Cost of goods sold

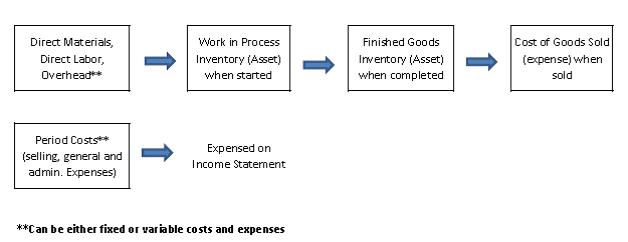

It excludes indirect expenses, such as distribution costs and sales force costs. If there are no sales of goods or services, then there should theoretically be no cost of goods sold. Instead, the costs associated with goods and services are recorded in the inventory asset account, which appears in the balance sheet as a current asset. Also, there may be production-related expenses (such as facility rent) even when there is no production at all, as would be the case when there is a union walkout.

What Is Cost of Goods Sold (COGS)?

The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good.

Is Cost of goods sold an operating expense?

The cost of goods sold is considered to be linked to sales under the matching principle. Thus, once you recognize revenues when a sale occurs, you must recognize the cost of goods sold at the same time, as the primary offsetting expense. This means that the cost of goods sold is an expense.

Cost of goods sold (COGS) is an important line item on an income statement. It reflects the cost of producing a good or service for sale to a customer. The IRS allows for COGS to be included in tax returns and can reduce your business’s taxable income. Whether you are a traditional retailer or an online retailer, the same rules apply. Under periodic inventory procedure, companies do not use the Merchandise Inventory account to record each purchase and sale of merchandise.

Under variable costing, cost of goods sold includes variable labor, materials and overhead costs. Because COGS is a cost of doing business, it is recorded as a business expense on the income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate the company’s bottom line.

For U.S. income tax purposes, some of these period costs must be capitalized as part of inventory. Costs of selling, packing, and shipping goods to customers are treated as operating expenses related to the sale. Both International and U.S. accounting standards require that certain abnormal costs, such as those associated with idle capacity, must be treated as expenses rather than part of inventory. Cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or services sold by a company. These are direct costs only, and only businesses with a product or service to sell can list COGS on their income statement.

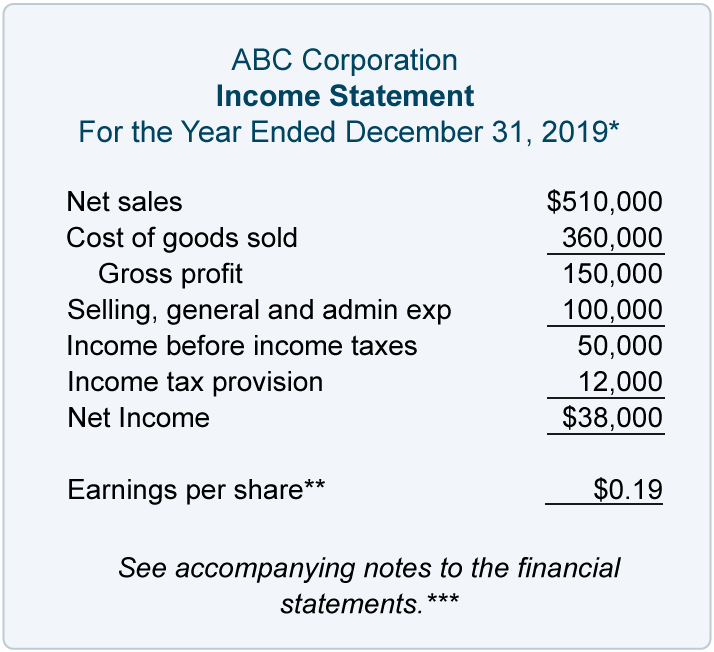

However, companies with inventory and cost of goods sold use a multiple-step income statement, so named because there are multiple subtractions to compute net income. In a multiple-step income statement, the accountant subtracts cost of goods sold from sales to determine gross profit. After calculating gross profit, the accountant subtracts all other expenses to arrive at net income.

AccountingTools

The popularity of online markets such as eBay and Etsy has resulted in an expansion of businesses that transact through these markets. Some businesses operate exclusively through online retail, taking advantage of a worldwide target market and low operating expenses. Though non-traditional, these businesses are still required to pay taxes and prepare financial documents like any other company. They should also account for their inventories and take advantage of tax deductions like other retailers, including listings of cost of goods sold (COGS) on their income statement. Operating expenses (OPEX) and cost of goods sold (COGS) are separate sets of expenditures incurred by businesses in running their daily operations.

Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes not recoverable paid on materials used, and fees paid for acquisition. For financial reporting purposes such period costs as purchasing department, warehouse, and other operating expenses are usually not treated as part of inventory or cost of goods sold.

Why cost of goods sold is an expense?

Cost of Goods Sold (COGS) is the cost of a product to a distributor, manufacturer or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement.

