Commercial Credit Definition

But as noted above, when you apply for multiple cards at once, lenders view this as risky behavior. Additionally, new credit is among the five most important factors in your FICO score.

Each credit card application typically knocks a few points off your score. You don’t want to risk lowering your score, even a little, when it could increase the cost of your mortgage. Even a slight increase in your home loan rate can cost you thousands of dollars over time, so you want your credit score to be as high as possible when you apply. Wait until after you’ve signed the mortgage to apply for a credit card. Whatever the sign-up bonus is, a higher rate on a home loan will cost you more.

You may learn something that you can address, such as fixing an error on your credit report or establishing a longer period of on-time bill payments. If you’re turned down for a major credit card, even if it’s a student credit card, don’t keep applying. Instead, look for a store credit card or a secured credit card. Choose these credit cards ahead of time so that you’re not desperately searching for a credit card that will approve you. If you eventually follow through with a credit card application, that hard inquiry will show up on your credit report and has the potential to lower your credit score.

It’s good to pay your bill in full each month to avoid finance charges. Your credit check will show any accounts where you have taken out credit. This includes credit cards, loans, mortgages, and any credit agreements you have in place, such as anything you’ve bought on finance, or utility debts. It will also include missed or late payments, which stay on your record for at least six years. CreditCards.com credit ranges are derived from FICO® Score 8, which is one of many different types of credit scores.

If you apply for a credit card, the lender may use a different credit score when considering your application for credit. Instead of applying for multiple credit cards, check your credit score and pull your credit report at AnnualCreditReport.com to get an idea of what type of card you’re likely to be approved for.

These are essentially what are commonly referred to as “targeted ads” in the world of the Internet. Despite all of this, however, even if you never apply for any product, the Credit Report Card will remain free, and none of this will impact how the editorial team reports on credit and credit scores.

Again, this tool is entirely free, and we mention that frequently in our articles, because we think that it’s a good thing for users to have access to data like this. Separate from its educational value, there is also a business angle to the Credit Report Card. Registered users can be matched with products and services for which they are most likely to qualify. You’d be no closer to getting a product you need, there’d be a wasted inquiry on your credit report, and Credit.com wouldn’t get paid.

Credit card issuers view multiple card applicationsin quick succession as a sign of financial distress. It raises red flags about your ability to make future payments and keep your accounts in good standing. In fact, FICO says that people with six or more inquiries on their credit reports are eight times more likely to declare bankruptcy compared with those who have no inquiries on their reports. he was always late on payments and also opened credit cards that i was not even aware until his untimely death in 2011. since i have been widowed, i have made every payment in a very timely manner.

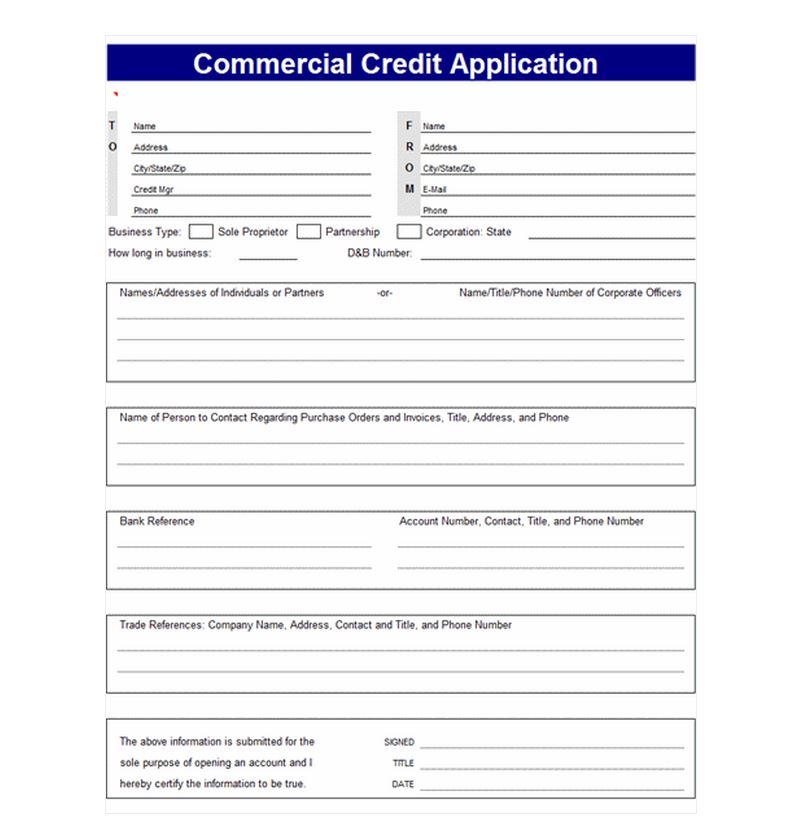

What Is Commercial Credit?

