Bookkeeping 101: The Beginner’s Guide to Bookkeeping

Sort them into expense categories, both to keep yourself organized for tax season, and to get a look at how much you’re really spending on inventory orders versus advertising. “Aside from revenue and expenses, the key thing is managing your cash and your cash flow. There’s usually a misconception that if you have revenue of X amount, then you have cash of that amount just sitting there, but that’s not necessarily the case,” says Charlie. “If you don’t have adequate support, you can be denied both tax credits and deductible expenses, which, if you’re actually entitled to them, can be a big hit at tax time,” says Charlie. But even if an expense is ordinary and necessary, you may still not be able to deduct all of it on your taxes.

- The accounting equation means that everything the business owns (assets) is balanced against claims against the business (liabilities and equity).

- On top of running your business, you also have to manage an asset account, tax returns, credit card chargeback, and more.

- Under single-entry, journal entries are recorded once, as either an expense or income.

If you’re months or years behind, you might want to get a bookkeeper to do some catch-up bookkeeping for you (Bench can help with that). Every transaction you make needs to be categorized and entered into your books. These days, you’ve got three options when it comes to bookkeeping tools.

Understanding Assets, Liabilities, and Equity When Balancing the Books

Especially if your accountant ends up telling you you’ve been using them incorrectly for the past year. Keeping an accurate, up-to-date set of books is the best way to keep track of tax deductions (expenses that you can deduct from your taxable income). Most accounting software will automatically import your bank data so you don’t have to manually enter and organize each transaction. If you’re using spreadsheet software as your GL, you’ll need to enter each transaction by hand.

Bookkeeping is the process of recording your business’s financial transactions so that you know exactly how much you’re making and where your money is going. You also need to understand what debits and credits are before you can start to enter any transactions. Any transaction posted in your ledger or your accounting software will be a debit or a credit. Effective bookkeeping requires an understanding of the firm’s basic accounts.

Bookkeeping 101: What Are The Basic Accounting Terms?

You can’t run a healthy, successful business without having your books in order. It’s like driving a car without a fuel gauge or a map—sooner or later you’re going to get lost or run out of gas. If you’ve accurately kept track of and reported your employees’ salaries and wages, you can claim them with the Employee Retention Credit.

Understanding how much cash you have on hand, and what else that cash needs to cover, is a key part of managing your books and your business. The bookkeeping process requires careful analysis and a little legal know-how. In the event your business is ever audited, you want to make sure your records are in order and deductions are legitimate. In this article, you’ll learn everything about how to start keeping books for a small business and how you can become more profitable today. If bookkeeping keeps getting pushed aside as your business starts growing and you simply can’t find the time to get your books in order every month, you should consider hiring a professional to help you.

Bookkeeping 101: A Beginner’s Guide On Where To Start

Banks tend to look at your income statement, cash flow history, and income tax returns when reviewing your application. Bookkeeping records financial transactions, whereas accounting analyzes the financial health of a business based on those records. Think of bookkeeping as an accountability buddy — it tracks your daily income and expenses and holds you accountable at managing your money. That way, you’ll always know what’s happening in your business and make the best financial decisions. While the job of bookkeeper may appear similar (or the same) as an accountant, they are only similar on the surface.

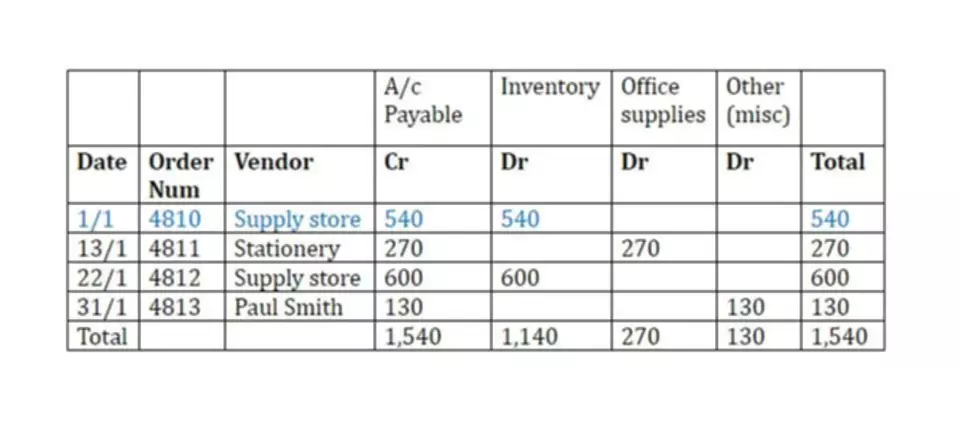

While you can certainly buy a ledger book at an office supply store, keep in mind that it’s much easier to set up your chart of accounts if you’re using an accounting software, such as Wave. A bookkeeper is responsible for identifying the accounts in which transactions should be recorded. Setting up bookkeeping or accounting software includes connecting business bank accounts, doing any necessary data entry and reconciling transactions. It also involves checking for errors, learning about your specific software and looking for ways to streamline different parts of your accounting processes.

Record every financial transaction

Here’s a look specifically at ecommerce bookkeeping from a daily, monthly, quarterly, and yearly perspective. You have to maintain your general ledger and ensure accuracy for each financial transaction, plus, you have to balance the books each day and track payments in and out from employees. The goal of bookkeeping is to show you your business’s bigger financial picture, balance your accounts, and improve cash flow management in a more strategic way.