Competitive Pricing Definition

You will either end up pricing too low and giving away potential profits, or pricing too high and selling less. With a cost-plus pricing strategy, you can simply markup your product to determine its selling price. However, you’ll want to look at the benefits and drawbacks of this markup method to determine if it’s a good fit for your business.

App Marketplace

Cost-plus pricing is a method used by companies to maximize their profits. There are several varieties, but the common thread is that one first calculates the cost of the product, then adds a proportion of it as markup. Basically, this approach sets prices that cover the cost of production and provide enough profit margin to the firm to earn its target rate of return.

Steps to Computing Cost-Plus Pricing

However, the process of determining costs and setting a price based on costs does not take into account what the customer is willing to pay in the marketplace. This strategy is a bit of a trap for companies that develop products and continually add features to them, thus adding cost. Their cost-based approach leads them to add a percentage to the cost, which they pass on to customers in the form of a new, higher price.

The cost-plus pricing method is a good fit for businesses who want to pursue a cost-leadership strategy. A cost-plus pricing strategy, or markup pricing strategy, is a simple pricing method where a fixed percentage is added on top of the production cost for one unit of product (unit cost). This pricing strategy ignores consumer demand and competitor prices. And it’s often used by retail stores to price their products.

For many finance-minded business owners, it’s a better measure of a company’s profitability since it takes expenses into account, not just sales. It’s possible for a company to have millions of dollars in sales yet still not be profitable. Each industry generally has its own average profit margin due to the differences in costs and materials needed for the different products and services across different industries. Thus, this method is likely to result in a seriously overpriced product. Further, prices should be set based on what the market is willing to pay – which could result in a substantially different margin than the standard margin typically assigned using this pricing method.

Objectives such as these and how a business generates profit in comparison to the cost of production, need to be taken into account when selecting the right pricing strategy for your mix. The marketing mix should take into account what customers expect in terms of price. Net profit margins are a great benchmark figure to take a look at every year — whether you feel the need to analyze your costs or not.

How do you calculate cost plus pricing?

A Cost-Based Pricing Example Suppose that a company sells a product for $1, and that $1 includes all the costs that go into making and marketing the product. The company may then add a percentage on top of that $1 as the “plus” part of cost-plus pricing. That portion of the price is the company’s profit.

Whether you’re purchasing bottled water from a convenience store or a designer handbag, its price is often much higher than the cost it took to produce it. In many cases, this selling price was determined using a cost-plus pricing strategy — selling price is determined by adding a percentage to the production cost for a product. A significant issue with cost-plus pricing is that it doesn’t consider any measure of demand for the product or service.

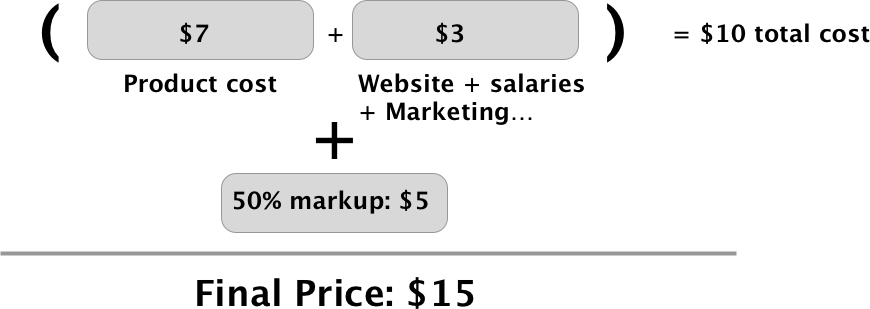

Cost-plus pricing is a very simple cost-based pricing strategy for setting the prices of goods and services. With cost-plus pricing you first add the direct material cost, the direct labor cost, and overhead to determine what it costs the company to offer the product or service. A markup percentage is added to the total cost to determine the selling price. Thus, you need to start out with a solid and accurate understanding of all the business’ costs and where those costs are coming from.

