Bond amortization schedule

If the amount is small, it can be calculated on a straight-line basis. If the amount is material, or if a greater degree of accuracy is desired, calculate the periodic amortization using the effective interest method. A business or government may issue bonds when it needs a long-term source of cash funding. When an organization issues bonds,investors are likely to pay less than the face value of the bonds when the stated interest rate on the bonds is less than the prevailing market interest rate.

It is the coupon rate stated on the bond certificate that determines the period interest payments. All of these It is the contractual interest rate used to determine the amount of cash interest paid by the borrower. When a corporation is preparing a bond to be issued/sold to investors, it may have to anticipate the interest rate to appear on the face of the bond and in its legal contract. Let’s assume that the corporation prepares a $100,000 bond with an interest rate of 9%. Just prior to issuing the bond, a financial crisis occurs and the market interest rate for this type of bond increases to 10%.

A fixed-rate residential mortgage is one common example because the monthly payment remains constant over its life of, say, 30 years. However, each payment represents a slightly different percentage mix of interest versus principal.

The recorded amount of interest expense is based on the interest rate stated on the face of the bond. Any further impact on interest rates is handled separately through the amortization of any discounts or premiums on bonds payable, as discussed below. The entry for interest payments is a debit to interest expense and a credit to cash. Bonds are issued at a premium, at a discount, or at par.

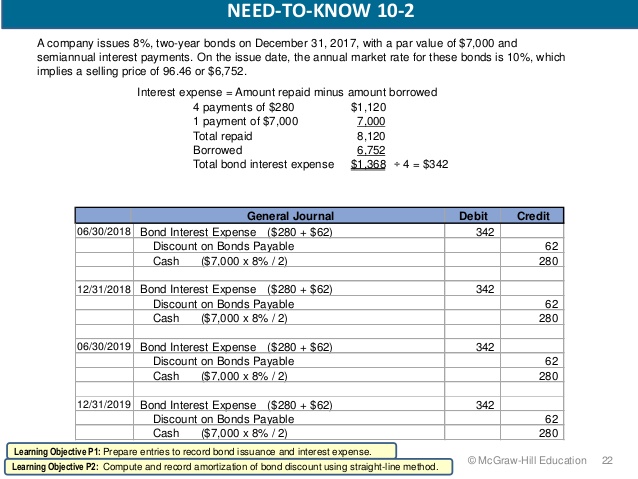

Straight-Line Amortization of Bond Discount on Monthly Financial Statements

If the corporation goes forward and sells its 9% bond in the 10% market, it will receive less than $100,000. When a bond is sold for less than its face amount, it is said to have been sold at a discount. The discount is the difference between the amount received (excluding accrued interest) and the bond’s face amount.

As the loan matures, however, the portion of each payment that goes towards interest will become lesser and the payment to principal will be larger. The calculations for an amortizing loan are similar to that of an annuity using the time value of money, and can be carried out quickly using an amortization calculator. It is the contractual interest rate used to determine the amount of cash interest paid by the borrower. All of these It is the coupon rate stated on the bond certificate that determines the period interest payments.

Second, amortization reduces the duration of the bond, lowering the debt’s sensitivity to interest rate risk, as compared with other non-amortized debt with the same maturity and coupon rate. This is because as time passes, there are smaller interest payments, so the weighted-average maturity (WAM) of the cash flows associated with the bond is lower.

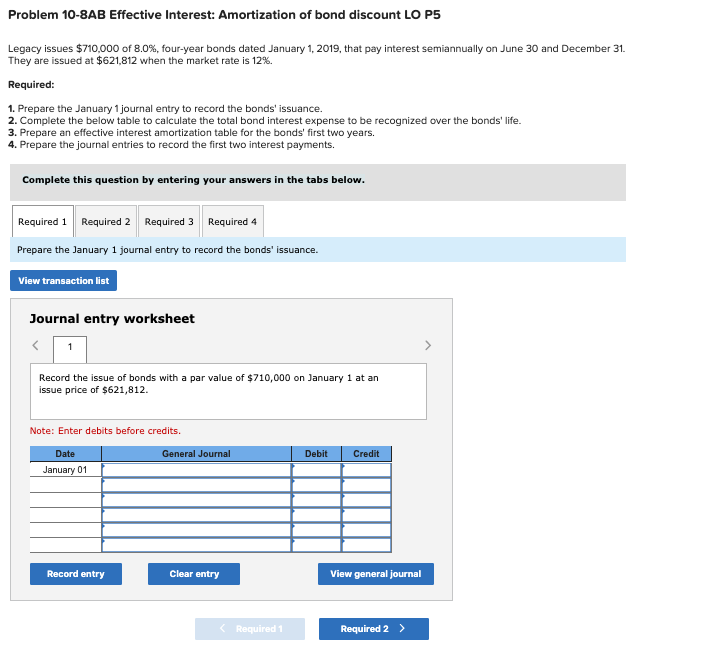

Under this second type of accounting, the bond discount amortized is based on the difference between the bond’s interest income and its interest payable. Effective-interest method requires a financial calculator or spreadsheet software to derive. The principal paid off over the life of an amortized loan or bond is divvied up according to an amortization schedule, typically through calculating equal payments all along the way. This means that in the early years of a loan, the interest portion of the debt service will be larger than the principal portion.

