Bookkeeping journals: Intro to Bookkeeping & Special Purpose Journals

Accounting software is a better solution for most companies because much of the effort around journal entry tracking, pulling and allocating to accounts can be automated. If you use accounting software or outsource your accounting, your journal entries may not be visible, but they’re being generated in the back end, ensuring your books are accurate and up to date. Every journal entry in the general ledger will include the date of the transaction, amount, affected accounts with account number, and description. The journal entry may also include a reference number, such as a check number, along with a brief description of the transaction. At the beginning of a financial period, you may need to reverse or cancel an entry made in the previous period. Reversing entries are commonly used for accrued revenue and expenses.

- Each journal entry corresponds to one discrete business transaction and is eventually posted to the general ledger.

- The Accounts Payable Account would show an increase, or credit, of $90,000 as it now owes that amount to a vendor on a future date or dates.

- Bookkeepers must understand how each tool is developed and how they interrelate.

- However, there are many scenarios where you might need to record a special entry for a transaction.

- Accurate and complete journals are also essential in the auditing process, as journal entries provide detailed accounts of every transaction.

The expenses account increases by that amount, while the cash account, which is an asset, decreases by $277.50 because that money is now spent. For accounting purposes, a journal is a physical record or digital document kept as a book, spreadsheet, or data within accounting software. When a business transaction is made, a bookkeeper enters the financial transaction as a journal entry. If the expense or income affects one or more business accounts, the journal entry will detail that as well.

Interest receivable journal entry

Journal entries may also include data specific to the business, such as the subsidiary or subsidiaries involved in the transaction and the currency or currencies used. This course has been developed by a CPA who has both small and large business accounting experience and background. Let’s look at a payment of $1,000 with $800 going towards the loan balance and $200 being interest expense.

Here’s everything you need to know about this essential building block of bookkeeping, including what they are, why they’re important, and how to make them.

Using Double-Entry Bookkeeping in Journals

T-accounts are a visual representation of the general ledger account. Here are some examples, as well as additional journal entry types. Now that you’ve identified the transaction type and the accounts it affects, you’re ready to make your journal entry.

- That way, you can start fresh in the new year, without any income or expenses carrying over.

- Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post.

- But most people today use accounting software to record transactions.

- This means that each journal entry is recorded with two columns.

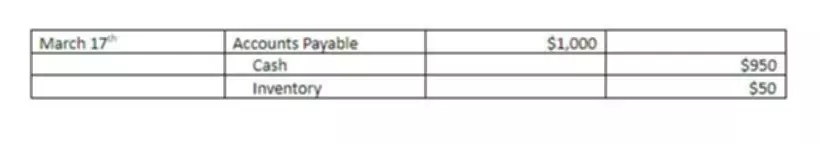

If you do your bookkeeping manually, it’s extremely important that you record journal entries accurately. It can be easy to accidentally debit or credit the wrong account or input the wrong amount, so check to make sure your work is correct. Reconciling your accounts at the end of the period also helps you catch any errors. Examples include sales and purchase journals that group sales to various customers or purchases from suppliers in one place. Modern accounting software negates the need for special journals by making it easy to sort transactions and search for granular details.

Determine your account type:

This happens when the debit or credit amount is made up of multiple lines. Description includes relevant notes—so you know where the money is coming from or going to. You’re going to meet up with a client, pick up some office supplies, and stop by the bank to make a loan payment. From these simplified but exacting measures, a company can know where it stands financially and how far it can go with future plans. The validity of all financial reports is affected by the accuracy — or inaccuracy — of the information entered at this level. This course examines each of these accounting tools and explains their protocols and how they are integral to the accounting process.

What did the transaction add to the business, and what did it take away? The physics adage that “for every action, there is an equal and opposite reaction” holds true in accounting, too. Make sure you identify all actions and reactions caused by the transaction. If you’re totally new to double-entry accounting and you don’t know the difference between debits and credits, pause here. It’ll teach you everything you need to know before continuing with this article. They take transactions and translate them into the information you, your bookkeeper, or accountant use to create financial reports and file taxes.

What Is the Purpose of a Journal Entry?

This post is to be used for informational purposes only and does not constitute legal, business, or tax advice. Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

General journal

An accounting journal is a detailed account of all the financial transactions of a business. It is also known as the book of original entry (the first place where transactions are recorded). An accounting ledger is an account or record used to store bookkeeping entries for balance sheet and income statement transactions. Accounting ledger journal entries can include accounts like cash, accounts receivable, investments, inventory, accounts payable, accrued expenses, and customer deposits. The term accounting ledger is often used interchangeably with accounting sub-ledgers or the general ledger. A general ledger contains all the accounts for recording transactions relating to a company’s assets, liabilities, owners’ equity, revenue, and expenses.

We’ll be using double-entry examples to explain how journal entries work. Financial statements are the key to tracking your business performance and accurately filing your taxes. The journal entry above illustrates how to write a very simple journal entry. However, there are many scenarios where you might need to record a special entry for a transaction. Automation delivers increased efficiency and reduced error rates. Further, modern accounting software will greatly ease the audit process.

Think of double-entry bookkeeping as a GPS showing you both the origin and the destination. It will show you where the money is coming from and where it’s going to. Going through every transaction and making journal entries is a hassle. But with Bench, all of your transaction information is imported into the platform and reviewed by an expert bookkeeper.

Reversing Entry

The purpose of a journal entry is to physically or digitally record every business transaction properly and accurately. If a transaction affects multiple accounts, the journal entry will detail that information as well. Journal entries are the fundamental building blocks that provide the answers to those and other questions. Journal entries list vital data, such as how much was credited and debited, when and from which accounts. Each journal entry corresponds to one discrete business transaction and is eventually posted to the general ledger. If, for example, a business owner purchases $1,000 worth of inventory with cash, the single-entry system records a $1,000 reduction in cash, with the total ending balance below it.