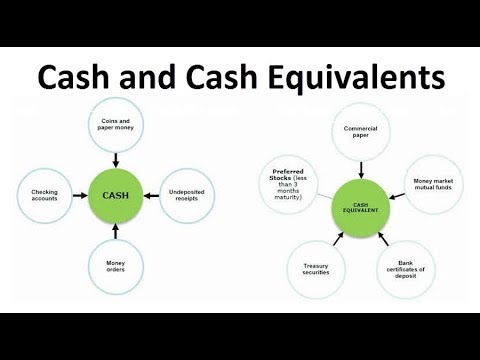

Cash and Cash Equivalents

Cash Equivalents

It considers cash and equivalents, marketable securities, and accounts receivable (but not the inventory) against the current liabilities. Restricted cash is the amount of cash and cash equivalent items which are restricted for withdrawal and usage. Restricted cash can be also set aside for other purposes such as expansion of the entity, dividend funds or “retirement of long-term debt”.

So, a company with relatively high net assets and significantly less cash and cash equivalents can mostly be considered an indication of non-liquidity. Nevertheless, this can happen only if there are receivables that can be converted into cash immediately. The speed with which an asset can beexchanged for cash at book value is referred to as liquidityand it is an important characteristic of cash equivalent assets.

Current assets, on the other hand, are all the assets of a company that are expected to be conveniently sold, consumed, utilized, or exhausted through standard business operations. They can easily be liquidated for cash, usually within one year, and are considered when calculating a firm’s ability to payshort-term liabilities. Examples of current assets include cash and cash equivalents (CCE), marketable securities, accounts receivable, inventory, and prepaid expenses.

What is included in cash and cash equivalents?

Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company’s assets that are cash or can be converted into cash immediately. Cash equivalents include bank accounts and marketable securities such as commercial paper and short-term government bonds.

Excludes cash and cash equivalents within disposal group and discontinued operation. One of the company’s crucial health indicators is its ability to generate cash and cash equivalents.

Foreign Currency

If a company has cash or cash equivalents, the aggregate of these assets is always shown on the top line of the balance sheet. This is because cash and cash equivalents are current assets, meaning they’re the most liquid of short-term assets. The quick ratio measures a company’s ability to meet its short-term obligations with its most liquid assets.

Current and Noncurrent Assets: Knowing the Difference

Other current assets (OCA) is a category of things of value that a company owns, benefits from, or uses to generate income that can be converted into cash within one business cycle. They are referred to as “other” because they are uncommon or insignificant, unlike typical current asset items such as cash, securities, accounts receivable, inventory, and prepaid expenses. In short, cash and cash equivalents mean the cash and those assets which are immediately convertible to cash.

The following ratios are commonly used to measure a company’s liquidity position. Each ratio uses a different number of current asset components against the current liabilities of a company. Additionally, creditors and investors keep a close eye on the current assets of a business to assess the value and risk involved in its operations. Many use a variety of liquidity ratios, which represent a class of financial metrics used to determine a debtor’s ability to pay off current debt obligations without raising external capital.

The higher the quick ratio, the “better” the company’s liquidity position. Likewise, the higher the denominator, the more cash your company may need to borrow, especially if the numerator is composed primarily of accounts receivable.

- Current assets, on the other hand, are all the assets of a company that are expected to be conveniently sold, consumed, utilized, or exhausted through standard business operations.

- They can easily be liquidated for cash, usually within one year, and are considered when calculating a firm’s ability to payshort-term liabilities.

Cash and Cash Equivalents Do Not Include

On the balance sheet, current assets are normally displayed in order of liquidity; that is, the items that are most likely to be converted into cash are ranked higher. Cash equivalents are used in liquidity ratio calculations to determine the speed with which a company can pay off its short-term debt. Liquidity ratios are connected to interest rates and may even triggerloan covenants. Current ratio is generally used to estimate company’s liquidity by “deriving the proportion of current assets available to cover current liabilities”. Cash and cash equivalents (CCE) are the most liquid current assets found on a business’s balance sheet.

Cash equivalents are short-term commitments “with temporarily idle cash and easily convertible into a known cash amount”. For simplicity, the total value of cash on hand includes items with a similar nature to cash.

An asset with higher liquidity is lower risk and more ‘cash-like’ than other assets. The most liquid assets are money orders, certificates of deposit and marketable securities; these are all cash equivalents. Accounts receivable can take 10, 30, 60, 120-days or more to convert into cash. These various measures are used to assess the company’s ability to pay outstanding debts and cover liabilities and expenses without having to sell fixed assets.

Cash equivalents include bank accounts and marketable securities, which are debt securities with maturities of less than 90 days. However, oftentimes cash equivalents do not include equity or stock holdings because they can fluctuate in value. Current assets include cash, cash equivalents, accounts receivable, stock inventory, marketable securities, pre-paid liabilities, and other liquid assets. Cash and cash equivalents are the amount of currency on hand as well as demand deposits with banks or financial institutions. Includes other kinds of accounts that have the general characteristics of demand deposits.

For example, a large machine manufacturing company receives an advance payment (deposit) from its customer for a machine that should be produced and shipped to another country within 2 months. Based on the customer contract the manufacturer should put the deposit into separate bank account and not withdraw or use the money until the equipment is shipped and delivered. This is a restricted cash, since manufacturer has the deposit, but he can not use it for operations until the equipment is shipped.

Cash And Cash Equivalents (CCE)

Cash and cash equivalents are very important for the liquidity of a business. A company should have sufficient cash and cash equivalents to meet its urgent liabilities when they fall due. Typically, the combined amount of cash and cash equivalents will be reported on the balance sheet as the first item in the section with the heading current assets.

Accounts receivable—which is the money due to a company for goods or services delivered or used but not yet paid for by customers—are considered current assets as long as they can be expected to be paid within a year. If a business is making sales by offering longer terms of credit to its customers, a portion of its accounts receivables may not qualify for inclusion in current assets.

Depending on its immateriality or materiality, restricted cash may be recorded as “cash” in the financial statement or it might be classified based on the date of availability disbursements. Moreover, if cash is expected to be used within one year after the balance sheet date it can be classified as “current asset”, but in a longer period of time it is mentioned as non- current asset.

Such commonly used ratios include current assets, or its components, as a component of their calculations. The total current assets figure is of prime importance to the company management with regards to the daily operations of a business. As payments toward bills and loans become due at the end of each month, management must be ready the necessary cash. The dollar value represented by the total current assets figure reflects the company’s cash and liquidity position and allows management to prepare for the necessary arrangements to continue business operations.

Unlike marketable securities, you are actuallypayinginterest on accounts receivable balances rather than receiving it — the interest paid goes to your bank. Cash and cash equivalents refers to the line item on the balance sheet that reports the value of a company’s assets that are cash or can be converted into cash immediately.