Basel III

Tier 3 capital includes a greater variety of debt than tier 1 and tier 2 capital but is of a much lower quality than either of the two. Under the Basel III accords, tier 3 capital is being completely abolished. Tier 1 capital consists of shareholders’ equity and retained earnings—disclosed on their financial statements—and is a primary indicator to measure a bank’s financial health. These funds come into play when a bank must absorb losses without ceasing business operations.

And a company’s degree of leverage, high versus low, translates directly into a measurement of risk for the shareholders. A limitation of using the leverage ratio is that investors are reliant on banks to properly calculate and report their tier 1 capital and total assets figures. If a bank doesn’t report or calculate these figures properly, the leverage ratio could be inaccurate. The leverage ratio is a measure of the bank’s core capital to its total assets. The ratio uses tier 1 capital to judge how leveraged a bank is in relation to its consolidated assets whereas the tier 1 capital adequacy ratio measures the bank’s core capital against its risk-weighted assets.

If the ratio equals 1, assets are equally financed with debt and equity. If the ratio is greater than 1, the company is financed more with debt. If the ratio is less than 1, the company is financed more with equity.

A degree of financial leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share (EPS) to fluctuations in its operating income, as a result of changes in its capital structure. The degree of financial leverage (DFL) measures the percentage change in EPS for a unit change in operating income, also known as earnings before interest and taxes (EBIT). Thedebt-to-capital ratiois a measurement of a company’s financial leverage. It is one of the more meaningful debt ratios because it focuses on the relationship of debt liabilities as a component of a company’s total capital base.

How is leverage ratio calculated?

The leverage ratio is the proportion of debts that a bank has compared to its equity/capital. There are different leverage ratios such as. Debt to Equity = Total debt / Shareholders Equity.

But when used together, a more complete picture emerges—one that helps weed out healthy corporations from those that are dangerously in debt. The debt-to-equity ratio shows the percentage of financing that comes from banks or stockholders. To calculate the debt-to-equity ratio, we take total liabilities divided by total equity. The debt-to-equity ratio is a baseline ratio, which means it has a baseline.

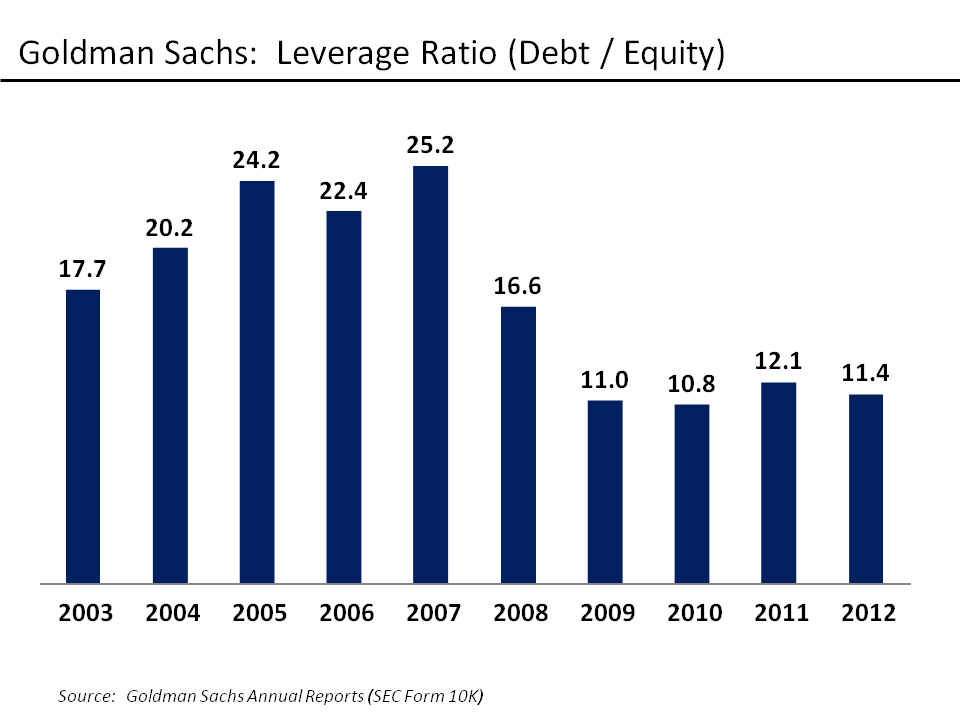

Leverage ratios in the credit boom and bust

The Accords set the capital adequacy ratio (CAR) to define these holdings for banks. Under Basel III, a bank’s tier 1 and tier 2 assets must be at least 10.5% of its risk-weighted assets. The tier 1 capital adequacy ratio (CAR) is the ratio of a bank’s core tier 1 capital—that is, its equity capital and disclosed reserves—to its total risk-weighted assets. It is a key measure of a bank’s financial strength that has been adopted as part of the Basel III Accord on bank regulation. It measures a bank’s core equity capital as against its total risk-weighted assets.

Typically, a D/E ratio greater than 2.0 indicates a risky scenario for an investor; however, this yardstick can vary by industry. Businesses that require large capital expenditures (CapEx), such as utility and manufacturing companies, may need to secure more loans than other companies. It’s a good idea to measure a firm’s leverage ratios against past performance and with companies operating in the same industry to better understand the data.

The ensuing deleveraging process at the height of the crisis created a vicious circle of losses and reduced availability of credit in the real economy. The leverage ratio measures a bank’s core capital to its total assets. The ratio uses tier 1 capital to judge how leveraged a bank is in relation to its consolidated assets. Tier 1 assets are ones that can be easily liquidated if a bank needs capital in the event of a financial crisis.