If you have poor credit or no credit, you should apply for new cards less frequently than someone with excellent credit. Also, be sure you are applying for cards appropriate for your credit score. Rewards credit cards and those with generous 0% interest offers are generally aimed at customers with good to excellent credit. Others, such as secured cards, are designed with credit builders in mind. If you’ll be applying for a mortgage in the near future, take extra care to space out your credit card applications at least six months apart.

That is a loan secured by your own deposit; you would pay interest, but probably far less than you are paying on your car loan. And if you have no credit cards, you can similarly get a secured card. (But you will want to be careful to keep your balance under 30% of your credit limit.) You can run the numbers to see what makes sense.

In some cases (such as landlords or letting agents), they’ll be looking if you have a history of late or missed payments, as opposed to your actual score. It is generally not a good practice to apply for multiple credit cards at the same time, if you care about your credit score. There are several reasons not to seek several cards at once, and most have to do with the effect applying for credit has on your credit score. Each time you apply for credit, a hard inquiry is generated on your credit report when a lender checks to see if you are creditworthy.

For example, get caught up on any past-due payments and work on paying down credit card balances. Also, check your credit report for potential inaccuracies that you can dispute with the credit reporting agencies. Improving your credit can take time, but it’s well worth it if it can save you money. When you have been rejected recently on a card application.Your instinct might be to immediately apply for several other cards, but doing so could further hurt your chances of approval. Instead, consider calling the card issuer to ask why your application was rejected.

- Credit card issuers view multiple card applicationsin quick succession as a sign of financial distress.

- It raises red flags about your ability to make future payments and keep your accounts in good standing.

If there was a large available balance on the card, closing it would close off the available balance and possibly have a negative impact on your revolving utilization percentage. Revolving utilization is the percentage of your balances to your credit limits, and accounts for roughly 30% of your credit score. The FICO score, specifically, looks at both individual utilization and aggregate — or total utilization across all of your credit cards. Visitors to Credit.com are also able to register for a free Credit.com account, which gives them access to a tool called The Credit Report Card. This tool provides users with two free credit scores and a breakdown of the information in their Experian credit report, updated twice monthly.

Credit Applications Explained

If you are asking about the ideal number of credit cards to obtain a strong credit score, two is a good number as well, though you can have many more and still maintain a strong credit rating. Generally, it’s a good idea to have at least four credit accounts of different types (for example, a mortgage, car loan, a major credit card and a retail card).

A soft credit check doesn’t affect your ability to get credit, as it only gives a snapshot of your previous financial behaviour using key pieces of information. A soft credit check can also be called a soft search, a quotation search, a soft inquiry, or a soft pull. What’s good is that while some lenders can see soft searches on your credit file, they aren’t allowed to let this influence their decision. A soft credit check is a useful way to check how likely you are to be accepted for a loan or credit card, for example, before you apply. You can perform as many soft credit checks as you want without affecting your ability get credit.

A soft credit check is what TotallyMoney uses to calculate your Borrowing Power in its Free Credit Report — so you can be in the know about your financial health without damaging it in the process. When you apply for credit (a loan, mortgage, or credit card, for instance), the lender runs a credit check to see if you’re eligible for their product. Based on your past financial behaviour, you’re given a score. This score varies, depending on which credit reference agency is used to generate it. A high score indicates a good credit rating, which means lenders are more likely to accept your application for any credit.

How do I create a credit application?

A credit application is a form used by potential borrowers to get approval for credit from lenders. Today, many credit applications are filled out electronically and may be improved in only a short amount of time.

Income limits vary depending on the credit card, but you must make at least enough money to repay your credit card balance each month. The higher your income, the better chance you have at getting approved for a credit card even though you don’t have a credit score. Can someone please tell me why my credit score should be affected by applying for mortgage refinancing? I just don’t understand how anyone can interpret an application for credit as a negative event that lowers your credit score.

What is a credit application in business?

The business credit application is your opportunity to prove that your business is an appropriate credit risk. These reports and business credit scores are used to decide not only if your business should be approved, but also what the terms of the loan or credit line will be if approved.

Prosper Personal Loans Review

So new credit card accounts will have a much smaller effect than a truly negative credit report item like a missed credit card payment or a maxed-out card. Applying for a credit card can hurt your credit score a little. Hard pulls stay on your credit report for two years, but their credit score effects wear off after one year. Unsecured credit cardsare regular credit cards — no security deposit required — with easy application processes. All of these cards report to the credit bureaus, so if you pay on time each month, your credit will begin to reflect your good behavior.

Discover Personal Loans Review

he had a heart transplant on 2001 and shortly after that we had to file bankruptcy (jointly). i am a very good money manager and since his death, i have a very good record–but no one seems to care about that. (Here’s how to monitor your credit score for free.) If you are paying a high interest rate, it might be better to apply for a small “credit builder” loan at a credit union.

Secured credit cards require a deposit that is usually equal to the amount of credit you’re issued, but your deposit is fully refundable after your balance is paid off or if you close the account. These cards generally offer a more lenient application process and may not require a minimum credit score or credit history. When you have bad or limited credit.Having 5 points knocked off your score because of a credit card application isn’t a huge deal if your score is 800.