Book value

These may be reported on the individual or company balance sheet at cost or at market value. Book value is a widely-used financial metric for determining a company’s value and whether its stock price is over- or under-appreciated.

Traditionally, a company’s book value is its total assets minus intangible assets and liabilities. However, in practice, depending on the source of the calculation, book value may variably include goodwill, intangible assets, or both. The value inherent in its workforce, part of the intellectual capital of a company, is always ignored. When intangible assets and goodwill are explicitly excluded, the metric is often specified to be “tangible book value”. Book value and Market value are key techniques, used by investors to value asset classes (stocks or bonds).

This is the amount that the company’s creditors and investors can expect to receive if the company is liquidated. The book value of a company is important for accounting purposes, and it’s part of the review of the business if the business is to be sold. Since book value isn’t related to the market value of an individual asset, it can be used as a reference point, but not as a selling price. Financial assets include stock shares and bonds owned by an individual or company.

The difference between book value and market value

In other words, the book value is literally the value of the company according to its books (balance sheet) once all liabilities are subtracted from assets. A corporation’s book value is used in fundamental financial analysis to help determine whether the market value of corporate shares is above or below the book value of corporate shares.

In this case, the shares outstanding number is stated at 3.36 billion, so our BVPS number is $71.3 billion divided by 3.36 billion, which equals $21.22. Each share of common stock has a book value – or residual claim value – of $21.22.

Which is better market value or book value?

Market Value Greater Than Book Value When the market value exceeds the book value, the stock market is assigning a higher value to the company due to the potential of it and its assets’ earnings power. However, it may also indicate overvalued or overbought stocks trading at a high price.

When book value is divided by the number of outstanding shares, we get the book value per share (BVPS) which can be used to make a per-share comparison. Outstanding shares refer to a company’s stock currently held by all its shareholders, including share blocks held by institutional investors and restricted shares. The book value literally means the value of a business according to its books (accounts) that is reflected through its financial statements. Theoretically, book value represents the total amount a company is worth if all its assets are sold and all the liabilities are paid back.

Intangible assets have value, just not in the same way that tangible assets do; you cannot easily liquidate them. By calculating tangible book value we might get a step closer to the baseline value of the company. It’s also a useful measure to compare a company with a lot of goodwill on the balance sheet to one without goodwill. The quickest way to calculate BVPS is to look at the equity section of a company’s balance sheet and think about what the common shareholder actually owns – common stock outstanding and retained earnings.

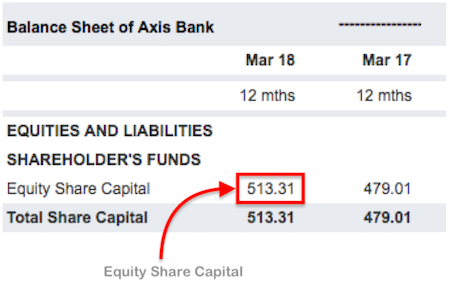

The number is clearly stated as a subtotal in the equity section of the balance sheet. To calculate BVPS, you need to find the number of shares outstanding, which is also usually stated parenthetically next to the common stock label (on Yahoo! Finance, it’s located in Key Statistics). What we’re looking for is the number of shares outstanding, not simply issued. The two numbers can be different, usually because the issuer has been buying back its own stock.

Market value is the value of a stock or a bond, based on the traded prices in the financial markets. Though the market value can be calculated at any point in time, an investor gets to know the book value when a company files it’s earning on a quarterly basis. Deriving the book value of a company is straightforward since companies report total assets and total liabilities on their balance sheet on a quarterly and annual basis. Additionally, the book value is also available asshareholders’ equity on the balance sheet. For example, Walmart’s January 30, 2012 balance sheet indicates that shareholders’ equity has a value of $71.3 billion.

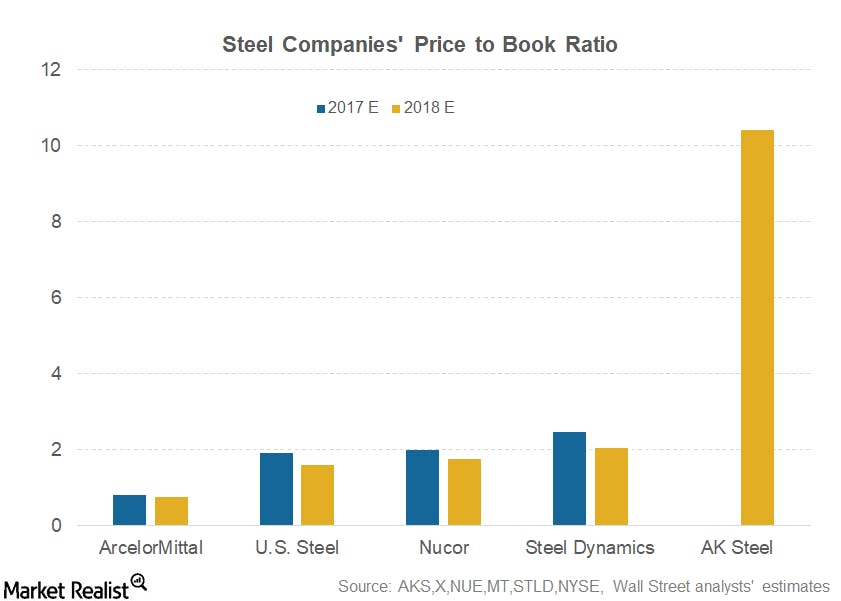

- The P/B ratio compares a company’s market capitalization, or market value, to its book value.

