Changes in Working Capital

How to Calculate Changes in Net Working Capital? (Step by Step)

It can be the case that the company has purchased something to expand its business. But if it is negative for a long time, it can imply that a company is in a difficult position.

You can do this because, the balance sheet shows the working capital accounts and you can see their changes. If Changes in Working Capital ispositive, the change in current operating liabilities has increased more than the part of the current assets. This means the use of cash has been delayed, which increases Free Cash Flow.

These are cash expenses that are not being captured on the income statement in operational expenses. If current liabilities are rising then the company is “gaining cash” in the sense that it has not yet paid for something that it will in the future.

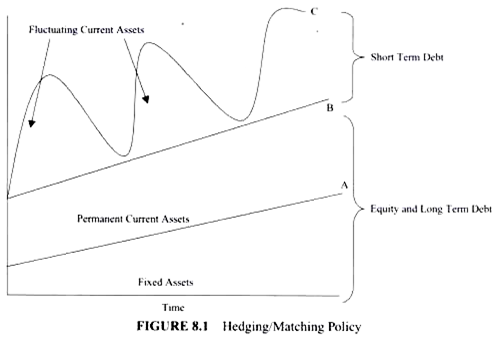

In fact, we would recommend that once working capital is being managed efficiently, the working capital changes from year to year be estimated using working capital as a percent of revenues. For example, consider a firm that has non-cash working capital that represent 10% of revenues and that you believe that better management of working capital could reduce this to 6% of revenues.

These might be things such as wages payable – which is being accounted for as an expense on the IS but has not yet been paid. Accounting Crash Course Used at top investment banks and universities. Get up to speed on the income statement, balance sheet, cash flow statement and more.

Keep in mind that a negative number is worse than a positive one, but it doesn’t necessarily mean that the company is going to go under. It’s just a sign that the short-term liquidity of the business isn’t that good. There are many factors in what creates a healthy, sustainable business.

If the final value for Change in Working Capital isnegative, that means that the change in the current operating assets has increased higher than the current operating liabilities. A positive working capital cycle balances incoming and outgoing payments to minimize net working capital and maximize free cash flow. For example, a company that pays its suppliers in 30 days but takes 60 days to collect its receivables has a working capital cycle of 30 days. This 30-day cycle usually needs to be funded through a bank operating line, and the interest on this financing is a carrying cost that reduces the company’s profitability. Growing businesses require cash, and being able to free up cash by shortening the working capital cycle is the most inexpensive way to grow.

Change in Working Capital: Calculations and Meaning (19:

- This is a negative event for cash flow and may contribute to the “Net changes in current assets and current liabilities” on the firm’s cash flow statement to be negative.

- Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows.

Working capital is calculated as current assets minus current liabilities on the balance sheet (see Lesson 302). Just as the name suggests, working capital is the money that the business needs to “work.” Therefore, any cash used in or provided by working capital is included in the “cash flows from operating activities” section. Net working capital (NWC) is calculated as current assets – current liabilities. When examining the changes in NWC, if current assets are rising – the company is investing money in assets such as inventory.

Changes in Net Working Capital

You could allow working capital to decline each year for the next 4 years from 10% to 6% and, once this adjustment is made, begin estimating the working capital requirement each year as 6% of additional revenues. Table 10.12 provides estimates of the change in non-cash working capital on this firm, assuming that current revenues are $1 billion and that revenues are expected to grow 10% a year for the next 5 years. As was said above, an entire transaction from start to finish will involve more working capital accounts, so the effect will include levels of inventory and A/P. The cash flow statement changes in working capital is the summary of working capital changes that go on during a period in a company. If you wanted to, you could recreate the cash flow statement with just the income statement and the balance sheet.

Working capital is a very important concept and it helps us to understand the company’s current position. When a company has more current assets than current liabilities, means that positive working capital, it implies that it can easily cover its short term expenses. But bear in mind that constant excessive working capital can lead to the inference that the company is not managing its assets efficiently. On the same line, Negative working capital does not mean that it is bad.

For example, a positive WC might not really mean much if the company can’t convert its inventory or receivables to cash in a short period of time. Technically, it might have more current assets than current liabilities, but it can’t pay its creditors off in inventory, so it doesn’t matter. Conversely, a negative WC might not mean the company is in poor shape if it has access to large amounts of financing to meet short-term obligations such as a line of credit. Typicalcurrent assetsthat are included in the net working capital calculation arecash,accounts receivable,inventory, and short-term investments.

Sophisticated buyers review closely a target’s working capital cycle because it provides them with an idea of the management’s effectiveness at managing their balance sheet and generating free cash flows. When non-cash working capital decreases, it releases tied-up cash and increases the cash flow of the firm. The question, however, becomes whether it can be a source of cash flows for longer than that. At some point in time, there will be no more inefficiencies left in the system and any further decreases in working capital can have negative consequences for revenue growth and profits. Therefore, we would suggest that for firms with positive working capital, decreases in working capital are feasible only for short periods.

So if the change in net working capital is positive, it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. Similarly, negative change in net working capital means that current liabilities has increased in this period. So this can be in the form of increased payables etc. which means that we have cash inflow. If a transaction increases current assets and current liabilities by the same amount, there would be no change in working capital.

For example, if a company received cash from short-term debt to be paid in 60 days, there would be an increase in the cash flow statement. However, there would be no increase in working capital, because the proceeds from the loan would be a current asset or cash, and the note payable would be a current liability since it’s a short-term loan.

The current liabilities section typically includesaccounts payable,accrued expensesand taxes, customer deposits, and other trade debt. A managerial accounting strategy focusing on maintaining efficient levels of both components of working capital, current assets, and current liabilities, in respect to each other. Working capital management ensures a company has sufficient cash flow in order to meet its short-term debt obligations and operating expenses. Changing working capital does mean actual change in value year over year.

But it means the change current assets minus the change current liabilities. The change in working capital value gives a real indication on why the working capital has increased or decreased. If current assets have remained same but the current liabilities have increased it means a negative change in working capital. The Working Capital Cycle for a business is the length of time it takes to convert the total net working capital (current assets less current liabilities) into cash. Businesses typically try to manage this cycle by selling inventory quickly, collecting revenue quickly, and paying bills slowly, to optimize cash flow.

Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows. For example, if a company’s accounts receivable increase at the end of the year, this means that the firm collected less money from its customers than it recorded in sales during the same year on its income statement. This is a negative event for cash flow and may contribute to the “Net changes in current assets and current liabilities” on the firm’s cash flow statement to be negative. On the flip side, if accounts payable were also to increase, it means a firm is able to pay its suppliers more slowly, which is a positive for cash flow. Similarly, change in net working capital helps us to understand the cash flow position of the company.