Breifly, what’s the Marginal Principle using diagram?

Marginal social benefit is the change in benefits associated with the consumption of an additional unit of a good or service. It is measured by the amount people are willing to pay for the additional unit of a good or service. For example, suppose you are currently consuming two slices of pizza .per day.

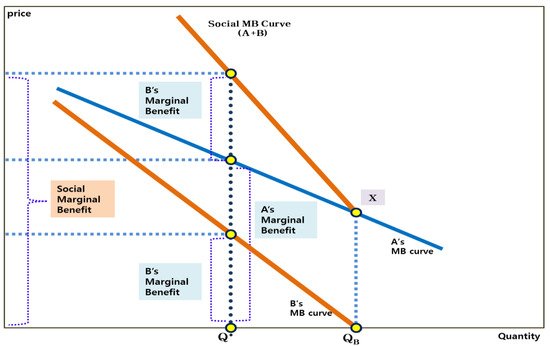

Falling Marginal Benefit

Marginal private cost (MPC) is the change in the producer’s total cost brought about by the production of an additional unit of a good or service. For example if production costs rise from$1,000 to $1,050 as one more unit of a good is produced the marginal private cost is $50.b.

Mathematically speaking, it is the derivative of the total cost. Marginal cost is an important measurement because it accounts for increasing or decreasing costs of production, which allows a company to evaluate how much they actually pay to ? In economics, the total cost (TC) is the total economic cost of production. Total cost is the total opportunity cost of each factor of production as part of its fixed or variable costs.

Marginal social cost (MSC) is the change in society’s total cost brought about by the production of an additional unit of a good or service. It includes both marginal private cost and marginal external cost. For example, suppose it costs a producer $50 to produce an additional unit of a good.

Suppose that when the additional unit is produced pollution is emitted which causes $25 worth of damage to the paint on your car. The marginal social cost of production is the producer’s cost plus the external cost, or $75.c.

The average cost is the total cost divided by the number of goods produced. It is also equal to the sum of average variable costs and average fixed costs. Average cost can be influenced by the time period for production (increasing production may be expensive or impossible in the short run).

The output at which marginal cost is equal to marginal revenue keeps losses minimum. The total cost per hat would then drop to $1.75 ($1 fixed cost per unit + $.75 variable costs). In this situation, increasing production volume causes marginal costs to go down. The marginal cost of production is an economics and managerial accounting concept most often used among manufacturers as a means of isolating an optimum production level.

The Difference Between Cost and Price

Marginal fixed cost is the total fixed cost at one unit of output and is nil for all higher units of output. Average fixed cost is also the total fixed cost at one unit of output but declines in the form of a hyperbola for all higher units of output. Marginal variable costs are the same as average variable costs.

- Marginal private cost (MPC) is the change in the producer’s total cost brought about by the production of an additional unit of a good or service.

In other words, if the total revenue (total sale proceeds) does not include total variable costs, the business must shut down. It will produce something only when the price covers the average variable cost and part of the average fixed costs.

Cost accountants have been quicker than economists to recognise this. The U shaped cost curve with its declining marginal curve is economically unrealistic as well as being superfluous. All these marginal and average curves can be shown on the same coordinates diagram.

Fixed costs do not change with an increase or decrease in production levels, so the same value can be spread out over more units of output with increased production. Variable costs refer to costs that change with varying levels of output. Therefore, variable costs will increase when more units are produced. The first stage, increasing returns to scale (IRS) refers to a production process where an increase in the number of units produced causes a decrease in the average cost of each unit. In other words, a firm is experiencing IRS when the cost of producing an additional unit of output decreases as the volume of its production increases.

Marginal Benefits for Businesses

What is marginal benefit and cost?

Marginal benefit and marginal cost are two measures of how the cost or value of a product changes. A marginal benefit is the maximum amount of money a consumer is willing to pay for an additional good or service.

Marginal external cost (MEC) is the change in the cost to parties other than the producer or buyer of a good or service due to the production of an additional unit of the good or service. For example, suppose it costs the producer $50 to produce another unit of a good. Suppose this production results in pollution which causes $60 worth of damage to another company’s plant.

Understanding Marginal Benefits

Assume you would be willing to pay $.75 to consume a third slice of pizza per day. $.75 represents the marginal social benefit of the third, or additional, slice of pizza.9. Explain how a market in pollution permits works to abate pollution and reduce compliance costs. In economics, the marginal cost of production is the change in total production cost that comes from making or producing one additional unit. To calculate marginal cost, divide the change in production costs by the change in quantity.

Manufacturers often examine the cost of adding one more unit to their production schedules. At a certain level of production, the benefit of producing one additional unit and generating revenue from that item will bring the overall cost of producing the product line down. The key to optimizing manufacturing costs is to find that point or level as quickly as possible. Marginal cost measures the change in cost over the change in quantity.

What is marginal benefit example?

Marginal benefit is the incremental increase in the benefit to a consumer caused by the consumption of one additional unit of a good or service. For example, a consumer is willing to pay $5 for an ice cream, so the marginal benefit of consuming the ice cream is $5.

The purpose of analyzing marginal cost is to determine at what point an organization can achieve economies of scale to optimize production and overall operations. If the marginal cost of producing one additional unit is lower than the per-unit price, the producer has the potential to gain a profit. If the price does not cover average variable costs, the firm prefers to shut down.