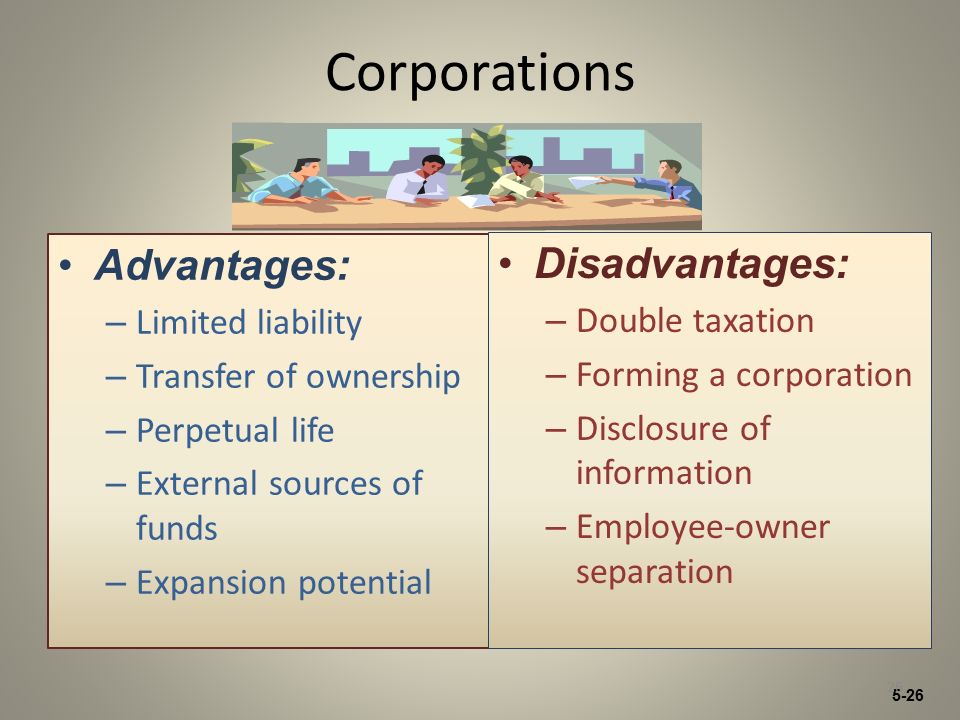

Corporation advantages and disadvantages

An LLC is not a corporation—it is a legal form of a company that provides protection and limited liability to its owners. Basically, if a corporation and a sole proprietorship (or partnership) had a baby, they’d name it LLC. Secondly the corporation pays tax when it pays out dividends to its shareholders.

Advantages of C Corporations

Now, let’s see if a partnership can remedy some of these disadvantages. While its exact legal status varies somewhat from jurisdiction to jurisdiction, a corporation’s most important aspect islimited liability. This means that shareholders may take part in the profits through dividends and stock appreciation but are not personally liable for the company’s debts. The rights and privileges of such corporations vary state to state.

An entity, usually a business, created by a legislative act or by individuals who have agreed upon and filed articles of incorporation with the state government. Ownership in the corporation is typically represented by shares of stock.

The basis for allowing corporations to assert such protections under the U.S. C corporation refers to any corporation that, under United States federal income tax law, is taxed separately from its owners. A C corporation is distinguished from an S corporation, which generally is not taxed separately. Most major companies (and many smaller companies) are treated as C corporations for U.S. federal income tax purposes.

Exceptions apply to treat certain distributions as made in exchange for stock rather than as dividends. Such exceptions include distributions in complete termination of a shareholder’s interest and distributions in liquidation of the corporation.

Furthermore, a corporation is legally recognized as an artificial person whose existence is separate and distinct from that of its shareholders who are not personally responsible for the corporation’s acts and debts. As an artificial person, a corporation has the power to acquire, own, and convey property, to sue and be sued, and such other powers of a natural person that the law may confer upon it. Corporate personhood is the legal notion that a corporation, separately from its associated human beings (like owners, managers, or employees), has at least some of the legal rights and responsibilities enjoyed by natural persons. In the United States and most countries, corporations, as legal persons, have a right to enter into contracts with other parties and to sue or be sued in court in the same way as natural persons or unincorporated associations of persons. In a U.S. historical context, the phrase “Corporate Personhood” refers to the ongoing legal debate over the extent to which rights traditionally associated with natural persons should also be afforded to corporations.

