Cash Budget Template

Cash Budget Template

A master budget is the central planning tool that a management team uses to direct the activities of a corporation, as well as to judge the performance of its various responsibility centers. It is customary for the senior management team to review a number of iterations of the master budget and incorporate modifications until it arrives at a budget that allocates funds to achieve the desired results. Hopefully, a company uses participative budgeting to arrive at this final budget, but it may also be imposed on the organization by senior management, with little input from other employees.

DisclaimerAll content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional.

Another document sometimes included in the master budget is a set of key performance metrics that are calculated based on the information in the budget. For example, it may show accounts receivable turnover, or inventory turnover, or earnings per share.

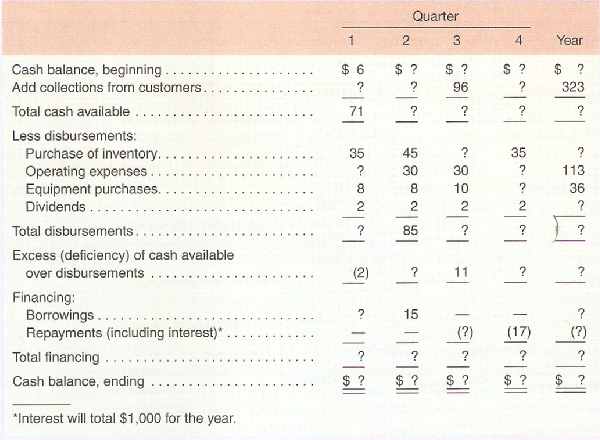

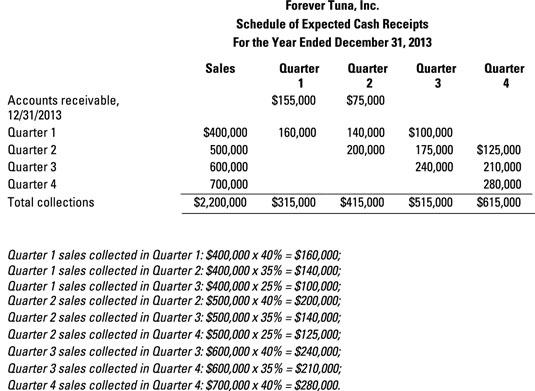

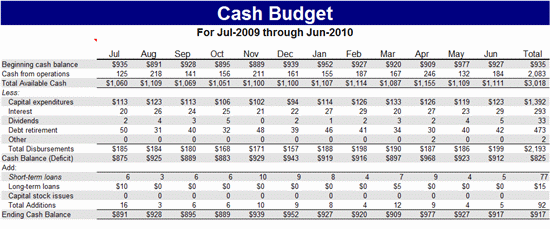

This budget is used to ascertain whether company operations and other activities will provide a sufficient amount of cash to meet projected cash requirements. A summary of the cash flows of an entity is formalized within the statement of cash flows, which is a required part of the financial statements under both the GAAP and IFRS accounting frameworks.

After a month passes, the January period is complete, so it now adds a budget for the following January, so that it still has a 12-month planning horizon that extends from February of the current year to January of the next year. A rolling budget calls for considerably more management attention than is the case when a company produces a one-year static budget, since some budget updating activities must now be repeated every month. In addition, if a company uses participative budgeting to create its budgets on a rolling basis, the total employee time used over the course of a year is substantial. Consequently, it is best to adopt a leaner approach to a rolling budget, with fewer people involved in the process.

Financial Analyst Certification

A forecasted summary of a firm’s expected cash inflows and cash outflows as well as its expected cash and loan balances. A persistent, ongoing negative cash flow based on operational cash flows should be a cause of serious concern to the business owner, since it means that the business will require an additional infusion of funds to avoid bankruptcy. ABC Company has adopted a 12-month planning horizon, and its initial budget is from January to December.

Master budget

These metrics are useful for testing the validity of the budget model against actual results in the past. Cash balances may fluctuate considerably within a single accounting period, thereby masking cash shortfalls that can put a company in serious jeopardy. To spot these issues, it is quite common to create and maintain cash forecasts on a weekly basis. Though these short-term budgets are reasonably accurate for perhaps a month, the precision of forecasting declines rapidly thereafter, so many companies then switch to budgeting on a monthly basis.

