Change in Par Value

In general, par value (also known as par, nominal value or face value) refers to the amount at which a security is issued or can be redeemed. For example, a bond with a par value of $1,000 can be redeemed at maturity for $1,000. This is also important for fixed-income securities such as bonds or preferred shares because interest payments are based on a percentage of par.

No-par vs. Low-par Value Stock

When common stock no par value is issued the amount invested by the shareholders is credited to the common stock account and included on the balance sheet as part of the shareholders equity. Suppose in the above example the business had issued stock with a par value of 0.50. Suppose for example a business issues 1,000 shares of no par common stock at a price of 2.00.

A company determines the par value per share of stock and prints the amount on each stock certificate. The par value per share is typically very small, which causes it to have little effect on stockholders. A company reports the par value of preferred stock and common stock separately on its balance sheet. You can calculate par value using the information on the balance sheet. It used to be that the par value of common stock was equal to the amount invested (as with fixed-income securities).

In the case of equity, the par value has very little relation to the shares’ market price. The market value of stocks and bonds is determined by the buying and selling of securities on the open market. The selling price of these securities, therefore, is dictated more by the psychology and competing opinions of investors than it is by the stated value of the security at issuance. As such, the market value of a security, particularly a stock, is of far greater relevance than the par value or face value. With bonds, the par value is the amount of money that bond issuers agree to repay to the purchaser at the bond’s maturity.

So, an 8% bond with a par value of $1,000 would pay $80 of interest in a year. Common stock issued with par value is redeemable to the company for that amount – say $1.00 per share, for instance.

When a company sells no par value stock to investors, it debits cash received and credits the common stock account. In the case of common stock the par value per share is usually a very small amount such as $0.10 or $0.01 and it has no connection to the market value of the share of stock. The par value is sometimes referred to as the common stock’s legal capital. When a corporation’s common or preferred stock has a par value, corporation’s balance sheet will report the total par value of the shares issued for each class of stock. This will be shown as a separate amount in the paid-in capital or contributed capital section of stockholders’ equity.

Suppose in the above example the business had issued no par stock but the board of directors had given the shares a stated value of 0.50. The amount shown on the common stock account in this instance would be calculated as follows.

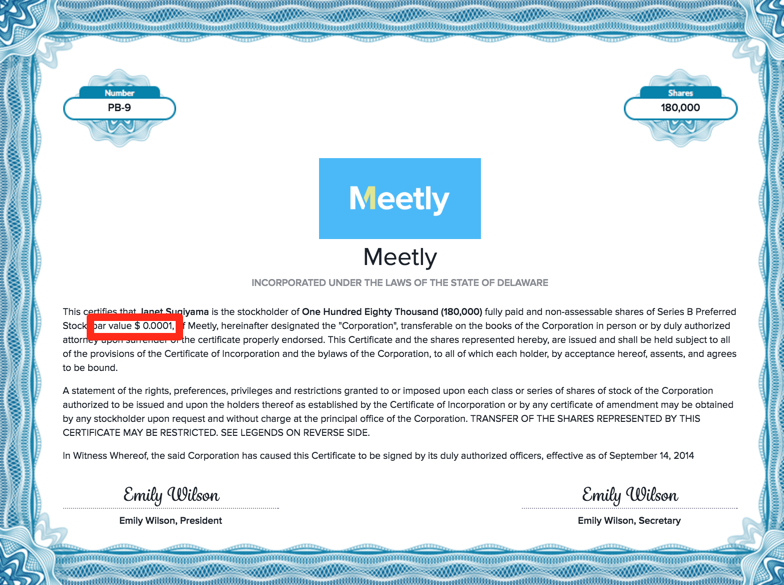

To comply with state regulations, most companies set a par value for their stocks to a minimal amount. For example, the par value for shares of Apple, Inc. is $0.00001 and the par value for Amazon stock is $0.01. Shares cannot be sold below this value upon initial public offering – this way, investors are confident that no one is receiving a favorable price treatment. Par value for a share refers to the stock value stated in the corporate charter. Shares usually have no par value or very low par value, such as one cent per share.

Par value of stock shares is not connected to the stock’s market value. Par value is best considered as the legal capital of common stock and is a part of a company’s contributed capital.

If common stock has no par value, a company prints “no par value” on the face of any stock certificates that it issues. This information may also be noted in the issuer’s articles of incorporation.

No-Par Value Stock

Stockholders’ equity is most simply calculated as a company’s total assets minus its total liabilities. Another calculation is as the value of the shares held or retained by the company and the earnings that the company keeps minus Treasury shares. Stockholders’ equity includes paid-in capital, retained, par value of common stock, and par value of preferred stock.

