Cash receipts procedure

Method 2 of 2: Making a Digital Receipt

Having an effective internal control system would deter such behavior. Receipts are the amount of cash a business takes in during any one accounting period. Receipts are cash sales, as well as money received on a customer’s account. Receipts also include any cash received in the business from any source, including loan or credit line proceeds or funding from investors. Cash receipts are shown on the cash flow statement, which is helpful in showing how much money is available for the business to pay its financial obligations.

However, I have not been able to establish a good set of internal controls to keep this situation from happening. And what does either of those things have to do with control of cash receipts and disbursements?

How to Compute Budgeted Cash Receipts

It is a good rule of thumb to never ever give free rein to one single employee to collect and report the cash account activities. Any employee can fall victim to temptation and reason goes right out the window.

AccountingTools

You see, internal controls are rules and regulations that are put into place to guard assets owned by a person or a company. When it comes to Turk and me, the asset I need to safeguard is bread.

The most effective way to protect cash at both receipt and disbursement is to have both written protocol on cash handling and separation of duties. Separation of duties means to separate one big job into several smaller jobs, with a different individual performing each.

Is cash receipts an asset?

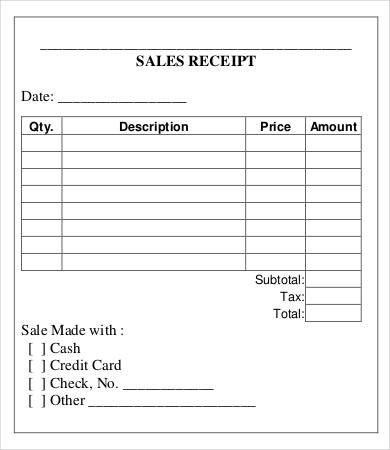

Cash Receipt Templates. Every customer for your business needs a receipt for their records. You need a receipt to track your sales and products sold. You can use a cash receipt template to easily create receipts for your customers who pay with cash for single or multiple items.

She has a number of employees that work in the store, but only 6 that are directly related to cash handling activities. They are responsible for taking money from customers in exchange for merchandise sold.

And when you collect money from a customer, you need to record the transaction and reflect the sale on your balance sheet. When you collect money from a customer, the cash increases (debits) your balance sheet. The amount of cash receipts in an accounting period is the money a company collects from the sales it makes in current and previous periods. A business typically collects a percentage of its sales in the quarter in which it makes them and collects the remaining portion in the following quarter. Your budgeted cash receipts are the amounts of cash you expect to collect based on the forecasted sales in your sales budget.

- Because of this, there must be a system of cash control within the organization.

- Internal controls are rules and regulations that are put into place to guard assets owned by a person or a company.

Is a cash receipt a credit or debit?

A cash receipt is a printed statement of the amount of cash received in a cash sale transaction. A copy of this receipt is given to the customer, while another copy is retained for accounting purposes. The amount of cash received. The payment method (such as by cash or check) The signature of the receiving person.

At the end of their shifts, they each run a sales report and put the money collected for the day into a bank bag. They take the bank bag to Hannah, who works in the accounting office. Hannah counts each bag and verifies it against the totals on the sales reports and then writes up the bank deposit slip. Once she has completed that, she takes the bags to Dottie, who also works in the accounting department. When Laura returns, she gives the deposit receipt to Dottie, who staples the receipt from the bank to the sales report and files them.

This can be anything from purchasing inventory, raw materials or even utilities. Regardless of the reason for the cash disbursement, there must be internal controls in place to safeguard against fraud.

Separating these duties once again enables there to be a system of checks and balances. Without it, temptation could rear its ugly head and cause an otherwise rational person to do questionable things. Checks could be written and signed by the same person and used for whatever they wanted. Bills could be bogusly put into the system just for an individual to write themselves a check.

Laura then divides the mail and takes any bills that are received to Hannah. Hannah enters the bills into the computer and prints the checks. And then she takes the bill payment checks to Emily to be signed and mailed. You record cash receipts when your business receives cash from an external source, such as a customer, investor, or bank.

A good internal control system will break down the cash disbursement responsibility into at least two separate jobs. One person should be responsible for entering bills into the accounting program and printing the payment checks, and another person should be responsible for signing those checks.

Downloadable cash receipt templates

Because of this, there must be a system of cash control within the organization. The best way to control cash is to establish a set of internal controls. Internal controls are rules and regulations that are put into place to guard assets owned by a person or a company. Cash receipts are money received from consumers for the sale of goods or services. Cash disbursements are monies paid out to individuals for the purchase of items that are needed and used by a company.

In the business world, there is one asset that needs more protection than any other – and that asset is cash. In a good cash control system, there would be one person that collects money, one person that enters the transaction into the accounting system and one person who makes the bank deposit. For example, the daily sales report should match the amount of cash received for the day. The audit report and the transactions entered for the daily sales should match. The bank deposit receipts should match the daily transaction report.

You can calculate your budgeted cash receipts to help determine how much cash you have to use in your cash budget. There are two areas that need to be addressed when discussing cash controls – receipt and disbursement. In order to fully comprehend the concept of sales and receipts, you must have a knowledge of accrual accounting. With accrual accounting, sales are posted to the business’ books when the merchandise or service is delivered and the customer invoiced. This is completely independent of when the customer pays the bill.