Consolidated Balance Sheet

Financial Statements

There are some key provisional standards that companies using consolidated subsidiary financial statements must abide by. The main one mandates that the parent company or any of its subsidiaries cannot transfer cash, revenue, assets, or liabilities among companies to unfairly improve results or decrease taxes owed. Depending on the accounting guidelines used, standards may differ for the amount of ownership that is required to include a company in consolidated subsidiary financial statements. Generally, a parent company and its subsidiaries will use the same financial accounting framework for preparing both separate and consolidated financial statements.

The decision to file consolidated financial statements with subsidiaries is usually made on a year to year basis and often chosen because of tax or other advantages that arise. The criteria for filing a consolidated financial statement with subsidiaries is primarily based on the amount of ownership the parent company has in the subsidiary. Generally, 50% or more ownership in another company usually defines it as a subsidiary and gives the parent company the opportunity to include the subsidiary in a consolidated financial statement. In some cases less than 50% ownership may be allowed if the parent company shows that the subsidiary’s management is heavily aligned with the decision making processes of the parent company.

What are the rules of consolidation?

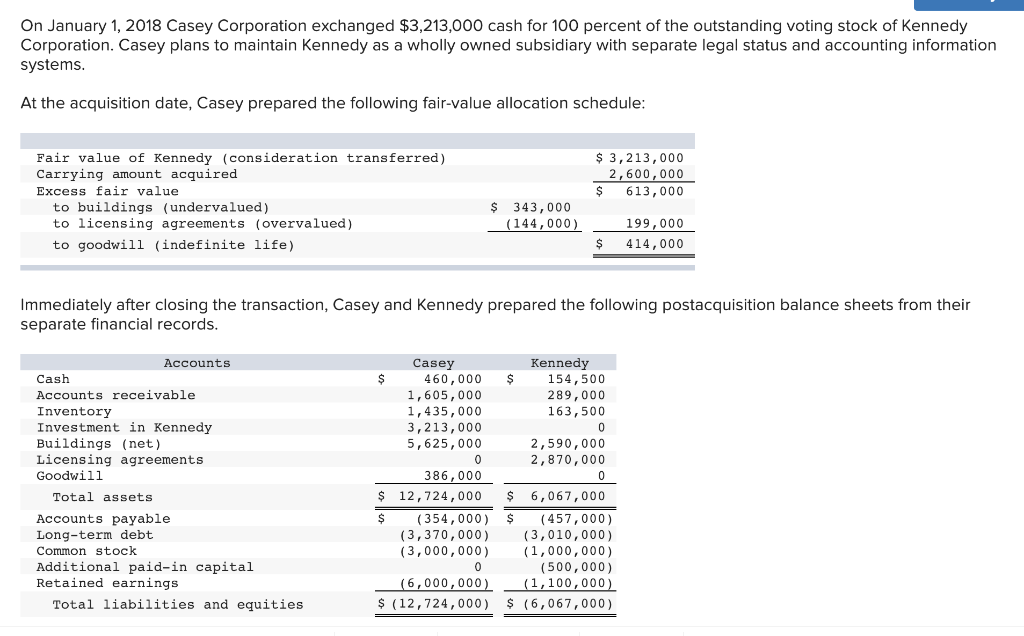

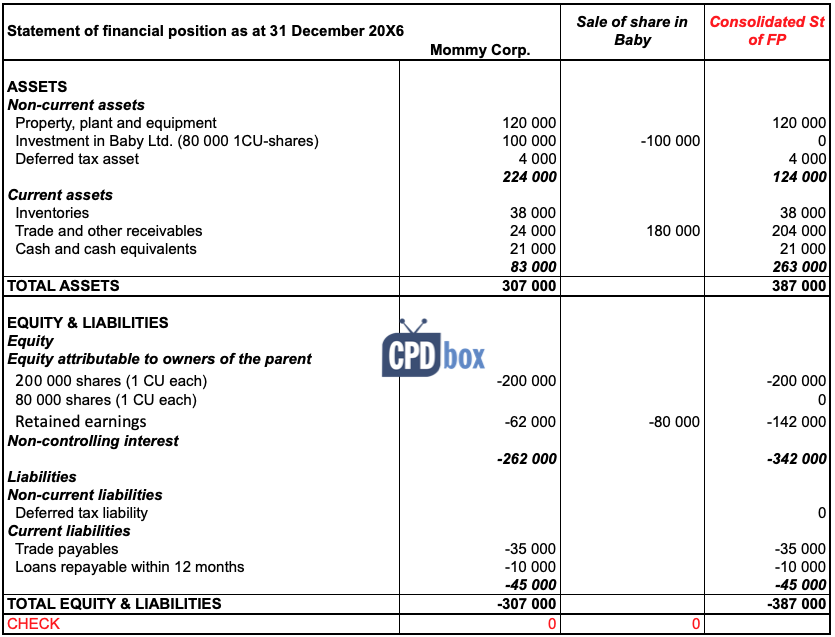

Consolidate financial statements by creating a balance sheet that reflects a sum of net worth, assets and liabilities. This is done by simply adding together the separate values from the balance sheets of the parent company and the subsidiaries.

How to Consolidate Financial Statements

In this case, the minority interest would be shown on the balance sheet as a type of ownership equity. The minority interest is the ownership interest in the subsidiary that is held by stockholders other than the parent company.

For example, the parent must record any intercompany loans from the subsidiary to the parent and any interest earned by the subsidiaries for these loans. If the parent runs a centralized accounts payable, it will distribute the related expenses to the subsidiaries as appropriate. The same is true for payroll expenses arising from a centralized paymaster system. The parent makes the usual end-of-period adjustments for accrued and prepaid items to complete the adjustment process. The parent company combines the group’s assets, liabilities and equity on the consolidated balance sheet, and 100 percent of the subsidiary’s assets and liabilities are included, even if the parent owns less than 100 percent of the voting shares.

Equity owned by the parent is presented separately from the noncontrolling interest of a subsidiary’s minority shareholders, although the parent can combine the noncontrolling interests of multiple subsidiaries. A parent also combines 100 percent of the group’s income and expenses on the consolidated income statement.

