Capital Gains vs. Dividend Income: The Main Differences

Preferred dividends accumulate and must be reported in a company’s financial statement. Noncumulative preferred stock does not have this feature, and all preferred dividends in arrears may be disregarded. A cash dividend is a sum of money paid by a company to a shareholder out of its profits or reserves called retained earnings. Each quarter, companies retain or accumulate their profits in retained earnings, which is essentially a savings account. Retained earnings is located on the balance sheet in the shareholders’ equity section.

In some cases, the corporation will use the cash from the retained earnings to reduce its liabilities. As a result, it is difficult to identify exactly where the retained earnings are presently.

Preferred stock shareholders may or may not enjoy any of the voting rights of those holding common stock. Also, unlike common stock, a preferred stock pays a fixed dividend that does not fluctuate. Thus, the company must pay all unpaid preferred dividends accumulated during previous periods before it can pay dividends to common shareholders. If the company is unable to pay this dividend, the preferred shareholders may have the right to force a liquidation of the company. If the dividend is not cumulative, preferred shares are not paid a dividend until the board of directors approves of a dividend.

Companies distribute stock dividends to their shareholders in a certain proportion to its common shares outstanding. Stock dividends reallocate part of a company’s retained earnings to its common stock and additional paid-in capital accounts. Therefore, they do not affect the overall size of a company’s balance sheet. If a company pays stock dividends, the dividends reduce the company’s retained earnings and increase the common stock account.

The actual payment of cash dividends to the investors account will be made on April 04, 2019. Stock dividends have no impact on the cash position of a company and only impact the shareholders’ equity section of the balance sheet. If the number of shares outstanding is increased by less than 20% to 25%, the stock dividend is considered to be small. A large dividend is when the stock dividend impacts the share price significantly and is typically an increase in shares outstanding by more than 20% to 25%. On a company’s balance sheet, retained earnings or accumulated deficit balance is reported in the stockholders’ equity section.

The two entries would include a $200,000 debit to retained earnings and a $200,000 credit to the common stock account. However, they shrink a company’s shareholders’ equity and cash balance by the same amount.

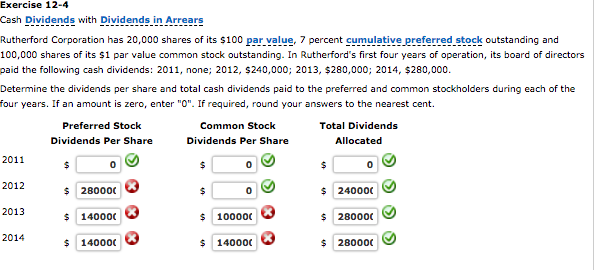

If board of directors decides to pay a dividend of $1,200,000 in 2015, the cumulative preferred stockholders will be paid a total dividend of $1,000,000 ($5 per share for two years – 2014 and 2015). The remaining amount of $200,000 will then be distributed among common stockholders.

Since stockholders’ equity is equal to assets minus liabilities, any reduction in stockholders’ equity must be mirrored by a reduction in total assets, and vice versa. Stockholders’ equity includes retained earnings, paid-in capital,treasury stock, and other accumulative income. Stockholder equity is usually referred to as a company’sbook value.

Firms must report any cash dividend as payments in the financing activity section of their cash flow statement. One of the most important financial statements companies issue each year is the balance sheet. The balance sheet outlines all a company’s assets and liabilities.

Stock dividends do not result in asset changes to the balance sheet but rather affect only the equity side by reallocating part of the retained earnings to the common stock account. Because preferred stockholders have priority over common stockholders in regards to dividends, these forgone dividends accumulate and must eventually be paid to preferred shareholders. Therefore, preferred stock dividends in arrears are legal obligations to be paid to preferred shareholders before any common stock shareholder receives any dividend. All previously omitted dividends must be paid before any current year dividends may be paid.

The company’s stockholder equity is reduced by the dividend amount, and its total liability is increased temporarily because the dividend has not yet been paid. Unlike cumulative preferred stock, unpaid dividends on noncumulative preferred stock are not carried forward to the subsequent years. If preferred stock is noncumulative and directors do not declare a dividend because of insufficient profit in a particular year, there is no question of dividends in arrears.

For example, say a company has 100,000 shares outstanding and wants to issue a 10% dividend in the form of stock. If each share is currently worth $20 on the market, the total value of the dividend would equal $200,000.

Stockholders’ equity is the amount of capital given to a business by its shareholders, plus donated capital and earnings generated by the operations of the business, minus any dividends issued. Like common stock, preferred stocks represent partial ownership in a company.

Stock dividends are sometimes referred to as bonus shares or a bonus issue. When most people think of dividends, they think ofcash dividends. When a company issues a stock dividend, it distributes additional quantities of stock to existing shareholders according to the number of shares they already own.