Then they may be disappointed if their customers do not see sufficient value in the cost-based price. Competitive pricing consists of setting the price at the same level as one’s competitors. This method relies on the idea that competitors have already thoroughly worked on their pricing.

- With cost-plus pricing you first add the direct material cost, the direct labor cost, and overhead to determine what it costs the company to offer the product or service.

- Cost-plus pricing is a very simple cost-based pricing strategy for setting the prices of goods and services.

- A markup percentage is added to the total cost to determine the selling price.

Yet, often times there are many additional costs that can’t be accounted for, which results in reduced margins. Fortunately, by increasing the arbitrary margin, businesses can create a buffer against uncalculated costs and fluctuations in demand.

What is cost plus pricing example?

Cost plus pricing involves adding a markup to the cost of goods and services to arrive at a selling price. Under this approach, you add together the direct material cost, direct labor cost, and overhead costs for a product, and add to it a markup percentage in order to derive the price of the product.

Suppose that a company sells a product for $1, and that $1 includes all the costs that go into making and marketing the product. The company may then add a percentage on top of that $1 as the “plus” part of cost-plus pricing. One advantage of competitive-based pricing is that it avoids price competition that can damage the company. Disadvantages include that businesses have to attract customers in other ways, since the price will not grab the customer’s interest. The price may also barely cover production costs, resulting in low profits.

What is cost-plus pricing?

The cost-plus pricing strategy makes it easy to communicate to consumers why price changes are made. If a company needs to raise the selling price of its product due to rising production costs, the increase can be justified. An alternative is value-based pricing, which is the process of determining the selling price of a product or service based on the benefits it provides to buyers, not what it costs to produce. If your business offers specialty or unique products with highly valuable features, you may be well positioned to take advantage of value-based pricing, which typically generates a higher profit percentage.

Cost-plus pricing is bad news – consider moving away from this pricing strategy as soon as you can. This strategy also does not take into account competitor actions/prices and the effect these will have on the price of your product. Your company may set a product price based on the cost-plus formula and then be surprised when it finds that competitors are charging substantially different prices. This has a huge impact on your market share and the profits you expect to achieve.

In any market, many firms sell the same or very similar products, and according to classical economics, the price for these products should, in theory, already be at an equilibrium (or at least at a local equilibrium). Therefore, by setting the same price as its competitors, a newly-launched firm can avoid the trial and error costs of the price-setting process. Considering this, the main limit of the competitive pricing method is that it fails to account for the differences in costs (production, purchasing, sales force, etc.) of individual companies.

The Ultimate Guide to Pricing Strategies

It is a way for companies to calculate how much profit they will make. Cost-plus pricing is a pricing method used by companies to maximize their profits. The firms accomplish their objective of profit maximization by increasing their production until marginal revenue equals marginal cost, and then charging a price which is determined by the demand curve. Our financial objectives in terms of price will be secured on how much money we intend to make from a product, how much we can sell, and what market share will get in relation to competitors.

As a result, this pricing method can potentially be inefficient and lead to reduced profits. The key to ensuring that the discount pricing strategy remains profitable for your business is to keep the profit margins close to $0 or slightly positive. In other words, don’t sell your products at a discount just to get customers in the door, only to find out you’re losing money hand over fist. The guarantee of a target rate of return creates little incentive for cutting cost or for increasing profitability through price differentiation. Stakeholders easily become passive towards pricing, facilitating laziness and an atrophy of profits as the market and customer continues to change.

Additionally, because your prices remain inert, you can easily estimate revenue for a given month based on conversion history, marketing spend, etc. Let’s take for example a tyre manufacturer who develops a more durable, longer lasting tyre. If this manufacturer implements a cost-plus pricing strategy their prices would be about 10% higher than competitive products reflecting the higher cost of materials required for greater durability. This would result in the manufacturer missing out on millions in profit, because the price would only be 10% higher but durability is 100% better than competitive tyres. The manufacturer is not selling the true value of the tyre – and losing profits on the way.