Bad debt

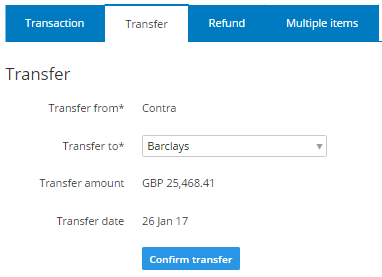

Contra Equity Account

The reason why is because most prepaid assets are consumed within a few months of being recorded. If a prepaid expense were likely to not be consumed within the next year, it would instead be along-term asset(this is not common). The payment of the insurance expense is similar to money in the bank, and as the money is used up, it is withdrawn from the account in each month or accounting period. Prepaid insurance is usually considered a current asset, as it will be converted to cash or used within a fairly short time.

Sales returns is a contra revenue account as the figure is a negative amount net against total sales revenue. It would appear on the company’s income statement in the revenue section. Depreciation, amortization, and depletion are expensed throughout the useful life of an asset that was paid for in cash at an earlier date.

For example, Accumulated Depreciation is a contra asset account, because its credit balance is contra to the debit balance for an asset account. This is an owner’s equity account and as such you would expect a credit balance.

The net realizable value of the accounts receivable is the accounts receivable minus the allowance for doubtful accounts. To illustrate, let’s use the contra asset account Allowance for Doubtful Accounts. Since it is a contra asset account, this allowance account must have a credit balance (which is contrary to the debit balances found in asset accounts).

If a company’s profit did not fully reflect the cash outlay for the asset at that time, it must be reflected over a set number of subsequent periods. These charges are made against accounts on thebalance sheet, reducing the value of items in that statement. Also known as a bad debt reserve, this is a contra account listed within the current asset section of the balance sheet.

The use of Allowance for Doubtful Accounts allows us to see in Accounts Receivable the total amount that the company has a right to collect from its credit customers. The credit balance in the account Allowance for Doubtful Accounts tells us how much of the debit balance in Accounts Receivable is unlikely to be collected. For example, assume ABC Company purchases insurance for the upcoming twelve month period. ABC Company will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash. Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense.

What is an example of a contra account?

A contra account is a general ledger account with a balance that is opposite of the normal balance for that account classification. The use of a contra account allows a company to report the original amount and also report a reduction so that the net amount will also be reported.

This account appears next to the current asset Accounts Receivable. The account Allowance for Doubtful Account is credited when the account Bad Debts Expense is debited under the allowance method.

Free Debits and Credits Cheat Sheet

Accounts receivable is rarely reported on the balance sheet at its net amount. Instead, it is reported at its full amount with an allowance for bad debts listed below it. Maybe more importantly, it shows investors and creditors what percentage of receivables the company is writing off. A prepaid expense is carried on the balance sheet of an organization as a current asset until it is consumed.

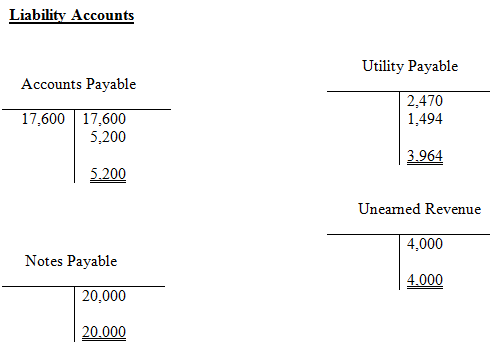

Other examples include the allowance for doubtful accounts, discount on bonds payable, sales returns and allowances, and sales discounts. For example net sales is gross sales minus the sales returns, the sales allowances, and the sales discounts.

- Contra accounts are reported on the same financial statement as the associated account.

- This type of account could be called the allowance for doubtful accounts or bad debt reserve.

The net of these two figures is typically reported on a third line. A regular asset account typically carries a debit balance, so a contra asset account carries a credit balance. Two common contra asset accounts include allowance for doubtful accounts and accumulated depreciation. Allowance for doubtful accounts represents the percentage of accounts receivable a company believes it cannot collect.

What Is a Contra Account & Why Is It Important?

The credit balance is reported in the property, plant and equipment section of the balance sheet and it reduces the cost of the assets to their carrying value or book value. Another example of a contra asset account is the accumulated depreciation account which reduces the reporting value of capital assets. Allowance for obsolete inventory or obsolete inventory reserve are also examples of contra asset accounts.

What is a contra account?

Contra accounts are reported on the same financial statement as the associated account. For example, a contra account to accounts receivable is a contra asset account. This type of account could be called the allowance for doubtful accounts or bad debt reserve. The balance in the allowance for doubtful accounts represents the dollar amount of the current accounts receivable balance that is expected to be uncollectible. The amount is reported on the balance sheet in the asset section immediately below accounts receivable.

The actual amount of uncollectible receivable is written off as an expense from Allowance for doubtful accounts. When a contra asset account is first recorded in a journal entry, the offset is to an expense. For example, an increase in the form of a credit to allowance for doubtful accounts is also recorded as a debit to increase bad debt expense. Transactions made to contra accounts are presented on a company’s financial statements under the related account.

The doubtful debt reserve holds a sum of money to allow a reduction in the accounts receivable ledger due to non-collection of debts. Once a doubtful debt becomes uncollectable, the amount will be written off. Allowance for doubtful accounts (ADA) is a contra asset account used to create an allowance for customers that do not pay the money owed for purchased goods or services. The allowance for doubtful accounts appears on the balance sheet and reduces the amount of receivables.

Free Financial Statements Cheat Sheet

In the twelfth month, the final $10,000 will be fully expensed and the prepaid account will be zero. A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods. An account with a balance that is the opposite of the normal balance.

Contra accounts are important because they allow a company to follow the matching principle by recording an expense initially in the contra asset account. The contra asset account is later reduced when the expense is recorded. Business owners should understand the functions of contra accounts and their importance to maintaining accurate financial records. The account Accumulated Depreciation is a contra asset account because it will have a credit balance.

Allowance for doubtful accounts offsets a company’s accounts receivable account. Accumulated depreciation offsets a company’s real property assets, such as buildings, equipment and machinery. Accumulated deprecation represents the cumulative amount of depreciation expense charged against an asset.

The Allowance for Doubtful Accounts is directly related to the asset account entitled Accounts Receivable. Therefore, the net amount of the accounts receivable that is expected to turn to cash is $38,000. The same is true for other asset accounts like accounts receivable.

Because of the matching principle of accounting, revenues and expenses should be recorded in the period in which they are incurred. When a sale is made on account, revenue is recorded along with account receivable. Because there is an inherent risk that clients might default on payment, accounts receivable have to be recorded at net realizable value. The portion of the account receivable that is estimated to be not collectible is set aside in a contra-asset account called Allowance for doubtful accounts. At the end of each accounting cycle, adjusting entries are made to charge uncollectible receivable as expense.

The most common contra asset account is Accumulated Depreciation. Accumulated Depreciation is associated with property, plant and equipment (plant assets). Accumulated Depreciation will be credited when Depreciation Expense is recorded. The credit balance in Accumulated Depreciation means that the cost of the property, plant and equipment will continue to be reported.