- These can be used for transactions, legal, financial modeling, financial analysis, business planning and business analysis.

- The master budget is the aggregation of all lower-level budgets produced by a company’s various functional areas, and also includes budgeted financial statements, a cash forecast, and a financing plan.

The example shows that an inordinately large dividend payment in the second week of the cash budget, coupled with a large asset purchase in the following week, places the company in a negative cash position. Paying out such a large dividend can be a problem for lenders, who do not like to issue loans so that companies can use the funds to pay their shareholders and thereby weaken their ability to pay back the loans.

These can be used for transactions, legal, financial modeling, financial analysis, business planning and business analysis. The master budget is the aggregation of all lower-level budgets produced by a company’s various functional areas, and also includes budgeted financial statements, a cash forecast, and a financing plan. The master budget is typically presented in either a monthly or quarterly format, and usually covers a company’s entire fiscal year.

What is included in a cash budget?

Definition: A cash budget is a budget or plan of expected cash receipts and disbursements during the period. These cash inflows and outflows include revenues collected, expenses paid, and loans receipts and payments. In other words, a cash budget is an estimated projection of the company’s cash position in the future.

A rolling budget is continually updated to add a new budget period as the most recent budget period is completed. Thus, the rolling budget involves the incremental extension of the existing budget model. By doing so, a business always has a budget that extends one year into the future. Forcing the organization to follow the budget requires a group of financial analysts who track down and report on variances from the plan.

The revenue recognition principle dictates the process and timing by which revenue is recorded and recognized as an item in a company’s financial statements. Theoretically, there are multiple points in time at which revenue could be recognized by companies. an accounting statement which analyses expected cash receipts and payments over forthcoming trading periods with a view to anticipating any potential cash shortages or surpluses before they arise and thus allow appropriate remedial action to be taken. This action could take the form of tightened CREDIT CONTROL to get cash in from customers more quickly, or arranging short-term loans in advance to cover an expected cash shortage, or plans to invest profitably any expected cash surplus.

In essence, a weekly cash budget begins to lose its relevance after one month, and is largely inaccurate after two months. A similar problem can arise with inventory, which is another component of working capital. It generally takes more inventory to support more sales, so the portion of working capital comprised of inventory can be expected to increase in conjunction with more sales. Thus, it is extremely likely that a company experiencing any amount of growth will forecast negative cash flows, because of the need to fund additional working capital.

Financial modeling is performed in Excel to forecast a company’s financial performance. The most difficult item to estimate in the cash budget is the net change in working capital from period to period. During periods of rapid growth, working capital can be a strongly negative number, since the company must invest in more accounts receivable than usual.

An explanatory text may be included with the master budget, which explains the company’s strategic direction, how the master budget will assist in accomplishing specific goals, and the management actions needed to achieve the budget. There may also be a discussion of the headcount changes that are required to achieve the budget. For more resources, check out our business templates library to download numerous free Excel modeling, PowerPoint presentation, and Word document templates.

The Sources of Cash section contains the beginning cash balance, as well as cash receipts from cash sales, accounts receivable collections, and the sale of assets. The Uses of Cash section contains all planned cash expenditures, which comes from the direct materials budget, direct labor budget, manufacturing overhead budget, and selling and administrative expense budget. It may also contain line items for fixed asset purchases and dividends to shareholders. The results of the cash budget are used in the financing budget, which itemizes investments, debt, and both interest income and interest expense. , as it indicates how much funding is required or how much surplus cash is produced over a period of time.

The rolling budget

Thus, it may be wiser for the company to consider a small dividend payment and avoid a negative cash position. If there are any unusually large cash balances indicated in the cash budget, these balances are dealt with in the financing budget, where suitable investments are indicated for them. Similarly, if there are any negative balances in the cash budget, the financing budget indicates the timing and amount of any debt or equity needed to offset these balances. The cash budget is comprised of two main areas, which are Sources of Cash and Uses of Cash.