Capital Definition

All revenues the company generates in excess of its expenses will go into the shareholders’ equity account. These revenues will be balanced on the assets side, appearing as cash, investments, inventory, or some other asset. Liabilities are also known as current or non-current depending on the context.

An example of a current liability is money owed to suppliers in the form of accounts payable. The assets on the balance sheet consist of what a company owns or will receive in the future and which are measurable. Liabilities are what a company owes, such as taxes, payables, salaries, and debt. The shareholders’ equity section displays the company’s retained earnings and the capital that has been contributed by shareholders.

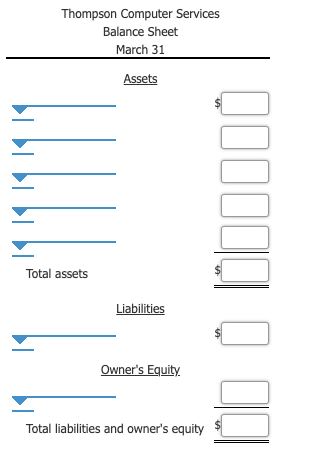

Balance Sheet Outline

A company will debit bad debts expense and credit this allowance account. This allowance can accumulate across accounting periods and may be adjusted based on the balance in the account.

It shows investors and analysts whether a company has enough current assets on its balance sheet to satisfy or pay off its current debt and other payables. In essence, a company’s cash flow statement measures the flow of cash in and out of a business, while a company’s balance sheet measures its assets, liabilities, and owners’ equity. Accounts payable is a liability since it’s money owed to creditors and is listed under current liabilities on the balance sheet.

The accounting equation is considered to be the foundation of the double-entry accounting system. The accounting equation shows on a company’s balance sheet whereby the total of all the company’s assets equals the sum of the company’s liabilities and shareholders’ equity. The analysis of current liabilities is important to investors and creditors. Banks, for example, want to know before extending credit whether a company is collecting—or getting paid—for its accounts receivables in a timely manner. On the other hand, on-time payment of the company’s payables is important as well.

Liabilities are obligations of the company; they are amounts owed to creditors for a past transaction and they usually have the word “payable” in their account title. Along with owner’s equity, liabilities can be thought of as a source of the company’s assets. For example, a company’s balance sheet reports assets of $100,000 and Accounts Payable of $40,000 and owner’s equity of $60,000. The source of the company’s assets are creditors/suppliers for $40,000 and the owners for $60,000.

The creditors/suppliers have a claim against the company’s assets and the owner can claim what remains after the Accounts Payable have been paid. The balance sheet provides a look at a business at a snapshot in time, often at the end of a quarter or year. In some cases, the accounts on the balance sheet — assets, liabilities, and equity — can also shed light into items that would normally be found on the income or cash flow statement. For example, if a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000.

They can include a future service owed to others; short- or long-term borrowing from banks, individuals, or other entities; or a previous transaction that has created an unsettled obligation. The most common liabilities are usually the largest likeaccounts payableand bonds payable. Most companies will have these two line items on their balance sheet, as they are part of ongoing current and long-term operations.

Some of the key metrics for analyzing business capital include weighted average cost of capital, debt to equity, debt to capital, and return on equity. For a company keeping accurate accounts, every single business transaction will be represented in at least of its two accounts. For instance, if a business takes a loan from a financial entity like a bank, the borrowed money will raise the company’s assets and the loan liability will also rise by an equivalent amount. If a business buys raw material by paying cash, it will lead to an increase in the inventory (asset) while reducing cash capital (another asset). Because there are two or more accounts affected by every transaction carried out by a company, the accounting system is referred to as double-entry accounting.

The ratio of current assets to current liabilities is an important one in determining a company’s ongoing ability to pay its debts as they are due. Current liabilities are a company’s short-term financial obligations that are due within one year or within a normal operating cycle. An operating cycle, also referred to as the cash conversion cycle, is the time it takes a company to purchase inventory and convert it to cash from sales.

Both the current and quick ratios help with the analysis of a company’s financial solvency and management of its current liabilities. Accounts payable is typically one of the largest current liability accounts on a company’s financial statements, and it represents unpaid supplier invoices. Companies try to match payment dates so that their accounts receivables are collected before the accounts payables are due to suppliers.

