’ve learned about overhead costs, variable costs and the total cost formula. For the purposes of this lesson, the important thing to remember is simply fixed costs are costs that do not change based on production, such as assets like buildings and equipment.

Variable costs are incurred only when some output is produced. Total costs comprise both total fixed costs and total variable costs.

How do we calculate cost?

Average total cost (ATC) is calculated by dividing total cost by the total quantity produced. The average total cost curve is typically U-shaped. Average variable cost (AVC) is calculated by dividing variable cost by the quantity produced.

The minimum efficient scale is scale of production at which average cost of production reaches its minimum point. Up to a certain point, more production volume reduces the cost per unit of production. The more output that is produced, the more thinly spread the fixed costs of production across the units of output are. Furthermore, production economies of scale can lower the threat of new entrants (competitors) into the industry. Add the cost of direct materials, direct labor and manufacturing overhead within a given time period, such as one month, to determine the total manufacturing costs for a product line.

Watch this clip as a continuation from the video on the previous page to see how average variable cost, average fixed costs, and average total costs are calculated. Total cost (TC) in the simplest terms is all the costs incurred in producing something or engaging in an activity. In economics, total cost is made up of variable costs + fixed costs.

If the price does not cover average variable costs, the firm prefers to shut down. In other words if the total revenue (total sale proceeds) does not cover total variable costs, the firm must shut down. Otherwise, its total loss will be greater than the fixed costs. It will produce something only when the price covers average variable cost and part of the average fixed costs.

Microeconomics

Consequently, the total costs, combining $16,000 fixed costs with $25,000 variable costs, would come to $41,000. This number is an essential value a company should be aware of to make sure the business remains fiscally solvent but also thrives over the long term. A variable cost, on the other hand, is a cost that varies, as the amount of goods and services a company produces fluctuates. Variable costs are functions of a company’s production volume.

Unless you’re already practicing very good financial habits, you may not keep track of every single expense in a given month. This means that you can run into problems when you have to total up all of your expenses at the end of the month. To remove guesswork from the equation, try actively tracking your expenses for one full month. Groceries can be a little messier to keep track of, but if you keep your receipts or monitor your checking account transactions online, it shouldn’t be hard to get an accurate total.