How do you calculate dividends in arrears?

A dividend in arrears is a dividend payment associated with cumulative preferred stock that has not been paid by the expected date. No payments are made to the person or entity that held the stock at the time when the dividends were in arrears.

- Stock dividends reallocate part of a company’s retained earnings to its common stock and additional paid-in capital accounts.

- Companies distribute stock dividends to their shareholders in a certain proportion to its common shares outstanding.

- Therefore, they do not affect the overall size of a company’s balance sheet.

It offers a snapshot of a company’s financial situation at a specific moment in time. Instead, the corporation likely used the cash to acquire additional assets in order to generate additional earnings for its stockholders.

What Are Dividends in Arrears?

However, a majority of preferred stock issuances are nonparticipating. Callable preferred stock results in higher preferred dividends, as investors are sacrificing long-term security. If the preferred stock is retired at the call price, future preferred dividends may be included in the repurchase. Convertible preferred stock has lower preferred dividends, as the investor receives the additional of converting the preferred stock to common stock. A preferred dividend is a dividend that is accrued and paid on a company’s preferred shares.

Instead, dividends impact the shareholders’ equity section of the balance sheet. Dividends, whether cash or stock, represent a reward to investors for their investment in the company. When dividends are actually paid to shareholders, the $1.5 million is deducted from the dividends payable subsection to account for the reduction in the company’s liabilities. The cash sub-account of the assets section is also reduced by $1.5 million.

Preferred stockholders typically receive the right to preferential treatment regarding dividends, in exchange for the right to share in earnings in excess of issued dividend amounts. Some preferred stockholders may receive the right of participation, in which their dividends are not restricted to the fixed rate of interest.

Retained earnings are the amount of money a company has left over after all of its obligations have been paid. Retained earnings are typically used for reinvesting in the company, paying dividends, or paying down debt.

The stockholders’ equity can be calculated from the balance sheet by subtracting a company’s liabilities from its total assets. Although stock splits and stock dividends affect the way shares are allocated andthe company share price, stock dividends do not affect stockholder equity. While cash dividends have a straightforward effect on the balance sheet, the issuance of stock dividends is slightly more complicated.

Preference Shares: Advantages and Disadvantages

Dividends impact the shareholders’ equity section of the corporate balance sheet—the retained earnings, in particular. Adividendis a method of redistributing a company’s profits to shareholders as a reward for their investment. Companies are not required to issue dividends on common sharesof stock, though many pride themselves on paying consistent or constantly increasing dividends each year. When a company issues a dividend to its shareholders, the dividend can be paid either in cash or by issuing additional shares of stock.

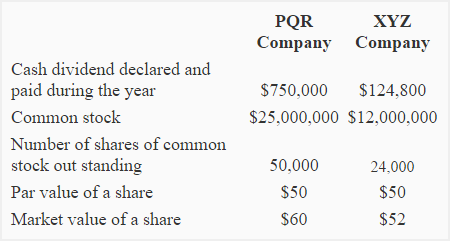

Dividends in arrears

The two types of dividends affect a company’sbalance sheet in different ways. When a company pays cash dividends to its shareholders, its stockholders’ equity is decreased by the total value of all dividends paid. However, the effect of dividends changes depending on the kind of dividends a company pays. As we’ll see, stock dividends do not have the same effect on stockholder equity as cash dividends. On December 20, 2018, a company, XYZ Limited’s board of directors announced that a cash dividend amounting to $ 4.5 per share will be paid to the shareholders of the company.

If a company is unable to pay all dividends, claims to preferred dividends take precedence over claims to dividends that are paid on common shares. The main benefit of preferred stock is that it typically pays much higher dividend rates than common stock of the same company. The stockholder equity section of ABC’s balance sheet shows retained earnings of $4 million. When the cash dividend is declared, $1.5 million is deducted from the retained earnings section and added to the dividends payable sub-account of the liabilities section.

The cash within retained earnings can be used for investing in the company, repurchase shares of stock, or pay dividends. Cash or stock dividends distributed to shareholders are not recorded as an expense on a company’s income statement. Stock and cash dividends do not affect a company’s net income or profit.

When Dividends Are Suspended

For example, a corporation issues 100,000 shares of $5 noncumulative preferred stock on 1st January 2014 and does not pay any dividend during the year 2014. The $5 dividend per share will not be carried forward to the year 2015. In case of cumulative preferred stock, any unpaid dividends on preferred stock are carried forward to the future years and must be paid before any dividend is paid to common stockholders. For example, a corporation issues 100,000 shares of $5 cumulative preferred stock on 1st January 2014 and does not pay any dividend during the year 2014. The $5 dividend per share will be carried forward to the year 2015.