Cost of equity

In this equation, the risk-free rate is the rate of return paid on risk-free investments such as Treasuries. Beta is a measure of risk calculated as a regression on the company’s stock price. The higher the volatility, the higher the beta and relative risk compared to the general market.

The cost of equity concept is very important when it comes to valuing shares on the stock market. Equity, like all other investment classes expects a compensation to be paid to its investors. The problem however is that unlike debt and other classes the cost of equity is never really straightforward. You can look at the interest rates that you are paying and you will straight away know what the cost of debt for your company is. Equity holders take the residual value that has been left from the profits.

Given a number of competing investment opportunities, investors are expected to put their capital to work in order to maximize the return. In other words, the cost of capital is the rate of return that capital could be expected to earn in the best alternative investment of equivalent risk; this is the opportunity cost of capital. However, for projects outside the core business of the company, the current cost of capital may not be the appropriate yardstick to use, as the risks of the businesses are not the same. But this formula does not exactly determine the cost of equity for a company, as it does not take into consideration the beta of the company’s stock. To incorporate this factor into the formula, the risk premium is multiplied by beta of the stock.

In other words, it is the difference between the risk-free rate and the market rate. Many argue that it has gone up due to the notion that holding shares has become riskier. The EMRP frequently cited is based on the historical average annual excess return obtained from investing in the stock market above the risk-free rate.

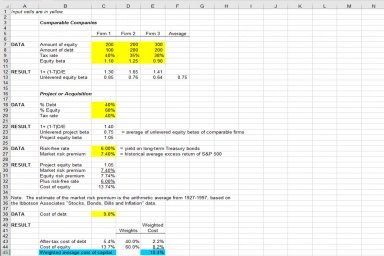

The cost of equity capital, as determined by the CAPM method, is equal to the risk-free rate plus the market risk premium multiplied by the beta value of the stock in question. A stock’s beta is a metric that reflects the volatility of a given stock relative to the volatility of the larger market. To calculate COE, first determine the market rate of return, the risk-free rate of return and the beta of the stock in question.

A stable, well-performing company, will generally have a lower cost of capital. To calculate the cost of capital, the cost of equity and cost of debt must be weighted and then added together. The cost of capital is generally calculated using the weighted average cost of capital. Cost of Equity is the rate of return a company pays out to equity investors.

This means, for instance, that the past cost of debt is not a good indicator of the actual forward looking cost of debt. (Rm – Rf)—Equity Market Risk Premium—The equity market risk premium (EMRP) represents the returns investors expect in exchange for them investing in the stock market over and above the risk-free rate.

Cost of capital

Interest payments to creditors are tax-deductible, but dividend payments to shareholders are not. Thus, a higher proportion of debt in the firm’s capital structure leads to higher ROE. Financial leverage benefits diminish as the risk of defaulting on interest payments increases. If the firm takes on too much debt, the cost of debt rises as creditors demand a higher risk premium, and ROE decreases. Increased debt will make a positive contribution to a firm’s ROE only if the matching return on assets (ROA) of that debt exceeds the interest rate on the debt.

The market rate of return is simply the return generated by the market in which the company’s stock is traded, such as the Nasdaq or S&P 500. The risk-free rate is the expected rate of return as if the funds were invested in a zero-risk security. When assessing the relative effectiveness of different financing plans, businesses use the capital asset pricing model, or CAPM, for determining the cost of equity financing. Equity financing is the amount of capital generated through the sale of stock.

What is a normal cost of equity?

The cost of equity applies only to equity investments, whereas the Weighted Average Cost of Capital (WACC) The WACC formula is = (E/V x Re) + ((D/V x Rd) x (1-T)).

While a firm’s present cost of debt is relatively easy to determine from observation of interest rates in the capital markets, its current cost of equity is unobservable and must be estimated. Finance theory and practice offers various models for estimating a particular firm’s cost of equity such as the capital asset pricing model, or CAPM.

For example, if the net margin increases, every sale brings in more money, resulting in a higher overall ROE. Similarly, if the asset turnover increases, the firm generates more sales for every unit of assets owned, again resulting in a higher overall ROE. Finally, increasing financial leverage means that the firm uses more debt financing relative to equity financing.

The DuPont formula, also known as the strategic profit model, is a common way to decompose ROE into three important components. Essentially, ROE will equal the net profit margin multiplied by asset turnover multiplied by financial leverage. Splitting return on equity into three parts makes it easier to understand changes in ROE over time.

Capital Structure

- While a firm’s present cost of debt is relatively easy to determine from observation of interest rates in the capital markets, its current cost of equity is unobservable and must be estimated.