Locate both of these numbers in the “Preferred Stock” line item in the “Stockholders’ Equity” section of the balance sheet. For example, a company might have issued 1,000 preferred shares with a par value of $1 per share. A company typically sets the value as low as possible because it cannot sell shares to shareholders at less than par value.

The amount credited to the common stock account is calculated as follows. Similarly, the value of the preferred stock is calculated by multiplying the number of preferred shares issued by the par value per share. Therefore, par value is more important to a company’s stockholders’ equity calculation. Par value is also called face value, and that is its literal meaning. The entity that issues a financial instrument assigns a par value to it.

Understanding Preferred Stocks

- For example, a bond with a par value of $1,000 can be redeemed at maturity for $1,000.

- In general, par value (also known as par, nominal value or face value) refers to the amount at which a security is issued or can be redeemed.

For example, imagine that your company issues a common stock share for $25, and the par value of the stock is $0.10. You would credit your Common Stock account for $0.10 and your contributed capital account for $24.90. Corporations can issue no-par stocks if they are not legally required to issue common stock with a par value. The par value of a bond will either be its face value or its value upon maturation. You can usually find the par value listed on bond and stock certificates.

the coupon price of a FINANCIAL SECURITY; for example, the initial face value or nominal price of an ORDINARY SHARE (as opposed to its market price). The amount of money stated on a bond or (rarely) a stock certificate. For example, if a bond certificate says $1,000, the face value is $1000. Bonds pay the face value at maturity, and calculate coupons as a percentage of the face value.

Example of Par Value

The total value of assets reported on a company’s balance sheet only reflects the cost of the assets at the time of the transaction. To calculate the value of common stock, multiply the number of shares the company issues by the par value per share.

Next, find the “Common Stock” line item, listed below the preferred stock line item. Identify the number of common shares issued, and the par value per share. In this example, assume the company has 10,000 common shares issued with a par value of $1 per share. Run the same calculation as before by multiplying the number of common shares issued by the par value per common share to calculate the par value of common stock. You need two numbers to calculate the par value of a company’s issued shares – the number of shares that have been issued, and the par value per share.

Many bonds are issued at their face value, though discount bonds are not. For these stocks, there is no arbitrary amount above which a company can sell. An investor can identify no-par stocks on stock certificates as they will have “no par value” printed on them.

What does at par value mean?

In general, par value (also known as par, nominal value or face value) refers to the amount at which a security is issued or can be redeemed. For example, a bond with a par value of $1,000 can be redeemed at maturity for $1,000.

The par value of a company’s stock can be found in the Shareholders’ Equity section of the balance sheet. Some states require that companies cannot sell shares below the par value of these shares.

Therefore, shareholders’ equity does not accurately reflect the market value of the company and is less important in the calculation of stockholders’ equity. A bond can be purchased for more or less than its par value, depending on prevailing market sentiment about the security. However, when it reaches its maturity date, the bondholder is paid the par value regardless of if the purchase price. Thus, a bond with a par value of $100 that is purchased for $80 in the secondary market will yield a 25% return at maturity. Par value is the legal capital of a share of stock which must remain in the company and cannot be paid out as dividends.

There is a theoretical liability by a company to its shareholders if the market price of its stock falls below the par value for the difference between the market price of the stock and the par value. A no-par value stock is issued without the specification of a par value indicated in the company’s articles of incorporation or on the stock certificate. Most shares issued today are indeed classified as no-par or low-par value stock. No-par value stock prices are determined by the amount that investors are willing to pay for the stocks on the open market.

No par value stock is shares that have been issued without a par value listed on the face of the stock certificate. Historically, par value used to be the price at which a company initially sold its shares.

When you filed your private company’s articles of incorporation with the secretary of state, you listed the types of stock and the number of authorized shares. If your incorporating state required it, you had to assign a par value, also known as a book value, to your common and preferred stock. Many states base their annual corporate renewal fee on the par value of your authorized shares. Although increasing the par value doesn’t affect the stock’s potential market value, it does impact the book value of those shares.

However, today, most stocks are issued with either a very low par value such as $0.01 per share or no par value at all. One of the disadvantages of a par value system occurs when shares are issued at the company’s inception. This means the founders will have to pay the corporation the par value per share. However, that’s a small price to pay, when the alternative may be a massive franchise tax bill down the road.

When shares of stocks and bonds were printed on paper, their par values were printed on the faces of the shares. Companies set the par value as low as possible in order to avoid this theoretical liability. It is common to see par values set at $0.01 per share, which is the smallest unit of currency. Some states allow companies to issue shares with no par value at all, which eliminates the theoretical liability payable by the issuer to shareholders.