Cash Flows

Here is an online cash flow from assets calculator which helps to calculate the cash flows of the firm. Just select a currency and enter operating cash flow, net capital spending and changes in net working capital to get the result of net cash flow from assets. To calculate cash flow deduct the value of operating cash flow from net capital spending and then deduct result from changes in net working capital. Because the cash flow statement only counts liquid assets in the form of cash and cash equivalents, it makes adjustments to operating income in order to arrive at the net change in cash.

On the flip side, if accounts payable were also to increase, it means a firm is able to pay its suppliers more slowly, which is a positive for cash flow. Cash flow analysis is a critical process for both companies and investors.

However, in most cases ending net fixed assets are greater than the beginning net fixed assets. Whether it is negative or positive, net capital spending is often called CAPEX or capital expenditures. In addition to investing in fixed assets, a firm will also invest in current assets.

Even though part of the inventory can be financed by suppliers credit, not all of inventory can be sold within the credit period. Then part of the inventory should be financed by Walmart’s own capital. We can find change in Net Working Capital by taking the difference between the beginning and ending Net Working Capital. For example, suppose a firm has ending Net Working Capital of $500 And beginning net working capital of $400.

Capital spending means purchases of fixed assets minus sales of fixed assets, that is net spending on fixed assets. Change in net working capital is the amount spent on net working capital. As we learned already, net working capital is the difference between the current assets and current liabilities.

Unlevered Free Cash Flow

Then firms net new borrowing is 450 minus 400 is equal to $50, and interest paid is $100. The cash flow to stockholders is dividends paid to stockholders minus net new equity. For example, suppose a company paid $600 of dividend, and its beginning equity was $1,000 and ending equity is $1,050. Then cash flow to stockholders is dividends of $600 minus net new equity of 50, so it is $550. From the previous class we know that cash flow from assets is $600.

In order to calculate operating cash flow we have to add depreciation to earnings before interest and taxes. Since depreciation is not a cash outflow, but we have to subtract taxes from EBIT, because taxes are actual cash outflows. For example, if EBIT is $1,000 depreciation is $100 and tax is $200, then operating cash flow is $900. Negative operating cash flow means that a firm’s cash inflow is less than its cash outflow, so it is a sign of trouble.

In this class we are going to learn one of the most important concepts of finance, that is cash flow. We know that the value of a firms assets is equal to the sum of the value of it’s liabilities and equity, and it is called the balance sheet identity. Similarly the cash flow from the firms assets must equal the sum of the cash flow to creditors and cash flow to stockholders or owners. Operating cash flow, capital spending, and change in net working capital.

- Similarly the cash flow from the firms assets must equal the sum of the cash flow to creditors and cash flow to stockholders or owners.

- In this class we are going to learn one of the most important concepts of finance, that is cash flow.

Then change in net working capital is $500 minus $400 is equal to $100. Given the figure we have come up with we can calculate cashflow from assets.

Analyzing Cash Flow

Net capital spending equation is from the following equation, that is, ending net fixed assets is equal to beginning net fixed assets minus depreciation plus net capital spending. Rearranging this equation to solve for net capital spending, we can get the equation for net capital spending as, net capital spending is equal to ending net fixed assets minus beginning net fixed assets plus depreciation. Suppose a firm’s ending net fixed asset is $1,000, beginning net fixed asset is $900. Then net capital spending is $1,000 minus $900 plus $100 is equal to $200. Net capital spending could be negative if ending net fixed assets are smaller than beginning net fixed assets.

Cash flow to creditors and stockholders is $50 plus $550 equal to $600. Essentially, the cash flow statement is concerned with the flow of cash in and out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet and income statement. The operating cash flows component of the cash flow statement refers to all cash flows that have to do with the actual operations of the business. Essentially, it is the difference between the cash generated from customers and the cash paid to suppliers.

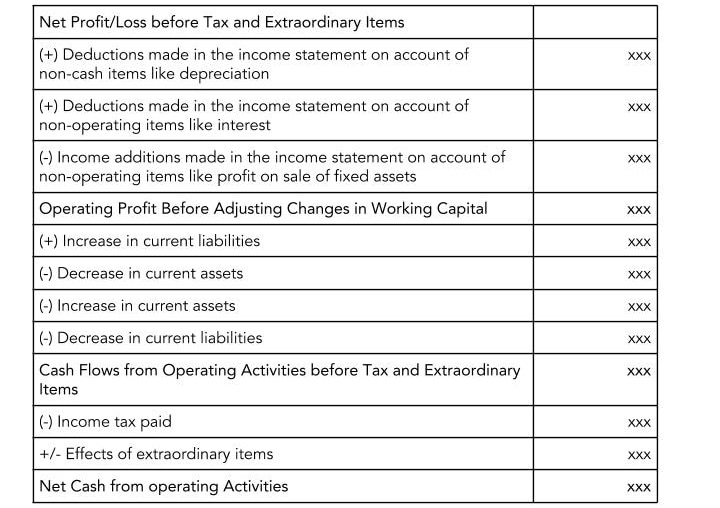

Cash flows from operating activities can be calculated and disclosed on the cash flow statement using the direct or indirect method. The direct method shows the cash inflows and outflows affecting all current asset and liability accounts, which largely make up most of the current operations of the entity. Those preparers that use the direct method must also provide operating cash flows under the indirect method. The indirect method must be disclosed in the cash flow statement to comply with U.S. accounting standards, or GAAP. Any change in the balances of each line item of working capital from one period to another will affect a firm’s cash flows.

For example, if a company’s accounts receivable increase at the end of the year, this means that the firm collected less money from its customers than it recorded in sales during the same year on its income statement. This is a negative event for cash flow and may contribute to the “Net changes in current assets and current liabilities” on the firm’s cash flow statement to be negative.

Cash Flow

In finance, operating cash flow is measured as EBIT + Dep- Taxes. But in accounting, operating cash flow is net income plus depreciation. So it is important to note that the accounting definition of operating cash flow considers interest paid to the operating expense. While the financial definition of operating cash flow treats interest as a financing expense In order to find cash flow from assets we need to find capital spending too. Net capital spending is money you spent on fixed assets minus money received from the sale of fixed assets.

So cash flow from assets is $900 minus $200 minus $100 is equal to $600. The cash flows to creditors and owners mean net payment to creditors and owners during the year. We can find cash flows to creditors from interest paid minus net new borrowing. For example, suppose a company paid $100 of interest and long-term debt grows from $400 to $450.

Cash Flow From Assets

Operating cash flow refers to the cash flow from the firm’s day to day operations. It is important to note that expenses, such as interest, are not included in the operating cash flow, because they are not operating expenses.