Cost of Capital

Put another way, WACC is an investor’s opportunity cost of taking on the risk of investing money in a company. It is important to compare investment options that have a similar risk. Comparing a Treasury bill, which is virtually risk-free, to investment in a highly volatile stock can cause a misleading calculation.

Clearly, the opportunity costs of waiting time can be just as substantial as costs involving direct spending. Still, one could consider opportunity costs when deciding between two risk profiles. If investment A is risky but has an ROI of 25% while investment B is far less risky but only has an ROI of 5%, even though investment A may succeed, it may not. And if it fails, then the opportunity cost of going with option B will be salient.

The cost of equity, then, is essentially the amount that a company must spend in order to maintain a share price that will satisfy its investors. One example of opportunity cost is in the evaluation of “foreign” (to the US) buyers and their allocation of cash assets in real estate or other types of investment vehicles. When assessing the potential profitability of various investments, businesses look for the option that is likely to yield the greatest return. Often, they can determine this by looking at the expected rate of return for an investment vehicle.

The person making the decision must estimate the variability of returns on the alternative investments through the period during which the cash is expected to be used. Thus, the variability of returns should also be considered when arriving at the opportunity cost of capital. This uncertainty can be quantified by assigning a probability of occurrence to different return on investment outcomes, and using the weighted average as the most likely return. The opportunity cost of capital is the incremental return on investment that a business foregoes when it elects to use funds for an internal project, rather than investing cash in a marketable security. The opportunity cost of capital is the difference between the returns on the two projects.

The opportunity cost of capital of investing in the manufacturing facility is 2%, which is the difference in return on the two investment opportunities. The required rate of return (RRR) is from the investor’s perspective, being the minimum rate an investor will accept for a project or investment. Meanwhile, the cost of capital is what the company expects to return on its securities.

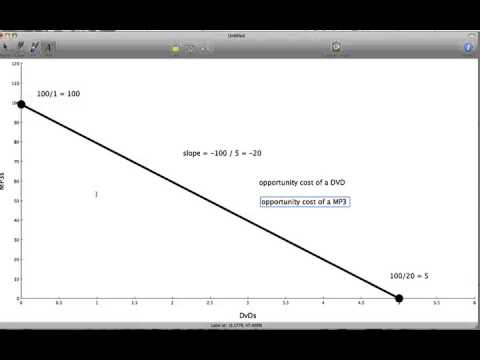

WACC may also be used as a hurdle rate against which companies and investors can gauge return on invested capital (ROIC) performance. WACC is also essential in order to perform economic value-added (EVA) calculations. The weighted average cost of capital (WACC) is a calculation of a firm’s cost of capital in which each category of capital is proportionately weighted. All sources of capital, including common stock, preferred stock, bonds, and any other long-term debt, are included in a WACC calculation. To understand the law of increasing opportunity costs, let’s first define opportunity costs.

This is often called the weighted average cost of capital and refers to the weighted average costs of the company’s debt and equity. Cost of capital refers to the opportunity cost of making a specific investment. It is the rate of return that could have been earned by putting the same money into a different investment with equal risk. Thus, the cost of capital is the rate of return required to persuade the investor to make a given investment.

Since the 9/11 hijackings, security screening has become more intensive, and consequently, the procedure takes longer than in the past. Say that, on average, each air passenger spends an extra 30 minutes in the airport per trip. Economists commonly place a value on time to convert an opportunity cost in time into a monetary figure.

For the sake of simplicity, assume the investment yields a return of 0%, meaning the company gets out exactly what it put in. It is equally possible that, had the company chosen new equipment, there would be no effect on production efficiency, and profits would remain stable.

As an investor that has already sunk money into investments, you might find another investment that promises greater returns. The opportunity cost of holding the underperforming asset may rise to where the rational investment option is to sell and invest in the more promising investment. Buying 1,000 shares of company A at $10 a share, for instance, represents a sunk cost of $10,000. This is the amount of money paid out to make an investment, and getting that money back requires liquidating stock at or above the purchase price.

The cost of capital helps establish a benchmark return that the company must achieve to satisfy its debt and equity investors. Opportunity cost analysis also plays a crucial role in determining a business’s capital structure. While both debt and equity require expense to compensate lenders and shareholders for the risk of investment, each also carries an opportunity cost.

Debt and equity are the two components that constitute a company’s capital funding. Lenders and equity holders will expect to receive certain returns on the funds or capital they have provided. Since the cost of capital is the return that equity owners (or shareholders) and debt holders will expect, WACC indicates the return that both kinds of stakeholders (equity owners and lenders) can expect to receive.

What is opportunity cost give example?

You can determine the opportunity cost of capital by comparing your return on investment, or ROI. You can calculate the return on your investment by using this formula: ROI = market value – cost/cost. For example, say you are considering the construction of an apartment building.