Market Value Greater Than Book Value

A good measure of the value of a stockholder’s residual claim at any given point in time is the book value of equity per share (BVPS). Book value is the accounting value of the company’s assets less all claims senior to common equity (such as the company’s liabilities). The book value of a stock is theoretically the amount of money that would be paid to shareholders if the company was liquidated and paid off all of its liabilities. As a result, the book value equals the difference between a company’s total assets and total liabilities.

Neither market value nor book value is an unbiased estimate of a corporation’s value. The corporation’s bookkeeping or accounting records do not generally reflect the market value of assets and liabilities, and the market or trade value of the corporation’s stock is subject to variations. Equity investors often compare BVPS to the market price of the stock in the form of the market price/BVPS ratio to attribute a measure of relative value to the shares. Keep in mind that book value and BVPS do not consider the future prospects of the firm – they are only snapshots of the common equity claim at any given point in time. A going concern is whether a company should always trade at a price/BVPS ratio in excess of 1 times if the market properly reflects the future prospects of the corporation and the upside potential of the stock.

At the time Walmart’s 10-K for 2012 came out, the stock was trading in the $61 range, so the P/BVPS multiple at that time was around 2.9 times. In simplified terms, it’s also the original value of the common stock issued plus retained earnings, minus dividends and stock buybacks. BVPS is the book value of the company divided by the corporation’s issued and outstanding common shares. The carrying value, or book value, is an asset value based on the company’s balance sheet, which takes the cost of the asset and subtracts its depreciation over time. The fair value of an asset is usually determined by the market and agreed upon by a willing buyer and seller, and it can fluctuate often.

Book Value Example

The P/B ratio compares a company’s market capitalization, or market value, to its book value. Specifically, it compares the company’s stock price to its book value per share (BVPS). The market capitalization (company’s value) is its share price multiplied by the number of outstanding shares. The book value is the total assets – total liabilities and can be found in a company’s balance sheet. In other words, if a company liquidated all of its assets and paid off all its debt, the value remaining would be the company’s book value.

To calculate tangible book value, we must subtract the balance sheet value of intangibles from common equity and then divide the result by shares outstanding. To continue with the Walmart example, the value of goodwill on the balance sheet is $20.6 billion (we are assuming the only intangible asset material to this analysis is goodwill). Again, we would want to examine the trend in the ratio over time and compare it to similar companies to assess relative value. In accounting, book value is the value of an asset according to its balance sheet account balance. For assets, the value is based on the original cost of the asset less any depreciation, amortization or impairment costs made against the asset.

It’s wise for investors and traders to pay close attention, however, to the nature of the company and other assets that may not be well represented in the book value. It can be defined as the net asset value of the firm or of the company that can be calculated as total assets less intangible assets (that is goodwill, patents, etc.) and liabilities. Further, Book Value Per Share (BVPS) can be computed based upon the equity of the common shareholders in the company.

The good news is that the number is clearly stated and usually does not need to be adjusted for analytical purposes. As long as the accountants have done a good job (and the company’s executives aren’t crooked) we can use the common equity measure for our analytical purposes.

Why is market value higher than book value?

The difference between book value and market value. The book value of an asset is its original purchase cost, adjusted for any subsequent changes, such as for impairment or depreciation. Market value is the price that could be obtained by selling an asset on a competitive, open market.

In other words, the carrying value generally reflects equity, while the fair value reflects the current market price. The market value of an asset is assigned by the investors on that particular date i.e. based on the current price of that asset traded in the financial markets. It is calculated by multiplying the market price per share of the company with the number of outstanding shares. It can vary and at any point in time, it can be more or less than book value. Book value and market value are two fundamentally different calculations that tell a story about a company’s overall financial strength.

Comparing the book value to the market value of a company can also help investors determine whether a stock is overvalued or undervalued given its assets, liabilities, and its ability to generate income. However, with any financial metric, it’s important to recognize the limitations of book value and market value and use a combination of financial metrics whenanalyzing a company. Like any financial metric, the real utility comes from recognizing the advantages and limitations of book value and market value. An investor must determine when the book value or market value should be used and when it should be discounted or disregarded in favor of other meaningful parameters whenanalyzing a company.

Book Value Vs. Market Value: An Overview

For example, if Company XYZ has total assets of $100 million and total liabilities of $80 million, the book value of the company is $20 million. In a broad sense, this means that if the company sold off its assets and paid down its liabilities, the equity value ornet worthof the business would be $20 million. An even better approach is to assess a company’s tangible book value per share (TBVPS). Tangible book value is the same thing as book value except it excludes the value of intangible assets.