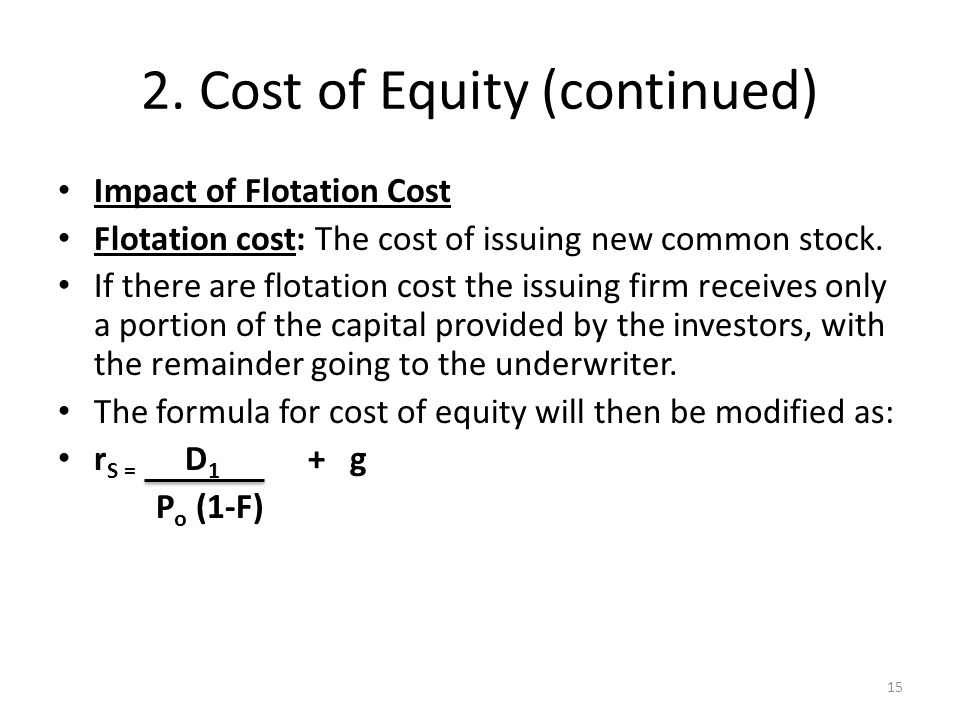

- Another method is derived from the Gordon Model, which is a discounted cash flow model based on dividend returns and eventual capital return from the sale of the investment.

The average market return is estimated using the rate of return generated by a major market index, such as the S&P 500 or the Dow Jones Industrial Average. The market return is further subdivided into the market risk premium and the risk-free rate. One way that companies and investors can estimate the cost of equity is through the capital asset pricing model (CAPM). To calculate the cost of equity using CAPM, multiply the company’s beta by its risk premium and then add that value to the risk-free rate.

Dividend Capitalization Model Example

The cost of equity financing is the rate of return on the investment required to maintain current shareholders and attract new ones. Though this concept can seem intimidating, once the necessary information is assembled, calculating the CAPM cost of equity (COE) is simple using Microsoft Excel. A company’s securities typically include both debt and equity, one must therefore calculate both the cost of debt and the cost of equity to determine a company’s cost of capital. Importantly, both cost of debt and equity must be forward looking, and reflect the expectations of risk and return in the future.

Companies usually do an internal WACC calculation to assess overall company health. The larger and more complex a company is, the harder it is to determine WACC. Unfortunately, only some of the information needed to calculate WACC can be found on a balance sheet.

Individuals and organizations who are willing to provide their funds to others naturally desire to be rewarded. Just as landlords seek rents on their property, capital providers seek returns on their funds, which must be commensurate with the risk undertaken. Cost of equity is the percentage return demanded by a company’s owners, but the cost of capital includes the rate of return demanded by lenders and owners. The cost of capital is the total cost of raising capital, taking into account both the cost of equity and the cost of debt.

Breakpoint of Marginal Cost of Capital

In theory, this figure approximates the required rate of return based on risk. A company’s total cost of capital includes both the funds required to pay interest on debt financing and the dividends on equity funding. The cost of equity funding is determined by estimating the average return on investment that could be expected based on returns generated by the wider market. Therefore, because market risk directly affects the cost of equity funding, it also directly affects the total cost of capital.

The average may either be calculated using an arithmetic mean or a geometric mean. The geometric mean provides an annually compounded rate of excess return and will, in most cases, be lower than the arithmetic mean. Both methods are popular but the arithmetic average has gained widespread acceptance. The weighted average cost of capital (WACC) is a calculation of a company’s cost of capital, or the minimum that a company must earn to satisfy all debts and support all assets. The calculation includes the company’s debt and equity ratios, as well as all long-term debt.

Cost of capital is the return that is necessary for a company to invest in a major project like building a plant or factory. To optimize profitability, a company will only invest or expand operations when the projected returns from a project are greater than the cost of capital, which includes both debt and equity. Debt capital is raised by borrowing funds through various channels, such as acquiring loans or credit card financing.

How do you calculate cost of equity in WACC?

It is commonly computed using the capital asset pricing model formula: Cost of equity = Risk free rate of return + Premium expected for risk. Cost of equity = Risk free rate of return + Beta × (market rate of return – risk free rate of return)

Another method is derived from the Gordon Model, which is a discounted cash flow model based on dividend returns and eventual capital return from the sale of the investment. Another simple method is the Bond Yield Plus Risk Premium (BYPRP), where a subjective risk premium is added to the firm’s long-term debt interest rate. The paper shows that a firm’s implied cost-of-capital is a function of its industry membership, B/M ratio, forecasted long-term growth rate, and the dispersion in analyst earnings forecasts. Moreover, a firm’s overall cost of capital, which consists of the two types of capital costs, can be estimated using the weighted average cost of capital model. The cost of equity funding is generally determined using the capital asset pricing model, or CAPM.

The CAPM approach towards cost of equity is based on the theory that the expected return on equity would be higher than the risk-free rate of return. This extra margin of return, above the risk-free rate, is called the equity risk premium.

On the other hand, equity financing is the act of selling shares of common or preferred stock. The primary way that market risk affects cost of capital is through its effect on cost of equity. The capital asset pricing model, however, can be used on any stock, even if the company does not pay dividends. The theory suggests the cost of equity is based on the stock’s volatility and level of risk compared to the general market. For an investment to be worthwhile, the expected return on capital has to be higher than the cost of capital.

Weighted average cost of capital

The market rate of return is the average market rate, which has generally been assumed to be roughly 10% over the past 80 years. In general, a company with a high beta, that is, a company with a high degree of risk will have a higher cost of equity.