Funds used to make payments on loans, for example, are not being invested in stocks or bonds, which offer the potential for investment income. The company must decide if the expansion made by the leveraging power of debt will generate greater profits than it could make through investments. Assume the expected return on investment in the stock market is 12 percent over the next year, and your company expects the equipment update to generate a 10 percent return over the same period. The opportunity cost of choosing the equipment over the stock market is (12% – 10%), which equals two percentage points.

The opportunity cost of choosing this option is then 12% rather than the expected 2%. To cover the cost of raising funds from the market, cost of capital must be obtained. Hence, it establishes a benchmark, which must be met out by the project. Securities analysts frequently use WACC when assessing the value of investments and when determining which ones to pursue. For example, in discounted cash flow analysis, one may apply WACC as the discount rate for future cash flows in order to derive a business’s net present value.

Opportunity cost of capital should reflect the return investors could get on an investment of equivalent timing and risk. Barring any other considerations, the better use of the cash is to invest $10,000,000 in stocks.

- This uncertainty can be quantified by assigning a probability of occurrence to different return on investment outcomes, and using the weighted average as the most likely return.

- The person making the decision must estimate the variability of returns on the alternative investments through the period during which the cash is expected to be used.

Interest Rates and Other Factors That Affect WACC

The WACC is essentially representative of the rate expected on equities and debt. Therefore, it represents the amount you could have earned if you had invested your capital in the exact proportions of the capital structure. As a result, it is the opportunity cost for investing your money in the investment project. However, the single biggest cost of greater airline security doesn’t involve money. According to the United States Department of Transportation, more than 800 million passengers took plane trips in the United States in 2012.

How do you calculate opportunity cost of capital?

The opportunity cost of capital is the incremental return on investment that a business foregoes when it elects to use funds for an internal project, rather than investing cash in a marketable security. The opportunity cost of capital is the difference between the returns on the two projects.

In other words, by investing in the business, you would forgo the opportunity to earn a higher return. The cost of capital and the discount rate work hand in hand to determine whether a prospective investment or project will be profitable. The discount rate usually takes into consideration a risk premium and therefore is usually higher than the cost of capital. Even though many companies use WACC as a proxy for the discount rate, other methods are used as well. Then, the returns of the project and the security should be the same.

Government backs the rate of return of the T-bill, while there is no such guarantee in the stock market. While the opportunity cost of either option is 0 percent, the T-bill is the safer bet when you consider the relative risk of each investment. The return an investor receives on a company security is the cost of that security to the company that issued it. A company’s overall cost of capital is a mixture of returns needed to compensate all creditors and stockholders.

Popular ‘Economics, Politics, & Society’ Terms

If the selected securities decrease in value, the company could end up losing money rather than enjoying the expected 12 percent return. If a firm were financed entirely by bonds or other loans, its cost of capital would be equal to its cost of debt. Conversely, if the firm were financed entirely through common or preferred stock issues, then the cost of capital would be equal to its cost of equity. Since most firms combine debt and equity financing, the WACC helps turn the cost of debt and cost of equity into one meaningful figure. The cost of capital refers to the required return necessary to make a project or investment worthwhile.

Cost of Capital vs. Discount Rate: An Overview

The formula for calculating an opportunity cost is simply the difference between the expected returns of each option. Say that you have option A, to invest in the stock market hoping to generate capital gain returns. Option B is to reinvest your money back into the business, expecting that newer equipment will increase production efficiency, leading to lower operational expenses and a higher profit margin. The company’s lenders and owners don’t extend financing for free; they want to be paid for delaying their own consumption and assuming investment risk.

Opportunity cost of capital

Opportunity cost is the cost of what you are giving up to do what you are currently doing. If you can either go to work or go to the beach, and you choose to work, the opportunity cost of working is the value you would have gotten had you gone to the beach.

However, businesses must also consider the opportunity cost of each option. Because opportunity cost is a forward-looking calculation, the actual rate of return for both options is unknown. Assume the company in the above example foregoes new equipment and invests in the stock market instead.

In economics, risk describes the possibility that an investment’s actual and projected returns are different and that the investor loses some or all of the principal. Opportunity cost concerns the possibility that the returns of a chosen investment are lower than the returns of a forgone investment.

Hurdle Rate vs. Internal Rate of Return (IRR): What’s the Difference?

Because many air travelers are relatively highly paid businesspeople, conservative estimates set the average “price of time” for air travelers at $20 per hour. Accordingly, the opportunity cost of delays in airports could be as much as 800 million (passengers) × 0.5 hours × $20/hour—or, $8 billion per year.

This is specifically attributed to the type of funding used to pay for the investment or project. If it is financed externally, it is used to refer to the cost of debt.