Comprehensive Income

This would include unrealized gains and losses on securities that are available for sale, foreign currency adjustments, as well as changes to certain pension benefit obligations. Accumulated other comprehensive income (OCI) includes unrealized gains and losses reported in the equity section of the balance sheet that are netted below-retained earnings.

The lottery winnings are considered part of his taxable or comprehensive income but not regular earned income. In business, comprehensive income includes unrealized gains and losses on available-for-sale investments. Comprehensive income also includes cash flow hedges, which can change in value depending on the securities’ market value, and debt securities transferred from available for sale to held to maturity, which may also incur unrealized gains or losses. Gains or losses can also be incurred from foreign currency translation adjustments and in pensions and/or post-retirement benefit plans.

What is an example of comprehensive income?

Examples of items that may be classified in other comprehensive income are: Unrealized holding gains or holding losses on investments that are classified as available for sale. Foreign currency translation gains or losses. Pension plan gains or losses. Pension prior service costs or credits.

For example, a large unrealized loss from bond holdings today could spell trouble if the bonds are nearing maturity. The statement does not address the recognition or measurement of comprehensive income but, rather, establishes a framework that can be refined later. Accumulated other comprehensive income (OCI) includes unrealized gains and losses that are reported in the equity section of the balance sheet. A company must determine reclassification adjustments for each classification of other comprehensive income, except for minimum pension liability adjustments.

Investors reviewing a company’s balance sheet can use the OCI account as a barometer for upcoming threats or windfalls to net income. Comprehensive income is the variation in a company’s net assets from non-owner sources during a specific period. Comprehensive income includes net income and unrealized income, such as unrealized gains or losses on hedge/derivative financial instruments and foreign currency transaction gains or losses. Comprehensive income provides a holistic view of a company’s income not fully captured on the income statement.

Currency Exchange

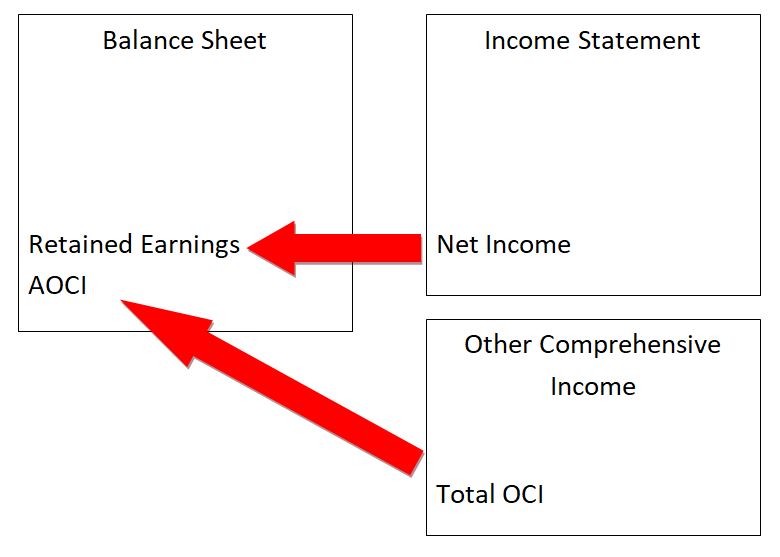

Accumulated other comprehensive income (AOCI) accumulates other comprehensive income (OCI), which records unrealized and realized gains and losses from certain transactions. Unrealized means paper gains and losses, which are usually not part of the net income calculation for a small business. Accumulated other comprehensive income is part of the shareholders’ equity section of the balance sheet, while other comprehensive income and net income are part of the income statement. Accumulated other comprehensive income is a general ledger account that is classified within the equity section of the balance sheet.

What is included in other comprehensive income?

Other comprehensive income is comprised of revenues, expenses, gains, and losses that, according to the GAAP and IFRS standards. Revenue does not necessarily mean cash received., expenses, gains, and losses that are reported as other comprehensive income are only those that have not been realized yet.

The general ledger account accumulated other comprehensive income, or AOCI, is a balance sheet line item that summarizes the gains and losses that have occurred in the current period, and in the past, and that remain unrealized. During the year, ABC Co. engaged in numerous transactions involving foreign currency, resulting in unrealized gains of $3,200 before tax. In addition, the company at yearend held securities classified as available-for-sale, which have unrealized gains of $2,400 before tax.