To compensate for this, three separate regulatory bodies, the FDIC, theFederal Reserve, and theComptroller of the Currency, review and restrict the leverage ratios for American banks. This means they restrict how much money a bank can lend relative to how much capital the bank devotes to its own assets.

It had a leverage ratio of about 20, but it continued to borrow more money. So when Lehman Brothers’ assets fell in value very quickly, in 2008, they were underwater. That is, their assets were worth less than the debt that they owed and the company was insolvent. So leverage ratio is important because it measures how leveraged a company is.

What Does a Leverage Ratio Tell You?

These means that every dollar of assets or equity is matched by one dollar of debt. Tier 3 capital is tertiary capital, which many banks hold to support their market risk, commodities risk, and foreign currency risk, derived from trading activities.

These funds are generated specifically to support banks when losses are absorbed so that regular business functions do not have to be shut down. It’s the borrowing of funds to finance the purchase of inventory, equipment, and other company assets. Business owners can use either debt or equity to finance or buy company assets.

An OECD study, released on 17 February 2011, estimated that the medium-term impact of Basel III implementation on GDP[who? Economic output would be mainly affected by an increase in bank lending spreads, as banks pass a rise in bank funding costs, due to higher capital requirements, to their customers. To meet the capital requirements originally effective in 2015 banks were estimated to increase their lending spreads on average by about 15 basis points.

- This is a non-risk-based leverage ratio and is calculated by dividing Tier 1 capital by the bank’s average total consolidated assets (sum of the exposures of all assets and non-balance sheet items).

The level of capital is important because banks can “write down” the capital portion of their assets if total asset values drop. Assets financed by debt cannot be written down because the bank’s bondholders and depositors are owed those funds.

Using debt increases the company’s risk of bankruptcy but can also increase the company’s profits and returns; specifically its return on equity. If debt financing is used rather than equity financing, the owner’s equity is not diluted by issuing more shares of stock. However, a high leverage ratio is not just a problem in the housing sector.

This is a non-risk-based leverage ratio and is calculated by dividing Tier 1 capital by the bank’s average total consolidated assets (sum of the exposures of all assets and non-balance sheet items). The banks are expected to maintain a leverage ratio in excess of 3% under Basel III. Financial leverage ratios, or gearing ratios, comprise a category of ratios that evaluate the financial leverage a business in terms of its assets, liabilities, and equity. These ratios evaluate how much a business’ capital comes from debt, which indicates how risky or not a business is from the perspective of its use of debt relative to its assets and equity. The Basel Accords are a series of three sets of banking regulations that help to ensure financial institutions have enough capital on hand to handle obligations.

Please note that the Degree of Financial leverage ratio is thus extremely valuable for helping an organization assess the quantity of debt or leverage it ought to choose in its capital structure. If operating financial gain is comparatively stable, then earnings and EPS (Earnings Per Share) would be stable as well, and the company will be able to afford to take a large amount of debt. However, if the firm operates in a sector where operating financial gain is kind of volatile, it may be prudent to limit the debt to easily manageable levels.

Degree of Financial Leverage

The term financial leverage is also used to describe the overall debt load of a company by comparing debt to assets or debt to equity. A highly leveraged company would have aleverage ratioclose to 1 or higher.

A higher leverage ratio is generally considered safer for a bank as it shows that the bank has higher capital compared to its assets (majorly loans). This is particularly useful when the economy falters and the loans are not paid off.

In other words, it becomes more difficult to meet financial obligations when a highly-levered company’s assets suddenly drop in value. The degree of financial leverage (DFL) is a leverage ratio that measures the sensitivity of a company’s earnings per share to fluctuations in its operating income, as a result of changes in its capital structure.

Fedex has a D/E ratio of 1.78, so there is cause for concern where UPS is concerned. However, most analysts consider that UPS earns enough cash to cover its debts. There are several forms of capital requirements and minimum reserve placed on American banks through the FDIC and the Comptroller of the Currency that indirectly impacts leverage ratios. The level of scrutiny paid to leverage ratios has increased since the Great Recession of 2007 to 2009 when banks that were “too big to fail” were a calling card to make banks more solvent.

Leverage ratio

So, it is basically a ratio to measure a bank’s financial health. While carrying a modest amount of debt is quite common, highly leveraged businesses face serious risks. Large debt payments eat away at revenue and, in severe cases, put the company in jeopardy of default. Active investors use a number of different leverage ratios to get a broad sense of how sustainable a firm’s borrowing practices are. In isolation, each of these basic calculations provides a somewhat limited view of the company’s financial strength.

The denominator in the leverage ratio is a bank’s total exposures, which include its consolidated assets, derivative exposure, and certain off-balance sheet exposures. Basel III required banks to include off-balance sheet exposures such as commitments to provide loans to third parties, standby letters of credit, acceptances, and trade letters of credit. An underlying cause of the Great Financial Crisis was the build-up of excessive on-and off-balance sheet leverage in the banking system. In many cases, banks built up excessive leverage while maintaining seemingly strong risk-based capital ratios.

Banks have relatively fewer creditors than it has debtors, which makes it difficult to write off the loans, and hence at such times, a high equity capital pays off well. For example, assume there a financial institution has US$200 billion in total tier 1 assets. To calculate the capital ratio, they divide $200 billion by $1.2 trillion in risk for a capital ratio of 16.66%, well above the Basel III requirements. Under Basel III, the minimum tier 1 capital ratio is 10.5%, which is calculated by dividing the bank’s tier 1 capital by its total risk-weighted assets (RWA). RWA measures a bank’s exposure to credit risk from the loans it underwrites.

The leverage ratio is the ratio of debt to equity in a company, bank, house, etc. A high leverage ratio indicates a company, bank, home or other institution is largely financed by debt.