Bookkeeper job in Alexandria at Apartments

If you work in a larger business, you can gain experience as an accounting clerk or associate with responsibility for certain accounts or business processes, like payables or receivables. The experience can contribute to a more responsible position with a smaller company as a full charge bookkeeper.

Although the field of bookkeeping and company-based accounting is projected to decline, almost all of the decline is represented by entry-level clerk positions being reduced by automation and technology. Most owners are not experienced in double-entry bookkeeping and lack the time to learn the ins and outs of payroll taxes, deposits and tax reporting. The responsibilities of this position match the job title in some respects, as “full charge” bookkeepers take charge of a company’s complete financial processes. This means that they make journal entries, close and open books at the beginning and end of accounting periods, and issue financial statements to the owners and company management.

Most of the decline that is projected is anticipated to result from consolidations of tasks performed by clerks. As one example, automated payroll software and payroll companies are reducing the need for payroll clerks. Small businesses are likely to continue to need bookkeepers who are responsible for the company’s finances.

The Bureau of Labor Statistics projects there will be an 8 percent decline, or about 148,000 fewer jobs of this type between now and 2024. The BLS includes beginning and entry level positions in the field, as well as full-charge bookkeepers.

Administrative Assistant/Bookkeeper to the Pastor/Parochial…

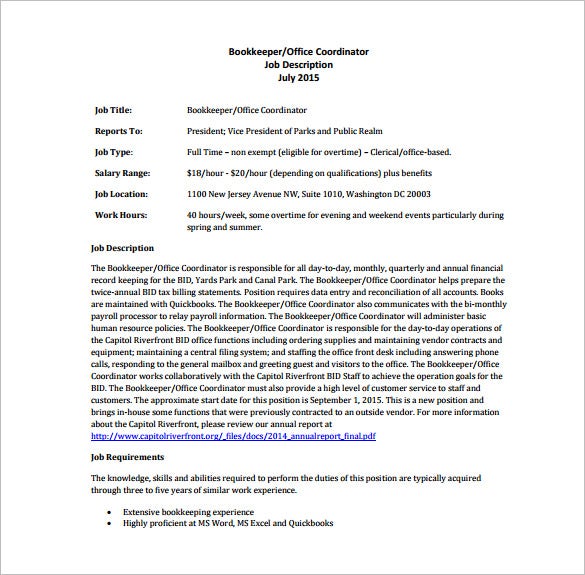

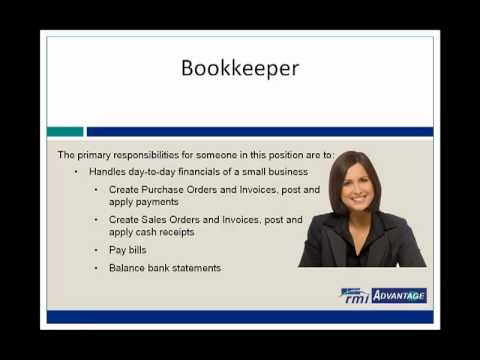

A bookkeeper is someone who works for a company (either as an employee or a contractor) to keep the financial books. Most bookkeepers these days use accounting software like QuickBooks for this task. A bookkeeper is responsible for accurately recording transactions, including accounts receivable, accounts payable, inventory, and (sometimes) payroll, and providing reports on a monthly, quarterly, and annual basis.

What exactly does a bookkeeper do?

Responsibilities include but are not limited to donor tracking, accounts payables, payroll, bank deposits and account reconciliations, and the maintaining of

The bookkeeping office manager handles company’s financial records, enters data, types and generates work orders, assists with budget preparations, and records financial transactions such as outgoing and incoming checks. The bookkeeping office manager also prepares purchase orders; reviews invoice listed prices; makes necessary pricing adjustments; and compiles reports to show information and statistics. The bookkeeping office manager summarizes details in separated ledger in computer files and transfers them to a general ledger; invoices clients; makes federal state tax depositions; and completes annual tax forms. A full charge bookkeeper performs bookkeeping and accounting duties, usually for a small to medium business.