It then subtracts any net income attributed to noncontrolling interests to present the net income attributable to the parent company. Consolidated financial statements are of primary importance to stockholders, managers, and directors of the parent company. The parent company benefits from the income and other financial strengths of the subsidiary. Likewise, the parent company suffers from a subsidiary’s losses and other financial weaknesses.

Since there are minority stockholders, just the amount of the stockholders’ equity that is owned by the parent company is eliminated. As mentioned, private companies have very few requirements for financial statement reporting but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP).

Companies who choose to create consolidated financial statements with subsidiaries require a significant investment in financial accounting infrastructure due to the accounting integrations needed to prepare final consolidated financial reports. In consolidated accounting, the information from a parent company and its subsidiaries are treated as though it comes from a single entity. The cumulative assets from the business, as well as any revenue or expenses, are recorded on the balance sheet of the parent company. This information is also reported on the income statement of the parent company.

If a public company wants to change from consolidated to unconsolidated it may need to file a change request. Changing from consolidated to unconsolidated may also raise concerns with investors or complications with auditors so filing consolidated subsidiary financial statements is usually a long-term financial accounting decision. There are however some situations where a corporate structure change may call for a changing of consolidated financials such as a spinoff or acquisition. Consolidated financial statements are financial statements of an entity with multiple divisions or subsidiaries. Companies can often use the word consolidated loosely in financial statement reporting to refer to the aggregated reporting of their entire business collectively.

However, the Financial Accounting Standards Board defines consolidated financial statement reporting as reporting of an entity structured with a parent company and subsidiaries. Consolidated financial statements are used when the parent company holds a majority stake by controlling more than 50% of the subsidiary business. Parent companies that hold more than 20% qualify to use consolidated accounting.

How do you consolidate financial statements?

Consolidation accounting is the process of combining the financial results of several subsidiary companies into the combined financial results of the parent company. This method is typically used when a parent entity owns more than 50% of the shares of another entity.

- The decision to file consolidated financial statements with subsidiaries is usually made on a year to year basis and often chosen because of tax or other advantages that arise.

- The criteria for filing a consolidated financial statement with subsidiaries is primarily based on the amount of ownership the parent company has in the subsidiary.