The difference is known by the terms discount on bonds payable, bond discount, or discount. To illustrate a fully amortizing payment, imagine a man takes out a 30-year fixed-rate mortgage with a 4.5% interest rate, and his monthly payments are $1,266.71. Because these payments are fully amortizing, if the borrower makes them each month, he pays off the loan by the end of its term.

When a discounted bond is sold, the amount of the bond’s discount must be amortized to interest expense over the life of the bond. When using the effective interest method, the debit amount in the discount on bonds payable is moved to the interest account. Therefore, the amortization causes interest expense in each accounting period to be higher than the amount of interest paid during each year of the bond’s life. Treating a bond as an amortized asset is an accounting method used by companies that issue bonds. It allows issuers to treat the bond discount as an asset over the life of the bond until its maturity date.

Under this method, the amount of interest expense in a given accounting period correlates with the book value of a bond at the beginning of the accounting period. Consequently, as a bond’s book value increases, the amount of interest expense increases. Over the life of the bond, the balance in the account Discount on Bonds Payable must be reduced to $0. Reducing this account balance in a logical manner is known as amortizing or amortization. Corporate bonds are debt obligations issued by corporations to raise capital and operating cash.

The straight-line amortization method allocates an equal amount of bond discount or premium to each interest period over the life of the bond. The calculation is the amount of the discount or premium over the number of interest payments over the bond’s term. If a discount or premium was recorded when the bonds were issued, the amount must be amortized over the life of the bonds.

- When a discounted bond is sold, the amount of the bond’s discount must be amortized to interest expense over the life of the bond.

- When using the effective interest method, the debit amount in the discount on bonds payable is moved to the interest account.

- Therefore, the amortization causes interest expense in each accounting period to be higher than the amount of interest paid during each year of the bond’s life.

Discount on Bonds Payable with Straight-Line Amortization

An analyst or accountant can also create an amortization schedule for the bonds payable. This schedule will lay out the premium or discount, and show changes to it every period coupon payments are due. At the end of the schedule (in the last period), the premium or discount should equal zero.

The actual interest paid out (also known as the coupon) will be higher than the expense. The difference is the amortization that reduces the premium on the bonds payable account. This is also true for a discount bond, however, in that instance, the effects are reversed.

The effective interest method is an accounting practice used to discount a bond. This method is used for bonds sold at a discount; the amount of the bond discount is amortized to interest expense over the bond’s life.

A bond is sold at a discount when a company sells it for less than its face value and sold at a premium when the price received is greater than face value. Amortization of debt affects two fundamental risks of bond investing.

This depends on the difference between its coupon rate and the market yield on issuance. When a bond is issued, the issuer records the face value of the bond as the bonds payable. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is recorded as a premium (discount) on bonds payable. Premiums are amortized in similar fashion to discounts under the effective interest method. Suppose a company issues $100,000 in 10-year, 9% coupon bonds at a premium to face value.

How do you amortize a bond discount?

Since a bond’s discount is caused by the difference between a bond’s stated interest rate and the market interest rate, the journal entry for amortizing the discount will involve the account Interest Expense. When the same amount of bond discount is recorded each year, it is referred to as straight-line amortization.

At that point, the “amortized” value of the bond should equal the bond’s face value. An amortized bond is one in which the principal (face value) on the debt is paid down regularly, along with its interest expense over the life of the bond.

On issuance, a premium bond will create a “premium on bonds payable” balance. At every coupon payment, interest expense will be incurred on the bond.

An amortized bond is different from a balloon or bullet loan, where there is a large portion of the principal that must be repaid only at its maturity. The effective interest rate calculation reflects actual interest earned or paid over a specified timeframe. The preferred method for amortizing (or gradually writing off) a discounted bond is the effective interest rate method or the effective interest method.

Investors lend money to the issuing corporation in exchange for periodic interest payments and repayment of principal at maturity. Unlike stockholders, bondholders have no ownership in the corporation. Corporate bonds usually are issued in $1,000 or $5,000 denominations. If a bond is issued at a premium or at a discount, the bond will be amortized over the years through to its maturity.

Straight line amortization is always the easiest way to account for discounts or premiums on bonds. Under the straight line method, the premium or discount on the bond is amortized in equal amounts over the life of the bond. Companies may also issue amortized bonds and use the effective-interest method. Rather than assigning an equal amount of amortization for each period, effective-interest computes different amounts to be applied to interest expense during each period.

How to Amortize a Bond Premium Using the Straight-Line Method

By doing so, investors earn a greater return on their reduced investment. The net result is a total recognized amount of interest expense over the life of the bond that is greater than the amount of interest actually paid to investors. The amount recognized equates to the market rate of interest on the date when the bonds were sold.

The concept is best described with the following example. Effective-interest and straight-line amortization are the two options for amortizing bond premiums or discounts. The easiest way to account for an amortized bond is to use the straight-line method of amortization. Under this method of accounting, the bond discount that is amortized each year is equal over the life of the bond.