Also called closed corporation, closely held corporation, or privately held corporation. The easiest definition of a close corporation is one that is held by a limited number of shareholders and is not publicly traded. The company is run by the shareholders and is generally exempt from many requirements of other corporations, including having a board of directors and holding annual meetings. Close corporations are state-specific statutory entities usually created to relax corporate formalities in operation and to be less focused on taxation.

One of the most significant things about a corporation is its limited liability. That is, shareholders have the right to participate in the profits through stocks and paid dividends, but are not held personally accountable for the company’s debts or legal issues that may arise.

What is the major disadvantage of a corporation?

The advantages of a corporation are limited liability, the ability to raise investment money, perpetual existence, employee benefits and tax advantages. The disadvantages include expensive set up, more heavily taxed, taxes on profits.

Some states have no provisions for allowing close corporations. For example, a corporation is allowed to own property and enter contracts.

- An entity, usually a business, created by a legislative act or by individuals who have agreed upon and filed articles of incorporation with the state government.

A C corporation has no limit on the number of shareholders, foreign or domestic. Any distribution from the earnings and profits of a C corporation is treated as a dividend for U.S. income tax purposes.

What are the main advantages of corporation?

A major disadvantage of a corporation is the double taxation of the corporation’s income and of dividends paid to shareholders. Corporations end up paying taxes twice. The corporation pays tax when it shows a profit.

However, as the business grows, converting to a corporation gives the company options to raise capital, attract new shareholders, and provide personal asset protection for the owners. Even though the initial cost to form a corporation is substantial and there is a lot of paperwork, the corporate form is beneficial to the shareholders in the long term. Corporations as legal entities have always been able to perform commercial activities, similar to a person acting as a sole proprietor, such as entering into a contract or owning property. Therefore, corporations have always had a “legal personality” for the purposes of conducting business while shielding individual shareholders from personal liability (i.e. protecting personal assets which were not invested in the corporation).

It is often more flexible than a corporation, and it is well-suited for companies with a single owner. The next type of business organization is a corporation, which is defined as a legal entity owned by shareholder(s). A corporation solves the personal liability problem that a sole proprietorship and partnership present and offers business continuity in the event of a shareholder’s death. However, two main disadvantages are double taxation and start-up costs. While there are benefits to being a sole proprietorship, there are also drawbacks.

The advantage of this is that the owners of a corporation are not taxed on the corporation’s profit. Starting a new business as a sole proprietorship is the easiest business form at the beginning.

One huge drawback is if the owner is sued, the owner is held personally liable. Personal liability means if the person or entity wins the lawsuit, the court can make the owner sell business and personal assets to satisfy the debt. Another disadvantage of this type of business organization is that when the owner dies, the business will become defunct or terminate.

Sole proprietorships and partnerships are taxed as owners of the business. The owners of a corporation are taxed individually from the corporation.

Corporation advantages and disadvantages

It can also sue and be sued and held liable under both civil and criminal law. As well, because the corporation is legally considered the “person”, individual shareholders are not legally responsible for the corporation’s debts and damages beyond their investment in the corporation. Similarly, individual employees, managers, and directors are liable for their own malfeasance or lawbreaking while acting on behalf of the corporation, but are not generally liable for the corporation’s actions. Among the most frequently discussed and controversial consequences of corporate personhood in the United States is the extension of a limited subset of the same constitutional rights. As a matter of interpretation of the word “person” in the Fourteenth Amendment, U.S. courts have extended certain constitutional protections to corporations.

An LLC is a flexible form of enterprise that blends elements of partnership and corporate structures. It is a legal form of company that provides limited liability to its owners in the vast majority of United States jurisdictions. The primary characteristic an LLC shares with a corporation is limited liability, and the primary characteristic it shares with a partnership is the availability of pass-through income taxation.

Disadvantages of C Corporations

An S Corporation gives out stock and is treated much like a corporation. The owners of the S corporation are called shareholders and they are protected from liability just as they would be if they had an incorporated business. That means that if something bad happens to the business, the shareholder’s personal bank accounts cannot be tapped. A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation (like in a partnership or sole proprietorship) with the limited liability of a corporation.