They also run trial balances, make journal entries, and prepare monthly or quarterly financial statements and tax returns. Working at a small company, this position may be in charge of every aspect of the company’s finances. Full charge bookkeepers don’t need to have college degrees, but nearly all of them have some college coursework and additional education and training. Typically, full charge bookkeepers prepare a company’s records for review by a certified public accountant.

This position performs many of the duties that accountants and controllers do for larger businesses. The words “full charge” mean that the employee takes responsibility for more than keeping ledgers.

- The bookkeeping office manager also prepares purchase orders; reviews invoice listed prices; makes necessary pricing adjustments; and compiles reports to show information and statistics.

- The bookkeeping office manager handles company’s financial records, enters data, types and generates work orders, assists with budget preparations, and records financial transactions such as outgoing and incoming checks.

Accounting Clerk

Earning an associate’s degree in book keeping is enough to get an entry level book keeping job and can be transferred into a four year university course. For those looking to develop and assume managerial positions, a Master’s of Business Administration (MBA) incorporates elements of management and leadership skills as well as accounting theory and practice. If you enjoy working with numbers and are detail-oriented, full charge bookkeeping could be a rewarding choice of career.

PT Bookkeeper for DSAS Parish

If you own or manage a small company, your bookkeeper might be your sole financial resource. If your company is large, you might have an accounting department. In a very large company, you might have a CFO, tax attorney, and a raft of financial consultants. Regardless of the size of the business, everything depends on a bookkeeper accurately recording the financial data in a timely manner. Any analyses done by someone above the level of bookkeeper are dependent on the accuracy of the data recorded by the bookkeeper.

They may be in charge of accounts receivable, payable and payroll and tax deposits. They may or may not supervise clerks or assistants, depending on the size of the business. With some employers requesting a college degree for full charge bookkeepers, you should keep in mind that opportunities for advancement or higher pay could require four years of college. You should be able to get started as a bookkeeper at the clerk and assistant level part-time, including while you may be attending college. Assistant bookkeeper, clerk and office assistant are all entry level positions that can lead to promotion to the lead or full charge bookkeeper in a variety of businesses.

Full charge bookkeepers need to understand and apply generally-accepted accounting principles (GAAP), and be able to perform double-entry bookkeeping. They also need to understand charts of accounts, journal entries, and proper procedures for taking a trial balance. Nearly all bookkeepers working with this level of responsibility also need to have management training, and also be familiar with accounting software and how to prepare and present financial statements and tax returns.

The job of bookkeeper is different from accountant because accountants almost always have a bachelor’s degree. Certified Public Accountants (CPAs) also have additional training and have passed a licensing exam. Employers are increasingly requesting that applicants for positions with responsibility should have at least some college, and many do prefer a college degree in business or accounting. A full charge bookkeeper who wants to work for a small to medium-sized business does not need to be a certified accountant. General business, accounting and bookkeeping courses as well as management and software training will provide the required education and training.

Full Charge Bookkeeper

In a school environment, bookkeepers typically handle all the school’s financial transactions and record keeping, without the aid of an accounting clerk. The school bookkeeper typically prepares bank deposits, verifies and balances receipts, pays and prepares invoices after approval by the principal and monitors overdue accounts. All of their financial duties must comply with Department of Education and school board polices. Alternatively referred to as an accounting or auditing degree, earning a book keeping degree prepares one for a career as an accountant across a variety of industries and sectors overseeing financial records.

What are the duties and responsibilities of a bookkeeper?

Bookkeepers oversee a company’s financial data and compliance by maintaining accurate books on accounts payable and receivable, payroll, and daily financial entries and reconciliations. They perform daily accounting tasks such as monthly financial reporting, general ledger entries, and record payments and adjustments.

Bookkeeper

They are expected to reconcile expenditures and revenues, and make any adjustments based on depreciation or amortization. Employees in this position can work in small offices or companies where they won’t have any other employees to supervise. They may also supervise small accounting or financial teams that can include clerks responsible for accounts payable or receivable, or payroll. They may supervise a clerk in preparing bank deposits, or in paying monthly bills.