- Generally, 50% or more ownership in another company usually defines it as a subsidiary and gives the parent company the opportunity to include the subsidiary in a consolidated financial statement.

Separate accounting records are kept for each separate company, but not for the consolidated entity. To determine the consolidated amounts, the amounts for the individual affiliated companies are added together. Elimination entries are made to remove the effects of inter-company transactions.

This annual decision is usually influenced by the tax advantages a company may obtain from filing a consolidated versus unconsolidated income statement for a tax year. Public companies usually choose to create consolidated or unconsolidated financial statements for a longer period of time.

Consolidated financial statements report the aggregate reporting results of separate legal entities. The final financial reporting statements remain the same in the balance sheet, income statement, and cash flow statement.

Equity Method Accounting

If a parent company holds less than a 20% stake, it must use equity method accounting. Consolidation involves taking multiple accounts or businesses and combining the information into a single point.

Consolidated and Separate Financial Statements

GAAP also states that comparative financial statements are preferred for annual reports. Consolidated financial statements are required when there are two or more affiliated companies. When a parent company either directly or indirectly controls a majority interest of a subsidiary, consolidated financial statements must be presented. Consolidated financial statements present the results of operations, statement of cash flows, and financial position of the combined entity.

These minority stockholders benefit from the subsidiary’s income and financial strengths; they suffer from the subsidiary’s losses and financial weaknesses. Thus, the subsidiary’s creditors and minority stockholders are more interested in the subsidiary’s individual financial statements than in the consolidated statements. Because of these factors, annual reports always include the financial statements of the consolidated entity, and sometimes include the financial statements of certain subsidiary companies alone, but never include the parent company’s financial statements alone. In addition, any dividends declared from those retained earnings can’t be included in the parent company’s net income.

If a company reports internationally it must also work within the guidelines laid out by the International Accounting Standards Board’s International Financial Reporting Standards (IFRS). Both GAAP and IFRS have some specific guidelines for entities who choose to report consolidated financial statements with subsidiaries. Private companies have very few requirements for financial statement reporting but public companies must report financials in line with the Financial Accounting Standards Board’s Generally Accepted Accounting Principles (GAAP). Both GAAP and IFRS have some specific guidelines for companies who choose to report consolidated financial statements with subsidiaries. The parent must enter some end-of-period adjustments when preparing consolidated financial statements.

After their acquisitions, these smaller companies, or subsidiaries, may have remained legally separate from the large corporation, or parent company. However, when reporting financial information, the parent company is required to submit financial statements that combine their information with that of their subsidiaries. These documents are called consolidated financial statements and allow the health of the group to be assessed as a whole, rather than piece-by-piece. An important item to understand in regard to consolidated financial statements is the concept of minority interest. A minority interest exists when a parent company owns a majority interest in a subsidiary, but not 100% of the outstanding shares.

consolidation

In financial accounting, consolidated financial statements provide a comprehensive view of the financial position of both the parent company and its subsidiaries, rather than one company’s stand-alone position. Consolidated financial statements are of limited use to the creditors and minority stockholders of the subsidiary. The subsidiary’s creditors have a claim against the subsidiary alone; they cannot look to the parent company for payment. Minority stockholders in the subsidiary do not benefit or suffer from the parent company’s operations.

Each separate legal entity has its own financial accounting processes and creates its own financial statements. These statements are then comprehensively combined by the parent company to final consolidated reports of the balance sheet, income statement, and cash flow statement. Because the parent company and its subsidiaries form one economic entity, investors, regulators, and customers find consolidated financial statements helpful in gauging the overall position of the entire entity. Private companies will usually make the decision to create consolidated financial statements including subsidiaries on an annual basis.

Consolidated accounting is used to group the financial information of a parent company and one or more subsidiary companies. A parent company owns the majority of voting shares of a subsidiary company or otherwise has contractual control of the subsidiary. The parent prepares consolidated financial statements by making adjusting entries and eliminating intercompany transactions. The parent files a combined tax return when it owns at least 80 percent of the subsidiary’s voting shares. Many large companies are partially or entirely made up of smaller companies that they’ve acquired throughout the years.