Shareholders’ equity is the net of a company’s total assets and its total liabilities. Shareholders’ equity represents the net worth of a company and helps to determine its financial health. Shareholders’ equity is the amount of money that would be left over if the company paid off all liabilities such as debt in the event of a liquidation.

Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash. Some examples of short-term liabilities include payroll expenses and accounts payable, which includes money owed to vendors, monthly utilities, and similar expenses.

Liabilities Explained

- Ideally, analysts want to see that a company can pay current liabilities, which are due within a year, with cash.

The financial position of any business, large or small, is assessed based on two key components of the balance sheet, assets, and liabilities. Owners’ equity or shareholders’ equity, is the third section of the balance sheet. The accounting equation is a representation of how these three important components are associated with each other. The accounting equation is also called the basic accounting equation or the balance sheet equation. The accounting equation shows on a company’s balance sheet where the total of all the company’s assets equals the sum of the company’s liabilities and shareholders’ equity.

In contrast, analysts want to see that long-term liabilities can be paid with assets derived from future earnings or financing transactions. Items like rent, deferred taxes, payroll, and pension obligations can also be listed under long-term liabilities. The current ratio measures a company’s ability to pay its short-term financial debts or obligations. The ratio, which is calculated by dividing current assets by current liabilities, shows how well a company manages its balance sheet to pay off its short-term debts and payables.

A liability is something a person or company owes, usually a sum of money. Liabilities are settled over time through the transfer of economic benefits including money, goods, or services. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses. Noncurrent liabilities, also called long-term liabilities or long-term debts, are long-term financial obligations listed on a company’s balance sheet.

Debt financing provides a cash capital asset that must be repaid over time through scheduled liabilities. Equity financing provides cash capital that is also reported in the equity portion of the balance sheet with an expectation of return for the investing shareholders. Debt capital typically comes with lower relative rates of return alongside strict provisions for repayment.

Its liabilities (specifically, the long-term debt account) will also increase by $4,000, balancing the two sides of the equation. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholders’ equity.

Contingent Liabilities

A bad debt expense is recognized when a receivable is no longer collectible because a customer is unable to fulfill their obligation to pay an outstanding debt due to bankruptcy or other financial problems. Companies that extend credit to their customers report bad debts as an allowance for doubtful accounts on the balance sheet, which is also known as a provision for credit losses. Working capital measures a company’s short-term liquidity—more specifically, its ability to cover its debts, accounts payable, and other obligations that are due within one year.

Businesses need a substantial amount of capital to operate and create profitable returns. Balance sheet analysis is central to the review and assessment of business capital. Split between assets, liabilities, and equity, a company’s balance sheet provides for metric analysis of a capital structure.

It is a financial statement that provides a snapshot of what a company owns and owes, as well as the amount invested by shareholders. Current liabilities typically represent money owed for operating expenses, such as accounts payable, wages, and taxes. In addition, payments on long-term debt owed in the next year will be listed in current liabilities. Like most assets, liabilities are carried at cost, not market value, and underGAAPrules can be listed in order of preference as long as they are categorized.

What are liabilities in accounting?

In its simplest form, your balance sheet can be divided into two categories: assets and liabilities. Assets are the items your company owns that can provide future economic benefit. Liabilities are what you owe other parties. In short, assets put money in your pocket, and liabilities take money out!

Current liabilities are short-term liabilities of a company, typically less than 90 days. Current liabilities — these liabilities are reasonably expected to be liquidated within a year. Current liabilities are typically settled using current assets, which are assets that are used up within one year. Current assets include cash or accounts receivables, which is money owed by customers for sales.

For the balance sheet to balance, total assets should equal the total of liabilities and shareholders’ equity. Investors and creditors use numerous financial ratios to assess liquidity risk and leverage. The debt ratio compares a company’s total debt to total assets, to provide a general idea of how leveraged it is. The lower the percentage, the less leverage a company is using and the stronger its equity position. Other variants are the long term debt to total assets ratio and the long-term debt to capitalization ratio, which divides noncurrent liabilities by the amount of capital available.

The AT&T example has a relatively high debt level under current liabilities. With smaller companies, other line items like accounts payable (AP) and various future liabilities likepayroll, taxes, and ongoing expenses for an active company carry a higher proportion.

What are some examples of liabilities?

A liability is something a person or company owes, usually a sum of money. Recorded on the right side of the balance sheet, liabilities include loans, accounts payable, mortgages, deferred revenues, earned premiums, unearned premiums, and accrued expenses.