When subtracted from revenue, COGS helps determine a company’s gross profit. The most common way to calculate COGS is to take the beginning annual inventory amount, add all purchases, and then subtract the year ending inventory from that total. She buys machines A and B for 10 each, and later buys machines C and D for 12 each. Under specific identification, the cost of goods sold is 10 + 12, the particular costs of machines A and C.

Any additional productions or purchases made by a manufacturing or retail company are added to the beginning inventory. At the end of the year, the products that were not sold are subtracted from the sum of beginning inventory and additional purchases. The final number derived from the calculation is the cost of goods sold for the year.

It appears in the income statement, immediately after the sales line items and before the selling and administrative line items. Cost of goods sold expense means just that—the cost of all products sold to customers during the year.

- Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes not recoverable paid on materials used, and fees paid for acquisition.

- For financial reporting purposes such period costs as purchasing department, warehouse, and other operating expenses are usually not treated as part of inventory or cost of goods sold.

- For U.S. income tax purposes, some of these period costs must be capitalized as part of inventory.

At a manufacturing company, the salaries and wages of employees in the manufacturing operations are assigned to the products manufactured. When the products are sold, the costs assigned to those products (including the manufacturing salaries and wages) are included in the cost of goods sold, which is reported on the income statement. (The costs of the products that are not sold are reported as inventory on the balance sheet. Hence, the inventory will contain some of the manufacturing salaries and wages. Costs of Goods Sold, or COGS, tracks all of the costs associated with the items you sell, which allows you to calculate gross profits accurately.

The IRS website even lists some examples of “personal service businesses” that do not calculate COGS on their income statements. For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together.

COGS accounts also give the total underlying costs on your Profit & Loss reports. In QuickBooks, you create new accounts through the Chart of Accounts, or COA, window. You then assign the necessary inventory items to these accounts so that you can accurately track what you have in stock, and know exactly how much you’ve spent and earned with it. Inventory that is sold appears in the income statement under the COGS account. The beginning inventory for the year is the inventory left over from the previous year—that is, the merchandise that was not sold in the previous year.

While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher. The cost of goods sold (COGS), also referred to as the cost of sales or cost of services, is how much it costs to produce your products or services.

In these cases, it is possible for there to be a cost of goods sold expense even in the absence of sales. As a rule of thumb, cost of goods sold includes the labor, materials and overhead costs associated with bringing a product to market. However, exactly what’s included in cost of goods sold depends on the costing system the company employs. The two main types of costing systems used by companies with inventory are absorption costing and variable costing. Absorption costing adds fixed manufacturing overhead, such as rent or property tax, to the cost of goods sold.

Costs of revenueexist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however.

Cost of Goods Sold Example

Firms assume any items not included in the physical count of inventory at the end of the period have been sold. Thus, they mistakenly assume items that have been stolen have been sold and include their cost in cost of goods sold.

The revenue from the sales is recorded in the sales revenue account, which is reported just above the cost of goods sold expense in the income statement (see Exhibit 6.1). Cost of goods sold expense is by far the largest expense in the company’s income statement, being almost three times its selling, general, and administrative expenses for the year. Cost of goods sold can be determined after sales revenue and before gross profit on a multiple-step income statement. The cost of goods sold balance is an estimation of how much money the company spent on the goods and services it sold during an accounting period. The company’s costing system and its inventory valuation method can affect the cost of goods sold calculation.

Consequently, their values are recorded as different line items on a company’s income statement. But both of these expenses are subtracted from the company’s total sales or revenue figures. The cost of goods sold is usually the largest expense that a business incurs. This line item is the aggregate amount of expenses incurred to create products or services that have been sold.

If COGS is not listed on the income statement, no deduction can be applied for those costs. Cost of Goods Sold (COGS) is the cost of a product to a distributor, manufacturer or retailer. Sales revenue minus cost of goods sold is a business’s gross profit. Cost of goods sold is considered an expense in accounting and it can be found on a financial report called an income statement. There are two way to calculate COGS, according to Accounting Coach.

If she uses average cost, her costs are 22 ( (10+10+12+12)/4 x 2). Thus, her profit for accounting and tax purposes may be 20, 18, or 16, depending on her inventory method. Many service companies do not have any cost of goods sold at all. COGS is not addressed in any detail ingenerally accepted accounting principles(GAAP), but COGS is defined as only the cost of inventory items sold during a given period. Not only do service companies have no goods to sell, but purely service companies also do not have inventories.

Instead, a company corrects the balance in the Merchandise Inventory account as the result of a physical inventory count at the end of the accounting period. Also, the company usually does not maintain other records showing the exact number of units that should be on hand. Although periodic inventory procedure reduces record-keeping, it also reduces control over inventory items.

What Is the Cost of Goods Sold Formula?

The cost of goods sold is considered to be linked to sales under the matching principle. Thus, once you recognize revenues when a sale occurs, you must recognize the cost of goods sold at the same time, as the primary offsetting expense.

COGS include direct material and direct labor expenses that go into the production of each good or service that is sold. Cost of goods sold is listed on the income statement beneath sales revenue and before gross profit. The basic template of an income statement is revenues less expenses equals net income.