In the past, companies did not include these other comprehensive income items in the income statement. Statement no. 130 does not affect the measurement of the three items included in other comprehensive income; it affects only where the information is presented.

Companies can designate investments as available for sale, held to maturity, or trading securities. Unrealized gains and losses are reported in OCI for some of these securities, so the financial statement reader is aware of the potential for a realized gain or loss on the income statement down the road. Accumulated other comprehensive income includes unrealized gains and losses reported in the equity section of the balance sheet. Statement no. 130 requires that all items meeting the definition of components of comprehensive income be reported in a financial statement for the period in which they are recognized. Items that are required by accounting standards to be reported as direct adjustments to paid-in capital, retained earnings or other nonincome equity accounts are not to be included as components of comprehensive income.

Other Comprehensive Income

- In the past, companies did not include these other comprehensive income items in the income statement.

- This would include unrealized gains and losses on securities that are available for sale, foreign currency adjustments, as well as changes to certain pension benefit obligations.

Other comprehensive income can consist of gains and losses on certain types of investments, pension plans, and hedging transactions. It is excluded from net income because the gains and losses have not yet been realized.

The adjustment for foreign currency translation is to be limited to translation gains and losses realized on the sale or substantially complete liquidation of an investment in a foreign entity. A company may display reclassification adjustments on the face of the financial statement or in the notes to the financial statements.

A defined benefit plan, for example, requires the employer to plan for specific payments to retirees in future years. If the assets invested in the plan are not sufficient, the company’s pension plan liability increases. A firm’s liability for pension plans increases when the investment portfolio recognizes losses. Once the gain or loss is realized, the amount is reclassified from OCI to net income.

These items are not part of net income, yet are important enough to be included in comprehensive income, giving the user a bigger, more comprehensive picture of the organization as a whole. Comprehensive income takes the company’s net income and adds to it what is termed other comprehensive income.

Other comprehensive income represents a company’s change in equity during a specific period, from transactions and events which are typically non-cash gains and losses. When the gains and losses crystallize into cash, they are usually reflected on the income statement and removed from other comprehensive income. Other comprehensive income provides additional detail to the balance sheet’s equity section, which identifies the change in stockholder’s equity beyond the net income listed on an income statement.

Other comprehensive income items include unrealized gains and losses from currency translations, changes in the market value of investment securities, and unrealized gains and losses in derivative instruments. For example, if a company’s currency translation gains are $10,000 and the tax rate is 15 percent, the net currency translation gains are $8,500 [$10,000 multiplied by (1 minus 0.15)]. If the company incurs $5,000 in after-tax unrealized losses on investment securities, the other comprehensive income is $3,500 ($8,500 minus $5,000).

Pension Plans

The net gain or (loss) for other comprehensive income is not reported on the income statement; rather, it is reported as accumulated other comprehensive income and is shown as an adjustment to stockholders’ equity on the balance sheet. This value provides investors with insights into all of the financial events that change the value of a stockholder’s ownership in the company. The consolidated statement of comprehensive income provides investor-analysts with insights into the unsettled transactions that could result in a gain or loss, and how these transactions would affect net income in the current period.

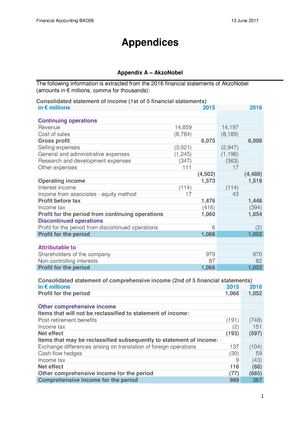

Real-Life Example of OCI

Comprehensive income is often listed on thefinancial statements to include all other revenues, expenses, gains, and losses that affected stockholder’s equity account during a period. In other words, it adds additional detail to the balance sheet’s equity section to show what events changed the stockholder’s equity beyond the traditional net income listed on the income statement.

It is used to accumulate unrealized gains and unrealized losses on those line items in the income statement that are classified within the other comprehensive income category. Thus, if you invest in a bond, you would record any gain or loss at its fair value in other comprehensive income until the bond is sold, at which time the gain or loss would be realized. Unrealized gains and losses relating to a company’s pension plan are commonly presented in accumulated other comprehensive income (OCI).